Energy & Commodities

Below are factors that suggest that water will be the world’s most sought-after commodity in a handful of decades.

I couldn’t help but notice a new ad on Yahoo! Mail from Fidelity Investments that boldly asks, “Are you ready for water to become a globally traded commodity?”

This video accompanying the Fidelity Investments ad is as thought-provoking as it is ominous. The video discusses the respective costs in water to make items like a slice of bread, a cup of coffee, and a hamburger. From the video: “With global population expected to increase by 30 percent by 2050 and more developing nations transitioning to higher standards of living, regional water shortages and peak water issues will become more widespread.” The issue of water becomes more complicated in considering the accessibility and availability of drinking water in the years to come. From the video: “Global consumption of water is expected to increase by 40 percent over the next 20 years. And according to some estimates, more than half of the world’s population could be living under conditions of water stress by 2025.” Thus, the video suggests that water stress could intensify geopolitical affairs and “border disputes” related to the water supply.

…..read more and view Action Items (scroll to the bottom) HERE

For investors seeking high potential returns and the thrill of participating in market innovation, the smallcap energy space is where it’s at. Managing Director and Co-Founder Laird Cagan of merchant bank Cagan McAfee Capital Partners has built his career by backing companies that are both filling current demand and creating new markets. In this exclusive interview with The Energy Report, Cagan shares his experiences and discusses several companies at the forefront of the energy revolution.

The Energy Report: Laird, you and your partner are active investors. You are company founders, you sit on the boards and you actually run the businesses in some cases. What kind of advantage does that give you?

Laird Cagan: We are involved with fewer portfolio companies compared to a private equity or larger firm. Because we take a very active role and are starting companies at early stages, our preference is to create a new platform company and a new business opportunity. So the benefit is that we can be very close to the company and try to launch it quickly to take advantage of whatever market opportunity we see. We have a lot of skin in the game, a lot of ownership, and we try to help guide companies in the right direction. But like private equity investors, we generally have professional managers from the industry who were either co-founders or who were brought in to lead the company on a day-to-day basis. One exception is the case of my partner Eric McAfee, who has been running Aemetis Inc. (AMTX:OTCPK) since 2005, when we started that company.

TER: What kinds of companies interest you most?

LC: For the last 10 years or so we’ve been focused on building companies in the microcap public space. We have found that this has given us better, faster access to capital for the right opportunities. Public investors don’t want to take the three, six, nine or 12 months that venture capitalists and private equity firms take to investigate opportunities before making an investment decision. Public investors want to see something faster and want an opportunity that they can understand. Typically, that means we stay away from pure-play technologies, but we do look for technologies that are creating new markets. For example, we founded Evolution Petroleum Corporation (EPM:NYSE) in 2002, when oil was $25 per barrel (/bbl). We created that company to do enhanced oil recovery using technologies like lateral drilling, which was not very prevalent back then. We could take mature oil and gas fields and extract additional reserves using new technologies. But we also benefited greatly from having oil prices go from $25–100/bbl. We founded Pacific Ethanol Inc. (PEIX:NAS) to replace gasoline additive MTBE (methyl tertiary butyl ether), which was outlawed in 2004 in California and many other states. Ethanol was the only known oxygenate that would burn gasoline cleanly enough to meet the clean air act. So, it was less of an alternative energy play than a replacement-commodity play with a West Coast focus. Those companies, Evolution Petroleum and Pacific Ethanol, got us into the energy space. With rising energy prices and a multitrillion-dollar marketplace, all sorts of new opportunities began to arise because of technology. Aemetis, originally called AE Biofuels, was focused on next-generation biofuel moving from corn to other feedstocks that would be more plentiful, more predictable and would not be in the food chain.

TER: Was horizontal drilling technology more capital-intensive at the time, with oil at $25/bbl?

LC: Not particularly. There were thousands and thousands of wells around the United States that had been drilled and shut-in or were at a trickle of their former production. Some were getting ready to shut down. People would practically give them away because it costs money from an environmental standpoint to close them. For us, Evolution was an opportunity to create an early-stage platform company to produce oil using enhanced oil recovery. We were fortunate that by 2006 oil prices were at $40–50/bbl.

TER: What’s the technique?

LC: The technique used is called CO2 (carbon dioxide) flooding, where you inject CO2 into the ground and it releases the trapped extra oil, which then bubbles up. The CO2 adds pressure, just as it does in a carbonated beverage. When you drill an oil well for the first time and release the virgin pressure by traditional means, you might get 40% of the oil. This means somewhere between 50% and 60% of the original oil in place is still there. With the CO2 floods, you can typically get between 15% and 20% of the original oil in place, and that’s a meaningful well.

TER: As a pioneer of this technology, where did you incur the most extensive costs?

LC: You have to have a pipeline to get your source CO2, and that’s a challenge. If you’re close to a source, the cost of injecting it can be around $10/bbl. But a project’s viability depends a lot on the fixed cost of getting the CO2 to the site. At the Delhi Field in Northern Louisiana, Evolution Petroleum formed a very effective partnership with the leading CO2 player in the industry, Denbury Resources Inc. (DNR:NYSE). Together we’ve done very well. The Delhi Field was 14,000 acres and is estimated to be capable of releasing an additional 60 million barrels (MMbbl) of oil. And with oil now over $100/bbl, that’s $6B worth of oil, and you can afford to spend a lot to go after that.

TER: Great foresight.

LC: I would say yes, it was foresight and some luck. We didn’t anticipate $100/bbl oil at the time. But, we really do focus on trying to get a play at the beginning of a growth cycle. Of course for any investor, being at the beginning of a rising tide is one of the keys to success and having superior returns.

TER: You’re not as actively involved in Camac Energy Inc. (CAK:NYSE) as you are in some of your portfolio companies, but starting the company has been an interesting saga. Can you tell us about that?

LC: In 2006, after having had some success with both Evolution Petroleum and Pacific Ethanol, I was introduced to Frank Ingriselli, the former head of Texaco International. He developed some important relationships in China and he had a lot of very high-level experience with majors in that region. After Chevron Corporation (CVX:NYSE) bought Texaco in 2001, he wanted to start a new oil and gas company and needed capital to grow, for which I was approached. We ended up funding a $21M offering and creating a new public entity, Pacific Asia Petroleum. Frank went to China to visit as a long-time contact and was granted a concession of 175,000 acres in the prime coal-bed-methane region of China. Without any upfront money, we got a hold of a major resource that launched the company. The Chinese government’s goal was to bring in people that had expertise and ability and who could bring capital for projects, because the country needs energy. Over time we ended up acquiring Camac, which owned a large property in offshore Nigeria that was just beginning production. In a sense it was a reverse merger for Camac because it became the majority shareholder and ended up taking control by its Chairman and CEO Kase Lawal. I dropped off the board around that period of time.

TER: Camac shares have been flat over the past six months, but down about 50% from a year ago. What accounts for the lag in the stock price?

LC: Its first production well started out at 20 thousand barrels per day (Mbbl/d) and it has gone down to about 4 Mbbl/d, but there’s still a huge reserve there, which is estimated to be between 600 MMbbl–2.2 billion (B) bbl of recoverable oil in the entire field. Camac is working on getting a new partner to come in and develop that. I’m bullish on the long-term. It’s going to take time, but it should be very exciting. I’m still a big shareholder and waiting, watching and hoping for the best.

TER: Were there any other companies you wanted to mention briefly?

LC: I recently became chairman of Blue Earth Inc. (BBLU:OTC), which is in the energy efficiency space. This is a very important new category, and it is frankly the lowest-hanging fruit of energy conservation by reducing energy consumption. Commercial real estate uses about 20% of our nation’s energy. Making those buildings more efficient is very important, and provides quick returns. For example, replacing old motors and with energy-efficient motors produces a one- to two-year payback. Blue Earth is geared toward doing that.

TER: Is the company actually manufacturing new technology?

LC: It’s not a technology company, but it’s using the latest improvements in energy efficiency to retrofit commercial real estate. It will also do energy audits for clients’ buildings and recommend an energy-generation project, be it solar, fuel cell, etc. that fits the client’s needs. This is called distributed generation: Instead of going into the grid and selling power back to the utility, the company sells directly to the customer. It therefore has none of the energy losses of going through the grid, nor any of the capex issues. Retrofitting to localize energy at a site is a tremendous innovation that needs to happen in order to reduce national and even global energy consumption. I’m very bullish on the energy efficiency and distributed generation space for the next 50 years. It has the power to replace and transform our energy production. We are not going to get rid of utilities because we need them, but we can chip away at our use of fossil fuels from our insatiable appetite for energy in a way that is cost effective. It also reduces carbon emissions.

TER: Is Blue Earth a consulting company?

LC: No. It’s more of a contractor, or a construction company. In other words, it does the work. In the solar world it’s called Engineering Procurement Construction or EPC. After the energy audit, the company does the engineering, including procurement of parts and construction. As we move on and migrate this business model, the company will also provide the financing and effectively become the developer. There are some good tax incentives involved in alternative energy, both in solar and fuel cells. Depreciation is also available, and that adds to the return.

TER: Solar systems would be on the roof or on land, but how far away would a generating fuel cell typically be from the building?

LC: Adjacent to the building. There’s no sound, and there are no moving parts. You need a footprint about the size of a tractor trailer. There are a few significant fuel cell manufacturers in the U.S., and they are growing nicely. Fuel cells are significantly more cost effective than solar if you can use energy 24 hours a day such as in a data center and can have net paybacks in 5–10 years at most, whereas it might take solar 10–20-years to payback.

TER: What are the fuel cell companies?

LC: One of the companies to look at is Bloom Energy (private). It has the larger units, and Google Inc. (GOOG:NASDAQ) put Bloom units into its building in Silicon Valley with a lot of publicity a year or so ago. Bloom is different from the other three manufacturers, as there is no waste heat, which is interesting. So, if you have large, consistent needs, Bloom is good. The data centers that Google runs are 24-hour operations. So, it would not be quite as suitable for a company that shuts down at night because you can’t amortize 24 hours, and perhaps solar would be better for a company that needs mostly peak daytime energy. That’s why an energy audit is so important, so clients can understand what’s most appropriate for their business.

Other companies include FuelCell Energy Inc. (FCEL:NASDAQ) and ClearEdge Power (private), the latter of which makes a variety of units, including small residential-size fuel cells. ClearEdge is blitzing homes. It’s the SolarCity (private) equivalent. SolarCity is trying to put solar on your roof, and ClearEdge is trying to put a fuel cell next to your house, and it makes systems all the way down to 5 kilowatts, which is appropriate for a midsize house.

TER: It has been a pleasure meeting you, Laird.

LC: Thank you.

Laird Cagan is managing director and co-founder of Cagan McAfee Capital Partners LLC, a merchant bank in Cupertino, CA. Cagan McAfee has founded, funded and taken public 10 companies in a variety of industries including energy, computing, healthcare and environmental. The company has helped raise over $500M for these companies, which achieved a combined market capitalization of over $2B. Mr. Cagan was the founder/chairman of Evolution Petroleum Corporation (AMEX: EPM), a company established to develop mature oil and gas fields with advanced technologies, and he is a former director of American Ethanol (AEB) and Pacific Asia Petroleum (PFAP).

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) George Mack of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: None. Streetwise Reports does not accept stock in exchange for services.

3) Laird Cagan: I personally and/or my family own shares of the following companies mentioned in this interview: Evolution Petroleum Corporation, Camac Energy, Aemetis Inc. and Blue Earth Inc. I personally and/or my family are paid by the following companies mentioned in this interview: Evolution Petroleum Corporation, Aemetis Inc. and Blue Earth Inc. I was not paid by Streetwise for this interview.

The idea of finding an undervalued stock is enticing, but how can investors distinguish between an international value tap and a bottomless money trap? Private investor and newsletter writer Chen Lin combs every continent to find junior exploration and production companies whose balance sheets outshine low stock valuations. In this exclusive interview with The Energy Report, Lin shares some lesser-known names that offer major profit potential.

COMPANIES MENTIONED: COASTAL ENERGY CO. – GROUNDSTAR RESOURCES LTD. – HARVEST NATURAL RESOURCES – IONA ENERGY INC. – ITHACA ENERGY INC. – MART RESOURCES INC. – NEW ZEALAND ENERGY CORP. – PAN ORIENT ENERGY CORP. – PETROBAKKEN ENERGY LTD. – PORTO ENERGY CORP. – PROPHECY COAL CORP. –PROPHECY PLATINUM CORP. – TRANSGLOBE ENERGY CORP.

The Energy Report: Chen, you follow world events very closely. Do events in Europe, especially Greece, have any effect on any of your decisions to buy or sell?

Chen Lin: Yes, but I look more at the fundamentals. Greece is on the edge of bankruptcy, but I think the market is well prepared for that. I’m looking more at whether there’s a major impact to the financial markets.

TER: How would it affect the way you trade?

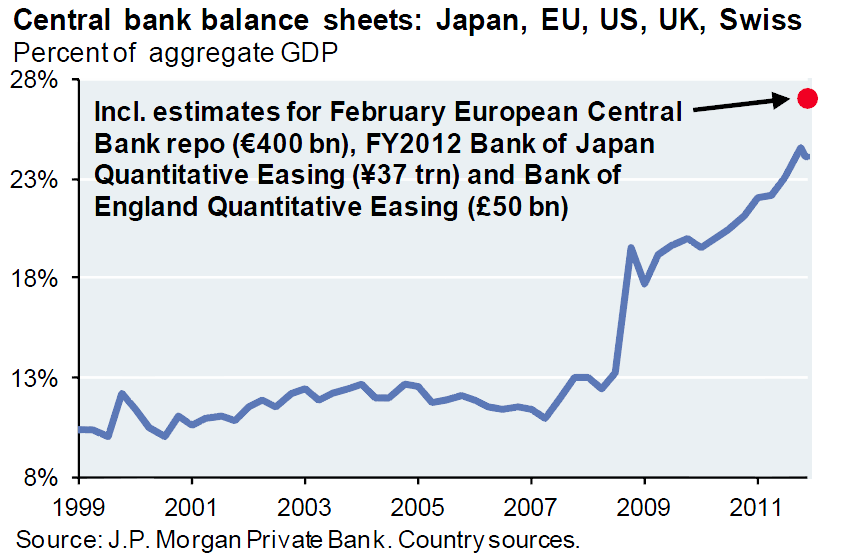

CL: If we have another round of a huge deleveraging, I think I will be more conservative in general. I’ve become very aggressive in my investing since the beginning of the year because the European Central Bank (ECB) did another round of money printing and low-interest loaning to all the banks for three years. That dramatically expanded balance sheets, just like quantitative easing (QE) did in the U.S.

TER: You have had stellar returns in your portfolios. You grew $5,411 as of Dec. 31, 2002, to $1,383,041 by Dec. 31, 2011, but your portfolios were down 11% in 2011. What were the issues that resulted in that downturn?

CL: In 2008 I had a down year by a similar amount. I usually invest mostly long in the market, and I like to invest in undervalued stocks. Sometimes if they are extremely undervalued, I overweight them. So that tends to concentrate those stocks. When the market is down and investors don’t recognize the value, my stocks can be dragged down along with the overall market. Considering how tough the market was in 2011, I think I did relatively well in the period. I’m up quite significantly since the beginning of this year. People were seeking refuge in U.S. Treasury bonds, and now are suddenly starting to put money back to work. There has been a huge run-up of commodities and commodity-related stocks.

TER: At the end of 2011, you said that energy stocks were on a year-end clearance sale. After some price appreciation, are they still on clearance?

CL: A lot of the stocks I own have already appreciated dramatically since the beginning of the year, some even close to 100%. However, because they went down very hard last year and people panicked and sold everything they could to raise cash, I think there are still a lot of extremely undervalued energy stocks right now. Historically, if you compare the risk-reward, they’re still extremely undervalued. So I’m still overweighting energy versus precious metals.

TER: Are you currently trading out of equities that have greatly appreciated since the beginning of 2012?

CL: No, I am not. Well, some stocks I have, but mostly I’ve stayed with what I’m holding. I believe this rally still has legs. My largest position is Mart Resources Inc. (MMT:TSX.V), and my second largest is Pan Orient Energy Corp. (POE:TSX.V). Although I’ve been mentioning them in my newsletter for quite some time, I am still holding and riding those two stocks. I believe they are still very much undervalued.

TER: You’ve written that you’re expecting some big news from Mart pretty soon.

CL: I’m hoping the company can deliver a dividend. Its cash has been increasing dramatically in the past few months. It’s going after light sweet oil in Nigeria and selling it at a premium to Brent crude, so the company has a lot of free cash flow. The money is just piling up on its balance sheet, and I expect that to continue for the rest of the year. It’s pretty amazing that only two years ago the company was close to bankruptcy. Since then, it has just changed dramatically, and I don’t think it is appreciated by the market. I’m still very optimistic about the company and holding my position.

TER: Mart Resources has given back about 6% over the past month. Is this a buying opportunity?

CL: I think so. If you compare the valuation of Mart to other companies in the space, seldom do you see a company trading potentially at one or two times this year’s cash flow. Potentially, it could more than double its cash flow next year because it is finding more and more oil. Every well has been great in the past two years. That’s very unusual for a junior company. In addition, its wells have no decline. That’s something that amazes me because if you look at nearly all energy companies, you’re looking at very sharp declines in the first three to six months.

TER: Is there no sign at all of depletion? This huge oil field just continues to keep producing?

CL: That’s the thing. My guess is that it is sitting on a huge oil pool that’s interconnected and extends over a very big range. Once it pumps oil out, still more oil flows to the area, and so there’s no decline. This type of well is very hard to find on earth except in Saudi Arabia and a few other countries.

TER: So, Mart is producing oil that gives the company a marketing advantage because light-sweet refinement is low cost and therefore commands a premium price to Brent crude. Plus, depletion is not notable yet. What am I missing? I’m sure the picture can’t be this bright.

CL: Exactly. Well, the issue is Nigeria. It is a country where there are frequent protests and attacks on the pipelines. But those conflicts are mostly in the north, whereas Mart operates in the south, near the coast. So it’s pretty far away from the major violence. There is still tremendous opportunity and tremendous cash flow for this company. I think this will be the year when people see a dramatic rise in cash on its balance sheet and hopefully, with all that cash, it can pay dividends and bring in more rigs. It will build a pipeline and do everything organically without coming back to the market. That’s the beauty of this.

TER: A year ago you said you expected investors to begin accumulating shares in Pan Orient based on anticipated production from its big land position in Indonesia. You were correct. Shares are up more than 60% over the past three months. How much more growth can we expect?

CL: Pan Orient has a slightly different thesis than Mart Resources because there is some exploration/discovery risk. It is drilling wells, potentially very big wells, but I don’t know if the wells will be successful. With Mart, there is much more certainty. However, though there is risk for Pan Orient, it is a very experienced oil exploration company, and it’s been in Thailand for five years, drilling and fine tuning its technology.

I shared with my subscribers a report that estimates each of the three Pan Orient wells in Indonesia is worth about $3 of net asset value (NAV)/share if successful in the first half of 2012 and $2 for each of the other three wells in the second half of 2012. In addition, Pan Orient also has an oil sands property in Canada that it wants to sell. The company has $1/share cash on the balance sheet and cash flow over $1/share right now, and this is in addition to the oil sands property that it has for sale. Thailand is ramping up production and Indonesia has the big wildcat wells at work. So in terms of risk-reward, it’s an ideal situation. I wouldn’t be surprised to see the stock be a ten-bagger by the end of this year. The company could be a $1 billion (B) company. It was a $2 stock when I recommended it in my newsletter. Right now it’s $3 and change. With some success in drilling in Indonesia, I’m looking for a ten-bagger. Seldom do you have those in one year, so I have pretty high hopes on the stock.

TER: What other companies do you like?

CL: This year, I have put a new fracking company in my newsletter, New Zealand Energy Corp. (NZ:TSX.V; NZERF:OTCQX). It has done very well so far. The stock has really exploded, and some of this excitement is about the company getting ready to explore for shale oil in New Zealand. The company has a big land package, and I think Apache is going to start drilling in April not far from their huge land package, and so we may see some results in H212. In the mean time, the company has drilled a nice conventional well, which has 500 barrels per day on restricted flow. It is drilling the second well and planning the third. The success of the current drilling program can move the stock as well.

I still have Porto Energy Corp. (PEC:TSX.V) on my list. It was one of my biggest losers last year. You win some and lose some. The stock has been down to about $0.11 recently, but I’m seeing significant insider purchases. The company has about $10 million (M) in working capital, but it doesn’t intend to use all the money to drill the well on its own and then have to come back to the market to raise money at this depressed level. Instead, it is looking to do a joint venture (JV). So basically it would like its partner to pick up the costs and risk. I just spoke with the company, and management is still optimistic about getting a JV deal very soon. Porto is unique in that it has a huge land package in Portugal of over 1M acres on trend with the North Sea.

TER: You’ve said that the Portuguese government wanted to do anything it could to help Porto, and so it’s disappointing to see that the stock has been so weak. What is the government doing to help the company?

CL: I think the government is making it easier to get permits. Porto has drilled three dry holes. It hasn’t found any major oil yet, and that was its big downfall last year. I was told last year that if it found oil it would be easier to work with the government to bring the oil into production.

Portugal is trying to do everything it can to avoid the fate of Greece, and so an oil discovery would be very significant. Porto is being run by very experienced oil guys, and most of them came from Devon Energy Corp.’s (DVN:NYSE) international division. In fact, Joe Ash was running the International division, but he left a comfortable, high-paying job to run Porto because he believes in the potential. You can see from insider trading reports that he has recently purchased more shares with his own money. So that tells you the people still believe in the whole thesis of finding massive amounts of oil in Portugal.

TER: At this low $25M market cap, it seems like Ash with a few other people could easily buy this company and take it private.

CL: Yes. But when the stock went down, the company adopted a poison pill. I think it’s afraid of a hostile takeover. Taking it private is possible.

TER: You mentioned New Zealand Energy. Its shares, as you indicated, have gone to the races. The company is up well over 100% over the past three months. That’s a lot of conviction.

CL: I believe there is the potential of doing fracking on this Bakken-like land. There will be some development later this year, and that’s actually driving the stock price. This stock is still very undervalued.

TER: Are there other companies you like?

CL: There are quite a few still that I like. PetroBakken Energy Ltd. (PBN:TSX) has been a big winner for me. It was paying a 10% dividend when I picked it up, but it’s up almost 70% since then, and now it is paying a 6-7% dividend. The key is that if you compare the company with other North American-based fracking companies in Bakken plays, it’s still relatively cheap. I think it could potentially have more upside, but the easy money has been made with this stock.

I am also holding Prophecy Coal Corp. (PCY:TSX; PRPCF:OTCQX; 1P2:FSE) and Prophecy Platinum Corp. (NKL:TSX.V; PNIKD:OTCPK; P94P:FSE). Both stocks are rising this year. I like Prophecy Coal as it is getting close to a contract with Mongolia’s government. That will lead to financing and construction of the power plant. Prophecy Platinum should have its preliminary economic assessment very soon, so investors can get a peek of the project’s huge potential.

TER: Most of your stocks are microcap companies. I find it interesting that you own Petrobakken, which has such a large market cap at $2.8B.

CL: As far as market cap, it’s one of the largest I own now, but it had been hit very hard, and thankfully I was able to pick it up when it was quite depressed.

TER: What about another company that you like?

CL: Another company I like, which still hasn’t appreciated much, is Harvest Natural Resources (HNR:NYSE). This company has had bad luck like Porto. It drilled three dry holes in a row, and the stock is still very close to its 52-week low. The main attraction is that it has a big oil field in Venezuela. If you are looking at normal valuations, and if it’s not in Venezuela but rather a country friendlier to the U.S., then the company is probably worth at least $20/share. The stock is trading at $6–7. Venezuela is going to have an election this year in the fall, and Hugo Chavez will be seeking his third term. With all the things happening around the world, like the Arab Spring, I wouldn’t be surprised if Venezuela has some major changes this year. If that’s the case, this stock can have a huge upside.

TER: Harvest Natural just hit another dry hole, but clearly the dry holes don’t make you as nervous as the Venezuelan government, is that right?

CL: If it gets a hit in Indonesia that would be great. But this company already has a huge oil field in Venezuela that is self-funding. It doesn’t need to put money in. It was hoping to get money out as dividends for shareholders, but so far it has been having trouble getting any money out because of the government. But this could change overnight if the government has a change of regime.

TER: What other companies did you want to mention to us today?

CL: Another company is TransGlobe Energy Corp. (TGL:TSX; TGA:NASDAQ), which I own. It is operating mostly in Egypt and Yemen. If you compare the company, cash-flow wise it is very, very cheap. Due to political problems, the company has mostly stopped production in Yemen. If it can start flowing again in the country, that would be another big catalyst. I like the stock, and I own the stock and options.

TER: What effect has the Arab Spring in Yemen had on TransGlobe’s business? Its shares have been above water for the last six months.

CL: The Arab Spring in Yemen actually depressed the stock. It used to produce from Yemen but because of violence, it stopped producing there. Any peaceful resolutions and new production would be a big plus.

TER: Any other positions you could talk about briefly?

CL: I also have two companies in the North Sea. Both did very well. One is Ithaca Energy Inc. (IAE:TSX). It just went up 40–50% because of a potential takeover. Another is a Iona Energy Inc. (INA:TSX.V), which was funded by the founder of Ithaca Energy. Both of these have done very well.

TER: Do you have any new positions?

CL: I recently purchased Coastal Energy Co. (CEN:TSX.V), operating in offshore Thailand. It has been growing its production quite dramatically in the past year, and it continues to grow.

TER: Coastal is another larger name with a $2B market cap. But just the opposite is Groundstar Resources Ltd. (GSA:TSX.V), which you owned last year.

CL: Yes. Groundstar was one of the worst stock picks I had last year. It drilled a well in Iraq and one in Egypt, and every well it drilled turned out to be a dry hole. So I had to cut my losses and get out of the stock when I saw it was raising money and diluting shareholders at a very low share price. The stock would have probably had a difficult time rebounding.

TER: It is so nice speaking with you again, Chen. Thank you for your time.

CL: I enjoyed it. Thank you.

Chen Lin writes the popular stock newsletter What Is Chen Buying? What Is Chen Selling?, published and distributed by Taylor Hard Money Advisors, Inc. While a doctoral candidate in aeronautical engineering at Princeton, Lin found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) George S. Mack of The Energy Report conducted this interview. He, personally and/or his family, own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Mart Resources Inc., New Zealand Energy Corp., Prophecy Coal Corp., Prophesy Platinum Corp., Iona Energy Inc. and TransGlobe Energy Corp. Streetwise Reports does not accept stock in exchange for services.

3) Chen Lin: I personally and/or my family own shares of the following companies mentioned in this interview: Mart Resources Inc., Pan Orient Energy Corp., New Zealand Energy Corp., Porto Energy Corp., Devon Energy Corp., Petrobakken Energy Ltd., Prophecy Coal, Prophecy Platinum, Harvest Natural Resources Inc., TransGlobe Energy Corp., Ithaca Energy Inc., Coastal Energy Co. and Groundstar Resources Ltd. I personally and/or my family am paid by the following companies mentioned in this interview: In early 2010, when Porto Energy was a private company, Chen Lin received shares from the company to introduce it to hedge funds. I was not paid by Streetwise for this interview.

We have been saying it for weeks, and today even the WSJ jumped on the bandwagon: the sole reason why crude prices are surging is because global liquidity has risen by $2 trillion in a few short months, on the most epic shadow liquidity tsunami launched in history in lieu of QE3 (discussed extensively here in our words, but here are JPM‘s). Luckily, the market is finally waking up to this, and just as world central banks were preparing to offset deflation, they will instead have to deal with spiking inflation, because the market may have a short memory, it can remember what happened just about this time in 2011. And the problem is that when it comes to the inflation trade, the market, unlike in most other instances, can be fast – blazing fast, at anticipating what the central planning collective’s next step will be, after all there is only one. And if Bank of America is correct, that next step could well lead to the same unprecedented economic catastrophe that we saw back in 2008, only worse: $200 oil. Note –this is completely independent of what happens in Iran, and is 100% dependent on what happens in the 3rd subbasement of the Marriner Eccles building. Throw in an Iran war and all bets are off. Needless to say, an epic deflationary shock will need to follow immediately, just as in 2008, which means that, in keeping with the tradition of being 6-9 months ahead of the market, our question today is – which bank will be 2012’s sacrificial Lehman to set off the latest and greatest deflationary collapse and send crude plunging to $30 just after it hits $200.

How do we get to $200 crude? Read the detailed explanation and view the charts HERE

The Bottom Line

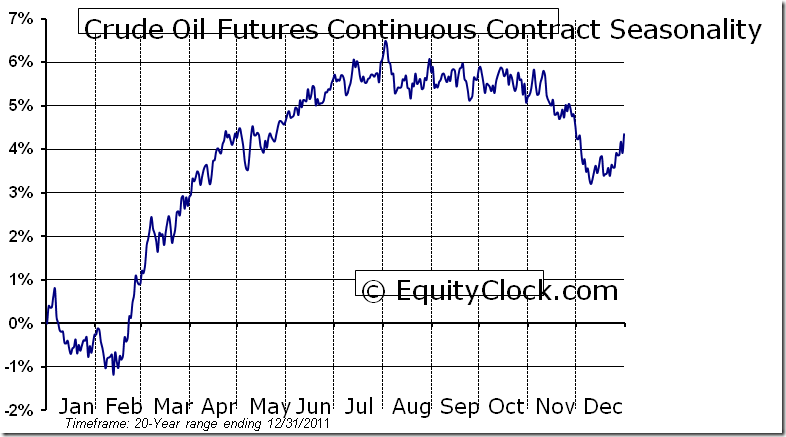

Downside risk in equity markets and most sectors exceeds short term upside potential. Short term weakness will provide an opportunity to enter into seasonal plays this spring including Energy, Mines & Metals, Chemicals and Auto sectors. Energy already is showing early signs of seasonal strength.

An Outlook for Crude Oil

Crude oil recently entered into a period of seasonal strength. What are prospects this year?

EquityClock.com notes that West Texas Intermediate (WTI) crude oil prices during the past 20 years have a period of seasonal strength from the middle of February to the end of July. Average gain per period is 7.5 per cent. The seasonal “sweet spot” is from the middle of February to the end of May. Average gain per period was 6.0 per cent.

Strength in WTI crude oil prices during the “sweet spot” is related to rising seasonal demand triggered by a recovery in the economy following the slower winter season. Notable gains are recorded by the transportation, construction and auto sectors. Once again, demand by these sectors is expected to rise this spring, particularly in Canada, United States, Japan, China and India.

Crude oil prices during the “sweet spot” this year are expected to be impacted by several special events that have limited supply. The price of Brent crude oil has jumped more than 14 per cent since mid-December despite a gain of only 8 per cent by WTI crude oil. Brent prices have responded to a decision by European buyers to switch from production from Iran to other sources including North Sea oil. Rising Brent prices slowly, but surely, is filtering back to WTI crude oil prices.

Concern about political instability in the Middle East also is an influence. Iran has threatened to close the Straits of Hormuz if attacked. International concerns about Iran’s nuclear program likely will continue to escalate this spring. On Wednesday, Iran denied a rumor that oil shipments to six European nations had been halted due to recent plans taken by European nations to discontinue purchases of crude oil from Iran by July.

On the charts, the technical picture on WTI crude oil prices is positive and improving. Intermediate trend is up. Support is at $95.44 and resistance is at $103.74. Crude oil recently bounced from near its 200 day moving average at $94.59 and broke above its 50 day moving average at $99.32. Short term momentum indicators are recovering from oversold levels. A break above resistance implies intermediate upside potential to $112.75 per barrel.

Investors can participate in seasonal strength in crude oil directly or indirectly. The direct method is to accumulate futures and Exchange Traded Funds that track the price of crude oil. The best known and most actively traded Exchange Traded Fund is United States Oil Fund LP (USO $39.18). In Canada, Horizons offers several currency-hedged Exchange Traded Funds trading in Canadian Dollars that are directly related to crude oil futures. The indirect way to invest in crude oil is in “oily” stocks.

Don Vialoux is the author of free daily reports on equity markets, sectors,

commodities and Exchange Traded Funds. . Daily reports are

available at http://www.timingthemarket.ca/. He is also a research analyst for

Horizons Investment Management Inc. All of the views expressed herein are his

personal views although they may be reflected in positions or transactions

in the various client portfolios managed by Horizons Investment Management.