Stocks & Equities

Wednesday December 6, 2017 Available Mon- Friday after 3:00 Pacific.

DOW – 40 on 443 net declines

NASDAQ COMP + 14 on 920 net declines

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bullish

STOCKS: Stocks meandered on Wednesday in a seemingly confused manner. We liked the fact that the high techs and the NASDAQ showed signs of life but the listed market couldn’t get out of its own way.

Breadth was still not encouraging and the put call ratio remains low. Given the seasonality, it’s tempting to put on a trading position, but let’s hold off for now.

GOLD: Gold was up $2. Just an anemic bounce within a downtrend.

CHART: The NASDAQ Composite is just curling up from an oversold condition. This has a decent chance of projecting further strength. If this market rallies, it’s unlikely that the Dow and S&P 500 will sit around.

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy.

System 7 We are in cash. Stay there for now. We’re looking to get back in, but we can’t get an all clear just yet.

System 8 We are in cash. Stay there for now.

System 9 We are in cash.

NEWS AND FUNDAMENTALS: The ADP employment report showed an additional 190,000 jobs, more than the expected 186,00. Oil inventories dropped 5.6 million barrels. Last week they dropped 3.4 million.

INTERESTING STUFF: “The difference between ‘involvement’ and ‘commitment’ is like an eggs-and-ham breakfast: the chicken was ‘involved’ – the pig was ‘committed’.”——– unknown

TORONTO EXCHANGE: Toronto was down 7.

BONDS: Bonds were up slightly.

THE REST:The dollar continued its rally. Crude oil got smacked, pretty good in spite of the lower inventories.

Bonds –Bullish as of November 14.

U.S. dollar – Bullish as of Nov. 28

Euro — Bullish as of October 10.

Gold —-Bearish as of November 29.

Silver-— Bearish as of November 29.

Crude oil —-Bearish as of Nov. 27.

Toronto Stock Exchange—- Bullish as of September 20, 2017.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.

I’m going to use the GDX and GDXJ as a proxy for the rest of the PM stock indexes which are very similar to these two. Last Wednesday we looked at the short term daily charts to the longer term weekly charts to see how things were setting in the PM complex.

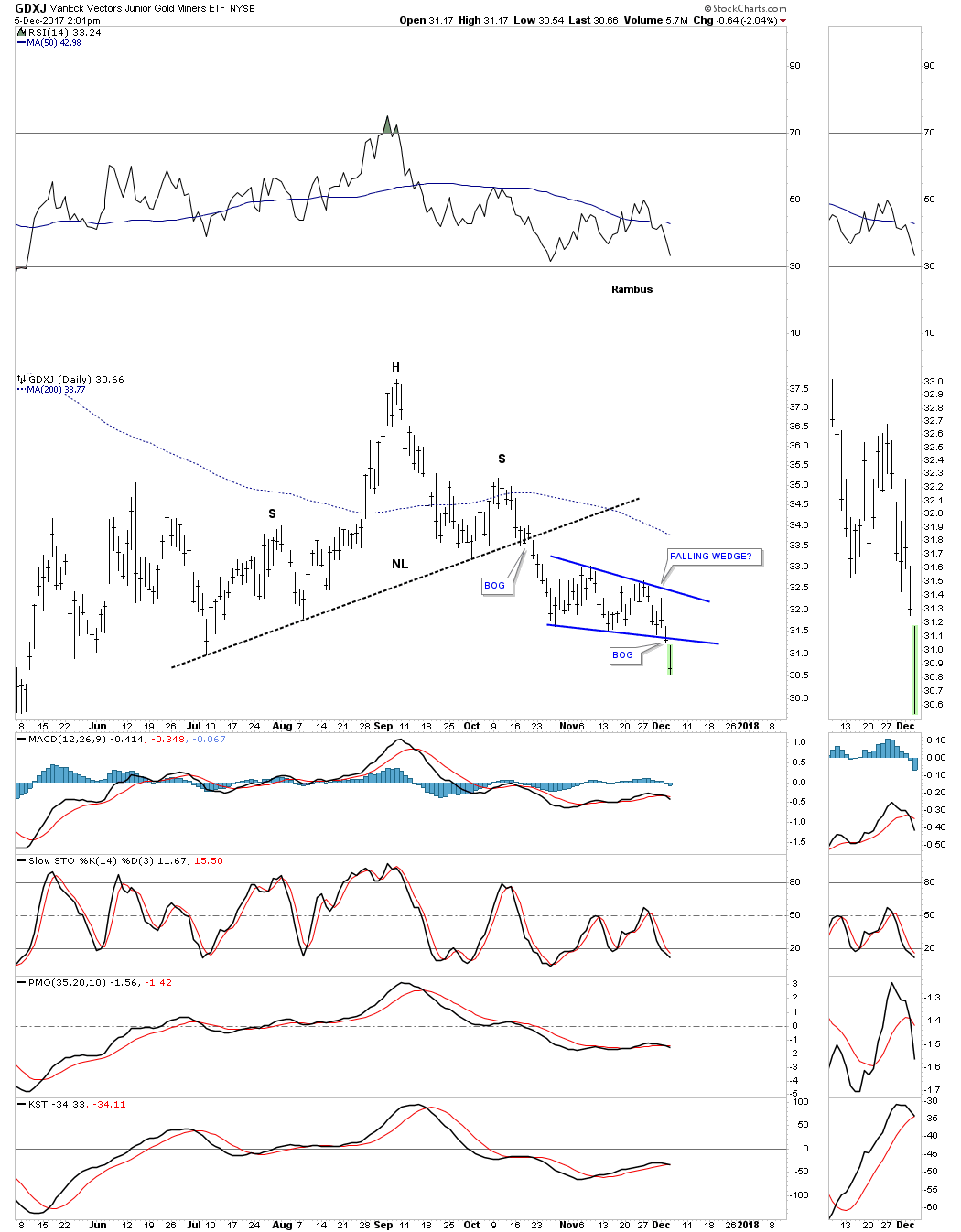

We first looked at the short term daily chart which was showing the H&S top and the smaller blue consolidation pattern that was building out below the neckline. The smaller blue patterns were kind of morphing, but were giving us a hint of what they would eventually look like when they competed.

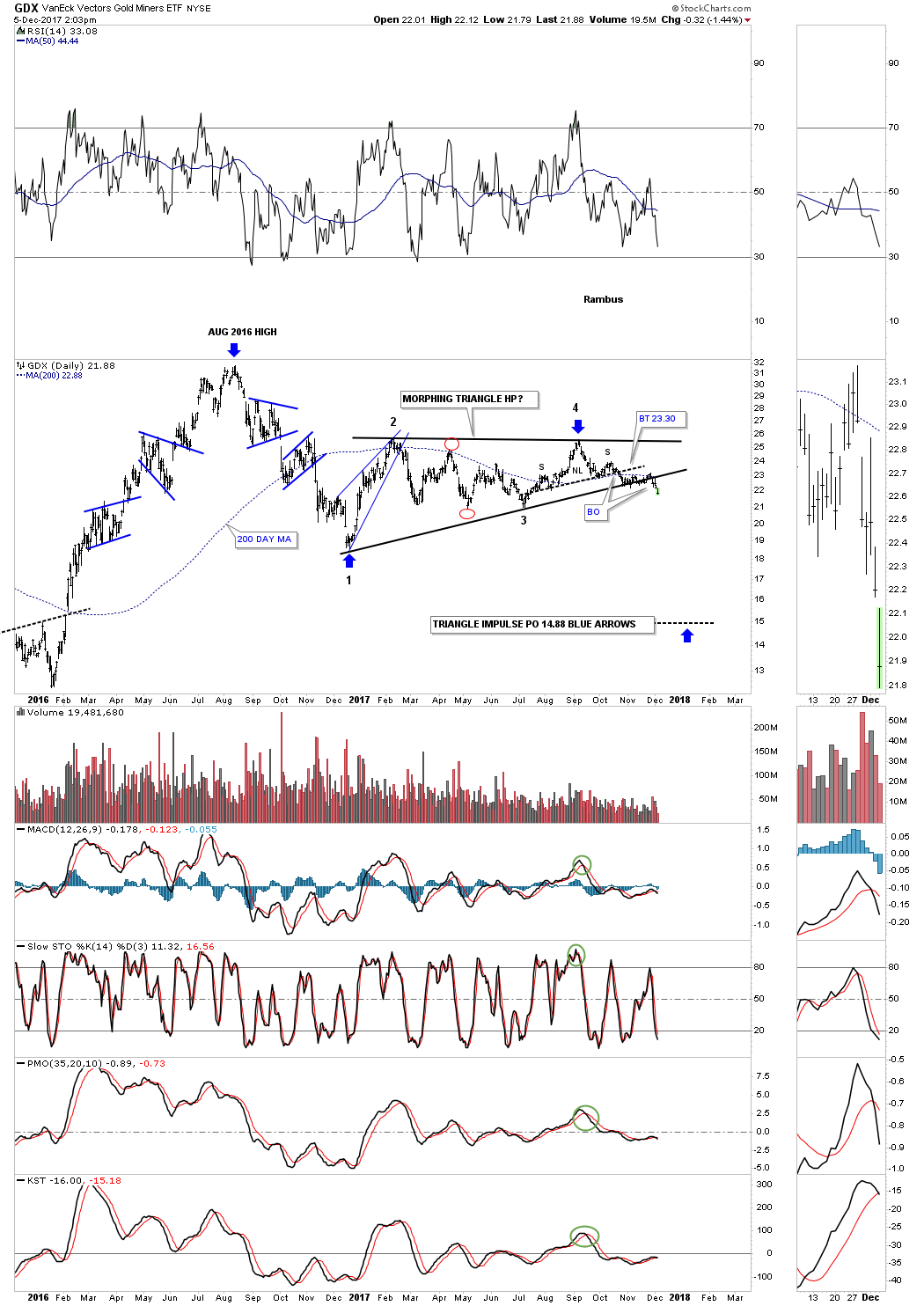

Below is the short term daily chart for the GDX which shows the H&S top with the completed bearish rising flag. The breakout was a little sloppy, but today we are getting some follow through to the downside.

This short term daily chart for the GDXJ shows it broke out below the bottom rail of its bearish falling wedge this morning with a breakout gap.

Now lets look at the longer term daily chart for the GDX which shows the one year triangle consolidation pattern with the breakout now visible. The chances are high that the triangle consolidation pattern will be a halfway pattern to the downside with a price objective to the 14.88 area as shown by the blue arrows.

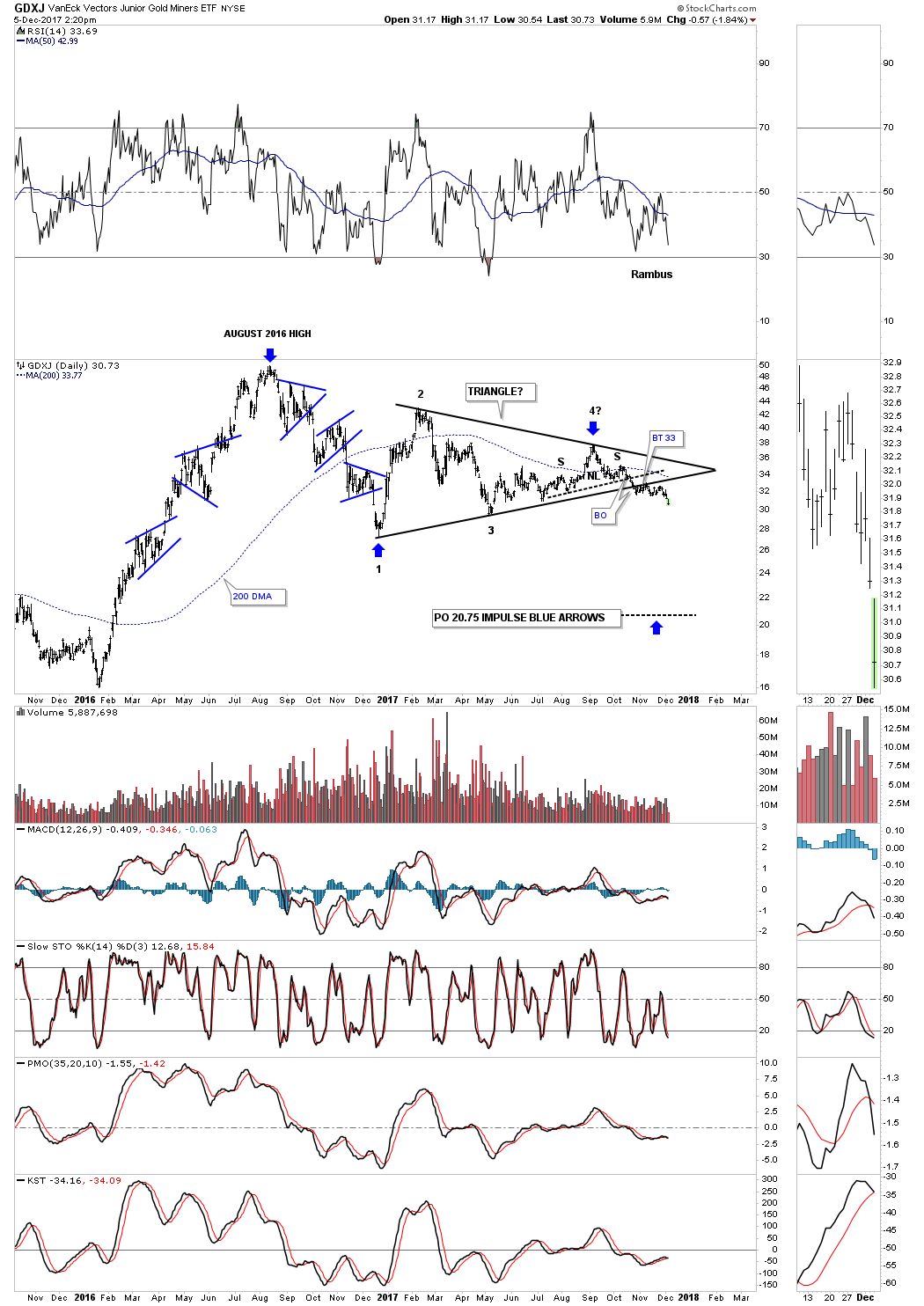

Below is the long term daily chart for the GDXJ which shows the H&S top on the short term daily chart as the 4th reversal point in its one year triangle consolidation pattern. The impulse measured move would be down to the 20.75 area as shown by the blue arrows.

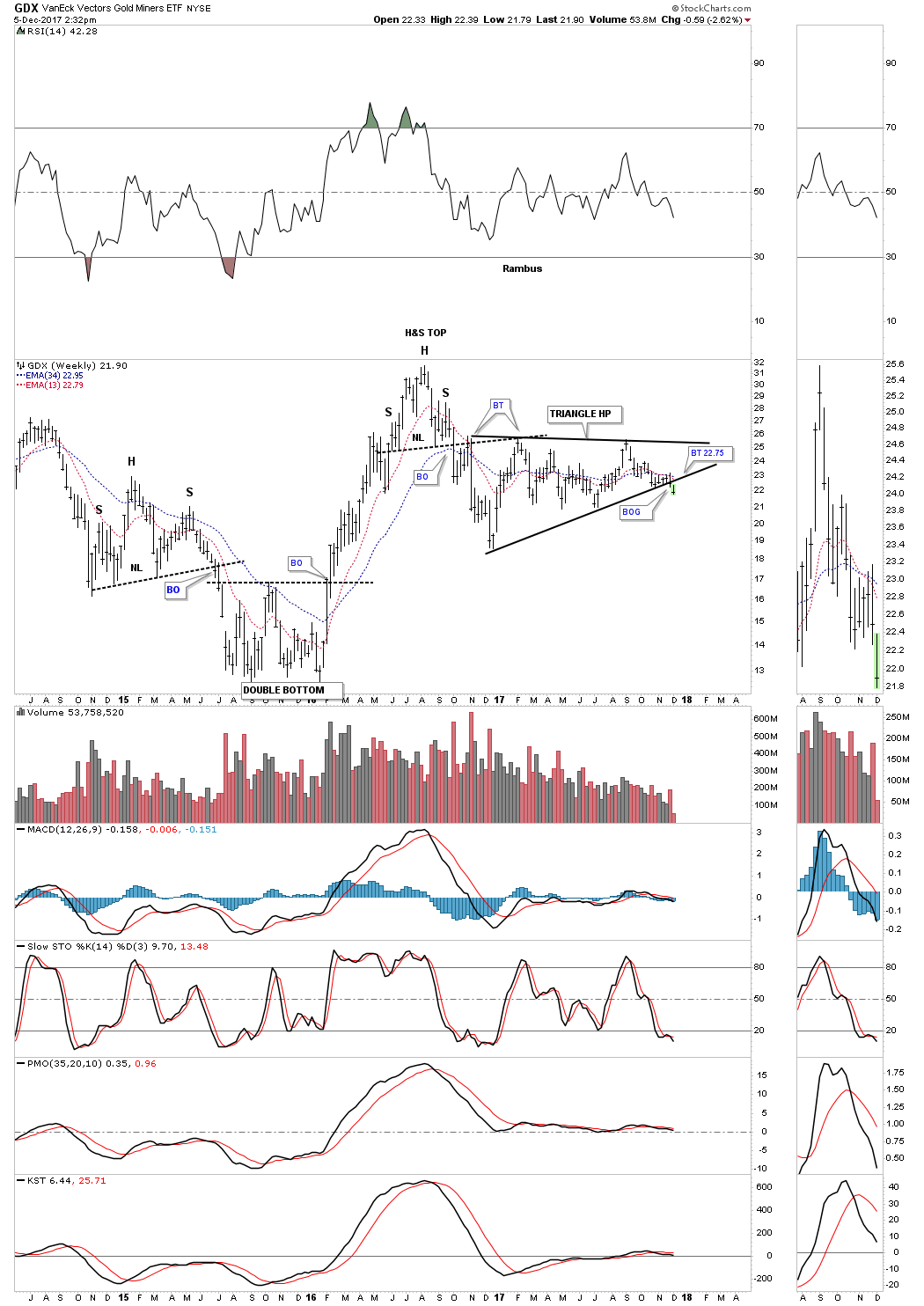

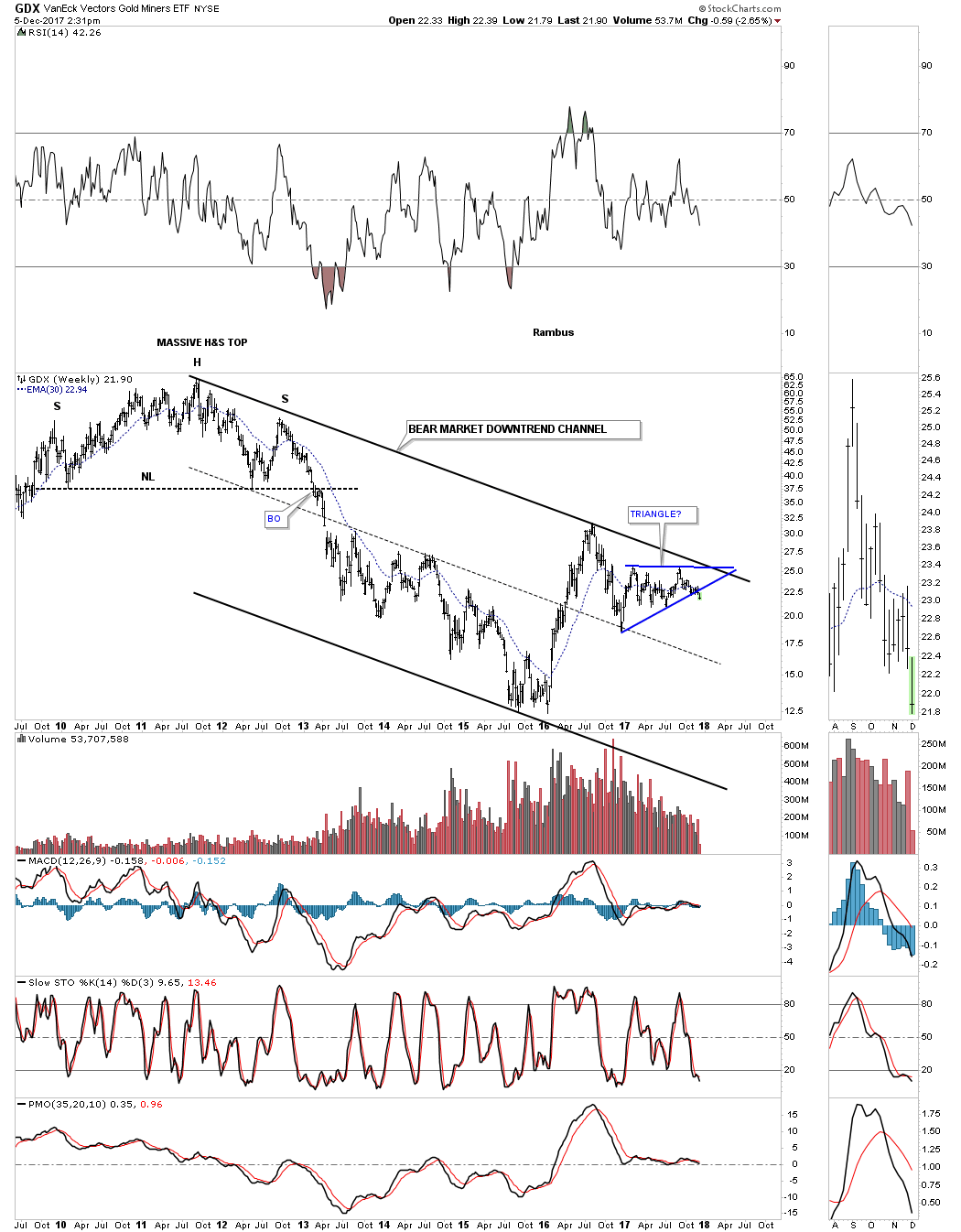

This four year weekly chart for the GDX puts the triangle in perspective as a possible halfway pattern to the downside. It’s still possible we could see a backtest to the underside of the bottom rail of the triangle which would come into play around the 22.75 area.

Until the bulls can take out the top rail of the downtrend channel the bears are still in charge.

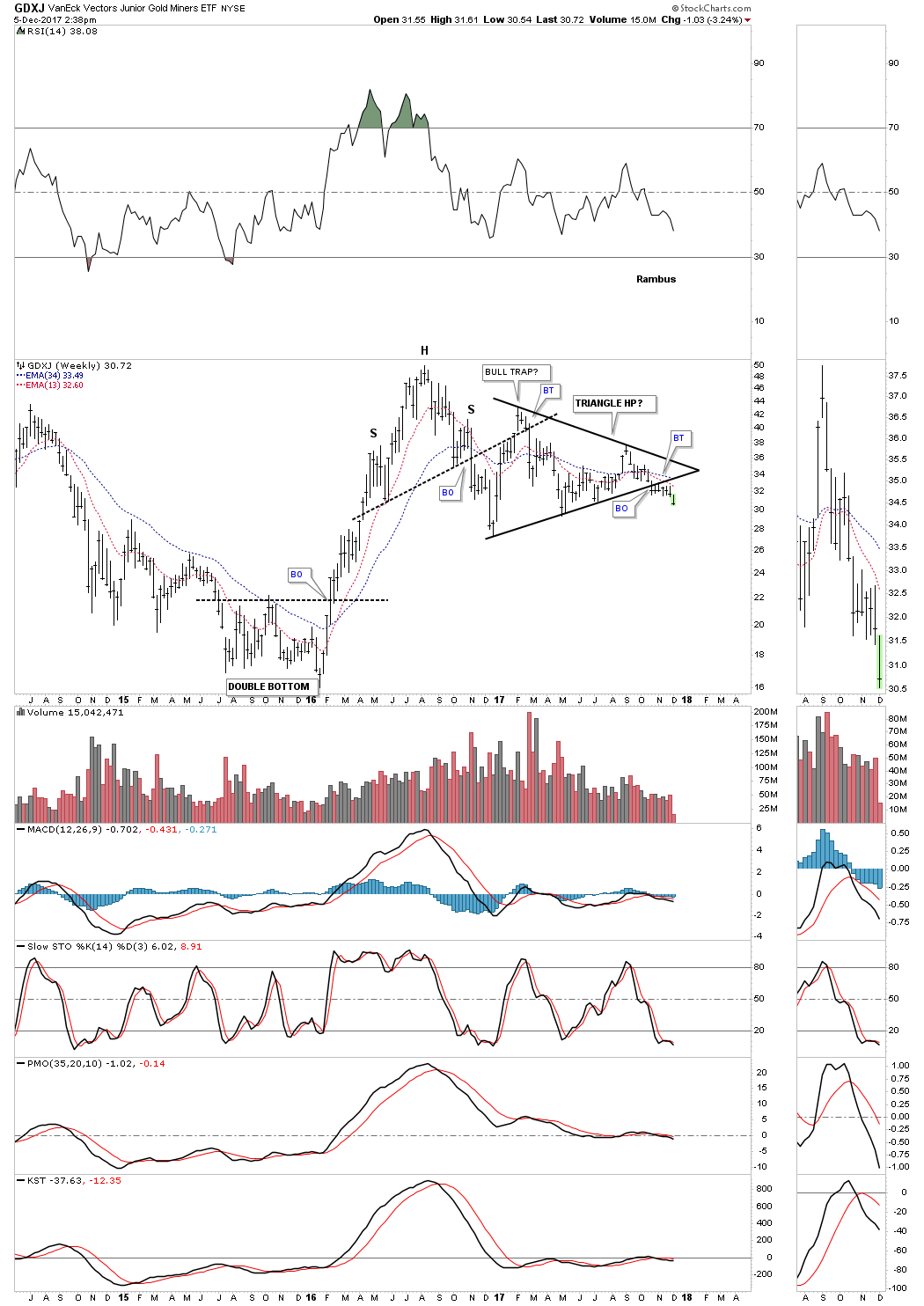

This short term weekly chart for the GDXJ puts its one year triangle in perspective as a possible halfway pattern to the downside.

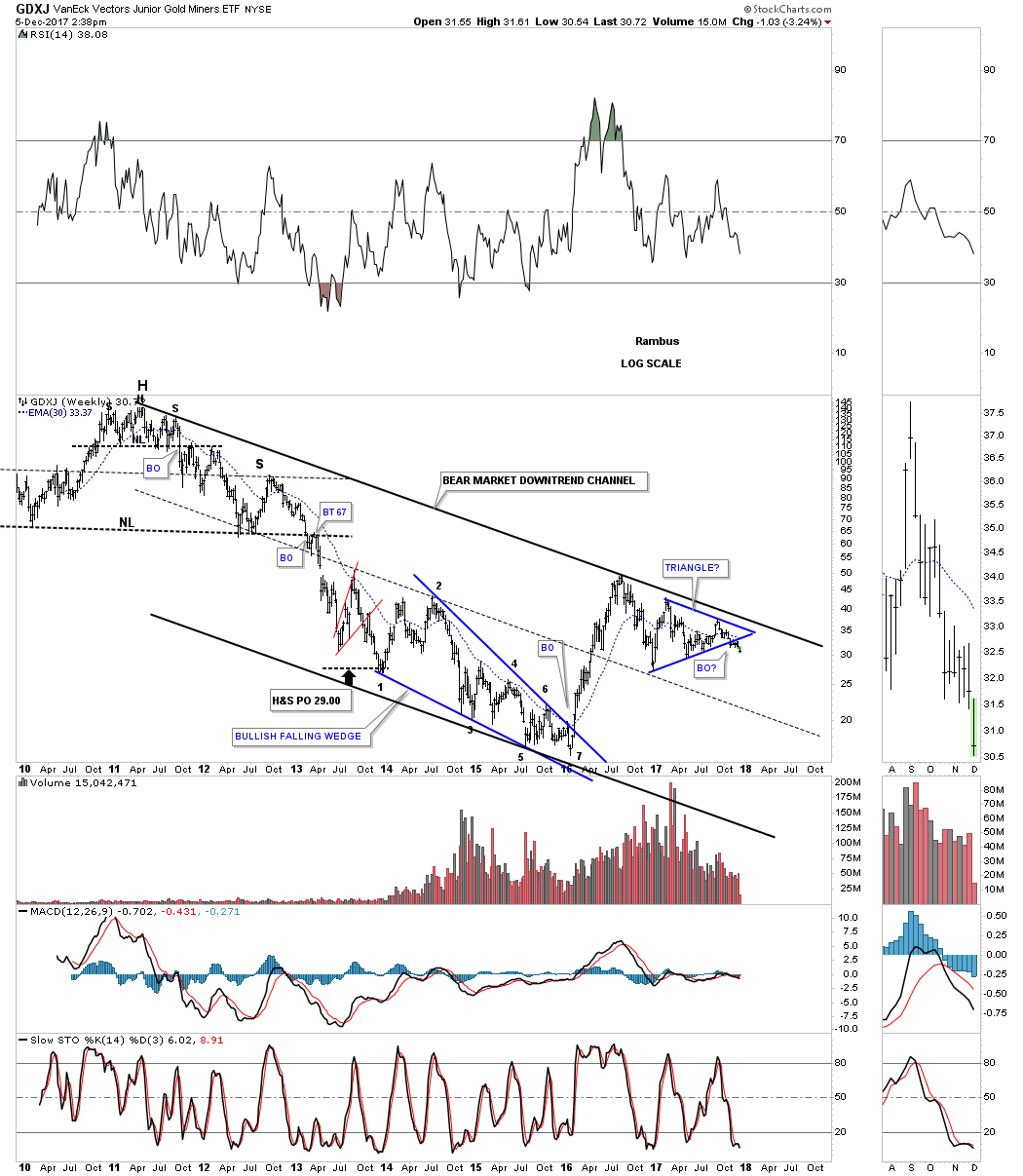

This long term weekly chart shows how the triangle fits into the very big picture. Again all the bulls need to do is take out the top rail of the bear market downtrend channel and all will be right with the world again. As you can see they have tried three times in the last year and a half, but so far haven’t been able to do it.

So, we are now in the ebullient month of December and as often stated, “It is tough to put stocks away to the downside in December. It can happen, but it’s pretty rare.” In fact, there were only two years that saw negative returns for the S&P 500 (SPX/2642.22) in December. They were 1936 and 1955, but even then the declines were small.

To be sure, over the last 100 years the average December gain has been 1.55% with a “win rate” of 74% of the time (Chart 1).

Moreover, ten of the S&P’s macro sectors have experienced positive returns in December. As Bespoke Investment Group notes, “Surprisingly, it has been the high yielding dividend paying sectors that have seen the largest gains with Real Estate, Telecom Services, and Utilities all posting gains of more than 2%.” Worth mention is that last December ALL the macro sectors rallied! Parsing a list of some of the historically best performing stocks in the S&P 500 during the month of December we find the following names from the Raymond James research universe. Each stock screens well on our models and carries a favorable rating from our fundamental analysts: Broadcom (AVGO/$271.56/Strong Buy), Oracle (ORCL/$49.61/Outperform), Valero (VLO/$84.17/Outperform), Red Hat (RHT/$125.26/Outperform), Nvidia (NVDA/$197.68/Outperform), and Mohawk (MHK/$284.82/Strong Buy).

It’s that time of the year again. Every holiday shopping season, the “retail apocalypse” discussion moves front and center.

In reality, it’s not so much an apocalypse as it is a rethinking of the way we shop. Online is definitely growing. Physical storefronts are hit-and-miss.

Forget all that. I want you to think about packaging.

If you do, you will see a gigantic opportunity that most other investors are missing.

Recently, Jeff Bezos, the founder of Amazon (AMZN) sat down for a wide-ranging interviewwith Michael Beckerman, the CEO of the Internet Association. That’s a trade group that bills itself as the “unified voice of the internet economy.”

In this interview, Bezos shared the principles behind how Amazon dominates its markets. These principles have organically inspired many of the company’s winning products, services and programs.

Bezos presented highlights of these success stories. And one of these achievements attracted my attention as an investor. But first, here’s how Amazon fosters excellence.

- Become obsessed with customers. Not products. Not technology. Not your competitors. Amazon always puts customers first. The company strives to know its customers so well that it can invent what they want before they even know they want it.

- Focus on long-term planning. Too many companies focus on the bottom line from year-to-year or quarter-to-quarter. At Amazon, they plan five to seven years ahead.

- Identify your big ideas. This will help your company focus on what’s important. You should only have two or three big ideas. But they should reflect values that will hold up for 10 to 20 years. Amazon has three big ideas: low prices, fast delivery and vast selection.

- Accept failure as a path to success. You can’t invent or pioneer without making experiments, says Bezos. And by their nature, experiments fail more often than they succeed.

I believe investors should pay close attention to one of Amazon’s experiments … because it offers a big key to the company’s success.

Consider this: You can’t shop anywhere without confronting clear plastic, clamshell packages. They’re used by most toy- and consumer electronics-makers. And consumers hate them. During the interview, Bezos described them as indestructible and frustrating. He has a point.

Merchants turned to clamshells in the 1980s to combat shoplifting. Without a sharp knife, it’s almost impossible to free the product. And the packaging is too bulky to hide under clothing.

Plus, there are other advantages. Clamshell packages look good on display. Customers can see the entire product through the clear plastic.

The downfall is that clamshells are very expensive, bulky to ship and hard to recycle. And yes, consumers hate them.

They’re also dangerous.

In 2006, the U.S. Consumer Product Safety Commission estimated that clamshell packages led to 6,000 emergency-room visits.

You see, it’s impossible for customers to open clamshells with their bare hands. So, they use dangerous tools like scissors, knives, box cutters, razor blades and combat knives.

And, bad things happen when frustrated people hack and slash at the plastic packages. The list of injuries ranged from severe cuts to severed tendons and injured eyes.

And, bad things happen when frustrated people hack and slash at the plastic packages. The list of injuries ranged from severe cuts to severed tendons and injured eyes.

Bezos says Amazon.com has been working on a program called Frustration Free Packaging for the past 10 years. To put that in perspective, the only older programs are Prime, its membership service, and Amazon Web Services, the web-hosting behemoth.

For Amazon, packaging is a very big deal.

The reasons should be obvious. Shoplifting and product displays don’t matter to the online giant. Its products get housed in giant warehouses all over the world. Pieces get scanned and counted.

That bulky clamshell packaging hurts Amazon in two important ways. It costs more to get products because there are fewer pieces per wholesale crate. And it requires larger boxes to send items to retail customers.

Amazon has made progress by working with vendors to create internet-friendly packaging. Easy to open. Easy to dispose of. Today 80,000 products are available under FFP. And in the past year alone, Amazon has saved 55 tons of waste.

This is an important trend in the packaging industry. As retail moves more online, there is a huge economic incentive to change the way products are packaged. Investors need to understand this trend, because a new ecosystem is evolving. Winners are being created right now.

One of the companies I have been watching for my members was founded in 1940. And, it has become one of the leading corrugated packaging companies in the world.

It makes simple, brown cardboard boxes that are both easy to open and just the right size for online shipping. Since 2010, shareholders have seen the stock rise 398%.

And, by all accounts, the best is yet to come.

In 2016 it shipped 6.7 billion metric meters of corrugated cardboard, and 2.4 million tons of paper packaging. It currently operates in 30 countries, and it is continuing to expand its footprint to meet robust demand for simplified online packaging.

Margins are expanding. Cash flow is strong.

And there are other winners. One company makes the robotic machines used to make box production more efficient. Another makes sensors. Another makes software.

This is a rapidly growing sector that very few investors even know exist. Packaging is the new black. And just like that universally flattering color, profits look good on everyone — especially you. Here’s how to get in on that trend.

Best wishes,

Jon Markman

Last week, as traders were all on vacation, the market surged to 2600 as the “inmates ran the asylum.” The expectation of a better than anticipated shopping holiday season and ongoing hopes of “tax cuts and reform” lifted stocks higher. The current advance, is still working the general year-end pattern I laid out three weeks ago as shown below.

With earnings season nearing its conclusion, the markets will begin to focus more heavily on the economic data which has been weak as of late. Furthermore, with the Fed continuing to hike rates, and professional investors waiting to take gains until January, the risk of a Q1 sell-off has risen markedly in recent weeks. This is particularly the case given the short-term deviation from longer-term trends in the market.

The chart below shows the percentage deviation above the 3-year monthly moving average. Previous deviations have resulted in an eventual reversion to, or beyond, the 3-year moving average. A reversion to the monthly moving average currently would entail a -15.8% decline. While such a decline would not register as a “bear market,” which would require a 20% decline, given the record length of time without so much as a 3% correction, such a decline will certainly “feel” like a bear market.