Currency

Yesterday the US Mint announced it had run out, following a surge in demand.

It was only a matter of time before the last bastion of paper money, London, also succumbed to the soaring demand for physical, and sure enough moments ago Bloomberg reported that the “Britain’s Royal Mint, established in the 13th century, sold more than three times more gold coins this month than a year earlier as prices declined.”

Sales are more than 150 percent higher than last month, according to Shane Bissett, director of bullion and commemorative coin at the Royal Mint.

“Since the dip in the price of gold we have seen increased demand for our gold bullion coins from the major coin markets, and this presently shows no sign of abating,” Bissett said by e-mail in response to questions from Bloomberg. “The Royal Mint continues to supply to its customers and is increasing production to accommodate the higher demand.”

Its not only the UK Mint, but a pervasive global “panic” to get as much gold as possible while prices are as low as they are, courtesy of the recent takedown in spot.

Its not only the UK Mint, but a pervasive global “panic” to get as much gold as possible while prices are as low as they are, courtesy of the recent takedown in spot.

Standard Chartered Plc said yesterday its gold shipments to India last week exceeded the previous record by 20 percent and were double the total of the week before.

…..read more about this Surge HERE

(Ed – for the US perspective)

The Eagles Have Fled

The U.S. Mint has been cleaned out of 1/10th-ounce Gold Eagles. So far this month, 85,000 of the coins have exited the Mint’s doors. Now sales are temporarily suspended.

“While the 1-ounce gold bullion coins remain the most popular,” says a Mint statement, “demand for the 1/10th-ounce coins has remained strong too, with year-to-date demand for these coins up over 118% compared to the same period last year.”

Overall Gold Eagle sales this month now total 183,500 ounces. At this rate, April will almost surely end with the second-highest sales on record… and an all-time high is within reach.

Silver Eagle sales for April now total 3,232,000 — the highest April on record.

Supply remains tight, and the Mint continues to ration sales to its dealer network — as it has since a temporary suspension of sales in January.

One of those authorized purchasers says the wholesale premium for Silver Eagles has doubled this month, to around $4.50 each — not that it’s dented sales a bit. “There’s no cheap silver out there,” says Jim Hausman of The Gold Center in Springfield, Ill.

The Mint says it’s trying to find another supplier of blanks — so far, with no luck. “Currently,” according to Coin World, “the Mint secures finished planchets from Sunshine Mint in Coeur d’Alene, Idaho; Vennerbeck Stern-Leach in Lincoln, R.I.; and GSM Metals in Cranston, R.I.”

Regards,

Dave Gonigam

Treading a fine line between contrarian thinking and conspiracy theory, Dave Gonigam explores the nexus of finance, politics, and the media for Agora Financial’s 5 Minute Forecast. He joined kindred spirits at Agora Financial in 2007 after a 20-year career as an Emmy award-winning writer, producer, and manager in local TV newsrooms nationwide. [cfopenx zone=”113″]

Today’s AM fix was USD 1,425.00, EUR 1,092.54 and GBP 935.04 per ounce. Friday’s AM fix was USD 1,414.00, EUR 1,080.46 and GBP 920.63 per ounce.

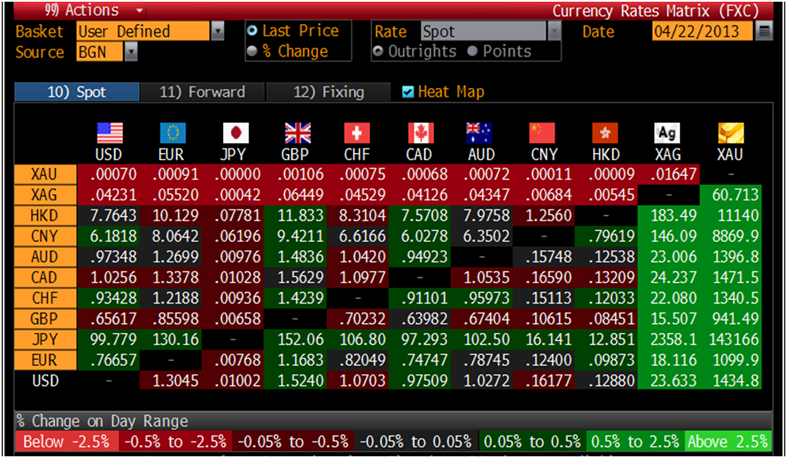

Cross Currency Table – (Bloomberg)

Gold climbed $12.90 or 0.93% on Friday to $1,400.90/oz and silver finished up 0.04%. Gold and silver both traded down for the week at 5.86% and 11.39%.

The state of Arizona may become the second state to use gold and silver coins as legal tender.

Last week, Arizona lawmakers passed a bill that makes precious metals legal tender. Arizona is the second state after Utah to allow gold coins created by the U.S. Mint and private mints to be used as currency. More than a dozen states have legislature underway to pass similar measures.

The move was launched by people who fear the Federal Reserve is not tackling the federal deficit and is thus debasing and devaluing the dollar. Some even fear, that if the Fed continues on the existing path it could lead to hyperinflation.

Miles Lester, who represents a group called Arizona Constitutional Advocates, said during a recent public hearing on legal-tender legislation that “the dollar is on its way out. It’s not a matter of if; it’s a matter of when.”

The upcoming U.S. FOMC meeting next week is April 30 and May 1 and will be closely watched by investors.

….read page 2 HERE

As a general rule, the most successful man in life is the man who has the best information

n July 1944, delegates from 44 nations met at Bretton Woods, New Hampshire – the United Nations Monetary and Financial Conference – and agreed to “peg” their currencies to the U.S. dollar, the only currency strong enough to meet the rising demands for international currency transactions.

Member nations were required to establish a parity of their national currencies in terms of the US dollar, the “peg”, and to maintain exchange rates within plus or minus one percent of parity, the “band.”

What made the dollar so attractive to use as an international currency was each US dollar was based on 1/35th of an ounce of gold, and the gold was to held in the US Treasury. The value of gold being fixed by law at 35 US dollars an ounce made the value of each dollar very stable.

The US dollar, at the time, was considered better then gold for many reasons:

- The strength of the U.S. economy

- The fixed relationship of the dollar to gold at $35 an ounce

- The commitment of the U.S. government to convert dollars into gold at that price

- The dollar earned interest

- The dollar was more flexible than gold

There’s a lesson not learned that reverberates throughout monetary history; when government, any government, comes under financial pressure they cannot resist printing money and debasing their currency to pay for debts.

Lets fast forward a few years…

The Vietnam War was going to cost the US $500 Billion. The stark reality was the US simply could not print enough money to cover its war costs, it’s gold reserve had only $30 billion, most of its reserve was already backing existing US dollars, and the government refused to raise taxes.

In the 1960s President Lyndon B. Johnson’s administration declared war on poverty and put in place its Great Society programs:

- Head Start

- Job Corps

- Food stamps

- Medicaid

- Funded education

- Job training

- Direct food assistance

Direct medical assistance

More than four million new recipients signed up for welfare.

During the Nixon administration welfare programs underwent major expansions. States were required to provide food stamps. Supplemental Security Income (SSI) consolidated aid for aged, blind, and disabled persons. The Earned Income Credit provided the working poor with direct cash assistance in the form of tax credits and welfare rolls kept growing

Bretton Woods collapsed in 1971 when Nixon severed (known as the Nixon Shock because the decision was made without consulting the other signatories of Bretton Woods, even his own State Department wasn’t consulted or forewarned) the link between the dollar and gold – the US dollar was now a fully floating fiat currency and the government had no problem printing more money. With gold finally demonetized the US Federal Reserve (Fed) and the world’s central banks were now free from having to defend their gold reserves and a fixed dollar price of gold.

The Fed could finally concentrate on achieving its mandate – full employment with stable prices – by employing targeted levels of inflation. The Fed’s ‘Great Experiment’ had begun – the objective being a leveling out of the business cycle by keeping the economy in a state of permanent boom – gold’s “chains of fiscal discipline” had been removed.

But there was a problem – because of the massive printing of the US dollar to cover war and welfare reform costs Nixon worried about the strength of his country’s currency – how do you keep the U.S. dollar as the world’s reserve currency, how do you keep demand strong, if one you remove gold’s backing and two print it into oblivion?

Recognizing that the US, and the rest of the world, was going to need and use more oil, a lot more oil, and that Saudi Arabia wanted to sell the world’s largest economy (by far the US) more oil, Nixon and Saudi Arabia came to an agreement in 1973 whereby Saudi oil could only be purchased in US dollars. In exchange for Saudi Arabia’s willingness to denominate their oil sales exclusively in U.S. dollars, the United States offered weapons and protection of their oil fields from neighboring nations.

Nixon also abolished the International Monetary Fund’s (IMF) international capital constraints on American domestic banks. This allowed Saudi Arabia and other Arab producers to recycle their petrodollars into New York banks.

Global oil sales in U.S. dollars caused an immediate and strong global demand for US dollars – the ‘Petrodollar’ was born.

By 1975 all OPEC members had agreed to sell their oil only in US dollars in exchange for weapons and military protection.

“In a nutshell, any country that wants to purchase oil from an oil producing country has to do so in U.S. dollars. This is a long standing agreement within all oil exporting nations, aka OPEC, the Organization of Petroleum Exporting Countries. The UK for example, cannot simply buy oil from Saudi Arabia by exchanging British pounds. Instead, the UK must exchange its pounds for U.S. dollars…

This means that every country in the world that imports oil—which is the vast majority of the world’s nations—has to have immense quantities of dollars in reserve. These dollars of course are not hidden under the proverbial national mattress. They are invested. And because they are U.S. dollars, they are invested in U.S. Treasury bills and other interest bearing securities that can be easily converted to purchase dollar-priced commodities like oil. This is what has allowed the U.S. to run up trillions of dollars of debt: the rest of the world simply buys up that debt in the form of U.S. interest bearing securities.” Christopher Doran, Iran and the Petrodollar Threat to U.S. Empire

As developed economies grew and prospered, as developing economies took center stage with their massive urbanization and infrastructure development plans their need for oil grew, and so too did the need for new U.S. dollars, as demand grew the currency strengthened. The U.S. Dollar quickly became the currency for global trades in almost every commodity and most consumer goods, it wasn’t used just for oil purchases anymore. Countries all over the world bought, had to buy, more and more dollars to have a reserve of currency with which to buy oil and ‘things.’ Countries began storing their excess US dollar capacity in US Treasury Bonds, giving the US a massive amount of credit from which they could draw.

There’s no disputing the U.S. greenback is the world’s currency – the dollar is the currency of denomination of half of all international debt securities and makes up 60 percent of countries foreign reserves.

The Petrodollar replaced the Gold Standard

Currently the only source of backing for the U.S. dollar is the fact that oil is priced in only U.S. dollars and the world must use the Petrodollar to make their nation’s oil purchases or face the weight of the U.S. military and economic sanctions. Many countries also use their Petrodollar surplus for international trade – most international trade is conducted in U.S. dollars.

It’s very obvious that the United States economy, and the global economy, are both intimately tied to the dollar’s dual role as the world’s reserve currency and as the Petrodollar.

“Trade between nations has become a cycle in which the U.S. produces dollars and the rest of the world produces things that dollars can buy; most notably oil. Nations no longer trade to capture comparative advantage but to capture needed dollar reserves in order to sustain the exchange value of their domestic currencies or to buy oil. In order to prevent speculative attacks on their currencies, those nations’ central banks must acquire and hold dollar reserves in amounts corresponding to their own currencies in circulation. This creates a built-in support for a strong dollar that in turn forces the world’s central banks to acquire and hold even more dollar reserves, making the dollar stronger still.” Harvey Gold, Iran’s Threat to the U.S. – Nuclear or the Demise of the Petrodollar?

It’s also very obvious that if global Petrodollar demand were ever to crumble the use of the U.S. dollar as the world’s reserve currency would abruptly end.

The consequences:

- Energy costs would rise substantially. American’s, because their dollar is the world’s reserve currency and they control it, have been buying oil and gasoline for a fraction of what the rest of the world pays.

- There would be substantially less demand for dollars and U.S. government debt. All nations that buy oil and hold U.S. dollars in their reserves would have to replace them with whatever currency oil is going to be priced in – the resulting sell-off would weaken the U.S. currency dramatically.

- Interest rates will rise. The Federal Reserve would have to increase interest rates to reduce the dollar supply.

- Foreign funds would literally run from U.S. stock markets and all dollar denominated assets.

- Military establishment collapses.

- There would be a 1930s like bank run.

- Dollar exchange rate falls. The current-account trade deficit would become unserviceable.

- The U.S. budget deficit would go into default. This would create a severe global depression because the U.S. would not be able to pay its debts.

Why some might think the Petro dollar is history, consider:

- Several countries have attempted to, or have already moved away from the petrodollar system – Iraq, Iran, Libya, Syria, Venezuela, and North Korea.

- Other nations are choosing to use their own currencies for inter country trade;China/Russia;China/Brazil;China/Australia;China/Japan;India/Japan;Iran/Russia; China/Chile; China/The United Arab Emirates (UAE);China/Africa Brazil/Russia/India/China/South Africa (the new BRICS are plus S.A.).

- Countries began storing their excess US dollar capacity in US Treasury Bonds, giving the US a massive amount of credit from which they could draw. But by keeping interest rates excessively low for so long a period of time, and with no relief in sight, the rate of return on U.S. interest bearing securities has been so low it’s not worth holding them to generate any kind of return for your U.S. foreign reserves, the very same reserves you want to hold to buy oil.

- The U.S. does not need its Arab Petrodollar partners as much since the invasion of Iraq with its immense oil resources (second largest in the world) and discovery of how to obtain oil from unconventional sources – shale oil, oil sands etc. Saudi Arabia and other OPEC countries in the region might be less needy for U.S. protection now that Iraq has been neutralized and Iran is in the crosshairs.

- Russia is the number one oil exporter, China is the number two consumer of oil and imports more oil from the Saudis then the U.S. does. Chinese and Russian trade is currently around US$80 billion per year. China has agreed to lend the world’s largest oil company, Russia’s Rosneft, two billion dollars to be repaid in oil.

- U.S. federal debt is close to 17 trillion dollars and is 90 percent of GDP. The deficit is a horrendous 7 percent of GDP. Political infighting and bickering has made cooperation nearly impossible and effective measures just aren’t being taken. The Federal Reserve is increasing its reserves by over a trillion dollars a year, the Fed is out of tools, its measures are not working. The ‘recovery’ is false, jobs are scarce and 6.2 million Americans have dropped out of the workforce.

Exorbitant Privilege

Valéry Giscard d’Estaing referred to the benefits the United States has due its own currency being the international reserve currency as an “exorbitant privilege.”

“Reserve currency status has two benefits. The first benefit is seigniorage revenue—the effective interest-free loan generated by issuing additional currency to nonresidents that hold US notes and coins… The second benefit is that the United States can raise capital more cheaply due to large purchases of US Treasury securities by foreign governments and government agencies…The major cost is that the dollar exchange rate is an estimated 5 to 10 percent higher than it would otherwise be because the reserve currency is a magnet to the world’s official reserves and liquid assets. This harms the competitiveness of US exporting companies and companies that compete with imports…

There is no realistic prospect of a near-term successor to the dollar. Although the euro is already a secondary reserve currency, MGI finds that the eurozone has little incentive to push for the euro to become a more prominent reserve currency over the next decade. The small benefit to the eurozone of slightly cheaper borrowing and the cost of an elevated exchange rate today broadly cancel each other. The renminbi may be a contender in the longer term—but today China’s currency is not even fully convertible.” McKinsey Global Institute,An exorbitant privilege? Implications of reserve currencies for competitiveness

The Alternatives

There has lately been a lot of talk about the demise of the Petrodollar. Fortunately, or unfortunately (depends what side of the debate your on) there exists no viable alternative to the U.S. dollar, not today, not tomorrow, not for a very long time.

The EU is a waste land, will the deeply flawed Euro even survive?

“The euro’s major weakness comes from its political base. If the entire 27-country strong European Union (EU) were backing the euro, its long-term international standing would be considerably enhanced. With only half of the E.U countries backing it, the euro zone is vulnerable in the future to a possible dissolution under the pressures of economic hardships. This is more so since the statutes of the European Central Bank are unduly rigid, not only freezing exchange rates between member states, which is OK, but also de facto freezing their fiscal policies, while the central bank itself has the goal of fighting inflation as its only objective. It seems that the objective of supporting economic growth was left out of its statutes, with the consequence that it may be unable to ride successfully future serious economic disturbances.” Prof Rodrigue Tremblay, Nothing in Sight to Replace the US Dollar as an International Reserve Currency

Well what about China you ask?

One of the preconditions of reserve currency status is relaxing capital controls so foreigners can reinvest their accumulated yuan back into a countries markets. China has strict capital controls in place. If they were to be relaxed to the level needed then market driven money flows, not China’s Communist leaders, would drive exchange and interest rates. Communist leaders would be facing the thing they fear the most – instability because they lose control over two of their main economic levers.

China has well over US$3.2 trillion in its foreign reserves. They’ve accumulated this massive amount of money over the years by maintaining the yaun’s semi fixed peg to the dollar.

Think about it; the euro-crisis makes the US dollar the preferred safe-haven, this lowers US borrowing costs. This in turn means China has to continue to lend to the US in order to hold-up the value of its current reserves, pushing down US borrowing costs.

A massive shift as many envision – China out of the U.S. dollar – would destroy the dollar and cause the instability the Communist Party fears so much. Why would China deliberately destroy its own wealth and why would Chinese communist leaders set themselves up for discord among its citizens?

“China, itself as a country, has a very limited moral international stance. It is still a totalitarian, authoritarian and repressive state regime that does not recognize basic human rights, such as freedom of expression and freedom of religion, and which crushes its linguistic and religious “minority nationalities. It is a country that imposes the death penalty, even for economic or political crimes…Only a fundamental political revolution in China could raise this country to a world political and monetary status. This is most unlikely to happen in the foreseeable future and, therefore, no Chinese currency is likely to play a central role in financing international trade and investment.” Prof Rodrigue Tremblay, Nothing in Sight to Replace the US Dollar as an International Reserve Currency

Conclusion

U.S. assets are free from default risk, free from political risk, the U.S. has never imposed capital controls and has only frozen funds once – Iran’s in 1978.

Fact; the United States of America, and only the United States of America, controls the fate of the Petrodollar. Not communist China, not Russia or Saudi Arabia or the EU.

The questionable ‘exorbitant’ privilege (the interest-free loans, U.S. Treasury purchases by foreign governments versus the loss of business competitiveness and all that entails) bestowed upon America for having the world’s reserve currency is going continue for the for-seeable future. This fact, and what it means to the U.S. and the world, should be on all our radar screens. Is it on yours?

If not, maybe it should be.

Richard (Rick) Mills

Richard is the owner of Aheadoftheherd.com and invests in the junior resource/bio-tech sectors. His articles have been published on over 400 websites, including:

WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, ninemsn, ibtimes, businessweek.com and the Association of Mining Analysts.

If you’re interested in learning more about the junior resource and bio-med sectors, and quality individual company’s within these sectors, please come and visit us atwww.aheadoftheherd.com

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Switzerland is the place that has traditionally stood above all the rest in its reputation for financial stability.

Why? Because the currency was well-managed, the banking system was sound, and the country had a long tradition of treating capital well.

Over the last few years, however, these advantages have collapsed.

Switzerland has voluntarily surrendered banking privacy, and the many Swiss banks are now hemorrhaging cash.

Even worse, the Swiss government destroyed its reputation for respecting capital when they pegged the Swiss franc to the euro in 2011 to arrest the franc’s rapid rise.

The country’s top central banker at the time, Philipp Hildebrand, claimed that he would buy foreign currencies in ‘unlimited quantities’ to defend the peg.

This is not something a responsible steward of currency should ever say. The currency peg was nothing more than a form of capital controls… and it effectively screwed anyone that had trusted the Swiss system with their savings.

Since then, the market’s need to find a financial safe haven has only become more desperate. One only needs to look at Cyprus to see why.

Yet just a small handful of countries inspire confidence in the marketplace. And the most popular seems to be Australia.

From a macro perspective, Australia is in much better shape than the rest of the bankrupt western hierarchy.

From a macro perspective, Australia is in much better shape than the rest of the bankrupt western hierarchy.

Though the national budget deficit has been rising over the last few years, Australia’s public debt as a percentage of GDP (less than 30%) is a tiny fraction of the US, France, Italy, etc.

Moreover, as the Australian economy is heavily dependent on resource exports, it’s a ‘commodity currency’, much like Canada. But unlike Canada which is wed to the US, Australia’s economy is much more closely tied to Asia’s growing dominance.

Perhaps most importantly, though, Australia is not printing money with wanton abandon like the rest of the world.

In fact, the RBA’s (Australia’s central bank) balance sheet has actually been -decreasing-, dropping from A$131 billion to just A$81 billion in 2012.

This constitutes a 38% decline in central bank assets in five years. By comparison, US Federal Reserve credit has grown 367% over the same period. This is an astonishing difference.

Plus, Australian interest rates here are typically much higher than in the US, Europe, or Canada. Just holding cash in an Australian bank account can yield over 4% in annual interest. It’s sad to say, but this is quite a bit these days…

(Attendees at our Offshore Tactics Workshop were able to open such accounts on the spot with an Australian bank representative; we’ll soon send out information about how you can do this as well…)

Now, there’s really no such thing as a “good” fiat currency. But given such fundamentals, it’s easy to see why Australia is replacing Switzerland as a global safe haven.

I’ve spent the last few days with some banker friends of mine, and they’ve been telling me about the surge of foreign capital coming into Australia from Europe, the US, and China.

But one thing to keep in mind, they reminded me, is that the Australian dollar has a loose correlation with the price of gold. After all, gold is Australia’s third biggest export.

Consequently, we’ll likely see a decline in the Aussie dollar if the gold correction continues to play out. This may prove to be a good entry point for individuals to get their money out of the US dollar.

Until tomorrow,

Simon Black

Senior Editor, SovereignMan.com

Get THE ABOVE Notes from the Field (It’s Free)

Receive updates and actionable information from Simon Black as he seek out freedom and opportunities around the globe. Just click HERE to Subscribe

Marc Faber of the Gloom Boom Doom Report was interviewed by Bloomberg on Friday, and of course topic number one was the brutal takedown of gold. Not all that surprisingly, he likes the resulting buying opportunity and expects “a major low in gold within the next two weeks.”

More interesting from a theoretical/historical point of view was his segue from gold to the state of the global economy:

“Today we have commodities breaking down including gold and we have bonds rallying very strongly. If you just stand aside and just look at these two events they would suggest that there are strongly deflationary pressures in the system.”

The following chart illustrates Faber’s point. Gold is the downward-trending blue line and long-term Treasury bonds are the upward-trending green line; bonds up, gold down is clearly a deflationary picture:

…..read more HERE