Daily Updates

A week ago today, I spent the afternoon visiting the Occupy Wall Street demonstrations in lower Manhattan. I brought a film crew and a sign that said “I Am The 1%, Let’s Talk.” The purpose was to understand what was motivating these protesters and try to educate them about what caused the financial crisis. I went down there with the feeling that much of their anger was justified, but broadly misdirected.

Indeed, there were plenty of heated discussions. I was called an idiot, a fool, a slave-driver, and a selfish person. But when we started talking about the issues, it seems like the protesters fell into two categories: those who generally understood and agreed that Washington caused this mess, and those who could only recite Democrat/union/Marxist talking points. It was the latter that usually resorted to calling names once I pointed out the hypocrisy of their positions. Usually, their argument boils down to, “the rich should be taxed until everyone is equal” or “the banks have taken over the regulatory agencies, so we need more regulations!”

{youtube}vZr9c1zYaOE{/youtube}

I think some of the leadership of Occupy Wall Street comes from this kind of radical Marxist background, and perhaps they’re smart to intentionally keep quiet about their goals. Because the vast majority of protesters I met did believe in capitalism – they’re just tired of being screwed over by crony capitalism. Noted school-choice activist Michael Strong calls it “crapitalism,” and that’s what it is. It’s a rotten deal for everyone, and they know it.

The problem is that many of these people are under the mistaken impression that Wall Street banks are to blame. That’s like blaming the dogs for getting into the trash can. Sure, it’s bad behavior, but the ultimate responsibility lies with the authority figures – in this case, Washington. After all, it’s not the New York metro area that has benefitted the most from this crisis. Rather, the counties around DC are now ranking as the wealthiest in the country. And while wealthy New Yorkers have historically made their living providing essential financial services to the global economy, Washington has always made its living one way: at your expense.

To see the complete highlights of my expedition to Occupy Wall Street, click here.

The end of 2011 is a golden opportunity to participate in an anticipated upside for mining equities, says Tocqueville Asset Management Senior Managing Director John Hathaway. We caught up to him at the Casey Research/Sprott Inc. Summit “When Money Dies” for this exclusive interview with The Gold Report. Hathaway predicted that once investors realize higher gold prices will stick, they will take a chance on the big upside waiting in the junior and senior space.

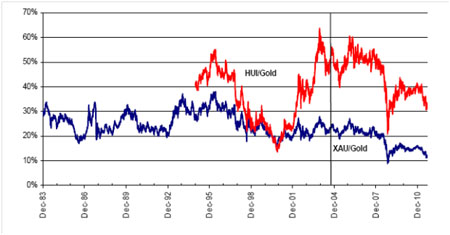

The Gold Report: In your recent article “A Golden Mulligan,” you called gold mining equities “a rational way to participate in what appears to be the end game for paper currencies on an attractive risk-adjusted basis.” After trailing the metals prices substantially since 2010, why do you think they are ready for a turnaround?

John Hathaway: Gold mining stocks have underperformed for a number of reasons. Gold ETFs created competition for gold stocks even as it made owning physical metal more attractive. Also, as gold flirted with $1,900 an ounce (oz), investors may not have priced that into the stocks as they weren’t convinced it would stick. Now that we have had a correction, investor analysis will show that the average price over time, as opposed to variable spot prices, is steadily rising—proof that industry profitability should also be on the rise. The best is yet to come for gold mining earnings as confidence in government monetary policy continues to erode.

TGR: We have seen a lot of volatility lately. What price do you predict for gold going into 2012?

JH: From years of experience, I have learned never to combine a price prediction with a specific point in time. The gold price will continue to rise until the fiscal and monetary policies of Western democracies undergo severe alteration in the direction of sanity.

TGR: What role do operating costs play in equity price challenges?

JH: Some companies have cited increased operating costs as a limiting factor in stock price growth, but the facts don’t support that argument. Energy prices, one of the most variable costs in gold production, are almost half of what they were four years ago. The same is largely true in everything from steel and chemicals to labor. Margins have steadily increased since 2008 and, unless declines in head grades or increased resource nationalism take their toll on future mine profitability, that margin expansion trend should continue. One of the biggest factors weighing on mining stock prices is probably investor risk tolerance. It goes without saying that mining stocks are riskier than physical metals and a lot of investors are looking for a safe haven right now.

TGR: At the end of September, the Tocqueville Gold Fund reported a three-month average return of -8.49% compared to -13.87% for the S&P 500 and a three-year average annual return of 32.24% compared to 1.23% for the S&P 500. Your top 10 holdings include (5.43% of assets) Goldcorp Inc. (G:TSX; GG:NYSE), (3.75% of assets) Randgold Resources Ltd. (GOLD:NASDAQ), (3.33% of assets) Silver Wheaton Corp. (SLW:TSX; SLW:NYSE), (3.07% of assets) Royal Gold Inc. (RGL:TSX; RGLD:NASDAQ) and (2.98% of assets) IAMGOLD Corp. (IMG:TSX; IAG:NYSE). What will be the catalyst that gets investors looking at mining stocks again?

JH: I think the release of third-quarter earnings will amaze people. I am very bullish on the future of the price of gold and gold equities. Equities represent extraordinary opportunities because they offer organic growth in resource production and bumps from merger activities that aren’t possible holding inert metal.

XAU & HUI as ratios of spot gold ($/oz)

Chart: Toqueville

TGR: How will companies that are not making profits at $1,900/oz be profitable going forward?

JH: If a company can’t make money at $1,300/oz gold, it shouldn’t be public. Companies have to find a way to make a profit. An example is Osisko Mining Corp. (OSK:TSX) (which is one of the top 10 in the Tocqueville Gold Fund at 4.49% of assets). It had a $200 million market cap five years ago when we invested; the market cap is now $5 billion. It has a large, low-grade deposit and the price could rise further as they ramp up production.

TGR: You mentioned seniors as a bright spot in the investing scene. Please explain the rationale for your portfolio diversification between bullion, small-, mid- and large-cap companies.

JH: I have about 7% invested in bullion because it is an anchor of value. Physical gold helps protect against currency depreciation. I have about 10–20% in small-cap companies, 20–30% in mid-caps and 30–40% in large caps. The percentages can vary as the valuations change even though we don’t trade very often. Turnover is usually less than 10% in a year.

Big caps benefit most from high gold prices because they are actually producing and selling the metal today. It therefore offers compelling valuations, attractive current returns and virtually a free ride on future gains. We own 11 companies accounting for about 40% of global gold production.

TGR: Are higher dividend payouts going to be the rule going forward?

JH: I hope so. Newmont Mining Corp. (NEM:NYSE) (another Tocqueville Gold Fund top 10 holding at 4.74% of assets) took the lead and linked its dividend to the gold price in April when gold was trading at $1,458/oz. For each $100 increase or decrease in the gold price, the dividend adjusts $0.20 a share. We expect similar announcements to follow from other producers.

TGR: For those who choose to invest in physical gold, where is the best place to keep it? In the U.S., out of the U.S.?

JH: Any good vaulting service will work. Where it is physically located doesn’t matter as long as it is secure, accessible and not in a bank.

TGR: Thank you for sharing your insights.

For the complete audio collection of the Casey Research/Sprott Inc. Summit “When Money Dies,” click here.

John Hathaway, senior managing director of Tocqueville Asset Management, manages all gold equity products and strategies at Tocqueville Asset Management. He holds a bachelor’s degree from Harvard University, a Master of Business Administration degree from the University of Virginia and is a chartered financial analyst. He began his career in 1970 as an equity analyst with Spencer Trask & Co. In 1976, he joined investment advisory firm David J. Greene & Co., where he became a partner. In 1986, he founded Hudson Capital Advisors and in 1988, he became chief investment officer of Oak Hall Advisors.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) JT Long of The Gold Report conducted this interview. She personally and/or her family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Goldcorp Inc., Royal Gold Inc.

3) John Hathaway: I personally and/or my family own shares of the following companies mentioned in this interview: Tocqueville Gold Fund. I personally and/or my family am paid by the following companies mentioned in this interview: Tocqueville Gold Fund.

You may not be able to count cards at the blackjack table, but counting historical trends of the stock market and discovering inflection points are not only legal strategies, they are essential to successful investing.

U.S. Stock Market – All is well with Europe again… NOT! While I’m glad to have been short-term bullish on equities and not getting killed as many shorts are/will, please don’t confuse a countertrend rally with a new bull market. You’re going to hear a lot of hype from the “Don’t Worry, Be Happy” crowd, especially if and when we approach key resistance of 1275 on the S & P 500 (my target for my short-term bullishness).

Chart updated at 8:55pm P.S.T.

As day always turns into night, rest assured as we get through Thanksgiving the “happy” people will be out in force (using their favorite home, TOUT-TV) telling us one of their great fables, the Santa Claus Rally.

I would use this anticipated run towards 1275 as an opportunity to prune portfolios as Europe is not only far from okay, but only the opening act to the real coming disaster unfolding here in the U.S.

Bonds – AVOID!!!

Gold – One again the death of the “mother’ of all bull markets has been greatly exaggerated. For several years now, I’ve suggested $2,000+ gold is a question of when, not if. Never have I been more confident in that assessment.

U.S. Dollar Index – How many times must the dollar bulls have their feet cut out from underneath them before they realize poor Uncle Sam is terminally ill. But don’t think for even a minute that the Euro is anymore special. Choosing between them is like picking your poison. The only paper currency I’m comfortable with holding is the Canadian Dollar (so long as they don’t put Roberto Luongo picture on the front).

Oil and Natural Gas – I’m neutral on oil but see a pop over $100 before year is out. I l really like natural gas but the shares trade as if the price was $7 not half that.

Special Note – I will be on Michael Campbell’s Moneytalks radio show this Saturday at 9AM pacific time and also his keynote speaker at his conference in November.

Because of their close trade links, Malaysia, Singapore, South Korea, Taiwan and Hong Kong would be among the first to feel the pain should China’s growth weaken dramatically.

However, it would probably take a shock even bigger than what followed the 2008 Lehman Brothers bankruptcy to spread significant damage beyond Asia.f

Judging from the latest HSBC survey of China’s manufacturing sector, released on Monday, there is no evidence that growth is collapsing in the world’s second biggest economy.

Indeed, not one of the 30 economists polled by Reuters last week predicted China’s 2012 growth rate would dip below 8 percent.

But that has not silenced speculation that China is heading for an economic disaster. Some economists have tried to calculate the potential fallout just in case their forecasts prove to be overly optimistic.

Bank of America-Merrill Lynch economists estimated that if China’s real per capita gross domestic product fell by 2 percentage points, the pain would remain contained within Asia.

“It would take a severe shock to China for the negative spillovers to be transmitted beyond Asia,” they wrote in a note last week to clients.

A 4 percentage point drop would be enough to spread to parts of Europe and the Middle East, with growth suffering in countries including Russia, Kuwait and Finland. Annual global growth would probably drop by 0.5 percentage points.

The last time China’s economy recorded a decline anywhere close to that magnitude was after the Lehman bankruptcy. Year-over-year growth dropped to 6.8 percent in the fourth quarter of 2008, down from 9.0 percent in the prior three-month period.

A full-blown crash, which BofA-Merrill described as a 6 percentage point drop in China’s real per capita GDP, would harm Europe’s biggest economies — Germany, France and Britain — and even nick U.S. growth. It would probably shave 0.8 percentage points off global growth.

That would be a significant hit considering the International Monetary Fund thinks world output will be up a relatively modest 4 percent in 2012.

Doomsday Scenario

BofA-Merrill considers the risk of a China crash negligible — a 0.13 percent probability event.

But the China bears are growing louder in their warnings of an impending doom. China simply cannot rely on fixed-asset investment to drive 8-percent-plus growth forever, they argue.

Heavily indebted local governments could default. A property market crash may drive hundreds or even thousands of developers out of business. Bad loans may pile up on banks’ books, and China could face an all-out credit crisis.

“China is undoubtedly a severely imbalanced economy, suffering from credit-fuelled investment and housing excesses that could easily spin out of control and crash, just like all the other ‘highly regarded’ economic bubbles before it,” Societe Generale strategist and well-known bear Albert Edwards wrote in an Oct. 20 research note.

Jim Walker, founder of Hong Kong-based consultancy Asianomics, said it would be a “miracle” if China’s 2012 GDP slows to just 7 percent.

“We’re really looking for something much, much worse than that,” he said. “China will be lucky to get away with 5 percent.”

That would be a drop of more than 4 percentage points from 2011’s expected growth. Not only would China’s regional trade partners take a hit, but so would commodity exporters such as Australia and Indonesia. China accounted for 65 percent of the world’s iron ore imports in 2009, and 15 percent of coal imports, according to IMF data.

Look On the Bright Side

A China slowdown would bring some benefits for Asia, albeit small ones. Lower prices would bring welcome inflation relief for Asia’s commodity importers, said Johanna Chua, chief Asia-Pacific economist for Citi in Hong Kong.

It might also swing a little bit more foreign investment toward other Southeast Asian economies that have struggled to compete with China for overseas funds.

China itself invested only about $2.4 billion last year into the 10 countries that make up the Association of South East Asian Nations, according to Bofa-Merrill economist Chua Hak Bin in Singapore, too little to pose a systemic threat on its own.

There is considerably more money flowing the other way. Since 1995, ASEAN has invested about $75 billion in China, with Singapore far and away the most exposed, accounting for $62 billion of that. A China hard landing could cause “significant” portfolio losses, BofA-Merrill’s Chua said.

But it also looks clear that Beijing will act if growth looks likely to weaken dramatically. It has room to ramp up government spending, ease credit conditions, and slow the appreciation of the yuan currency to give exports a boost.

“If China is hard landing, I agree with the bulls on one thing: expect the authorities to become aggressively stimulative,” SocGen’s Edwards said.

© 2011 Thomson/Reuters. All rights reserved.

Read more: Cost of ‘Unlikely’ China Crash Could be Catastrophic

Important: Can you afford to Retire? Shocking Poll Results