Daily Updates

Seawater Greenhouses & Thorium-Powered Cars

With the world approaching 7 billion people and 20% of us lacking access to freshwater, cheap food is getting harder and harder to come by. Maybe you’ve noticed.

Gas, natural gas, diesel, biofuel, hybrid, electric, fuel cell.

Those are the only options for transportation fuels most folks know about.

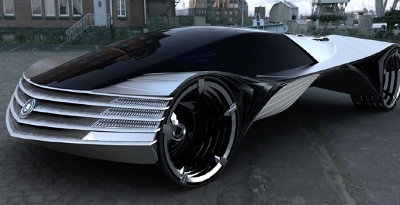

They haven’t heard of thorium-powered cars, for which a few people are working on prototypes.

Cadillac unveiled such a concept two years ago. And now Charles Stevens of Massachusetts-based Laser Power Systems has unveiled one as well.

According to the website txchnologist.com, owned by GE:

A 250-kilowatt unit (equivalent to about 335 horsepower) weighing about 500 pounds would be small and light enough to put under the hood of a car, Stevens claims. And because a gram of thorium has the equivalent potential energy content of 7,500 gallons of gasoline, LPS calculates that using just 8 grams of thorium in the unit could power an average car for 5,000 hours, or about 300,000 miles of normal driving.

You can’t invest in these types of cars yet, but you can invest in companies pursuing thorium for use in nuclear reactors.

Lightbridge Corp. (NASDAQ: LTBR), formerly known as Thorium Power Corp., comes to mind.

…read more about Seawater GreenHouses & Printing your Bikini HERE

Print. Lie. Borrow. Deceive. Deny. These are a the principal tenets of the Greek restructuring plan that were released today from Brussels

The news of the Swiss government’s intervention in the currency market is far bigger than most can even imagine. The author of this article copped on to that. The currency war has officially begun. A key benefactor should be gold. – Peter Grandich

Switzerland move threatens currency war

Switzerland is moving aggressively to weaken its franc and protect exports from watches to chocolates, sparking fears of an escalating currency war that would ripple through markets and other economies.

For months, the Swiss National Bank tried to rein in its surging currency by lowering interest rates and injecting francs into the market, but that did little to dissuade investors who viewed the franc as one of the few safe places to keep their money in a world of economic turmoil.

Gold has been rising faster than the price of mining stocks. Here are some statistics to prove this point.

In the twelve months ending Aug. 31, gold has risen 46.5%, but the XAU Index of precious metal mining stocks climbed only 17.7%. By itself, that is a good rate of return for mining stocks, but not what one would expect given gold’s appreciation over this period.

The current year-to-date results are even more telling. Gold has risen 28.7% this year, compared to a -3.8% loss in the XAU Index.

In the last two months, gold has risen 21.7%, while the XAU Index climbed 8.4%. You might notice from these results that the XAU Index is finally starting to show some relative strength compared to its year-to-date results, which is one sign that things may be turning in favor of the mining stocks. Here is another.

The following chart simply measures the difference between the annual rate of change of gold and the XAU Index at each month end. So for example, using the 12-month results ending Aug. 31 reported above, the last point plotted on this chart is 28.8%, which reflects gold’s outperformance over this period.

There is an important message from the above chart. Namely, gold’s relative outperformance compared to the XAU Index has reached a level that in the past has marked important turning points. If we take the period in 2008 relating to the collapse of Lehman Brothers as an unusual exception and not likely to be seen again – or at least not to be seen at the present time – we can conclude that gold’s outperformance has reached an extreme.

It is not uncommon for the XAU Index to underperform gold from time to time, which is clear from the above chart. But just like night follows day, relative valuations and performance turn when they reach an extreme. We appear to be at one of those turning points for gold and the XAU Index.

I expect gold to continue climbing higher. That is after all, its primary trend. But look for the price of the mining stocks to start climbing even more rapidly than gold. The mining stocks are on the runway and ready for take-off.

For my specific mining stock recommendations, see my recent article: Update on long-term “Core Positions”.

James Turk is founder and chairman of GoldMoney, which provides a convenient and economical way to buy and sell gold, silver and platinum online using digital gold currency for which he has four US patents.

Today is just “Another Futile We are Saved” type of day. Nothing has changed, no problems have been solved, in Europe, In Japan, or in the US.