Stocks & Equities

Summary

Summary

- Hindenburg Omens using NYSE data can be misleading

- Using stock-only indices provides better signals

- Russell 2000 had an Hindenburg Omen trigger on Black Friday

- Given extended nature of the current advance, some weakness likely ahead

Every now and then the financial media is abuzz when a Hindenburg Omen is signaled and investors turn cautious.

….read it all HERE

There is only ONE number in the oil price saga that’s important to investors. It’s the same number the Saudis are tracking.

That is: how much did US oil production increase in the last week. *Note: Go HERE for Keith’s Interview on Money talks Nov 29th – Moneytalks Editor

That number is released every Wednesday morning at 10:30 EST in the weekly EIA (US Energy Information Administration) put out by the US government.

Investors can find that data right here—the direct link is:

Weekly US Oil Production Increase

just scroll down to the bottom or click on the excel file.

The global oil price will have its biggest 30 minute move of the week right at 10:30 am right then—both the international Brent benchmark and the US domestic WTI (West Texas Intermediate) price.

Why is this number so important?

Because it’s very clear in Saudi communications they want to put a bridle on galloping US oil production.

(Notice I didn’t say OPEC. The Saudis don’t care a whit about other OPEC countries. Members like Nigeria, Algeria, Venezuela are either so corrupt or so unable to cut production that the Saudis ignore them—as they should.)

The Saudis are watching this US production number like a hawk—as they should.

The unbridled oil production growth in the US from the Shale Revolution has disrupted oil flows and prices like nothing else since the OPEC embargo in the early 1970s.

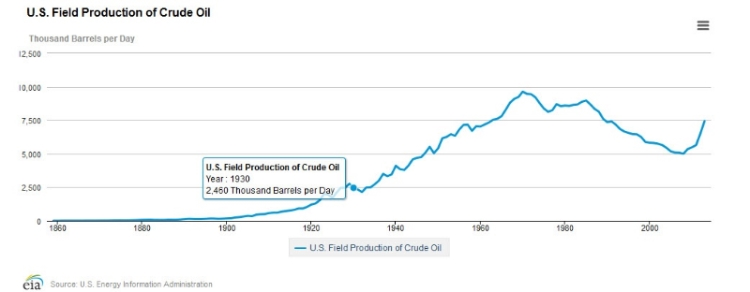

Everyone has seen this chart of US oil production:

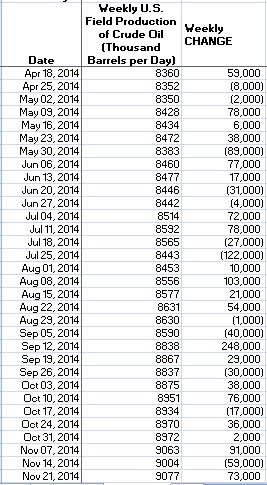

That’s a very steep upward curve right now. US oil production is on a RAPID increase. Here’s the excel file from the weekly EIA report, and I added a third column and calculated the weekly change in production for the last few months:

There have been a couple times that US production has dropped a couple weeks in a row this year.

For the Market to begin to think the oil price has bottomed, it has to see US production drop AT LEAST THREE weeks in a row.

Only God knows when that might happen.

Improvements in fracking are STILL increasing flow rates per metre drilled—five years after the Shale Revolution really took off.

This is increasing cash flows and reducing break-even costs for tight oil producers.

Exports of US refined products continue to hit new highs—now over 4 million barrels a day.

Personally, I don’t think the Saudis start to collect other OPEC members to talk about cutbacks until the price is low enough that American oil production growth slows down—a lot.

By the way, this number is always a true surprise to the Market.

Gas production can be estimated with pipeline flows (in fact US energy consultant Bentek out of Denver Colorado puts out a daily estimate of US natural gas production) but with the weekly Wednesday morning oil number—there is no way to “game” that number.

What are not-so-relevant numbers?

- Overall, all-in costs for oil and gas production. These numbers are great for PhDs, academics or first year college economics students. But for investors they are meaningless. In the short term during a rout like this, there is no bottom—especially with financial derivatives deciding much of the price movement.

- The price that various OPEC countries need to balance their budgets. Like I said, the Saudis are the only relevant producer in OPEC and they don’t care about the other countries in the cartel (yet)—so investors need not bother with this statistic either.

Related Posts:

Is US Oil Production Set to Plummet?

The Only Oil Price Going UP in the World Right Now

So it finally happened. The Federal Reserve ended its Quantitative Easing program on October 29, 2014 due to concerns that keeping QE for so long could fuel excessive risk-taking by investors. The U.S. dollar continued to conquer new heights, while gold did not welcome this central bank action. Its price fell in November to $1,142, a four-year low. This is not surprising given the fact that as we wrote (in the last Market Overview), the condition of the U.S. dollar is one of the most important drivers of gold prices.

However, the future (in the medium term) of the yellow metal’s price in the post-QE world is unclear. So much is unknown. When will Fed hike the interest rates? Is the U.S. central bank going to get rid of the enormous level of assets it bought? How and when does it plan to do so? How will the financial market perform without stimulus? Is the end of QE really a sign of a strong U.S. recovery? Some analysts agree, forecasting that gold will fall towards the $800-$900 level, while other economists fear that without Fed’s bond-buying program, a market crash may be on its way, leading to renewed investors’ interest in gold.

As a result, markets are confused right now. In this edition of Market Overview we try to clarify concerns about the impact of the end of QE3 on the U.S. economy and gold market. But first, let’s analyze what the recent halt of QE really means.

The quantitative easing was an unconventional monetary policy of buying financial assets from commercial banks. It increased the monetary base, Fed’s balance sheet and prices of purchased assets, decreasing their yields. The third, and for now the last, round of quantitative easing was announced on September 13, 2012 without stating the end date. Initially, the program involved purchases of agency mortgage-backed securities at a pace of $40 billion per month, but was extended to purchases of Treasuries involving $45 billion per month. In this largest asset-buying program, the Fed purchased assets worth around $1.6 trillion, expanding its balance sheet to about $4.5 trillion.

Graph 1: Fed’s assets (in millions of dollars) from 2002 to 2014

Theoretically, the halt of QE3 means the end of the multi-year asset purchases. However, not completely, because the “Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction,” as seen in the statement released by the Fed on October 29, 2014. It implies that although the Fed discontinued expanding its balance sheet, it will not allow it to shrink, at least for some time. And we are not talking about small amounts. According to Treasury Borrowing Advisory Committee estimates, if the Fed decides not to roll Treasuries (large amounts of them start maturing in 2016) over into new debt, the Treasury would be forced to borrow an extra $675 billion from the public over a three-year period. Therefore, the end of QE3 does not imply the end of quantitative easing. To use a metaphor, ending QE is not putting on the brakes; it is just easing off the accelerator.

However, even the complete reversal of QE3 would not mean the abandonment of the quantitative easing concept. The asset-buying program has become an established part of the Fed’s policy that could be implemented again in times of crises. Fed Chairwoman Janet Yellen has already said explicitly that she would not rule out more assets buying if needed. It is not coincidence that we have witnessed three rounds of the quantitative easing. We hope you remember that after the end of QE1 in March, 2010, there was a substantial correction in stocks (just under 20%), leading the U.S. central bank to start QE2. Then, after the halt of QE2 in June, 2012, there was another important stock market decline (about 20%), and that was the reason why the Fed launched the third round of QE. Given the fragile nature of the global economy, if asset prices fall or economic growth falters, we could witness QE4, especially since the Fed’s actions are data driven.

Thank you.

Despite the junior resource sector being near a major bottom and going through a bear market of epic proportions, I still believe that this may be one of the best times to add to quality positions. Nothing perfects one’s craft in the financial markets like a bear market. In a bear market one has to refine their skills in stock picking. The emergence of a new bull market is usually the most propitious time for outsized gains.

Investing in stocks is easy if you follow the rules that have proven to be successful over time. The number one rule is buying low and selling high. Many investors are chasing the US dollar (UUP) and Large Cap Equities (SPY) to record heights liquidating all their junior miners (GDXJ). Be careful of selling low the junior miners and buying assets such as US bonds (TLT) and large caps (DIA) at record high valuations.

In 2011, the herd mentality pushed silver and gold to record values selling all their stocks before a multi-year correction ensued. See my article back in 2011 which was published on Seeking Alphawhich warned about the precious metals market overheating and my video analysis from August 2011 forecasting a bottom in the S&P500.

The opposite tactic should now be considered of liquidating large cap equities, real estate and the US dollar and build positions in junior resource stocks that are extremely high quality and compelling takeout targets. Gold (GLD) and silver (SLV) could gap higher by the end of 2014 and the top notch juniors could skyrocket.

Its not just me that sees the value in gold, but entire nations. The Swiss voters decided not to back the Franc with a 20% gold reserve with a pledge never to sell its gold again. However, it is important to be encouraged that people are beginning to be concerned about fiat currency and foreign exchange manipulation. The Swiss made a mistake back in 1999 to drop their gold backing.

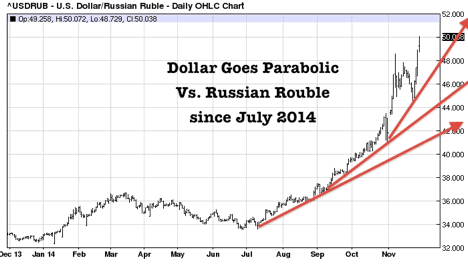

Look at the Russians who bought close to 19 tons in October. The Russian Rouble is crashing along with the economy due to the Ukraine standoff and record low oil prices. Smart investors should be adding precious metals and energy to their portfolio instead of expensive US dollars. Demand in China and India is still strong for gold and silver as evidenced by record coin sales and numismatic premiums rising.

Could the Russian economic collapse spark a global rush to buy physical gold and silver by other nations and sovereign wealth funds? Eventually, a change in psychology for precious metals could affect our junior mining positions trading at pennies on the dollar to see explosive gains.

Many Central Banks around the world have a zero or negative interest policy. This expansion of fiat currency on the market has never occurred before yet investors are flocking to the US dollar in record proportions. However, smart investors are already positioning ahead of the masses. When the US dollar bubble pops and follows other currencies lower, then gold and silver may appear as the new safe haven. It is at this time where our junior miners which are trading at pennies could be trading for dollars.

When this financial event occurs it will be too late to buy. One has to prepare ahead of the storm. The sages ask who is wise? One who sees the future. Its easy to recognize what’s happening now. Being able to see the developing storms ahead and acting upon it before it hits is the challenge. The rebound in precious metals could be one of a series of gaps higher. Right now look for a rally to begin when the recent downtrend in gold since July is broken to the upside at $1205.

For the past 70 years, Americans have lived in economic luxury like we have never seen before in human history. This has been due to huge increases in debt and borrowing. The Roman emperor’s would be jealous of the average American and Monday Night Football. More Americans care about the top Quarterback ratings rather than the debt level. Only a small minority of Americans and Swiss are concerned about the dangerous debt levels in Europe, Japan and the United States.

Now the dollar is strong against other currencies. Some incorrectly believe this is true to the strength of the US economy. The only reason the US dollar is rising is because all the other currencies are weak. The Japanese and Europeans have been turning on the printing presses to maximum for the past few months. Don’t be surprised to see credit rating changes to these nations.

The US may be on the verge of another economic crisis. In addition, there is a growing chasm between the races in the United States. Look at the violence and looting in Ferguson, Missouri. Watch the protests in Hong Kong as well.

We are in an environment which could destroy the banks. They are scared as they are still sitting on hundreds of millions of bad loans. Don’t be misdirected by the new age economists who say deficits and soaring debts are not such a big deal. Eventually, the piper must be paid and not with fiat money but with real money such as gold and silver that has maintained its value for thousands of years.