Stocks & Equities

The Dow sets a startling record

The Dow sets a startling record- The biggest drop since 2011

- Plus: What’s next for the stock market?

Investors took a sledgehammer to the face yesterday as the major averages posted their worst drop in more than six years.

The Dow shed 1,175 points (its biggest point lost in history) to close lower by a staggering 4.6%. The S&P 500 wasn’t far behind, posting a loss of more than 4%. In a dramatic shift, the major averages flipped from extremely overbought to painfully oversold in a matter of days.

The stock market carnage is the top story at many major media outlets. Everyone wants to know what pushed stocks down an open elevator shaft. Was it earnings? The Nunes memo? A Trump tweet?

Nope.

The truth is the market has grinded higher without a correction for too long. Stocks were too hot. Volatility was dead. Something had to give.

Check out this chart:

The S&P 500 grinded higher for the past 15 months. You can clearly see the upward channel it carved out during 2017. It was a historically smooth run, with no significant shakeouts spooking investors — just a slow, orderly grind higher.

But look how the trend accelerated in January. Stocks went parabolic as they blasted through the roof almost every single day. Toward the end of the month, the major averages were all higher by at least 7%.

That’s clearly unsustainable. But investors didn’t care. They were making money hand over fist, lulled to sleep by a market that never went down. So it’s no surprise that a 4% drop is sending shockwaves of panic across Wall Street. None of us remember what a drop of this magnitude feels like!

All is not lost, of course. The major averages are now back to levels we haven’t seen since December. Generations of wealth haven’t disappeared into thin air — just seven weeks of gains. That should put this week’s drop into perspective.

Believe it or not, yesterday’s biggest losers weren’t stock market investors. As it turns out, volatility traders are the ones who have suffered the most during the market’s breakdown this week, causing some hidden panic in the markets late last night that you probably didn’t see…

The unusually smooth rally has encouraged big bets against volatility using inverse VIX funds such as the VelocityShares Daily Inverse VIX Short Term ETN (XIV). These trading vehicles go up when the Volatility index goes lower. Naturally, many traders have viewed this as a “sure thing” trade every time the market drops. They simply bet against volatility, the market bounces, and they collect their winnings.

That’s not what happened on Monday. Instead of a bounce off Friday’s lows, stocks tumbled and volatility spiked, sending XIV lower.

But the real panic happened after hours. XIV traders slammed the sell button as fears of a volatility event spread. XIV was eventually halted, down a staggering 80% after hours after dropping just 14% during Monday’s session.

We don’t have any complex bets on volatility in our portfolio. But that doesn’t mean a volatility unwind won’t affect the markets in the days ahead. We’ll have to look for signs of contagion and act appropriately.

Barring any of these nasty volatility concerns creeping into the stock market, we should look for a potential relief rally to materialize soon. When and how the market bounces should give us some clues as to what to expect and how we should trade the return of some exciting market action.

Buckle up. It’s going to be a wild ride…

Sincerely,

Greg Guenthner

Last week, I discussed the continuation of the “market melt-up.” To wit:

“Since the beginning of the year, the acceleration in the markets has continued unabated. As I showed yesterday, the acceleration in the S&P 500 has now gone parabolic.”

“Never before in recent history has the market been this overbought and extended from longer-term averages which suggests that a correction that reduces such conditions is highly likely in the near-term.”

Well, this past week, the market tripped “over its own feet” after prices had created a massive extension above the 50-dma as shown below. As I have previously warned, since that extension was so large, a correction just back to the moving average at this point will require nearly a -6% decline.

I have also repeatedly written over the last year:

“The problem is that it has been so long since investors have even seen a 2-3% correction, a correction of 5%, or more, will ‘feel’ much worse than it actually is which will lead to ’emotionally driven’ mistakes.”

The question now, of course, is do you “buy the dip” or “run for the hills?”

Don’t do either one, yet.

Yes, corrections do not “feel” good. But they are part of a “healthy” market cycle. In more normal, healthy, bullish trends corrections should be used as buying opportunities to increase exposure to equity risk in portfolios.

However, the recent parabolic acceleration in the markets heading into the New Year was neither normal or healthy. Much of it had to do with the massive liquidity injection by the Federal Reserve at the end of 2017 as shown below.

But, after the stumble this past week, it will be interesting to watch the next the Fed’s balance sheet over the next month to see if they continue with their planned $30 billion / month reduction.

At the moment, this is the expected correction we have been discussing over the last several weeks. It is also something we had planned for by reducing overweight positions and adding a short-hedge to portfolios.

With the markets on a short-term sell signal (noted by gold vertical dashed lines in the chart above,) the current correctional process is underway and still has room to go at this juncture. But, with the market now oversold on a VERY short-term basis a rally over the next week, or so, would not be surprising.

It is the outcome of that rally that is most important to the current bull market advance.

This is what we are looking for to drive our next set of portfolio actions:

- If the market rallies back and sets a new closing high, the bullish trend will be confirmed and equity allocations will remain at target levels and hedges removed.

- If the market rallies back BUT FAILS to set a new high, a series of actions will take place.

- At the point of rally failure, portfolio hedges will be modestly increased.

- If the subsequent decline breaks the previous low, the hedges will be further increased and tactical trading long positions will be reduced.

Why is this important?

A Hint Of 1987

A recent article on Zerohedge discussing a view of Albert Edwards is salient to this discussion.

“Certainly, as we explained at our Conference, the current conjuncture feels similar to just before the 1987 equity crash. All that was missing was the slanging match over the weak dollar between the US and Europe.”

He’s right. There are many similarities between today and 1987. Recently passed tax legislation reform, exuberance in the markets, and a strong market rally.

And then the crash.

But no one could have seen that coming? Right?

(We have an in-depth report, titled 1987, coming out next week ONLY for our newsletter subscribers and those who have expressed an interest in our soon to be released RIA Pro.

If you are not currently on our email list and want a copy of the report click here.)

Actually, there were five technical signals, that when considered along with fundamental factors should have been enough to warrant caution at a minimum…that is if you were paying attention.

The graph above, from our 1987 article, highlights the technical indicators which are explained in the report along with a summary of the myriad of fundamental factors that preceded Black Monday. There are certainly many differences between today and 1987, but as we highlight in the report there are many similarities as well worth considering.

Along with plummeting stock prices in October of 1987, interest rates also declined sharply as money sought the relative safety of bonds.

It is here that I also agree with Albert Edwards:

“Every man, woman, and child seems to have decided that the US 10y bond yield has broken out of its long-term downtrend and we are in a bond bear market. Our own excellent Technical Analyst, Stephanie Aymes, shows that 3% (not 2.6%) is the key long-term breakout yield we should be watching. But she thinks that 2.64% was also significant as this means the RSI downtrend has now been broken and a run to 3% is now perfectly plausible. That though does not mean the bond bull market is over.”

With yields now closing on 2¾% and the 30y closing on 3.0%, many see this as a great time to dump bonds and switch into equities. Really?

“Well, I expect that the true extent of how close the US is to actual outright deflation, and hence how high real yields currently are, will soon be revealed. But before US 10y yields turn negative, expect them to visit 3% first.“

He is absolutely right. Despite a rampant rise in the markets, the recent spate of economic growth has been due to massive natural disasters across the lower third of the U.S. The impetus from those rebuilding efforts are now running their course and we are already seeing a weakness in the numbers.

But wages are crushing it, and employment is booming?

Yes, wages are rising but only for the top 20% of workers.

And employment in the key demographic is not.

The Next Bull Market

Edwards is correct. There are several important points to understand about bonds.

- All interest rates are relative. With more than $10-Trillion in debt globally sporting negative interest rates, the assumption that rates in the U.S. are about to spike higher is likely wrong. Higher yields in U.S. debt attracts flows of capital from countries with negative yields which push rates lower in the U.S. Given the current push by Central Banks globally to suppress interest rates to keep nascent economic growth going, an eventual zero-yield on U.S. debt is not unrealistic.

- The coming budget deficit balloon. Given the lack of fiscal policy controls in Washington, and promises of continued largesse in the future, the budget deficit is set to swell back to $1 Trillion or more in the coming years. This will require more government bond issuance to fund future expenditures which will be magnified during the next recessionary spat as tax revenue falls.

- Central Banks will continue to be a buyer of bonds to maintain the current status quo, but will become more aggressive buyers during the next recession. The next QE program by the Fed to offset the next economic recession will likely be $2-4 Trillion which will push the 10-year yield towards zero.

The next bull market is coming, it just won’t be in stocks.

It will be in the U.S. Treasury market which will coincide with the next recessionary drag in the economy within the next 12-18 months (at the most).

As I have written previously, interest rates have everything to do with economic growth. Since economic growth is almost 70% driven by consumption, with savings rates extraordinarily low and debt hitting record levels, small increases to interest rates will have an immediate negative impact on the consumptive capability of U.S. citizens.

The chart below goes to my point. Currently, interest rates are 4-standard deviations above their 1-year moving average. (For an explanation read this.)

How often has this happened going back to 1965?

Never.

Negative events such as the S&L Crisis, Asian Contagion, Long-Term Capital Management, etc. all drove money out of stocks and into bonds pushing rates lower, recessionary environments are especially prone at suppressing rates further. Given the current low level of interest rates, the next recessionary bout in the economy will very likely see rates near zero.

Furthermore, given rates are already negative in many parts of the world, which will likely be even more negative during a global recessionary environment, zero yields will still remain more attractive to foreign investors. This will be from both a potential capital appreciation perspective (expectations of negative rates in the U.S.) and the perceived safety and liquidity of the U.S. Treasury market.

However, what you will notice is that each time rates were as overbought as they are currently, they coincided with either a recession, a correction, or a major market crash.

Could this time be different? Sure. It’s possible.

But probably, it won’t be. The stock market is a reflection of the economy, not the other way around. Higher interest rates are a drag on economic growth which will impact earnings and valuations for the market.

Not tomorrow. Or even next week.

But over the next several months, higher interest rates, if they remain elevated for long, will have a deleterious effect on the economy.

Valuations will become problematic.

Furthermore, the safety of bonds becomes much more attractive when the yield is significantly above the dividend yield in stocks. (Why take the risk is stocks for a sub-2% yield when I can get 3% in a U.S. Treasury?)

That’s not hard math.

Things are finally starting to get interesting.

See you next week.

Market & Sector Analysis

Data Analysis Of The Market & Sectors For Traders

S&P 500 Tear Sheet

Performance Analysis

We are updating this analysis, it will return next week.

ETF Model Relative Performance Analysis

Sector & Market Analysis:

Well, that escalated quickly.

Last week I wrote:

“This is just getting a bit TOO extreme. Take a look at the sectors below. Every sector is pushing 2- and 3-standard deviations of longer-term moving averages.

This isn’t normal.”

The reversal came this past week.

Every Sector was in sell-off mode last week, in particular on Friday, as money left the markets entirely. Basic Materials, Energy, and Staples all broke their 50-dma, while Healthcare, Financials, Discretionary, Technology, and Industrials are still heading towards it.

While it is VERY likely we will get a counter-trend bounce next week, there is still likely more selling to come as we head into February. The question is whether current bullish trends will hold, or not? I suspect they will, for now, which will keep portfolios primarily allocated to the long-side. However, we will monitor and adjust holdings accordingly.

Utilities, we remain long the sector for now but are re-evaluating our holdings with the recent break in support. With the sector very oversold, we are likely going to see a bounce in the days ahead so we will reconsider our holdings and sell into strength if we don’t see improvement in short order.

Small and Mid-Cap index We hare repeatedly suggesting taking profits and rebalancing to portfolio weights in recent months. The sell-off last week explains why. While markets all remain positively trending currently, risk is rising that something more may be on the horizon. Use any bounce next week to rebalance holdings and raise stops if you have not already.

Emerging Markets and International Stocks As noted above, rebalancing portfolio weights and reducing some risk is prudent here as well. Trends remain positive, but there is risk of a bigger correction on the horizon so a bit of risk management remains prudent.

Gold – we have been on the lookout for a pullback in the overbought condition of gold to add it to portfolios. We may be getting that opportunity. A pullback to support at the 50-dma should provide a good opportunity to add a trading position to the metal. We will keep you apprised.

S&P Equal Weight & Dividend Stocks – Dividend stocks are flirting with support, but are now back to oversold conditions. After a hefty rise, we will look to trim back positions on a rally in the next week.

Bonds and REIT’s – We remain long these sectors currently, but they are both testing our long-term stop loss levels. With rates GROSSLY extended, as noted in the main missive above, we will look for a rally to re-evaluate our holdings. We still expect interest rate sensitive holdings to be important during a “risk off” rotation, although that wasn’t the case this past week. Our conviction on these positions continues, but we are still honoring our longer-term stop-loss levels and will exit accordingly if needed.

Sector Recommendations:

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

I am republishing last week’s table to as we had recommended reducing positions across the board due to the sharp ramp in asset prices.

Currently, HOLD, all positions until we get a better understanding of the current correction as noted above. I will update strategy and actions on Tuesday.

Portfolio Update:

Over the last several weeks, we have repeatedly noted the near parabolic rise in the markets and the addition of hedges being added to our portfolios. As noted in the main body of this weekly missive, we shouldn’t make rapid, emotionally based, decisions based on an initial correction.

It is what the market does “next” which will determine our next course of actions.

As far as portfolios go, we continue to maintain our current positions.

- We have taken profits in some of our positions that were most grossly extended.

- We added a short S&P 500 position which is currently working.

- Interest rates, in the very short-term, are not cooperating with our interest rates sensitive exposure and we are monitoring those positions very closely for our next actions.

Currently, everything remains within our longer-term tolerance bands for risk controls. While corrections certainly do not “feel” good, it is important we don’t let short-term pickups in volatility derail longer-term investment strategies.

While positions are certainly under-pressure currently, we are monitoring them closely. We do not recommend making wholesale changes to investments based on a minor market correction which remains well confined to a long-term bullish trend. We are highly concerned about the underlying risk and remain focused on capital controls.

THE REAL 401k PLAN MANAGER

The Real 401k Plan Manager – A Conservative Strategy For Long-Term Investors

There are 4-steps to allocation changes based on 25% reduction increments. As noted in the chart above a 100% allocation level is equal to 60% stocks. I never advocate being 100% out of the market as it is far too difficult to reverse course when the market changes from a negative to a positive trend. Emotions keep us from taking the correct action.

Don’t Panic….Yet.

As I penned last week:

“Over the last several weeks, I have noted how the current advance just keeps getting “nuttier.” The acceleration of the advance is not only unsustainable, it is also dangerous, as eventually it will lead to a very sharp reversion that few investors are ready for.

But, I know. It hasn’t happened yet.

However, just because it hasn’t happened yet, does not mean it won’t. As with everything in life, ‘timing’ is everything.”

Well, it happened.

And yes, it certainly did not “feel” good.

But as noted repeatedly throughout this weekend’s missive, it is important NOT to mistake a short-term correction for a full-blown reversion. I have circled the “crash” in RED in the chart above…if you can see it.

Keeping perspective is always important.

While this COULD be the beginning of a larger corrective process that will require further action, it is simply WAY to early to know for sure. As I laid out in the main body above, the actions of the market over the next week, or two, will determine our next major course of action.

Continue adding All NEW contributions to cash or cash equivalents like a stable value fund, short-duration bond fund or retirement reserves. We will use these funds opportunistically to add to weightings when the market decides where it is headed next.

If you need help after reading the alert; don’t hesitate to contact me.

Current 401-k Allocation Model

The 401k plan allocation plan below follows the K.I.S.S. principle. By keeping the allocation extremely simplified it allows for better control of the allocation and a closer tracking to the benchmark objective over time. (If you want to make it more complicated you can, however, statistics show that simply adding more funds does not increase performance to any great degree.)

401k Choice Matching List

The list below shows sample 401k plan funds for each major category. In reality, the majority of funds all track their indices fairly closely. Therefore, if you don’t see your exact fund listed, look for a fund that is similar in nature.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

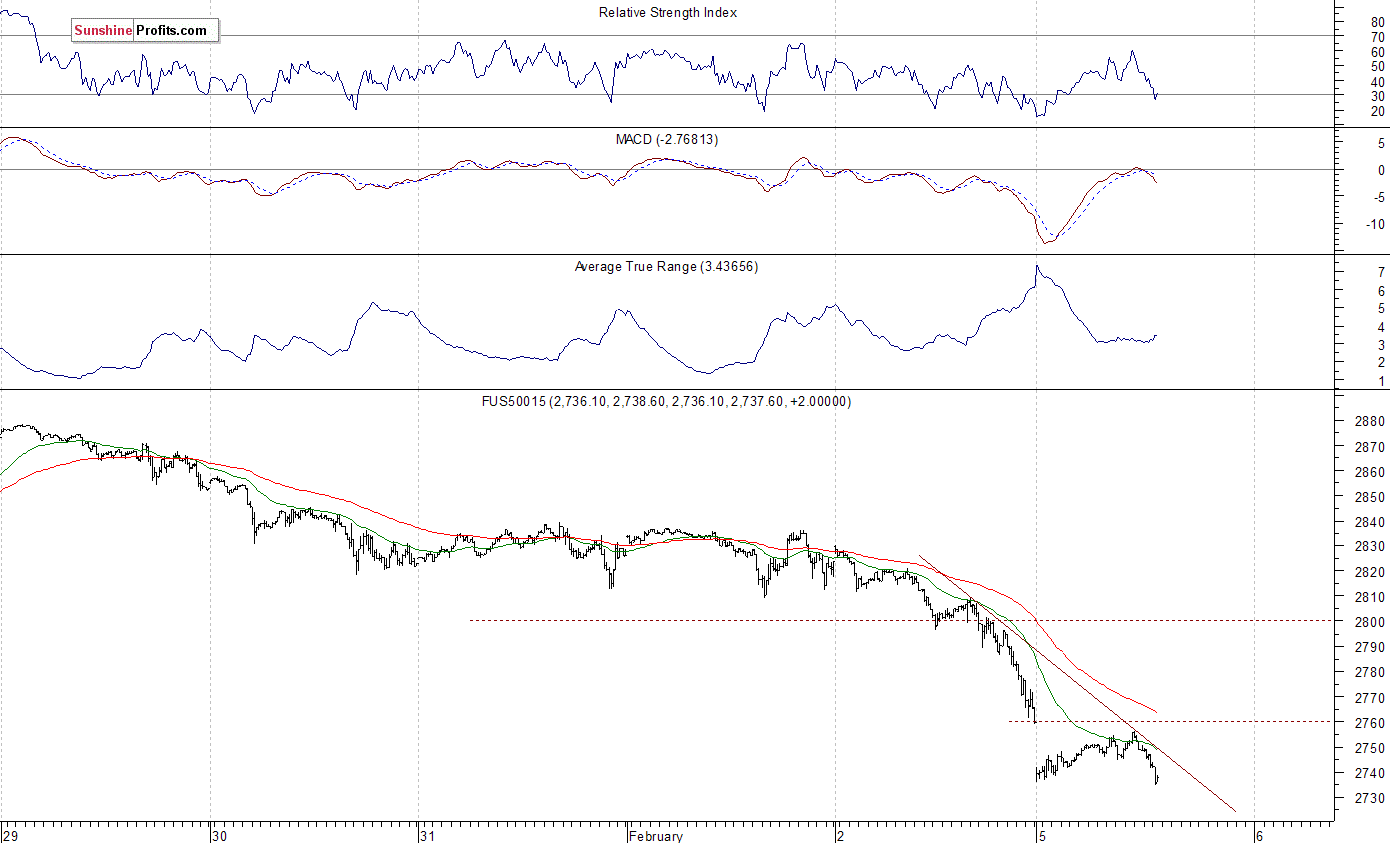

The main U.S. stock market indexes lost 2.0-2.5% on Friday, breaking below their three-day-long consolidation as investors reacted to quarterly corporate earnings, economic data releases, among others. The S&P 500 index accelerated its short-term downtrend following breakout below the level of 2,800. It currently trades 3.9% below its January 26 record high of 2,872.87. The broad stock market retraced more than 50% of its month-long rally off the December 29th local low at 2,673.61. The Dow Jones Industrial Average was relatively weaker, as it lost 2.5% on Friday, and the technology Nasdaq Composite fell 2.0%.

The nearest important level of support of the S&P 500 index is at around 2,750, marked by the January 11 daily gap up of 2,750.80-2,752.78. There is also an important Fibonacci retracement of 61.8% of the month-long rally at the level of 2,749.73. The next potential support level is at 2,720-2,740, marked by some previous consolidation. On the other hand, resistance level is now at 2,780-2,800, marked by previous level of support. The resistance level is also at around 2,835, marked by last week’s local highs.

There is a pretty big chance that the index reached some major medium-term high on Friday a week ago. It broke below its month-long upward trend line on Tuesday following gap-down opening of the trading session, confirming reversal of the uptrend. Will it retrace all of its January rally or even continue lower? The index is at its three-month-long upward trend line. For now, it looks like a downward correction:

Negative Expectations Again

The index futures contracts trade 0.8-1.2% lower vs. their Friday’s closing prices this morning. So, investors’ expectations before the opening of today’s trading session are very negative again. The European stock market indexes have lost 1.0-1.4% so far. Investors will wait for the ISM Non-Manufacturing PMI number release at 10:00 a.m. The market expects that it was at 56.5 in January. However, this data release probably won’t affect the overall negative market sentiment today. Investors will also wait for more quarterly corporate earnings announcements.

The S&P 500 futures contract trades within an intraday consolidation, as it fluctuates following an overnight move down. The market remains close to its local lows, well below its Friday’s panic end-of day-lows. It continues its short-term downtrend, as it retraces more of January move up. The nearest important level of resistance is at around 2,760, marked by an overnight gap down and Friday’s daily low. The next level of resistance is at 2,780-2,800, among others. On the other hand, support level is at 2,730-2,740, marked by short-term local lows. The next level of support is at 2,700-2.720. The futures contract is well below its Friday’s session lows, as the 15-minute chart shows:

Nasdaq At New Lows

The technology Nasdaq 100 futures contract follows a similar path, as it continues its short-term downtrend today. It extends its Friday’s sell-off after an overnight gap-down opening. The nearest important level of resistance remains at around 6,750-6,760, and the next resistance level is at 6,800, among others. On the other hand, potential support level is at 6,680-6,700. The Nasdaq futures contract trades below its short-term downward trend line, as we can see on the 15-minute chart:

Let’s take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com) – worth mentioning because Apple’s market capitalization is around $850 billion, which is more than two times current value of all the cryptocurrencies combined. The stock reached new record high around three weeks ago, following short-term consolidation along the support level of $175. The market got closer to $180 mark, but it failed to continue higher. Consequently, the stock retraced its January advance and continued lower. It accelerated its decline on Friday, as it got closer to $160. We can see some short-term oversold conditions, but no confirmed positive signals so far:

On the other hand, Amazon.com, Inc. stock (AMZN) was relatively strong vs. the broad stock market. Despite an overall weakness, it further extended its month-long rally recently. The stock even reached new record high on Friday, before closing slightly lower. It remained above the level of $1,400 following bouncing off $1,500 mark. The market may be trading within some medium-term topping pattern here:

The Dow Jones Industrial Average daily chart shows that blue-chip index broke below its short-term consolidation on Friday. The price broke below the level of 26,000 and continued lower. We still can see medium-term negative technical divergences – the most common divergences are between asset’s price and some indicator based on it (for instance the index and RSI based on the index). In this case, the divergence occurs when price forms a higher high and the indicator forms a lower high. It shows us that even though price reaches new highs, the fuel for the uptrend starts running low.

The DJIA broke below its three-month-long upward trend line. Is this a new downtrend or still just correction? For now, it looks like a downward correction, because it retraces relatively small amount of its months-long rally:

Concluding, the S&P 500 index sold off on Friday, as it lost more than 2% following breakout below its three-day-long consolidation and the support level of 2,800. The broad stock market continued its short-term downtrend after some important economic data, quarterly earnings releases. Investors took profits off the table following the unprecedented month-long rally. Is this a new downtrend or just downward correction? For now, it looks like a quick correction, but a little more downside and we may see some panic in the stock market. Friday’s sell-off sets the tone for weeks to come – new record highs seem like some very unlikely scenario now.

The S&P 500 index traded around 7.5% above its December 29 yearly closing price on Friday January 26. This almost month-long rally seems unprecedented. The legendary investor John Templeton once said that “bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria”. So, was this an euphoria phase of the nine-year-long bull market? It’s hard to say, but some major downside risks are growing.

We still can see some medium-term overbought conditions. We can use indicators such as Relative Strength Index (RSI), Stochastic Oscillator, Money Flow Index to identify overbought conditions. For example, one can view a given market as “overbought” if the RSI indicator for this market is above 70. Paying attention to the overbought/oversold status of the market is very useful, but there are many other factors that need to be considered before placing a trade.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Thank you.

Paul Rejczak

Stock Trading Strategist

Following the trend of extreme, euphoric bullishness on stocks, Investors Intelligence said Bulls rose 1.3 pts w/o/w to 66, just below the 32 year high of 66.7 seen two weeks ago. Bears fell to 12.6, a fresh 32 year low, down from 12.8 last week and vs 12.7 in the week prior. The spread of 53.4 is just below that 32 year high of 54 two weeks ago…

Boockvar continues: “Reflecting also the euphoric state was the read in yesterday’s Conference Board Consumer Confidence data which showed the amount of respondents who think the stock market will be higher this year reached a record high dating back to June 1987when the question first started being asked. See chart below.

also from KingWorld:

There Is Extreme Danger Ahead And All Roads Lead To A Higher Gold Price

There is no real secret to the market. In fact, it is rather simple. But, that does not mean the specific smaller degree moves in the market will be just as simple.

You see, markets are no different wherever you look. Whether that be metals, equities, Forex, crypto-currencies, etc, they all react in the exact same way. Markets simply move from one extreme to another. And, we need to be able to identify where those extremes can cause a turn.

Moreover, in making your determination of turning points, there is no one definitive point at which a market must turn. Rather, we are dealing in probabilities when we attempt to analyze that which is non-linear in nature, such as the financial markets.

For those that have followed me for years, you would know that this is exactly how I apply my analysis. As an example, we were able to identify major shift changes in the DXY when we called for a multi-year rally in 2011 when we were in the 74 region, with a long term target in the 103.50 region.

Another example was when we caught the top in the gold market in 2011 within $6 of the high actually struck. However, our initial expectation was that gold would see a 40% pullback. And, before gold even struck its high, we noted that if that 40% drop would not hold support, it could open the door for gold to correct all the way back down to the $1,000 region. Many disregarded our analysis since everyone was so certain it would easily eclipse the $2,000 region during the parabolic phase it was in at the time I made this call. So, when gold gave us a 40% correction from our top call, we began looking for a resurrection of the bull market. Yet, when the market made it clear that it was not going to resurrect, we began looking down to that $1,000-1100 region before looking for another bottoming structure.

This is how we view markets, as we do not believe that anything MUST happen within the financial markets.

As another example, back in 2015, we had LONG term targets in the SPX at 3500. And, we maintained this perspective even when the market pulled back to the 1800 region in early 2016. Our immediate target from the 1800 region was the 2537-2611 region, at which time, we expected a standard pullback before we would march onto our next target region between 2800-3000.

Well, as you can see, we were clearly not perfect in our smaller degree expectations for a pullback from our initial target zone. While I would love to be able to accurately identify each twist and turn in the market, the fact that I am a fallible human being attempting to analyze a non-linear system makes perfection unattainable.

Again, we deal in probabilities when we analyze these non-linear financial markets. That suggests we should not expect a market moving in one direction for an extended period of time. And, clearly, we did not expect a market to pullback to only .118 and .236 retracement levels, when standards suggest .328-500 retracements. Yet, that is all the pullback that the market gave us on our way up towards the 3000 region.

So, while markets often provide us standard paths to follow the great majority of the time, if one understands the non-linear nature of the market, then one also understands that the market will act outside of standards in the minority of times. That is what seems to have occurred in the last 6 months. But, that does not mean one should abandon analyzing markets based upon standard higher-probability patterns to which the market adheres the great majority of the time. Rather, it means one has to understand that the market may not adhere to those patterns in the minority of instances, accept that, and move on.

In summary, one must maintain a broader perspective of the market based upon probabilities. And, in order to maintain an appropriate risk management perspective, one should reduce their higher risk positions when we strike a standard target, but maintain core stock holdings during a long term 3rd wave. This is what I noted to the members of my services, and how I handle a market that extends beyond standard expectations.

Lastly, to show you the general perspective I have maintained in the overall equity market for many years, I am attaching a monthly chart of how I see us continuing in this bull market, which likely still has a number of years to run. While we are certainly getting closer to a point where a 15-20% correction can be seen, that will simply be another buying opportunity before the market rallies north of 3500SPX in the early 2020’s. And, for those wondering, this chart has been relatively unchanged for the last several years, other than adjusting for this extension in wave (3) of v of 3.

See all charts illustrating the wave counts on the S&P 500.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.