Bonds & Interest Rates

What are the classic signs of an asset bubble? People piling into an asset class to such an extent that it becomes unprofitable to do so.

Treasury bonds are so overbought that they are now producing negative real yields (yield minus inflation):

That’s right, after taking into account inflation, many investors in treasuries are standing over a drain and pouring their money down it.

And so America’s creditors are now getting slapped quite heavily in the mouth by the Fed’s easy money inflationist policies.

I propose (much, I am sure, to the consternation of the monetarist-Keynesian “print money and watch your problems evaporate” establishment) that this is a very, very, very dangerous position. And I propose that those economists who are calling for even greater inflation are playing with dynamite.

See, while the establishment seems to largely believe that the negative return on treasuries will juice up the American economy — in other words that “hoarders” will stop hoarding and start spending — I believe that negative side-effects from these policies may cause severe harm.

There is the danger of a bursting treasury bubble. What would happen if America’s creditors decide they want to liquidate their positions? After all, they’re getting slapped in the mouth , and the Fed is promising to continue with the zero interest rate policy until at least 2014.

To Read More CLICK HERE

April Employment A Graphic Review of the Strategic Investment Conference A Little Over 31 Years New York, Atlanta, Philadelphia, and Austin

The US employment numbers came out this morning, and they were disappointing. But disappointing does not begin to describe the situation I read about today in Europe. I have just finished up with my conference in Carlsbad, California and am getting back to the room late. I have to get up in a few hours (4 AM is rather obscene) to fly to Tulsa to see my daughter graduate from university, but wanted to drop you a note as I normally do on Friday night. But given the time and the need for some sleep, tonight I will draw your attention to the writing of a few friends and some of the more interesting charts I saw at the conference. It will be a shorter letter than usual, but we will uncover a few real nuggets; and next week I will be back to a more normal writing schedule.

On May 22 I will be doing a webinar with my conference co-host, Jon Sundt of Altegris Investments, where we will talk about what we heard at the conference and some of the material I covered in my speech. This webinar will be a great way for those not able to attend the SIC conference to get a sense of its scope and depth. Because of the nature of the material, and due to SEC regulations, we will need to limit the webinar to accredited investors. If you have already registered at my Accredited Investor website, you should be getting an invitation. If you have not registered and would like to listen in, you can go to www.mauldincircle.com/ and sign up. The call will be at 11 AM Central Time. (In this regard, I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.)

Also, I will be in Atlanta May 23 (details at the end of the letter). And now for some “nugget hunting.”

April Employment

A few hours after the employment numbers are released, I always get a rather thorough analysis from Philippa Dunne & Doug Henwood of The Liscio Report (www.theliscioreport.com). Philippa gave me permission to share this with you just this once. While it may be more detail than you are used to, it will help give you a perspective on how much data is actually tracked. I think Philippa and Doug are some of the best at analyzing employment, and their regular reports are a must-read for me. They call the “labor department” in every state and track what is going on at a very deep level, and also follow tax receipts and flows. (Funds and managers who need detailed analysis like this can contact them for a look at their recent work and decide if you should subscribe.) And now to this morning’s report:

Though it’s likely there are lingering weather influences on this month’s disappointing employment report, as there will be in coming months, it appears that the trend is also slowing. That conclusion is bolstered by the decline in our withholding survey, which we believe to be less weather-sensitive than the BLS numbers, and weakness in our survey was not limited to states sensitive to this year’s unusual weather.

* April’s headline gain of 115,000 was the weakest initial print since last October’s 80,000 (now revised up to 112,000). It’s considerably below the 146,000 average for the second half of 2011, before the acceleration earlier this year. Looking just at the private sector would make those comparisons a little better, but not much. Manufacturing added 16,000, almost all in durables; retail added 29,000, mostly in general merchandise (largely reversing the losses of the previous two months); professional and business services added 62,000, a third of it from temp firms; education and health added 23,000, well below its recent averages (with health care alone adding just 19,000, at the 20th percentile of gains since 1990); leisure and hospitality, 12,000 (more than accounted for by accommodation and food services, up 27,000). Finance was up just 1,000, and mining and logging were unchanged (low natural gas prices seem to have put an end to the fracking boom).

In the loss column: construction, off 2,000, with nonres leading the way down; transportation and warehousing, off 17,000, mostly from ground transportation; information, off 2,000; and government, off 15,000, almost all of it from local government education (where losses have averaged 8,000 a month for the last year). Almost 70% of job gains came from bars and restaurants, temp firms, and retail, which do not seem the strongest foundations for long-term growth.

To Read More CLICK HERE

Written by David Einhorn via huffingtonpost.com

A Jelly Donut is a yummy mid-afternoon energy boost.

Two Jelly Donuts are an indulgent breakfast.

Three Jelly Donuts may induce a tummy ache.

Six Jelly Donuts — that’s an eating disorder.

Twelve Jelly Donuts is fraternity pledge hazing.

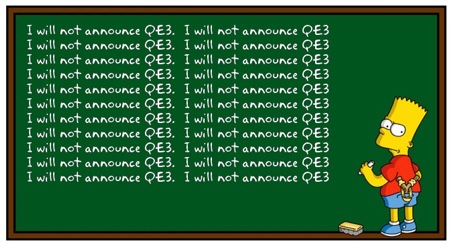

My point is that you can have too much of a good thing and overdoses are destructive. Chairman Bernanke is presently force-feeding us what seems like the 36th Jelly Donut of easy money and wondering why it isn’t giving us energy or making us feel better. Instead of a robust recovery, the economy continues to be sluggish. Last year, when asked why his measures weren’t working, he suggested it was “bad luck.”

I don’t think luck has anything to do with it. The blame lies in his misunderstanding of human nature. The textbooks presume that easier money will always result in a stronger economy, but that’s a bad assumption. Here is a good example of how a real family responds to monetary policy.

Consider my neighbors, Homer, Marge, and their three adult children, Bart, Lisa and Maggie. Homer has retired from the nuclear plant, and he and Marge live off savings and Homer’s pension. Bart is in a bit of trouble with too much credit card debt and an underwater mortgage. Lisa has been putting away her salary and has enough for a downpayment on her first home. Maggie owns her own business and is ready to expand.

When interest rates are high, Homer and Marge park their savings in CDs or Money Market accounts and get a decent return. There is no incentive for them to take much risk with their money. Bart gets into trouble very quickly and defaults on his loans. Lisa decides she can’t afford a mortgage until rates fall. And Maggie, who’s been helping out Bart with some of his expenses, believes that she’d make money if she grew the business, but possibly not enough to service the debt she’d be undertaking.

When interest rates are low, everything changes. Homer and Marge are getting only a little interest on their savings, and are struggling to live off Homer’s pension. They need to rethink their finances. Bart can manage to keep up the minimum payments on his credit cards and stay in his house. Lisa can get a cheap mortgage, and Maggie doesn’t need to make such optimistic assumptions in order to expand her business.

Everyone agrees that low interest rates are a good way to stimulate a stalled economy. The Fed takes this logic a step further. It believes that if low interest rates are good, then zero-interest rates must be even better. As a brief emergency measure, such drastic behavior is reasonable and can even be necessary. In 2008, Chairman Bernanke had near unanimous support for his decision to drop rates to near zero. At the peak of the crisis, it made sense. But that was four long years and many jelly donuts ago. In the 2012 economy, a zero rate policy not only adds no benefit, it’s actually harmful. Just ask the Simpsons.

When Homer was approaching 65, he and Marge met with a financial planner to figure out if they had enough money saved for retirement. They assumed they’d live to be 90, and could count on receiving a fixed amount from Homer’s pension and social security checks. Marge, the cautious one, has not forgotten that stock market meltdown better known as the bursting of the tech bubble. She didn’t want to take any investment risk and was content to have just enough for regular haircuts for herself, a bowling and beer budget for Homer, and visits with the children. They were told that, with nominal interest rates at 3%, they could safely retire with $200,000.

“What happens if interest rates go to zero and stay there?” Marge asked the advisor.

“You mean indefinitely? If you weren’t willing to start taking investment risk, you’d need 50% more in savings, or $300,000. But why would you ask such a silly question?” asked the advisor.

To which Marge replied, “Well, we were thinking about moving to Japan…”

Homer and Marge aren’t the only ones doing this sort of math. Every single day for the next 19 years, more than 10,000 Baby Boomers will turn 65. Those who started saving for retirement 15 years ago are suddenly finding themselves with insufficient savings to do so.

Some will stay in the work force longer, some will drastically reduce their spending, and some will do both. In a recent survey, 20% of U.S. workers say they have postponed their planned retirement age at least once during the last year. And those who have already retired have fewer options. Returning to the workforce could be challenging. David Rosenberg points out that the workforce for those 55 and older has expanded by 4 million since the start of the recession, and they are returning to the workforce at lower wages. Even more challenging is trying to find safe investments that generate a decent yield.

To Read More CLICK HERE

Munch’s “The Scream” may be all the rage today, but to Jim Grant, in his latest interview on Bloomberg TV, the record price paid for the painting is not so much a manifestation of modern art as one of modern currency: “This is the flight into things from paper” . Thus begins the latest polemic by the Grant’s Interest Rate Observer author whose topic is as so often happens, the Federal Reserve (for his latest definitive expostulation on why the Fed should be disbanded and why a gold standard should return, delivered from the heart of Liberty 33 itself, read here). The world in which we invest is a world of immense wall to wall manipulations by our friends in Washington. And people get off on Goldman Sachs because it has done this and this, it is pulling wires… The Federal Reserve is the giant squid of squids, it is the vampire squid of vampire squids.”

He continues: “They – the vampire squids – have manipulated virtually every single price and valuation in the capital markets. People ought to recognize when they invest that one of the unspoken risks is the risk that this hall of mirrors, this Barnum and Bailey world that the Fed has created for us is going to vanish one day because they will not be able to hold it any more… It’s not as if there is nothing to do in investing, but one must always keep in mind that the valuations that we see, that the prices that we watch flicker across the tape are prices that are fundamentally manipulated by these well-intended, dangerous people in Washington called the Federal Reserve“. And to think that 3 short years ago Grant would have been branded a loony, tin-foil hat wearing gold bug, while now it has become trendy for hedge fund managers to bash the Fed with impunity. It is all downhill from here.

To Watch the Video CLICK HERE

Every quarter as part of its refunding announcement, the Office of Debt Management together with the all important Treasury Borrowing Advisory Committee, which as noted previously is basically Wall Street’s conduit telling the Treasury what to do, releases its Fiscal Quarterly Report which is for all intents and purposes the most important presentation of any 3 month period, containing not only 70 slides worth of critical charts about the fiscal status of the country, America’s debt issuance, its funding needs, the structure of the Treasury portfolio, but more importantly what future debt supply and demand needs look like, as well as various sundry topics which will shape the debate between Wall Street and Treasury execs for the next 3 months: some of the fascinating topics touched upon are fixed income ETFs, algo trading in Treasurys, and finally the implications of High Frequency trading – a topic which has finally made it to the highest levels of executive discussion. It is presented in its entirety below (in a non-click bait fashion as we respect readers’ intelligence), although we find the following statement absolutely priceless: “Anticipation of central bank behavior has become a significant driver of market sentiment.” This is coming from the banks and Treasury. Q.E.D.

Some highlights specifically from the TBAC component of the presentation.

First, the TBAC discusses key changes to the Fixed Income markets over the past few years:

- Reduced liquidity of spread product

- Likely a consequence of investor risk aversion and regulatory reform. Treasuries remain liquid

- Prevalence of “risk on / risk off” mentality

- Extreme valuations, correlations rising, excess returns becoming more volatile

- Role of government

- Extraordinary monetary policy (ZIRP, balance sheet growth, communication/transparency)

- Regulatory reform

- Changes in market participant behavior

- Cyclical (risk tolerance) and secular (demographics / LDI strategies), customized solutions

- Growing role of electronic trading

- Driven by increased efficiency and regulatory reform

Supporting visual data:

And what matters for bond traders everywhere: Implications of Reduced Corporate Bond Liquidity, which are mostly the lobby group’s efforts to neutralize the Volcker Rule:

- A reduction in liquidity / wider bid-offer spreads has both an upfront cost to existing investors (who have to mark their existing holdings at wider levels) as well as an ongoing cost for issuers and investors

- Per a recent study, a strict implementation of the Volcker Rule for the corporate bond market may cost $90-315bn upfront plus $12-43bn/yr for issuers and $1-4bn/yr for investors in future transactions

- Analysis by Barclays** indicates that the liquidity premium has risen from ~20bps in Jan ’07 to ~40bps in Mar ’12

- Policy makers should carefully consider the impact on market liquidity when introducing new financial regulations, such as the Volcker Rule

- SIFMA, the Credit Roundtable (a group of large fixed income money managers), and other market participants have submitted comments on this topic

- Given the size of the bond markets, it would be difficult, if not impossible, for the banking sector to reintermediate the capital markets (replacing bonds with loans) in response to a prolonged market dislocation

To Read More CLICK HERE