Stocks & Equities

Near the end of each year, Barron’s magazine highlights the outlooks for the next year from 10, or so, Wall Street strategists. As noted recently by Sentiment Trader:

Near the end of each year, Barron’s magazine highlights the outlooks for the next year from 10, or so, Wall Street strategists. As noted recently by Sentiment Trader:

“Strategists are a little more optimistic than the Big Money was, forecasting a gain of around 7% for the S&P 500 in 2018. That’s about how much they thought the S&P would rally in 2017. And 2016. And pretty much every other year. When forecasting, it’s often a good bet just to go with the base rate – the average probability of being positive, or average gain in a random year. For stocks, that’s about a 7% nominal return, with about a 65% probability of showing a gain. Just stick with those, and you’ll have a better record than most. In aggregate, that’s what Wall Street does.”

Of course, 2017, has been a much better than the forecasted year as one of the great triumphs of the Fed’s liquidity-driven policy is that investor’s “animal spirits” finally returned to the investment markets. However, actual results, as Sentiment Trader showed, can vary.

” They overestimated the market’s 2008 return by 50% (!) and underestimated the 2012 return by 20%. Like most outlooks, forecasts, and research pieces, the biggest value isn’t necessarily in the bottom line, but in the thought processes and data used to get there. In those senses, reading through the outlooks can be a great exercise. Using them just for the bottom-line guess at next year’s S&P level is next to worthless as an indicator.”

But, with the ongoing massive global Central Bank interventions, as Michael Lebowitz discussed yesterday, it should not be surprising that as markets continue their seemingly unstoppable advance. That advance has ultimately triggered the “greed factor” as shown by surging investor confidence and expectations which have surged to historically high levels. (The chart below is a composite index of both the University of Michigan and Conference Board surveys.)

Even the level of individuals believing the financial markets will be higher over the next 12-months has spiked sharply higher in recent months.

However, while Wall Street expects the markets to increase by 7% next year, the long-term historical average, the charts above suggest individuals have bigger aspirations.

How much bigger? A lot!

Schroders Global Investors Study recently surveyed over twenty thousand investors from around the globe to get their expected portfolio returns over the coming 5 years. To wit:

- Investors expect an annual return of 10.2% on their investments over the next five years

- The 2017 survey, which surveyed 22,100 globally who invest, found millennials even more optimistic. Those born between 1982 and 1999 expected their money to make average returns of 11.7% a year between now and 2022.

- Even the Baby Boomer generation is anticipating an above average return of 8.6% a year.

- Breaking it down by generation:

- Millennials (born 1982-1999, aged 18-35): 11.7%

- Generation X (born 1965-1981, aged 36-52): 9.8%

- Baby Boomers (born 1945-1964, aged 53-72): 8.6%

- Silent Generation (born 1923-1944, aged 73+): 8.1%”

Such levels of optimism may be a bit egregious given the overly optimistic positioning by investors in the market currently as shown.

Add the overly optimistic outlook and positioning to a market that is the most overvalued, overbought, and extended, in the last 20-years and the risk to future returns becomes much more evident.

The reality, of course, is once again investors are setting themselves up for disappointment. The expectations of “compounding returns” of 6, 8 or 10% is a myth that needs to go away. As Richard Rosso wrote recently:

“When it comes to compounding, investors should never suffer torturous time to breakeven. Compound interest works if the rate of interest is consistent, not variable. You wouldn’t know it from stocks, especially this year, but from what I know, stocks are indeed a variable, and occasionally, volatile asset class.

So sorry, Suze. This bit of knowledge? Strike out. Not everything compounds.

‘Orman explained that if a 25-year-old puts $100 into a Roth IRA each month, they could have $1 million by retirement.’“

“As outlined in the chart above, on an inflation-adjusted basis, achieving a million-buck balance in 40 years by dollar-cost averaging $100 a month, requires a surreal 11.25% annual return. In the real world (not the superstar pundit realm), a blind follower of Suze’s advice would experience a whopping retirement funding gap of $695,254.68.

I don’t know about you, to me, this is a Grand Canyon expectation vs. reality-sized unwelcomed surprise.”

But yet, Millennials are currently hoping for “Orman” type returns.

Reality is likely to be extremely disappointing as drawdowns of 10% or more have occurred throughout history with regularity.

Irrational Exuberance

Here’s a little secret, “Animal Spirits” is simply another name for “Irrational Exuberance,” as it is the manifestation of the capitulation of individuals who are suffering from an extreme case of the “FOMO’s” (Fear Of Missing Out). The chart below shows the stages of the previous bull markets and the inflection points of the appearance of “Animal Spirits.”

At the peak of previous bull market advances, the markets have entered into an accelerated phase of price advances.

Since “the price you pay day is the value you receive tomorrow,” as famously noted by Warren Buffet, it should not come as a surprise that “value investing” is lagging the “momentum chase” in the market currently. But again, this is something that has historically, and repeatedly occurred, during very late stage bull market advances as the “rationalization” for a “never-ending bull market” is promulgated.

Given the length of the economic expansion, the risk to the “bull market” thesis is an economic slowdown, or contraction, that derails the lofty expectations of continued earnings growth.

While tax reform legislation may provide a bump to earnings growth in the near-term, it is the longer-term growth rates of the economy that matters. Furthermore, while providing a tax cut to corporations will certainly boost their bottom line, there is little evidence, historically speaking, “trickle-down economics” actually occurs. If it did, wages as a share of corporate profits wouldn’t look like this.

With an economy that is 70% driven by the 90% of the population who don’t benefit from corporate tax cuts, the long-term effects of a deficit and debt busting tax bill should be worrying investors.

But, for now, that is not the case as the rise in “animal spirits” is simply the reflection of the rising delusion of investors who frantically cling to data points which somehow support the notion “this time is different,” a point recently made by Sentiment Trader:

“We’ve discussed a multitude of momentum studies in the past month or two, with an almost universal suggestion that the types of readings we’ve seen this year are rare and hard to bust. This unrelenting bid has been one of, if not THE, most compelling bullish argument, and it shows little sign of stopping.”

But importantly, they always do.

We have seen this before.

There was no catalyst that we know of that burst the dot-com bubble in 2000. There was no catalyst that started the slide in the markets in 2008 until it triggered the Lehman bankruptcy and “all hell broke loose.”

Today, we once again have exuberance present and there is a widespread belief that nothing will stop this runaway train.

But eventually, for whatever reason, the market will top. It is impossible to predict when, or how it will happen. It just most assuredly will, and will do so just as everything seems to be its brightest.

It will be the rudest of awakenings for the slumbering bulls.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

Emerging Markets Shrug Off Crises For Best Gains in Eight Years

Straight forward:

“2017 is set to go down as the year when easy monetary policy and budding global growth came together to deliver blockbuster returns for the world’s emerging markets. Currencies and stocks in developing economies are on track for their biggest rallies in eight years as even the riskiest markets shrugged off various crises and threats to deliver gains for investors.

Bonds, too, have had a good run, with local-currency emerging-market debt returning the most since 2012 amid the loose policy environment.”

EM are still below 2007 peak . . .

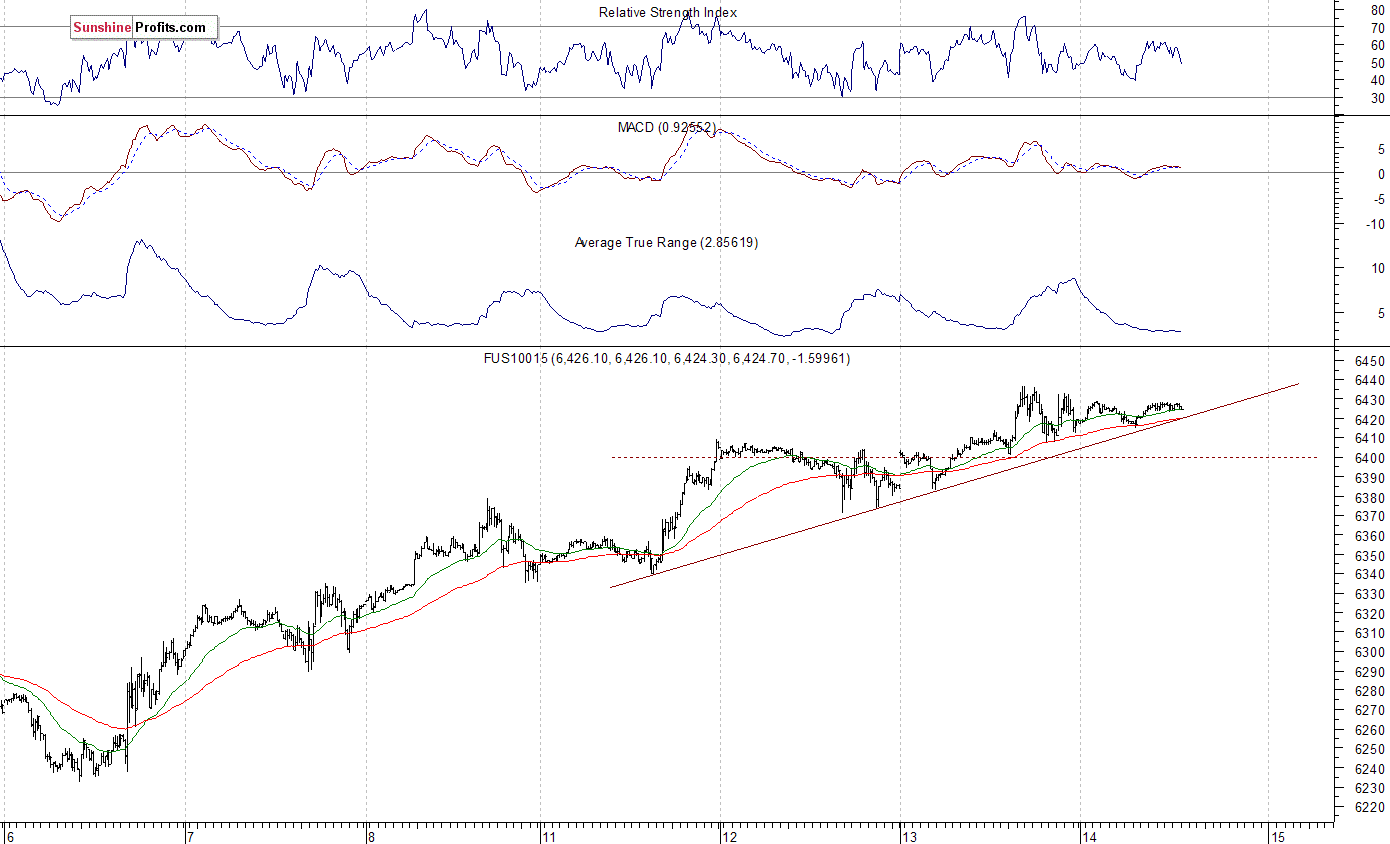

Intraday trade: Our Wednesday’s intraday trading outlook was bearish. It proved partly accurate because the S&P 500 lost 0.05% following higher opening of the trading session. The index extended its short-term uptrend, as it reached new record high. There have been no confirmed negative signals so far. However, we can see some short-term technical overbought conditions. Therefore, intraday short position is favored today. Stop-loss is at the level of 2,680 and potential profit target is at 2,640 (S&P 500 index).

Our intraday outlook is bearish again. Our short-term outlook is neutral, and our medium-term outlook is neutral:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

The main U.S. stock market indexes were mixed between -0.05% and +0.3% on Wednesday, as investors reacted to the FOMC Rate Decision announcement. The S&P 500 index reached new record high of 2,671.88 (around 2 points above its Tuesday’s record high) following interest rate hike release. The Dow Jones Industrial Average was relatively stronger than the broad stock market, as it gained 0.3%. It has reached new record high at the level of 24,666.02. The technology Nasdaq Composite gained 0.2% yesterday, remaining below its late November record high. The nearest important level of support of the S&P 500 index is at around 2,660, marked by recent daily lows. The next support level is at 2,650. The support level is also at 2,640, marked by last Friday’s daily gap up of 2,640.99-2,644.10. On the other hand, resistance level is at around 2,670-2,675, marked by new all-time high. Will the S&P 500 index continue its uptrend? Or is this some topping pattern before medium-term downward correction? There have been no confirmed negative signals so far. However, we still can see medium-term technical overbought conditions along with negative technical divergences:

Close To Record High

Expectations before the opening of today’s trading session are slightly positive, with index futures currently up 0.1-0.2% vs. their Wednesday’s closing prices. The European stock market indexes have lost 0.3-0.5% so far. Investors will wait for some economic data announcements: Retail Sales, Initial Claims at 8:30 a.m., Flash Manufacturing PMI, Flash Services PMI at 9:45 a.m., Business Inventories at 10:00 a.m. The market expects that Retail Sales grew 0.3% in November. The S&P 500 futures contract trades within an intraday consolidation, as it continues to fluctuate along new record high. The nearest important level of resistance is at around 2,675. On the other hand, support level is at 2,660-2,665, marked by some recent local lows. The next level of support is at 2,650-2,655, marked by short-term fluctuations. The futures contract trades along its new record high, as the 15-minute chart shows:

Topping Action Or Just Consolidation?

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation. The market extends its yesterday’s fluctuations along new record high. For now, it looks like a consolidation following recent advance. The nearest important level of resistance is at around 6,430-6,440, marked by record high. On the other hand, support level is at 6,400, and the next level of support remains at 6,370-6,380, marked by recent fluctuations. The Nasdaq 100 futures contract remains above short-term upward trend line, as we can see on the 15-minute chart:

Let’s take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The price reached new record high a month ago, as it extended its uptrend following better-than-expected quarterly earnings release. Since then it fluctuated along the level of $170. The price bounced off support level of the early November daily gap up on Monday. Will it continue higher despite negative technical divergences?

The Dow Jones Industrial Average daily chart shows that blue-chip index reached new record high yesterday. We still can see negative technical divergences. The most common divergences are between asset’s price and some indicator based on it (for instance the index and RSI based on the index). In this case, the divergence occurs when price forms a higher high and the indicator forms a lower high. It shows us that even though price reaches new highs, the fuel for the uptrend starts running low. We can see two-month-long potential rising wedge topping pattern:

Concluding, the S&P 500 index was virtually flat on Wednesday, after reaching yet another new record high above 2,670 mark. Will uptrend continue? Or is this some topping pattern before downward correction? We still can see medium-term overbought conditions along with negative technical divergences. However, there have been no confirmed negative signals so far.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts

This past weekend, I discussed the current extension of the market. To wit:

“In the short-term, the market trends are CLEARLY bullish, very overbought, but nonetheless bullish.”

“As such, our portfolios remain ‘long’ on the equity side of the ledger…for now. “

The current momentum behind the market advance is clearly bullish, and with the “smell of tax reform” in the air, there is little to derail the bulls before year-end.

As I previously wrote, I am still somewhat suspicious of the markets going into 2018. As I laid out over the last couple of weeks, I believe the risk of “tax-related” selling is a strong possibility at the beginning of the year as portfolios lock in gains without having to pay taxes until 2019. While the risk to the overall market trend remains small, a correction of 3-5% is possible. I am still looking for the right “setup” by the end of the month to add a small “short S&P 500” position to portfolios and increase longer-duration bond exposure to hedge off some of the potential risks.

I will keep you apprised, of course.

However, in the meantime, there seems to be nothing stopping the market from going higher. As stated in the title, the current push higher puts 2700 in sight by the time Santa fills the “stockings hung by the chimney with care.”

As shown below, price momentum triggered a short-term “buy” signal following Thanksgiving, and after the brief “AMT Tax Debacle” in the Senate Tax Bill, momentum again has turned up as prices continue to press higher.

As noted above, this “momentum” keeps portfolios allocated towards equity risk, but we continue to be prudent about the risk we are taking and continue to hedge risk as necessary.

It’s All About Liquidity

As I have discussed previously, what fundamental strength there is in the market currently was long-ago priced in. The reality is this continues to be a liquidity driven market through Central Bank interventions. The correlation between the NYSE Advance/Decline line and the Japanese Yen shows the “carry trade” that arises from these monetary interventions.

Following the early 2016 correction, the “carry trade” has picked up steam and has continued to force asset prices higher as liquidity seeks opportunity. With the “carry trade” now extremely extended currently, which is also highly leveraged, watch for a triggering of a “sell signal” as a sign to temporarily reduce equity-related risk.

But wait, the Fed is reducing their liquidity flows into the financial system, right?

Not so much.

As shown in the first chart below, the Fed’s balance sheet continues to remain stable even as asset prices surge.

With global Central Banks still flooding the system with liquidity, the Fed has yet to begin rolling off their reinvestments as expected. In fact, the Fed made a timely reinvestment during the “Senate Tax Bill” debacle earlier this month.

Of course, that bump of liquidity sent asset prices rocketing higher.

The question becomes just what will happen to the markets when the Fed actually does begin to aggressively decrease their “reinvestments” in the coming year. The projected decline in the balance sheet looks like the following:

One can only imagine how market which has been repeatedly driven higher on a “feast of liquidity,” either from the Fed or other Central Banks, will react to being put on a diet.

The consequences for investors is likely not optimal particularly given, as discussed this past weekend, the degree of extensions in the market from both long and short-term moving averages. As shown, there are only a few occasions in history where the market has gotten extremely deviated from it 6-year moving average as it is now.

Such deviations do not necessarily mean a crash is coming tomorrow, as shown, irrational exuberance can last much longer than logic would otherwise dictate. However, with the economy running at substantially weaker levels of growth, the ability to leverage debt limited, and valuations already grossly extended, a repeat of the late-90’s is much less likely currently.

The current environment, while bullish, is much more fragile than what was witnessed at the end of the last century hence the need for ongoing “emergency measures” from global Central Banks. This is due to:

- Weakness in revenue and profit growth rates

- Stagnating economic data

- Deflationary pressures

- Excessive bullish sentiment

- Rising levels of margin debt

- Expansion of P/E’s (5-year CAPE)

(For visual aids on these points read: 4 Warnings)

But, for now, the bull charges on.

2700 by Christmas? It’s likely as asset managers try to make up ground, performance wise, before year-end reporting.

How To Play It

With the markets currently in extreme intermediate-term overbought territory, it is likely that the current “hope driven” rally is likely near a short-term top.

For individuals with a short-term investment focus, pullbacks in the market can be used to selectively add exposure for trading opportunities. However, such opportunities should be done with a very strict buy/sell discipline just in case things go wrong. (See last week’s post for guidelines)

However, for longer-term investors, and particularly those with a relatively short window to retirement, the downside risk far outweighs the potential upside in the market currently. Therefore, using the seasonally strong period to reduce portfolio risk and adjust underlying allocations makes more sense currently. When a more constructive backdrop emerges, portfolio risk can be increased to garner actual returns rather than using the ensuing rally to make up previous losses.

For More Read: “You Can’t Time The Market?”

With our portfolios invested at the current time, it makes little sense to focus on what could go “right.” You can readily find that case in the mainstream media which is biased by its needs for advertisers and ratings. However, by understanding the impact to portfolios when something goes “wrong” is inherently more important. If the market rises, terrific. It is when markets decline that we truly understand the “risk” that we take. A missed opportunity is easily replaced. However, a willful disregard of “risk” will inherently lead to the destruction of the two most precious and finite assets that all investors possess – capital and time.

Just something to consider when the media tells you to ignore history and suggests “this time may be different.”

That is usually just about the time when it isn’t.

With the stock market and Bitcoin reaching all-time highs, what can possible go wrong? In offering my thoughts on 2018, I see my role in reminding investors to stress test their portfolios. Is your portfolio built of straw, sticks or brick?

First, let me allege many investors have portfolios built of straw and sticks rather than brick. How do I know this? Here’s a brief check:

- If a robust portfolio is a diversified one (the only free lunch on Wall Street), then please check whether you have rebalanced your portfolio of late. If not, odds are equities have taken on an oversized portion in your portfolio, thus making it more vulnerable than you might have intended in a downturn.

- Equities are part of the so-called risk assets in a portfolio. But what about the rest of the portfolio? Have you been chasing yield by extending duration of your fixed income portfolio? Have you accepted less creditworthy issuers? Have you been lured by the promise of higher yields by financing something in a private placement? I have news for you: without judging the merits of those investments, odds are high that the value of these investments are more correlated with risk assets than you might be aware. Read: just because the label says fixed income doesn’t mean you are diversified.

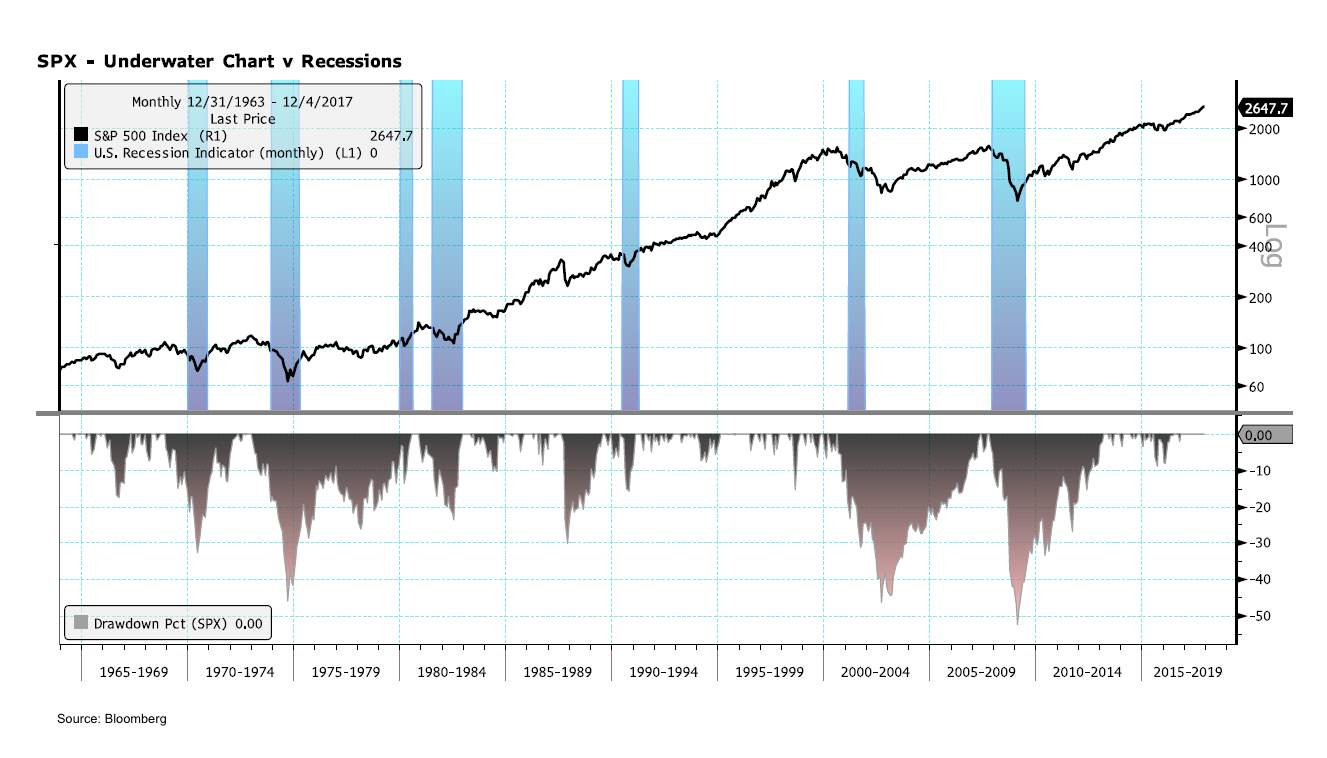

Without a doubt, equities have had an extra-ordinary run. There is the view that, without a recession, you cannot have a bear market. In our analysis, that’s true for the most part – but is “for the most part” good enough? The notable exception is the Crash of 1987 where a bear market was not accompanied by a recession. In today’s context, the buy-the-dip crowd will remind you that the ’87 crash was, well, a buying opportunity. As such, if you are an asset manager interested in keeping your job, you buy. It reminds of the 1980s where buying IBM office equipment was the sure way to keep your job, as no one would question your choice. Here’s a chart that shows the S&P 500 with the percent drawdown from any peak, with recessions shaded:

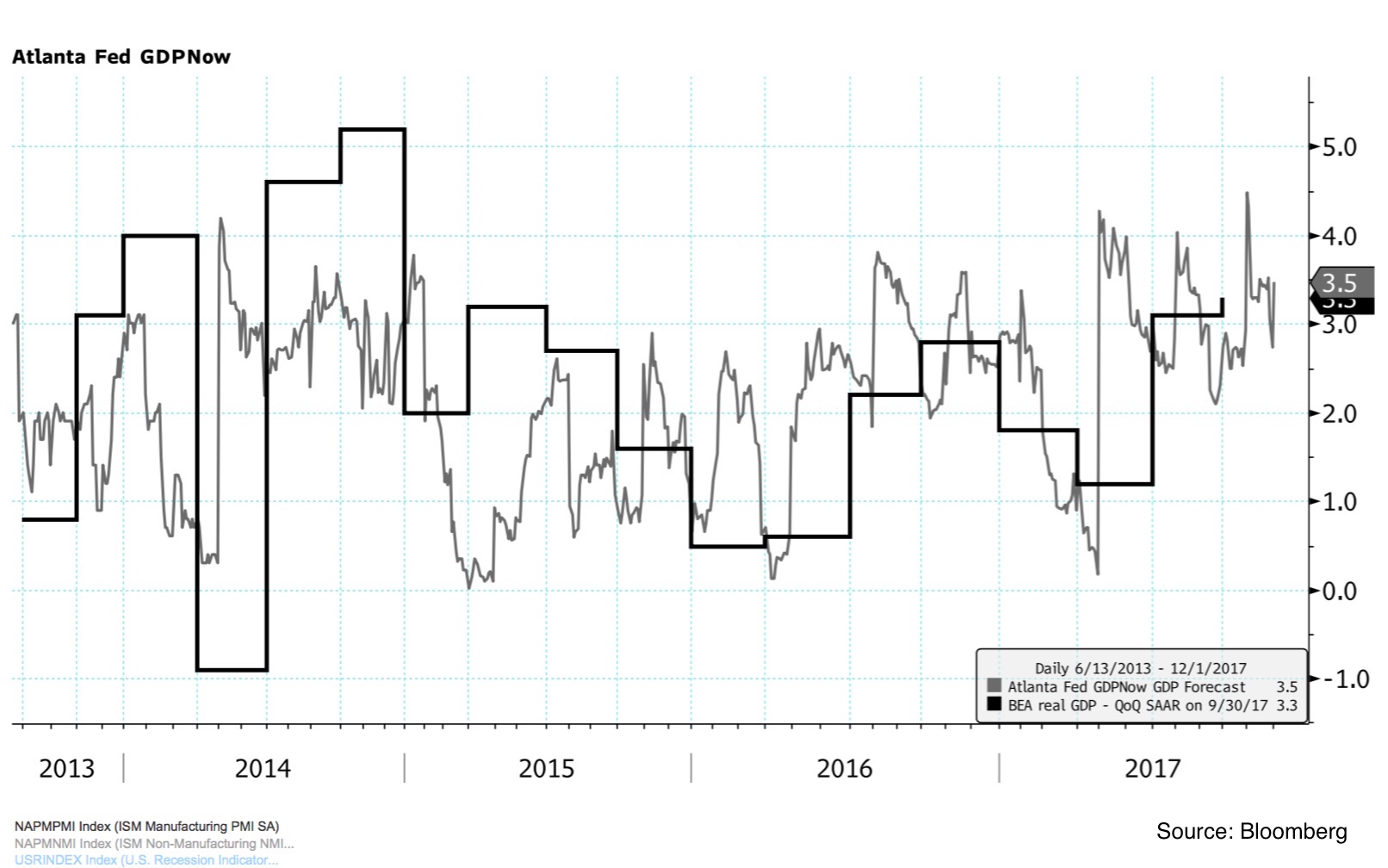

Keep in mind that we may not know about whether we are in a recession until we are well into it; also note the above chart is based on monthly data, thus not showing the maximum drawdown intra-month. That said, few economic forecasters are predicting a recession in the near future. Below is the quarter over quarter, seasonally adjusted GDP in black, then in grey the so-called Atlanta Fed GDPNow indicator, an indicator trying to predict the current quarter’s GDP reading:

So why be concerned? In a recent discussion with market veteran David Kotok (Chairman & CIO of Cumberland Advisors) regarding the views of an analyst who is optimistic about the outlook, he paraphrased Ronald Reagan’s debate with Walter Mondale: “I am not going to exploit his youth and inexperience…”, adding, “we will see if he knows how to swim.”

What are the optimists missing? First, let me make clear that you do not have to be a pessimist to be concerned. Risk assets are called risk assets for a reason: if you aren’t concerned, that should be the very first sign why you should be concerned. The prudent investor manages risk. However, risk management has become more complex in an era where central banks have helped propel asset prices to new highs; in an era where very low, if any returns can be had in so called risk-free assets. For European investors, returns are negative for many investment grade fixed-income investments, not just government securities. Monetary policy is indeed designed to encourage more risk taking. All the more so, when “risk is off”, i.e. when risk assets re-price lower, investors may be losing more money than they signed up for. If history is any guide, this could amplify any downturn as investors re-calibrate their portfolios to match their risk tolerance in an era when risk levels may be elevated once again.

Below, I’m highlighting a few factors that investors may want to pay particular attention to; this is not intended as a crystal ball, but food for thought.

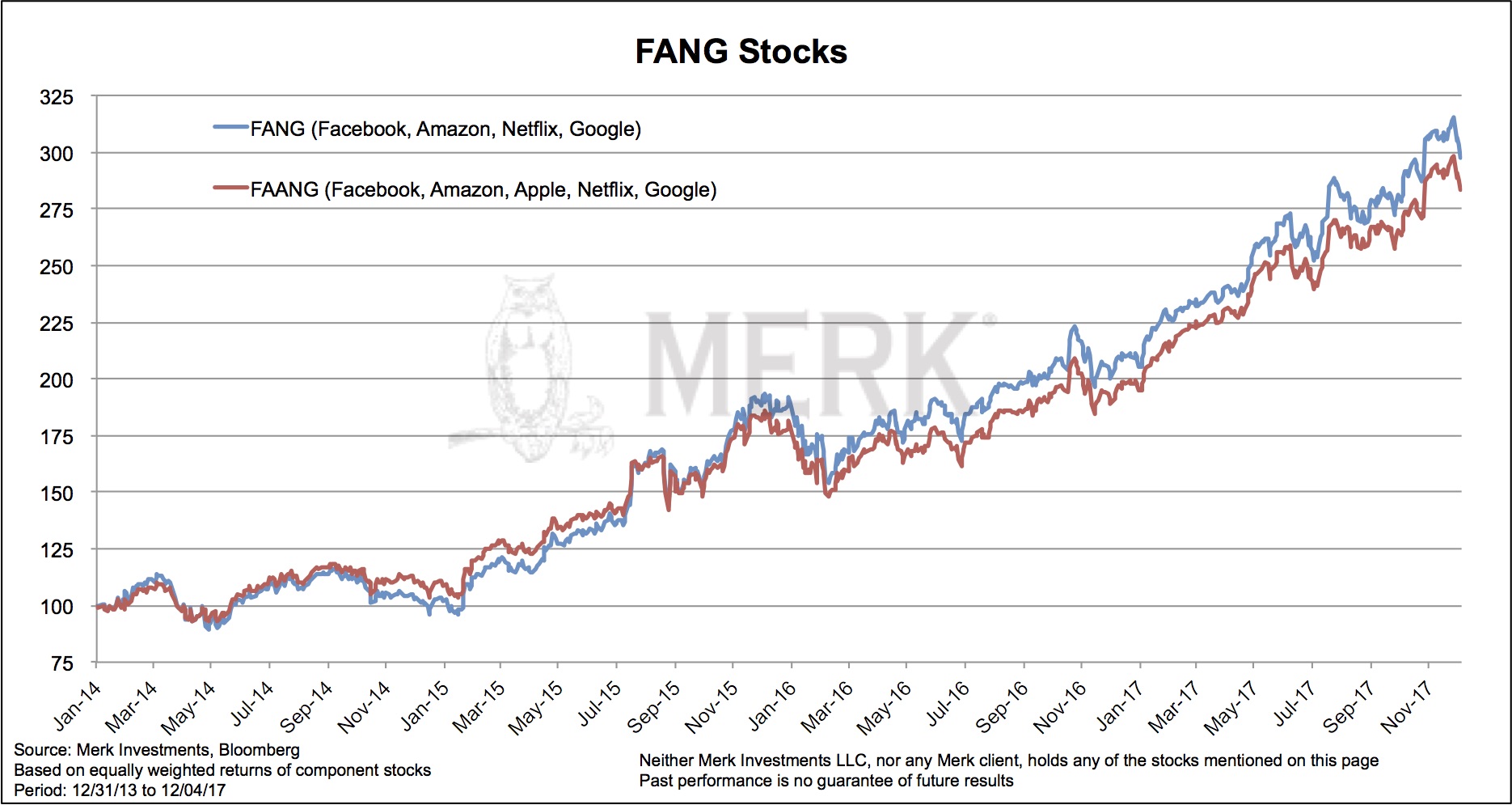

First, the most obvious: a glass that’s considered half full can also be considered half empty. Facts don’t have to change for an assessment of those facts to change. What was a brilliant project may suddenly be considered a bottomless pit. Some say the recent under-performance of tech stocks is due to the fact that these firms already pay relatively low taxes and, thus, benefit less from lower corporate taxes than others. Have a look at this chart of some of Wall Street’s darlings. Is it yet another buying opportunity or have we seen the top in the markets?

Broader market indices reached new highs as those former market leaders have turned. That said, other market breadth indicators we monitor appear to show little concern.

Let’s switch to something that may very well be changing: the tax system. I’ll leave it up to tax pros to dissect the details, but would like to focus your attention on what I believe is an under-reported theme: there are incentives in the proposed tax legislation to limit the deductibility of interest expense. The potential new limits on deducting mortgage interest, but more relevant for the markets may be limits on deductibility of interest expense for corporations. While there are exceptions, it appears there will be caps on how much in interest expense is deductible for corporations (section 3301 of the GOP House bill). This will make it less attractive to do debt financing, more attractive to pursue equity financing. Less debt may be good news for financial stability, but it means the supply of equity may go up, thus causing potential downward pressure on prices.

Year-end tax optimization may also take on a new dimension this year, as large college endowments might race to reset the cost basis of their investments, assuming their gains will be subject to taxation going forward. In this context, it is quite plausible that the Santa Claus rally came early this year (the Santa Claus rally is a colloquial term for a year-end rally).

With regard to monetary policy, we are told a Powell Fed will be very similar to a Yellen Fed. I disagree: from what I have learned about Mr. Powell, he appears extremely well versed when it comes to bank regulation, but is agnostic when it comes to monetary policy. I have had to search long and hard to find original content on his monetary policy views. That’s not necessarily bad, but suggests that he will rely on others – presumably the staff at the Federal Reserve or possibly someone else on the FOMC Board – when it comes to setting monetary policy. My view is that the Fed is on auto-pilot until, well, until something disengages said autopilot. I can see Mr. Powell manage a financial crisis; but I do not think anyone knows how he will react when there are unforeseen surprises in the economy or the markets. My best guess is he’ll convene committees and come up with what appears to be a reasonable decision. The relevance being that markets don’t wait for committees to be convened. So if volatility shoots up in the markets, not just for a few minutes, but for weeks, substantial damage may be caused to risk assets. A textbook approach to monetary policy suggests that the Fed, not the markets are in charge, hence, why rush? Except that in an era of compressed risk premia and elevated asset prices, maybe, just maybe, the markets are in charge. If early 2016 is any guide, the Yellen Fed back-peddled promptly. As a new Fed Chair comes in with good intentions, I do not think Mr. Powell wants to be bullied by the markets.

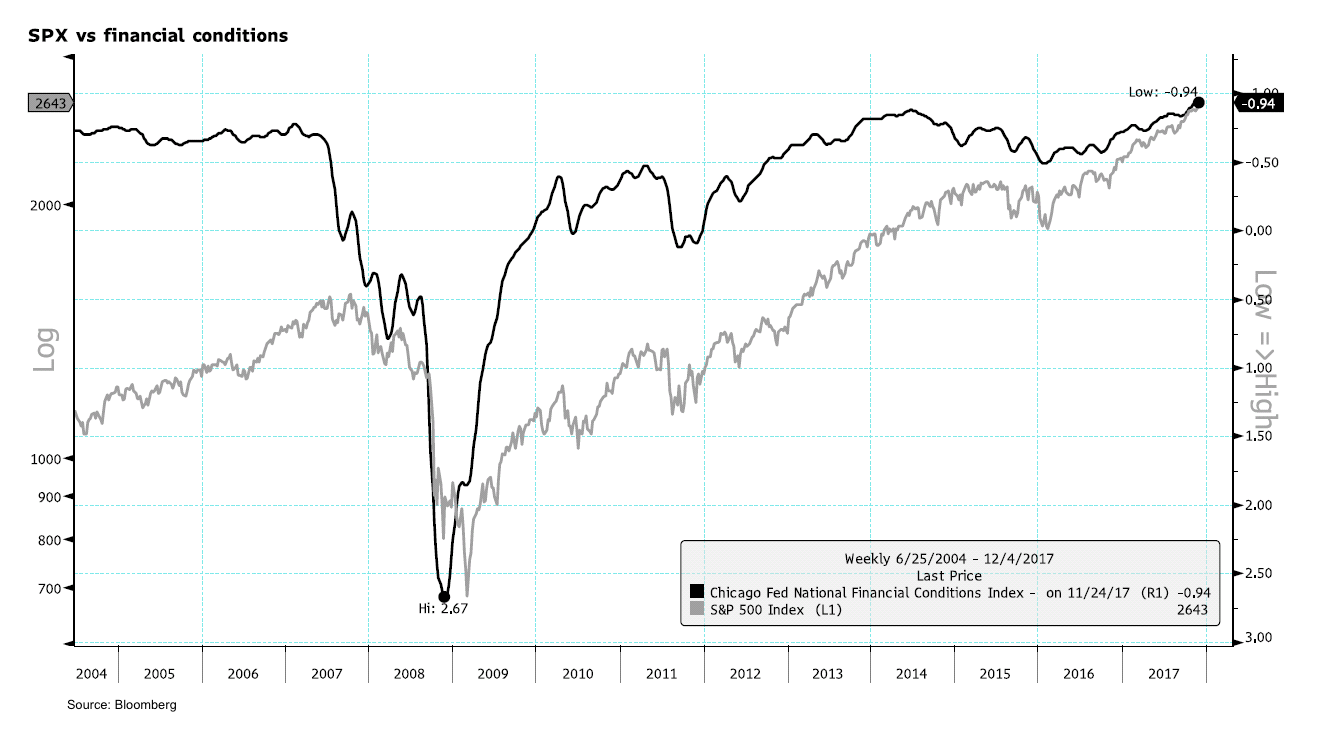

The Fed, of course, will never admit that they are slaves of the markets. They react to financial conditions. But what’s the difference? In normal times, there might be a big difference, but when central banks have made risk assets appear to carry only little risk, I argue that there isn’t much difference. Indeed, the reason Ms. Yellen tells us quantitative tightening (QT) is akin to watching paint dry on a wall is because she doesn’t want financial conditions to deteriorate as the Fed’s balance sheet is being reduced. In my humble opinion, that’s an oxymoron because both raising interest rates, as well as reducing the Fed’s balance sheet are inherently designed to tighten financial conditions. That’s the whole point! Except, of course, that financial conditions haven’t tightened:

The Fed can set interest rates, but doesn’t dictate how easy it is for borrowers to get credit. In a typical economic expansion, the Fed will start to raise rates to make it more expensive to borrow money (to tighten financial conditions!). But because the economy does well, banks might ease lending standards; or demand by borrowers may pick up for other reasons despite higher rates. As a result, the Fed continues to tighten until, well, until the economy at some point slows down. It’s this indirect dynamic that makes it so difficult for the Fed to engineer a soft-landing, i.e. to stop tightening just in time for excesses to be avoided. There’s a chance that the Fed will get this right. I just assign a very low probability to it.

So what does it mean for different asset classes:

- Equities: you be the judge. I don’t like where equities are, rather seek my returns elsewhere.

- Treasuries: many, including the Fed, suggest long-term rates ought to move higher, that the reducing of the Fed balance sheet will lead to higher long-term rates. I’m not convinced. My view is the Fed’s actions (together with fewer global central bank purchases) will lead risk premia to expand once again. That is, just as QE caused risk premia to come down, QT will push risk premia higher again, causing headwinds to risk assets. Read: there may well be a flight into Treasuries. Together with higher short-term rates, this a flattening of the yield curve. And that, in turn, is a sign of tighter financial conditions to come.

It may well be that all the good news of the tax legislation is priced in, thus not causing equities to move and not causing Treasuries yields to move higher (part of the so-called Trump trade was higher Treasury yields reflecting higher long-term growth prospects).

- Gold has been resilient despite higher rates. In my assessment, this has two reasons: one is that the Fed Funds rate has been very low, thus real yields have stayed low despite nominal rates inching up. More relevant may be that gold may be the easiest diversifier. I call it such because, in our analysis, the correlation to equities since 1970 is just about zero. To get non-correlated returns otherwise, you either need to move to cash (which many are reluctant to do) or embrace sophisticated long-short strategies (which many are also reluctant to do, albeit for different reasons).

- The dollar. Once again, there’s talk about the dollar rallying because growth prospects are better in the US. I would like to caution that the dollar rallied for many years on the prospect of Fed tapering. When it ultimately started, the dollar fell. Now we’ve started the process of taper talk at the ECB, but it is also a drawn-out affair. More so, the euro may have become a funding currency. That is, in risk-off environments, I’ve increasingly seen the euro rally. As such, the euro may be a diversifier for those concerned about risk assets.

As indicated, we don’t have a crystal ball, but that doesn’t mean we don’t have an opinion. We will discuss more in our December 12 outlook webinar (click to register). We will also give you food for thought for the global macro environment in the era of a Powell Fed. And if you are interested in a behind the scenes look at the sort of data we look at in our research meetings, we are working on a special report to share with those interested.

If you believe this analysis might be of value to your friends, please share it with them; follow me on LinkedIn and Twitter.

Axel Merk

President & CIO, Merk Investments