Sinclair, who was once called on by former Fed Chairman Paul Volcker to assist during a Wall Street crisis, had to say.

Gold & Precious Metals

Interest in Gold “Disappears” as North Korea Tensions Rise

Posted by Ben Traynor: The Bullion Vault

on Tuesday, 2 April 2013 12:23

Silver “Acting More Like Base Metal than Store of Value”

U.S. DOLLAR prices to buy gold dipped back below $1600 an ounce Tuesday morning, though they remained close to that level by lunchtime in London, as the physical bullion market re-opened following the Easter break.

Stock markets edged higher in Europe despite news of record high unemployment and contracting manufacturing sectors, while major government bond prices dipped.

“Looking at gold for six months shows the metal making successively lower lows and lower highs,” says the latest technical analysis from Scotia Mocatta.

“The last major lower high was $1620…We feel that while this $1620 level holds, the risk is for another drop to $1555 and possibly the one year low of $1528.”

“We saw buying interest from the general public on TOCOM this morning,” says one dealer in Tokyo, referring to the Tokyo Commodity Exchange.

“But then it disappeared. [People] don’t want to buy or sell because of the matters concerning North Korea.” North Korea said over the weekend that it is in a ‘state of war’ with South Korea, technically true since the 1950-53 Korean War ended with an armistice rather than a peace treaty. Pyongyang, which conducted a third nuclear test in February, has also said it will restart all facilities at its Yongbyon nuclear complex.

In the south, “people do seem a bit more concerned than before,” says one BullionVault contact based in Seoul, adding that a colleague of his has “bought lots of noodles and canned food ‘just in case'”.

“People’s fear is more based on the fact that the North has done small attacks in recent years to force a return to the negotiating table, and that if they do the same again, it could escalate this time because the South’s new president will need to show a reaction.”

BullionVault‘s Gold Investor Index fell for the third month running in March, figures published Tuesday show, despite the online precious metals exchange seeing its busiest week since mid-October following the Cyprus bailout news.The world’s biggest gold exchange traded fund meantime continued to see outflows Monday. The volume of gold backing shares in the SPDR Gold Trust (ticker: GLD) fell to its lowest level since July 2011 at just over 1217 tonnes.

On the Comex exchange, the so-called speculative net long position of gold futures and options traders, calculated as the difference between the number of bullish and bearish contracts held by hedge funds and other money managers, fell by 0.2% to the equivalent of 397.3 tonnes in the week ended last Tuesday, weekly data published by the Commodity Futures Trading Commission show.

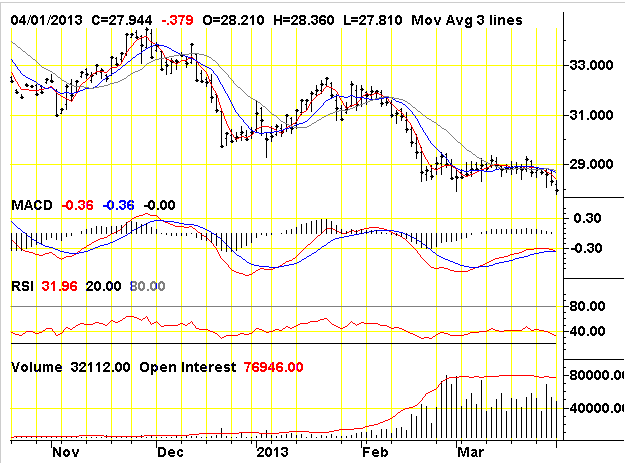

Silver meantime fell below $28 an ounce Tuesday, trading near seven-month lows, while other commodities were broadly flat on the day. “In the past two weeks silver has been performing more like a base metal and less like a store of value,” says today’s commodities note from Commerzbank.

(Ed Note: Below is what silver looked like trading Tuesday 6:35 am PST)

“Silver’s underlying demand/supply fundamentals remain weak…inventory is abundant,” says Standard Bank’s monthly Precious Metals Definer, estimating that China’s surplus is equivalent to 18 months’ of fabrication demand. “The situation within China implies that one of two scenarios should happen before silver can rise substantially higher on a sustainable basis:

(1) internal demand (fabrication and investment demand) must grow faster to decrease the stockpiles, or

(2) China must become a net exporter of silver again.” Standard’s analysts add that the second scenario “would only imply that the metal has shifted location and not been consumed — the result of which would be price neutral at best.”

Although the Dollar silver price ended the first quarter down more than 4%, the US Mint recorded its strongest quarter for silver coins sales since it began keeping records in 1986.

Over in Europe, the Eurozone unemployment rate hit a record 12% in January, according to revised figures published this morning, maintaining that level in February.

Eurozone manufacturing meantime continued to contract last month and a faster rate than a month earlier, according to purchasing managers index data published Tuesday. Germany’s manufacturing PMI fell back below 50, also indicating contraction, while Britain’s PMI fell further below 50.

India is unlikely to raise gold import duties again, having raised them to 6% in January, according to the country’s finance minister.

“There are limits to which tariffs can be raised on gold,” P. Chidambaram told Reuters Tuesday, “because if you raise tariffs prohibitively, gold smuggling will increase.”

Turkey imported 18.26 tonnes of gold last month, up from 17.34 tonnes a month earlier, according to data from the Istanbul Gold Exchange. Turkish gold imports in 2012 were up 51% from a year earlier at 120.78 tonnes. Turkey’s gold exports also jumped last year, with reports suggesting it was using gold in trade with sanctions-hit Iran.

Ben Traynor

Gold value calculator | Buy gold online at live prices

Sinclair: “There is a public relations campaign that is gaining momentum in the amount of articles being published by brokerage firms, commentators, and newspapers. There is now a definite desire to communicate to the public that there may be a chink in the armor of ‘too big to fail.’

The message is that depositors may be considered as lenders, whereby their deposits will be taken in exchange for shares in the banks or financial institutions, rather than what’s happened up to now which is their deposits have been guaranteed by the bailouts.

It’s a scare tactic, but it is having an impact because it’s growing….

……continue reading the Jim Sinclair interview HERE

Investment guru gives his take on the developments in financial markets in general and commodity markets in particular.

Dennis Gartman is the man behind The Gartman Letter, a daily newsletter discussing global capital markets. For more than 20 years, The Gartman Letter has tackled the political, economic and social trends shaping the world’s markets, and Gartman himself is a frequent guest on CNBC, Bloomberg and other financial media outlets. Hard Assets Investor’s Sumit Roy recently caught up with Gartman to discuss a wide range of topics, including gold, oil, natural gas, housing and China.

HardAssetsInvestor: Is the crisis in Cyprus significant for the global economy?

Dennis Gartman: It is significant for the psychology of investors. I think it’s significant for the psychology of wealthy families. I think it’s significant for people outside the United States to worry about the sanctity of contract and to worry about the sanctity of bank deposits. It adds a real concern to whether your money is indeed safe. Now it doesn’t mean that things are going to fall apart. It doesn’t mean that the world is coming to an end. But it does mean that you have an added concern that you have to add to the many other concerns that one has when making investment decisions.

At the margin, you have to suspect that wealthy families and wealthy corporations have had meetings to say “Look, the game changed a good deal … what do we have to do to protect ourselves?”

And as I like to say—since all economics is the study of people’s propensity to do something—what is the propensity for an investor from outside of Europe to put money into Europe? I have to suspect that that has been somewhat reduced. What is the propensity of somebody from inside Europe to move money outside of Europe? I have to think that that propensity has been somewhat increased.

In the long run, the Cyprus situation is bearish of the euro. I think in the long run, it’s bullish of dollars—U.S., Canadian, Australian and Kiwi dollars. On other hand, I’m not quite convinced that it is either bullish or bearish of the stock markets.

HAI: Back in May, before the announced QE3, you made the call that gold had put in its short-term low below $1600. Of course, that proved to be very accurate, as gold rallied all the way up to $1800. Now we find gold back near $1600 again. What do you think is going to happen this time?

Gartman: I’m very bullish on gold, but not in dollar terms. I could care less, to be honest, about gold in dollar terms. I have immense interest in gold in yen. And it’s hard for people to believe that gold denominated in yen is at a new all-time high. Nobody recognizes that fact. But gold in yen terms is at a new high.

I’ll Take My Chances The Banks Are Right on Gold

Posted by Peter Grandich & Other Authors

on Thursday, 28 March 2013 6:43

Just about every day I awake to read some bearish prediction on gold and/or an email telling me how wrong I am to be so bullish on gold (and mom, you can stop sending them-lol).

After decades of being aggressive sellers, Central Banks are aggressive net buyers of gold. I don’t believe it’s just a coincidence that more of them are seeking to make sure they physically control their own gold going forward.

This is why I endure the onslaught of Crimenex and the desire by the gold paper market pulling out all the stops in hopes of getting a major break in the gold price. The longer it slips away from them despite their best efforts, the bigger the rally can be.

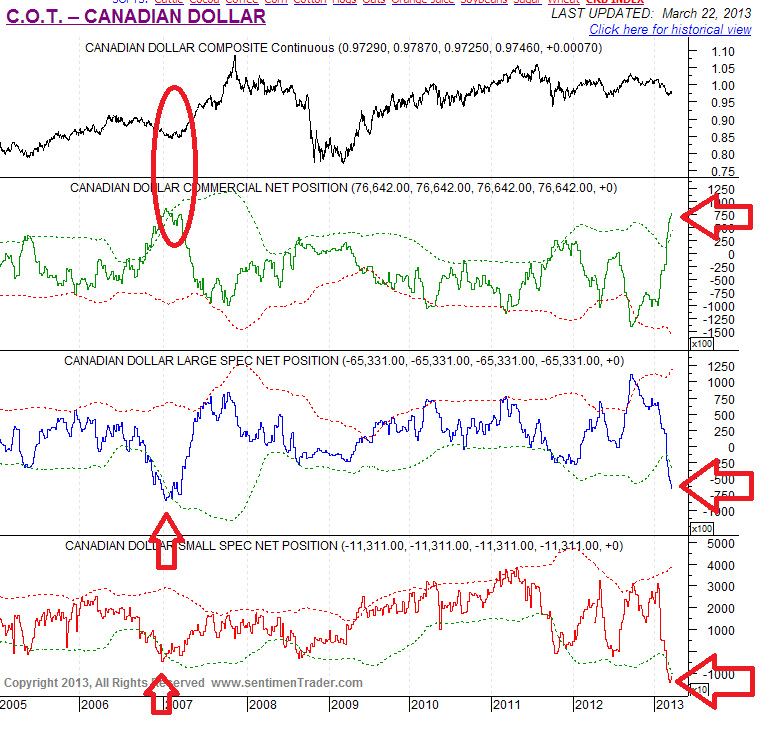

Loonie Time?

My good friend Bill Murphy had these charts in his daily newsletter. To see how incredibly long the commercials have become while large and small speculators have gone in the opposite direction, suggests to this old-timer a contrarian play is upon us.

Gold, a Hedge Against Financial Repression

…..read it all HERE

Peter Krauth, resource specialist for Money Map Press, considers the precious metals space an overarching requirement for investors. He sees value in every sector, although he admits it takes a contrarian mindset to see the opportunity among stocks that have been trending down for as long as 18 months. In this Gold Report interview, Krauth shares names from majors to mid caps to royalty companies, including those in the platinum group metals space, where supply-and-demand tensions will move the price of palladium up.

The Gold Report: Peter, playing equities is all about timing. With many resource equities trading near all-time lows, it seems like a buyer’s market. Do you agree?

Peter Krauth: Central banks have been on a fiat money printing binge since 2008. In the last 18 months, that is starting to have the desired effect. The global economy seems to be healing: Demand for goods is coming back strongly, the Dow Jones Industrial Average is setting new records. But at the same time, there will be a serious price to pay with inflation. Commodities tend to benefit from inflation. This is a very good and important space that investors need to include in their portfolios.

TGR: Does that hold true across all commodities?

PK: The entire secular commodities bull market is not completely over. It has been going for 12 years, but the average tends to be closer to 17 years. This bull market might last 20 years or even longer, if you consider development in China and India—home to nearly one-third of the world’s population—along with the rest of the developing world. These populations are improving their standards of living, growing their incomes and looking for a better lifestyle. That means someone will have to make all the stuff they will want to acquire.

However, there could be a serious low or even a setback in the form of seriously reduced economic demand or an inflationary crisis. That would quiet things for a while, but would also do a lot of cleansing. After that, we will be back on our way.

Nonetheless, investors have to be picky. Every resource has its own cycle. It takes a lot of research to decide where you should be and when.

TGR: What are you telling the readers of your newsletter about increasing their exposure to natural resources in their portfolios?

PK: Right now, I see opportunities in base metals, energy and agriculture. And of course, precious metals will remain an overarching requirement to have exposure to commodities.

The larger gold miners have become extremely cheap, with very compelling valuations. As a group, they have not been cheaper since the secular bull market started. Gold may have been in consolidation mode since it reached $1,900/ounce ($1,900/oz) in September 2011, but I believe the secular bull market is far from over, despite the possibility of some sideways or downward price action.

The Market Vectors Gold Miners (GDX), an exchange-traded fund (ETF) that many consider a proxy for the Amex Gold BUGS Index (HUI), has a price-to-earnings ratio (P/E) of 10, far better than the average blue chip stock, which is closer to 16–17 P/E.

TGR: Some say the gold price is like a ball when you drop it. The first bounce is the highest, and the bounces keep getting smaller after each drop. Does that pattern worry you?

PK: No. As the consolidation moves forward in time, the price range gets narrower and narrower. At some point, that will have to change. The price will either drop down or break out of its narrowing price range. I believe it will break out.

The gold price is unlikely to stay very stable for an extended period. There is too much political and economic instability. The run on the banks in Cyprus is an example; a lot of Southern Europe has too much unemployment and sovereign debt. Ongoing gold purchases by the central banks provide renewed support for the gold price. All of these factors, and others, will support the gold price, at least in the $1,500/oz range. It could continue sideways for some time, but the bias is very much on the upside.

TGR: What analysis do you do on small- and mid-cap resource names before adding them to your portfolio?

PK: My main filters are management, location, cash strength, ease of execution and asset quality. This analysis eliminates many potential plays, but there are more than enough attractive opportunities if you stick to those that stay within those parameters. I see no reason to take on additional risk.

TGR: Which small- and mid-cap resource names in your portfolio might you share with our readers?

PK: My favorite development-stage play is Paramount Gold and Silver Corp. (PZG:NYSE.MKT; PZG:TSX). The company recently released a preliminary economic assessment (PEA) on its San Miguel project in Mexico. The numbers look very attractive. Its initial capital requirements of $232 million ($232M) are pretty reasonable. The mine would actually produce about 57,000 oz (57 Koz) gold and more than 3 million ounces (3 Moz) silver annually for 14 years.

If you were to convert the forecast silver production to gold, it would be more than 115 Koz gold equivalent (Au eq) produced annually. With the 5% discount rate that the company used to evaluate the project, the net present value (NPV) exceeds $707M, with an internal rate of return (IRR) around 32%. This single project at a $707M NPV is more than double the company’s current market cap of $290M. On that basis alone, the stock should be twice its current $2.16/share trading price. Shares barely budged on the news of the San Miguel PEA. That is a ridiculous reaction, and a clear sign that sentiment is coloring everything gold-related.

TGR: You buy Paramount for San Miguel, and you get Sleeper, its precious metals project in Nevada, for free. Is that what you are saying?

PK: Or vice versa, or you buy Paramount for both San Miguel and Sleeper and get a lot for free.

Paramount released PEA results on Sleeper in July 2012. The startup costs would be about $340M; production would be 172 Koz gold and 263 Koz silver annually. The average operating cost was $767/oz Au eq and the IRR was about 26%, at $1,384/oz gold price. If you bumped up the gold price to $1,615/oz, the IRR shoots up to 40%. This makes Sleeper very attractive at the current gold price. Paramount prudently used lower gold and silver prices in its estimates.

TGR: Will Paramount have any trouble raising that $232M to develop San Miguel?

PK: Paramount just had some warrants exercised, so it is cashed up to $18M. That should carry it through 18 to 24 months. I believe it will keep moving both projects forward. Both are attractive and could draw the interest of a major.

TGR: Might Paramount sell one project to develop the other?

PK: I could see that as a possibility, however, given its advantageous cash balance compared to the rest of the industry, I doubt Paramount will be pushed into that situation anytime soon. It could probably even raise cash to tide it over without being overly dilutive to its shareholders.

Both projects are in great jurisdictions and have great infrastructure. With each project worth about $700M, that is close to $1.4 billion ($1.4B) in value, and the market values Paramount at less than $300M. Realistically, the shares could be 4.5 times what they are trading at now.

TGR: Please tell us about another name.

PK: We hold Timmins Gold Corp. (TMM:TSX; TGD:NYSE.MKT), a small producer whose San Francisco mine is in Mexico. The company had record gold production last year, a 27% increase year over year (YOY). It is expanding its crushing capacity, which should allow for another 25–30% growth in 2013. For a small producer, its P/E is 10.5, and its forward P/E is 7. It has a $28M cash balance and roughly $20M in debt. Timmins is very well run. It is a smaller producer with a great future.

TGR: Timmins looks to be a company that would benefit from a change in market sentiment. Do you think the market is already factoring in last week’s news that the Mexican government may raise taxation rates and royalties on mining operations?

PK: That is possible, but the Mexican government understands what it is doing. Gold production is growing fast there.

On raising taxes and royalty rates, Mexico will be the rule, not the exception. We expect to see this everywhere. Governments are hungry for income. If gold continues to rise, these companies will be increasingly profitable. This rise in taxes will have only a temporary dampening effect; it will not hurt the bull market in any way.

TGR: What will Timmins do with its cash flow?

PK: Timmins is expanding its crushing capacity, drilling off and expanding its resource. I believe that as the company was drilling off and delineating more ounces, its finding costs were $10/oz—an incredible return. Its exploration program is relatively aggressive, but the company also is confirming the gold in higher confidence categories.

TGR: Are there any other names you would like to discuss?

PK: In silver, we hold Aurcana Corporation (AUN:TSX.V; AUNFF:OTCQX), which also has been growing its production quickly. In mid-December, the company reached commercial production at its Shafter mine in Texas. It also produces in Mexico from a project called La Negra.

Shafter is a milestone that will move Aurcana to much higher production levels this year. I look forward to seeing Shafter’s contribution in the company’s Q1/13 results. Even without Shafter, Q4/12 production was up 34% YOY; overall 2012 production was up 42%.

La Negra is another exciting project. In October 2012, Aurcana announced a new resource there, which brought the silver resource from 4.9 Moz to more than 115 Moz.

Aurcana’s P/E is relatively high, at about 39. It is a smaller silver producer but it is profitable, which means a lot. Its forward P/E is estimated at 5.3, which is very low and makes it very attractive. The forward P/E reflects the higher production levels and, therefore, profitability.

TGR: Aurcana has four institutional analysts covering it. Does institutional coverage on a small company reassure you?

PK: Institutional ownership is more important. Ownership means more than just giving an opinion. Institutional investors tend to take a longer view.

TGR: Both Shafter and La Negra are past-producing assets. Aurcana has nothing in the pipeline beyond those two, although both are producing fairly strong cash flow. What does Aurcana plan to do with that cash flow?

PK: The plan is to plow it back into drilling off and expanding the resource and increasing production capacity. Aurcana wants to mill and crush more of the ore it gets out of the ground.

At La Negra, the company wants to prove up higher levels of its 115 Moz silver. Shafter is a similar story. In the first phase, production at Shafter will be around 3.8 Moz with 1,500 tons per day (1,500 tpd). The second phase will achieve 2,500 tpd. That could actually increase the Shafter production to approximately 6.3 Moz silver annually. That is close to 70–80% growth from the initial production targets. If Shafter reaches its phase 2 targets, it will be the third-largest primary silver mine in North America.

TGR: You recently wrote about the coming global shortage of palladium and the likely rise in the palladium price. Investors have heard similar refrains from experts relative to rare earth elements, lithium and even some base metals. Those commodities have witnessed only what one might call sporadic price gains. Are you “crying wolf” when it comes to palladium?

PK: The fundamentals for palladium’s supply-demand profile are very solid. On the demand side, two-thirds end up in vehicles, mostly for catalytic converters. Car sales are growing very quickly. In 2011, 77M vehicles were sold worldwide; in 2012, 81M. This year, the forecast is to reach 85M and the 2018 estimate is 104M. A lot of that growth will happen in China, which also has a serious pollution problem. China has been increasing its emission standards as its air becomes relatively unbreathable.

On the supply side, Russia accounts for 44% of palladium production; South Africa for 38%.

South Africa has serious labor disruptions. In August 2012, miners at Lonmin Plc’s (LMI:LSE) Marikana mine went on strike. Clashes between strikers and the police resulted in 46 deaths. Protests and strikes have multiplied since then. In January, Anglo American Plc (AAUK:NASDAQ) decided to close and sell off several of its platinum mines. Labor problems and production costs have just become overbearing. The mines are not profitable anymore. That does not help supply.

Ore grades from Russia have been falling quickly. Output from Norilsk, the world’s largest palladium producer, is declining. Russia also sells palladium into the physical market from Gokhran, its state repository. In 2010, as much as 1 Moz of the physical palladium—representing 15% of the global supply—came from Gokhran. In 2011, that dropped to 775 Koz and last year to 250 Koz. This year, Johnson Matthey forecast Gokhran will supply only 150 Koz. In four years, supply from Gokhran will have dropped from 15% of the global supply to only 2%. Some insiders say there will be no supply from Gokhran in 2014.

TGR: Are resource equities the best way to play palladium?

PK: They are. Palladium’s demand outlook is solid, and Russia and South Africa—source of 80% of the supply—will have a difficult time keeping up with demand. As a result, palladium prices will continue climbing. That will attract investors to things like palladium ETFs. As those ETFs use the metal as backing, it will drive up physical demand further.

The equities provide leverage to the palladium price. If companies can mine palladium at a relatively low cost, they can generate healthy profit margins. That is how investors should play this trend.

TGR: There are few platinum group metals (PGM) plays out there. Can you give us one or two names?

PK: I like Colossus Minerals Inc. (CSI:TSX; COLUF:OTCQX), a developing precious metals miner. Its flagship project, Serra Pelada in Brazil, is fully permitted and has environmental, installation and mining licenses going back to 2010. The mine is under construction, with first production planned for early H2/13. It has done all kinds of metallurgical testing and expects very good recoveries.

The company has come across some extremely high-grade intercepts for gold, platinum and palladium. Some of the high-grade intercepts have been 4,600 grams per ton (4,600 g/t) gold over admittedly short intercepts, about 2–2.5 meter (2–2.5m) sections, 1,600 g/t platinum and 1,700 g/t palladium. Its margins are likely to be extremely wide, so it should be a very profitable producer. Some of the grades at Serra Pelada are among the highest on record. The project has drilled 100,000m to date, and a lot of exploration upside remains.

TGR: For a long time, a group of workers called the Cooperativa de Mineração dos Garimpeiros de Serra Pelada (COOMIGASP) held a percentage of Serra Pelada. Does it still own a percentage?

PK: Yes, that group still owns 25% of Serra Pelada.

TGR: Is Colossus likely to try to buy them out?

PK: I think that could be part of its long-term plan.

TGR: Is Colossus on target for production in H2/13?

PK: Yes. It has a $75M contingency for construction and working capital. It sold some of its production in advance to Sandstorm Gold Ltd. (SSL:TSX.V) and Sandstorm Metals & Energy Ltd. (SND:TSX.V), but it has the right to repurchase half of those commitments.

Platinum and palladium production will be relatively important, in addition to gold. This makes it an interesting way to play the PGM space. Investors can be part of a company that is very close to production and should have attractive profit margins.

TGR: With its margins and its unusual gold-PGM project, is this a takeover target?

PK: Yes. Imminent producers inevitably become targets because they are irresistible in terms of adding to production and reserves. Colossus would be a trophy piece for a miner that wanted to own potentially large, high-grade reserves in a good, relatively safe jurisdiction.

TGR: Why have we not seen a pure PGM royalty play?

PK: The market for a pure royalty play in PGMs is probably just too small for a given royalty company to focus solely on these metals; its growth opportunities would be limited.

There are few PGM projects being developed. PGMs are found in places that are not the best or most attractive places to work. Outside of South Africa and Russia, there are relatively few viable locations, therefore, there are very few PGM projects coming onstream in the next two years.

TGR: Large-cap royalty plays in the precious metals space have had a pretty good run. Some are trading around 21 times projected 2013 cash flow. Is there still value there?

PK: I think so. Some are trading at relatively high P/Es, but there is opportunity. First, along with other precious metals equities, they have sold off to some extent. Second, and more important, they are being valued using gold prices that are probably too low.

The average analyst thinks that gold will average somewhere around $1,500/oz by 2015. They may be right, but if you look at their projections since 2007, analysts have regularly underestimated the gold price by several hundred dollars.

Inflation and money printing by central banks will not back down. Precious metals royalty companies will certainly come back quite strongly as gold continues to rise.

TGR: What are a couple of your favorites in the royalty space?

PK: Our portfolio has Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX). About 68% of its revenues come from gold. Of its large inventory of assets, 39 are producing, 28 are development stage and almost 140 are exploration.

We also hold Sandstorm Gold Ltd. (SSL:TSX), a smaller royalty company with an $870M market cap. It has been aggressive, and is growing quickly. It has very savvy, experienced management, including Nolan Watson from Silver Wheaton Corp. (SLW:TSX; SLW:NYSE). Sandstorm’s recent purchase of a controlling interest in one of its competitors, Premier Royalty Inc. (NSR:TSX), grew its book quite quickly. It also closed a large deal with Entrée Gold Inc. (EGI:NYSE.A).

This is a great space. Royalty companies will continue to perform very well over the medium and long term. I definitely want to maintain exposure to precious metals royalties.

TGR: Shares of Royal Gold were trading near $100/share last fall, and now it has fallen to below $70/share. It is rare to see a royalty company fall that far so quickly. What happened?

PK: I believe delays by Barrick Gold Corp. (ABX:TSX; ABX:NYSE) on a large project that Royal Gold has a royalty in weighed on the stock.

That does not concern me. We doubled our purchase price and took profits. We continue to hold Royal Gold as a free ride. On a technical basis, Royal Gold is trading below its 200-day moving average. That 200-day average tends to be a magnet that a stock gravitates back toward and sometimes moves considerably beyond. When it does so, it can be a time to take some profits and wait for it to become more of a value once again.

TGR: Do you have some parting thoughts for us?

PK: We are in a secular resource bull market that still has lots of legs and will last several more years. The imprudent behavior of central banks printing copious amounts of fiat money just makes serious inflation more of a threat to people’s savings.

Commodities tend to be a strong beneficiary of inflation. I think everyone needs some exposure to commodities. But there is the element of cyclicality for all resources; at any given point in time, it makes sense to be in certain resources or to play them certain ways over others.

TGR: Peter, thank you for your time and your insights.

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals, and mining stocks. Krauth is the resource specialist for Money Map Press and has contributed some of its most widely read and highly regarded investing articles to Money Morning. As editor of Real Asset Returns, he travels around the world to dig up the latest and greatest profit opportunity, whether it’s in gold, silver, oil, coal, potash, chromium, or even water. Krauth holds a Master of Business Administration degree from McGill University and is headquartered in resource-rich Canada.

DISCLOSURE:

1) Brian Sylvester conducted this interview for The Gold Report and provides services to The Gold Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Paramount Gold and Silver Corp., Timmins Gold Corp. and Colossus Minerals Inc. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Peter Krauth: I or my family own shares of the following companies mentioned in this interview: None. I personally or my family am paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair