Mike's Content

Another tie, sweater, bottle of wine or electronic gadget again? Really?

I was sitting around with some friends on the weekend and we were talking about the nightmare of trying to find the perfect gift for family and friends. Come on – how many cell phones do we need or iPads or other tech gifts? Or should we go down sweater alley yet again?

Instead, I have a better idea. Why not something a little different like giving him or her a ticket to hear the person whose been dubbed, The Smartest Guy in the Room, Martin Armstrong. I get it – who the heck wakes up Christmas morning and says, “Gee, look Mom – I can hardly wait to see a whole raft of economic and financial analysts.”

Ah, but this is different. You get to see Martin Armstrong. He’s the guy who charges $5 million plus a year to pension funds, hedge funds and money managers of other major pools of investment capital to review their holdings against his models forecasts. And they pay because Marty’s analytical model has proven to be incredibly accurate.

Here’s a small example. In 2013 he told our conference attendees the date of the Russian invasion of Ukraine in 2014. In the process he said that move would make investors a lot of money in the US dollar, US dividend paying stocks and treasury bills. Actually they would have made a lot of money following his advice.

But here’s the thing.

Marty’s model has been pointing to Sept 30, 2015 as the beginning of massive changes in all investment markets. This is the same model that predicted years in advance the high in Japan’s Nikkei index in December, 1989 and the fall in the Berlin Wall in November, 1989. Those are just two examples of why a new documentary film on Marty’s work entitled, The Forecaster, has just been released in Europe.

At the conference I will ask him what specifically he sees coming on Sept, 30, 2015.

But that’s not all. Last year every major investment forecast at the Conference proved accurate including the fall in interest rates (contrary to the prediction of every major financial institution), the dramatic fall in the price of oil and the fall in commodity markets in general.

It is a phenomenal two days.

It’s a terrific and unique gift but then again – another bottle of wine, flowers, chocolates or a gift card. Really?

Who doesn’t love – money, power, fame or at least the next best thing – a chance to get all those by giving them a ticket to the 2015 World Outlook Financial Conference Jan 30st & 31st at the Westin Bayshore in Vancouver.

For tickets go to http://moneytalks.net/events/world-outlook-financial-conference.html and also see the raft of special bonuses that are included in the ticket.

One more thing

Please share this because as you may know I am hugely interested in educating our younger generation and to that end we have a special offer – if you buy a ticket – we have another one absolutely free for anyone under 30. The only thing is that we ask you to let us know that you want the young adult ticket when you purchase a ticket for either a friend or for yourself. We have a limited number set aside and we want to be able to accommodate you.

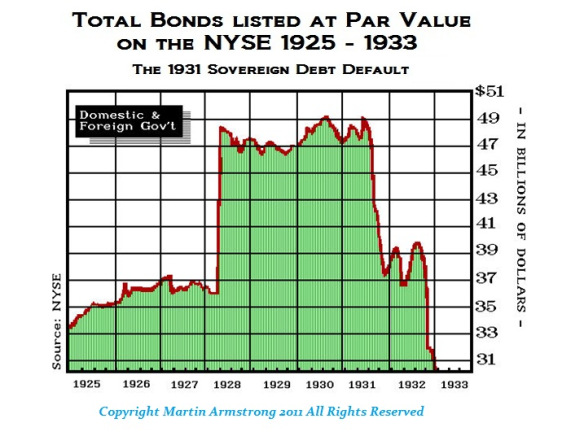

The anti-dollar contingent around the world who have preached that since Russia already trades its own currencies independently from the dollar and China has been trying to make the same move, are spinning the blogs claiming this is a “Zionist banker” conspiracy and this proves that all nations are tired of debt making Zionist banking. Well aside from the prejudice, this is not about merely debt and banking. I warned in the Greatest Bull Market that during a massive Sovereign Debt Crisis, there is nothing that remains standing. This is a complete control-alt-delete.

The anti-dollar contingent around the world who have preached that since Russia already trades its own currencies independently from the dollar and China has been trying to make the same move, are spinning the blogs claiming this is a “Zionist banker” conspiracy and this proves that all nations are tired of debt making Zionist banking. Well aside from the prejudice, this is not about merely debt and banking. I warned in the Greatest Bull Market that during a massive Sovereign Debt Crisis, there is nothing that remains standing. This is a complete control-alt-delete.

….continue reading HERE

Almost everyone I talk to thinks the European sovereign debt crisis is coming to an end. They claim the decline in the euro will stoke inflation there … that Mario Draghi, the European Central Bank head, will do everything possible to turn the economy around …

That major European companies are now cheap, based on the decline in the euro … and that the leaders of the euro region are finally getting their act together.

I say baloney, to all of it.

First, severe austerity measures continue to this day and they are hollowing out Europe’s economic growth.

The proof is in the numbers. Before the Greek crisis flared up, debt-to-GDP in Greece stood at 113 percent. Today — according to the most recent data and even after all the write-offs — Greece’s debt-to-GDP stands at a whopping 174 percent.

In Spain, pre-crisis debt stood at 40 percent of GDP. Today it’s 97.6 percent.

In Italy, debt to GDP is hovering near 100 percent while France is set to exceed 100 percent early next year.

Clearly, all the austerity measures that Europe has implemented have done nothing to reduce debt levels.

Meanwhile, it’s created some of the worst social chaos we have seen in modern times.

Second, Italy, Portugal, Spain, and Greece remain hotbeds for massive social unrest.

Second, Italy, Portugal, Spain, and Greece remain hotbeds for massive social unrest.

Each and every one of these countries is in hock way over its head. And each and every one of them is in the depths of a nightmare caused by austerity measures.

Spain’s unemployment is stubbornly high at 24 percent. Portugal’s, 13.4 percent. Italy’s, 13.2 percent. Greece’s, 25.9 percent.

Unemployment among youth is still off the charts. From the second quarter of 2008, the youth unemployment rate — those under 25 years of age — has skyrocketed and now stands at a whopping 23.1 percent.

All told, over 24 million people are jobless in the 28 European member states.

Third, European banks are a disaster in the making. Although their ratings have improved lately, most European banks are still saddled down with huge debts. Plus, the sanctions against Russia are killing small- and medium-sized European businesses, which threatens to set off a new round of loans that will go bad.

Pretty picture? Hardly. It’s the ugliest economic picture for Europe since the 1930s, when 17 European countries went belly up, sending hundreds of billions of dollars’ worth of francs, marks, liras, and more flooding into the U.S.

Fourth, deflation is high. With austerity measures squashing growth all over Europe, deflation is starting to run rampant.

According to the latest data, inflation is running at a very low 0.4 percent. But that hides the problem. In most European countries, prices are now falling faster than at any time since the 2008 financial crisis.

There are huge problems when an economy suffers from deflation. Demand falls off and growth comes to a halt as consumers think, why buy something today when it will be cheaper tomorrow?

That, in turn, causes a host of problems. Debt to GDP worsens, economic activity slows further. Unemployment worsens, and more.

That means Europe is facing more hits to economic growth, more debt going bad, more unemployment, and more social discontent in the months ahead.

In short, nothing, and I mean nothing, has been solved in Europe. The crisis will soon escalate with a vengeance.

So what does all this mean for you and your investments? A heck of a lot!

As Europe’s economy continues to worsen:

First, you’re going to see trillions more euros stampede for the exits. That’s going to send several large European financial institutions down the tubes.

Second, that will likely send global interest rates rocketing higher. The U.S. will not escape rising interest rates. In fact, our rates are now poised to move sharply higher in 2015.

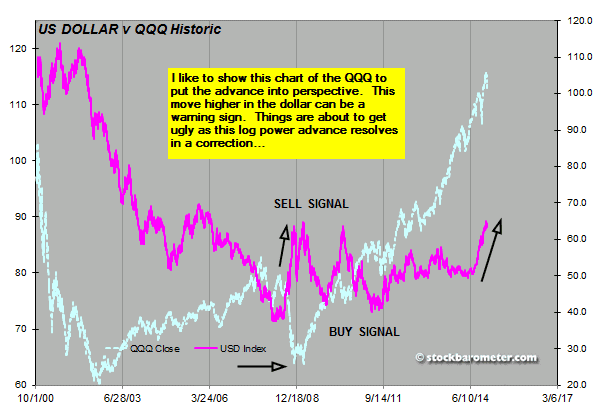

Third, it’s going to send the U.S. dollar further into rally mode. That in turn, will eventually usher in more disinflation here in the U.S., driving commodity prices still lower in 2015.

Fourth, it’s also going to send our stock markets roaring higher. After the current correction completes, which could be the most substantial yet, a roaring dollar again in 2015 could send our stock markets through the roof, just like it did between 1932 and 1937 when the Dow Jones Industrials soared 387 percent as Europe went under.

Fifth, it’s going to give you multiple profit opportunities in 2015 to potentially make more money that you ever dreamed of.

I just gave my Real Wealth Report members the details in my very important 2015 forecast issue. To find out more, and to become a member, click here now.

In the meantime, my suggestions are …

- Keep your eyes on Europe. And keep most of your liquid funds in cash, in the U.S. dollar, ready to be deployed on a moment’s notice, but as safe as can be right now.

The best way, in my opinion: A short-term Treasury-only fund in the U.S., or the equivalent.

- Earmark a portion of your cash for speculation. Not too much, and not too little. I recommend 25 percent of your total investable funds. Funds that you do not need for anything else.

And …

- If you acted on my previous suggestions to buy inverse ETFs on the euro, mining shares, and gold and silver — you’re sitting pretty. Hold those positions!

Best wishes,

Larry

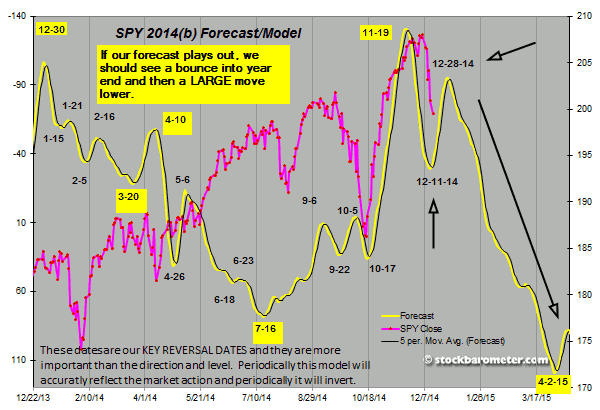

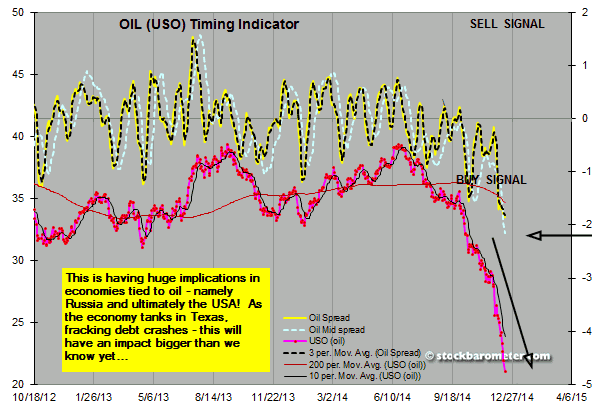

As the oil drop plays out in global economies – Russia’s push to 17% interest rates is an ominous sign worldwide. Let’s start with our forecast:

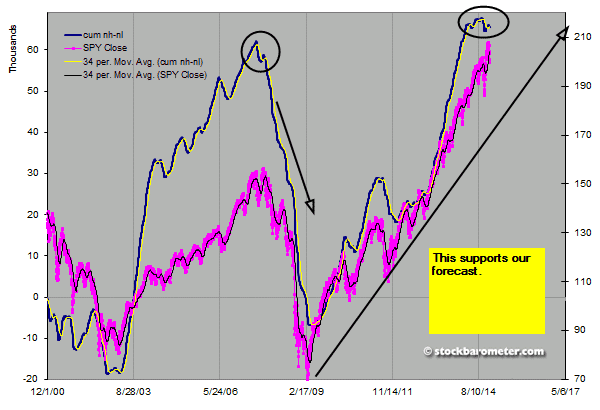

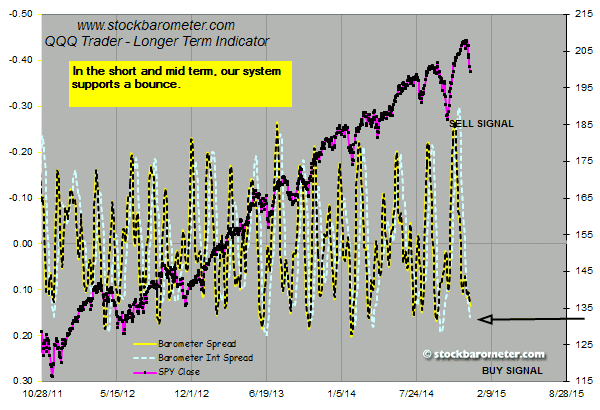

To support the potential of a large move lower:

It’s all about this move in oil:

In the short term:

Unless the crash initiates now, which is less likely but not impossible, I expect a bounce into year end. The mid term line above will bounce to just below the zero level where a larger move lower will begin.

The move from the 2009 lows has been historic and while it can go higher, it’s culminating in a sell off at some point. Even 20% would be a significant move. So while we can play short term bounces, I would be very cautious entering 2015.

The Fed meeting and options expiration are playing into where the market is right now. I would expect the bounce to initiate in the next couple of days. During the bounce, I expect to see more evidence of distribution setting up the next move lower.

You can’t control markets, you have to let them play out. And all markets are related – so I expect this move to filter through other markets eventually…

Regards,