Economic Outlook

Visualizing Biden’s Budget Proposal for 2022

On April 9th, President Joe Biden released his first budget proposal plan for the 2022 fiscal year.

The $1.52 trillion discretionary budget proposes boosts in funding that would help combat climate change, support disease control, and subsidize social programs.

This graphic outlines some key takeaways from Biden’s budget proposal plan and highlights how funds could be allocated in the next fiscal year.

U.S. Federal Budget 101

Before diving into the proposal’s key takeaways, it’s worth taking a step back to cover the basics around the U.S. federal budget process, for those who aren’t familiar.

Each year, the president of the U.S. is required to present a federal budget proposal to Congress. It’s usually submitted each February, but this year’s proposal has been delayed due to alleged issues with the previous administration during the handover of office.

Biden’s publicized budget only includes discretionary spending for now—a full budget that includes mandatory spending is expected to be released in the next few months.

Key Takeaways From Biden’s Budget Proposal

Overall, Biden’s proposed budget would increase funds for a majority of cabinet departments. This is a drastic pivot from last year’s proposal, which was focused on budget cuts.

Here’s a look at some of the biggest departmental changes, and their proposed spending for 2022: Read More

As the economy shut down in March of last year due to the pandemic, the Federal Reserve flooded the system with liquidity. At the same time, Congress passed a massive fiscal stimulus bill that extended Unemployment Benefits by $600 per week and sent $1200 checks directly to households.

In December, Congress passed another $900 stimulus bill extending unemployment benefits at a reduced amount of $300 per week, plus sending $600 checks to households once again.

Now, the latest iteration of Government largesse comes in a solely Democrat supported $1.9 trillion “spend-fest.” Out of the total, only about $900 billion goes to consumers in the form of $400 extended unemployment benefits and $1400 checks directly to households. The remaining $1.1 trillion will have little economic value as bailing out municipalities and funding pet projects doesn’t boost consumption.

Economists estimate the latest stimulus bill could add nearly $1 trillion to nominal growth (before inflation) during 2021. While such a surge in growth would be welcome, it represents just $0.50 of growth for each dollar of new debt.

Such a high growth estimate also assumes that individuals will quickly spend their checks in the economy. The hope is that as vaccines become available, individuals will unleash their “pent-up” demand from the last year.

While that could indeed be the case, there are also other facts to consider.

We feel very good about ourselves — but for no apparent reason.

Tristin Hopper’s weekend article in the National Post asked why Canada can’t get things done anymore, from procuring vaccines to renovating 24 Sussex Drive. Malaise about Canada’s performance is entirely justified as our pampered public sector fails to deliver and few Canadian brands dominate in the global marketplace.

Canada’s image was not always so dim. As the resource boom started in 2003, The Economist featured a cover story about “Cool Canada,” featuring a moose wearing hipster shades. With oil and gas prices soaring, Prime Minister Stephen Harper trumpeted Canada as an “energy superpower.” Our technology sector hit a home run with the Blackberry cellphone. The Great Financial Crisis further boosted our international stature, showcasing the world’s soundest banking system. Bank of Canada Governor Mark Carney parlayed this into becoming the first foreign-born head of the Bank of England. It seemed Canada understood banking better than anyone else.

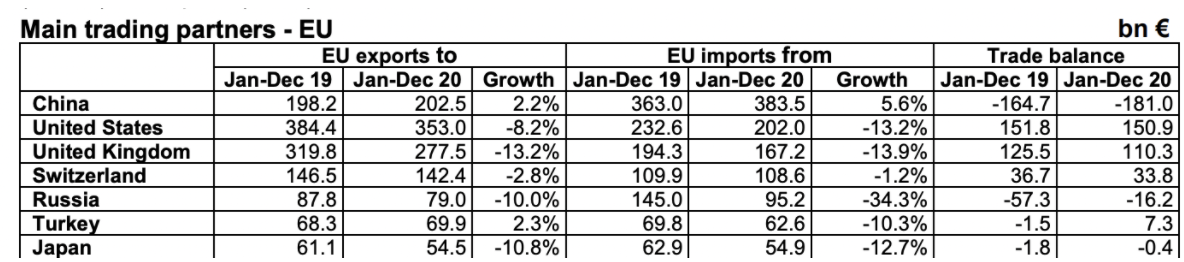

For the first time, China has officially become the European Union’s top trading partner, trumping the United States, which has long held that status.

According to the EU’s statistics office, Eurostat, last year, mostly impacted by the coronavirus pandemic but also due to the Trump Administration’s economic policies, EU-China trade grew while imports and exports to the United States dropped compared with 2019.

Export of EU goods to China grew by 2.2% and China exports to the EU grew by 5.6% in 2020.

At the same time, EU exports to the US fell by 8.2% and EU imports from the US fell by 13.2%.

Source: Eurostat

China’s trade volume in goods with the EU reached $710 billion in 2020, according to the data.

Both the EU’s exports to and imports from China grew last year, with exports valued at $245 billion and imports worth $465 billion. The trade deficit the EU has with China also rose 9.9%, ballooning from 4200 billion in 2019 to $220 billion last year.

According to Eurostat, the EU bought a large number of pharmaceuticals, medical equipment and medical supplies from China last year.

Ostensibly offsetting that, large-scale public investment in infrastructure fueled demand for European manufacturing goods.

For the past few years, the EU has been trying to intensify its economic ties with China by concluding a bilateral investment pact, also known as Joint Comprehensive Agreement on Investment.

Last December, after seven years of negotiations, the EU and China agreed to sign an investment deal that will give their companies greater access to each other’s markets. The deal is still pending ratification by the European Parliament but once completed, should boost trade even further.

Essentially, the deal would give European companies greater access to Chinese markets. China has committed to being transparent on subsidies for state-owned firms and forced technology transfers.

The deal also makes it easier for European firms to navigate the Chinese paperwork bureaucracy and gain some leverage with the authorities. Previously, EU companies were locked out of many industries in China, where they were forced to partner with Chinese firms or stymied by unfair competition from state-owned enterprises.

There is strong opposition to the deal, with EU lawmakers and human rights activists rallying against it. They believe that the agreement is lacking in enforcement mechanisms, and they criticize the Chinese authorities for their policies toward labor and minorities. Some also believe that the deal could jeopardize relations with the United States.

Even though the trade shift was perhaps ultimately caused by the pandemic, the Trump Administration’s open economic warfare with many countries, the EU included, is leaving a mark on these developments.

Since President Trump started his mandate in January 2017, the US and EU have been at odds over several issues, not the least of which was Trump’s imposition of tariffs on several EU products, prompting the EU to retaliate with its own.

On January 20th, Brussels did little to hide its happiness over Joe Biden’s inauguration and ambitions for the new administration.

Ursula von der Leyen, president of the European Commission, said that “the United States is back and Europe stands ready to reconnect with an old and trusted partner.”

Even though Biden promised to ‘reunite’ with US allies, such as the EU, experts insist the change will not come overnight and certainly won’t undo China’s newfound status as the bloc’s biggest new trading partner.

Parliamentary Budget Office to investigate $635.9 million in CERB cheques sent to children living at home. Program was supposed to help workers “in dire straits” because of lost employment income…massive mismanagement?

` Holly Doan, Blacklocks.ca