Stocks & Equities

These great charts as usual clearly show opportunities both long and short in everything from individual stocks through Commodity and Stock Market ETF’s. Besides the individual stock Novo, be sure to listen to Morris’s analysis of the Nasdaq Triple Bear ETF & GDXJ Short Term Chart – R. Zurrer for Money Talks

Today’s videos and charts (double click to enlarge):

SFS Key Charts & Video Update

SF60 Key Charts & Video Update

SF Juniors Key Charts & Video Analysis

SF Trader Time Key Charts & Video Analysis

Morris

website: www.superforcesignals.com

email: trading@superforcesignals.com

email: trading@superforce60.com

SFS Web Services

1170 Bay Street, Suite #143

Toronto, Ontario, M5S 2B4

Canada

Paul Rejczak highlights the current situation in all-three stock indices and lists the support points to buy should the market should be lower today. He also analyses the high flyers Apple and Amazon and their negative trading action of the last two days – R. Zurrer for Money Talks

Downward Pressure Mounting

The main U.S. stock market indexes extended their Tuesday’s losses, as they closed 0.2-1.0% lower yesterday. The S&P 500 index lost 0.6% following Tuesday’s bounce off resistance level at 2,800. However, it remained at the support level of last Friday’s daily gap up. It currently trades 4.6% below January 26 record high of 2,872.87. The Dow Jones Industrial Average was relatively weaker than the broad stock market, as it lost 1.0% and the technology Nasdaq Composite lost just 0.2%.

The nearest important level of resistance of the S&P 500 index is now at around 2,775-2,780, marked by yesterday’s daily high. The next resistance level is at 2,790-2,800, marked by short-term local highs. On the other hand, support level is at 2,740-2,750, marked by Friday’s daily gap up of 2,740.45-2,751.54. The next level of support is at 2,700-2,720, among others.

The S&P 500 index reached its record high on January 26. It broke below month-long upward trend line, as it confirmed uptrend’s reversal. Then the broad stock market gauge retraced all of its January rally and continued lower. The index extended its downtrend on February 9, as it was almost 12% below the late January record high. We can see that stocks reversed their medium-term upward course following whole retracement of January euphoria rally. Then the market bounced off its almost year-long medium-term upward trend line, and it retraced more than 61.8% of the sell-off within a few days of trading. Is this just an upward correction or uptrend leading to new all-time highs? The market seems to be in the middle of two possible future scenarios. The bearish case leads us to February low or lower after breaking below medium-term upward trend line, and the bullish one means potential double top pattern or breakout above the late January high. However, the most likely scenario may be that stocks go sideways for a while, and it would be the worst future scenario:

Uncertainty Following Move Down

The index futures contracts trade 0.1% higher vs. their yesterday’s closing prices, so expectations before the opening of today’s trading session are slightly positive. The European stock market indexes have gained 0.2-0.3% so far. Investors will wait for some economic data announcements: Empire State Manufacturing Index, Philly Fed Manufacturing Index, Initial Claims at 8:30 a.m., NAHB Housing Market Index at 10:00 a.m. Will yesterday’s move down continue? The S&P 500 index reached its Friday’s daily gap up, which may act as a short-term support level. If the market breaks lower, it could continue towards the level of 2,700. But for now, it looks like a downward correction. So, we will likely see more fluctuations above support level of 2,750, and below resistance level of 2,800.

The S&P 500 futures contract trades within an intraday consolidation, as it retraces some of its overnight move down. The nearest important level of support is at around 2,745-2,750, marked by local low, among others. On the other hand, resistance level is at 2,775-2,785, marked by yesterday’s local high. The futures contract is below its short-term downward trend line, as we can see on the 15-minute chart:

Nasdaq Remains Above 7,000 Mark

The technology Nasdaq 100 futures contract was stronger than the broad stock market recently, as it broke above 7,000 mark and continued reaching new record highs. The market gained more than 1,000 points off its February 9 bottom, as it remarkably retraced all of its late January – early February sell-off in one month. The Nasdaq futures contract was above 7,200 mark on Monday, before reversing lower and retracing most of its Friday’s rally. Since then, it keeps bouncing off support level at 7,000-7,050. The Nasdaq futures contract fluctuates along that support level, as the 15-minute chart shows:

Click Chart for Larger Image

Apple, Amazon – Ugly Charts

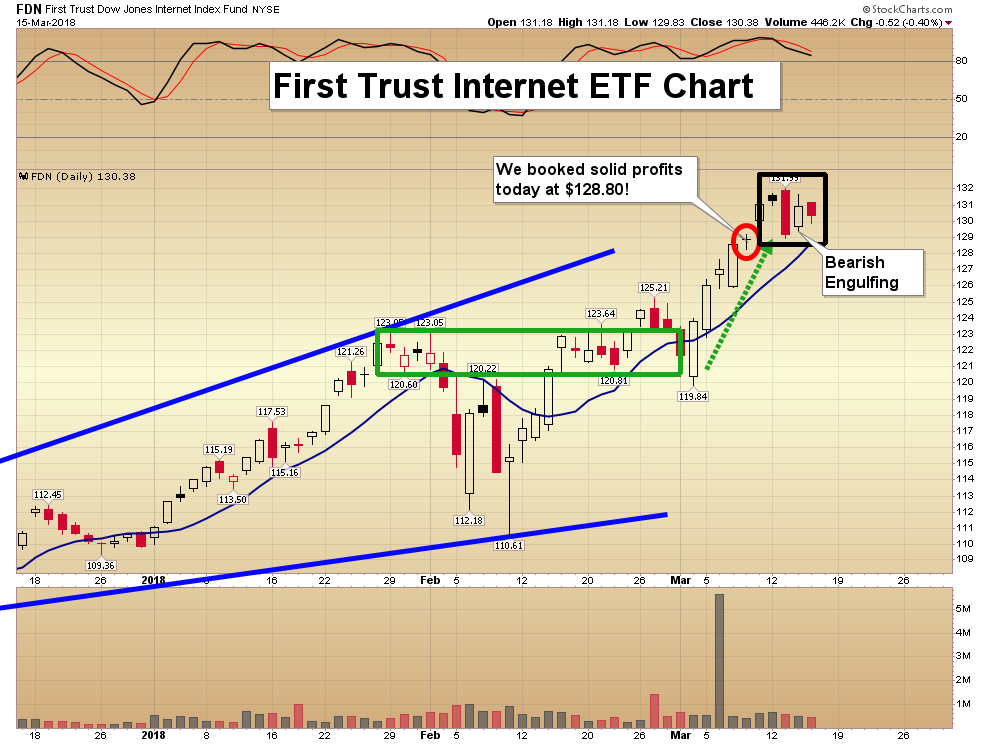

Let’s take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com) again. It was one of February stock market rout’s main drivers. Then it led broad stock market rebound rally. It fell close to support level of $150 on February 9. Since then it was retracing early February losses. The market reached new record high on Tuesday, but then it reversed its intraday uptrend and closed below $180. We can see some negative medium-term technical divergences – the most common divergences are between asset’s price and some indicator based on it (for instance the index and RSI or MACD based on the index). In this case, the divergence occurs when price forms a higher high and the indicator forms a lower high. It shows us that even though price reaches new highs, the fuel for the uptrend starts running low. On Tuesday, the market formed a negative candlestick chart pattern called “bearish engulfing”. It consists of a smaller white candlestick followed by a black candlestick that “engulfs” the white one. This downward reversal pattern has been confirmed by yesterday’s move down:

Amazon.com, Inc. stock (AMZN) continued its uptrend recently, as it reached new record high above the price of $1,600. The stock reversed its upward course on Tuesday and closed below previous day’s closing price. Tuesday’s trading action was bearish, as the stock formed a similar to the above-mentioned bearish engulfing pattern. However, yesterday’s confirmation of the pattern was weaker than Apple’s. Amazon remains relatively strong vs. the rest of the market, even stronger the other big-cap technology stocks. We still can see negative technical divergences:

Dow Jones Remains Relatively Weaker

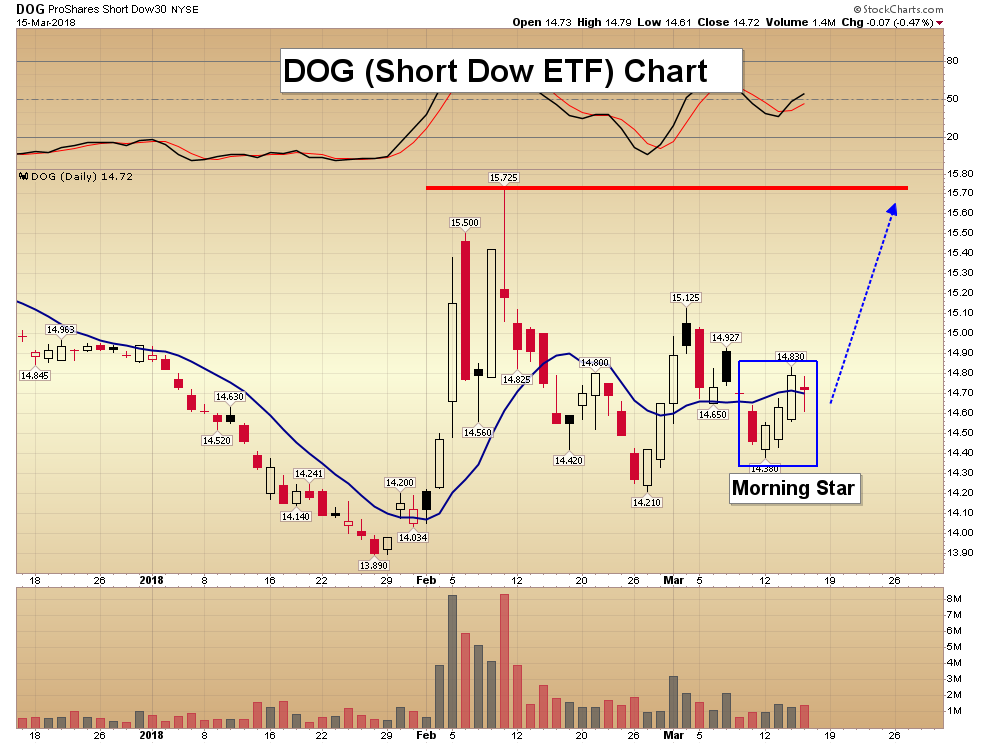

The Dow Jones Industrial Average daily chart shows that blue-chip index remains relatively weaker than the broad stock market and much weaker than record-breaking technology stocks, as it still trades well below late February local high. The market broke below 25,000 mark yesterday, as it retraced more of its recent rebound. Possible support level is at around 24,250, marked by previous local low. If the index breaks lower, it could continue towards February 9 panic low. In late February, there was a negative candlestick pattern called Dark Cloud Cover, a pattern in which the uptrend continues with a long white body, and the next day it reverses following higher open and closes below the mid-point between open and close prices of the previous day. It acted as a resistance level, as we can see on the daily chart:

Concluding, the S&P 500 index may extend its short-term fluctuations following Tuesday’s bounce off resistance level at 2,800. We prefer to be out of the market today, avoiding low risk/reward ratio trades. However, if sentiment worsens considerably and the index continues lower, we would think about buying the dip (within the support level of 2,700-2,720).

The rally failed to continue following negative political news release. Was this just quick profit-taking action or more meaningful downward reversal? It’s hard to say right now. Stocks are likely to open slightly higher today, but the outlook is bearish after recent rout. It seems that the overall market risk is higher than in the late February when S&P 500 was trading at the same level.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign me up!

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts

Sunshine Profits – Free Stock Market Analysis

Lance Roberts highlights the breakout to all-time highs in the technology sector as the “Chart Of The Year” for 2018. But not for the reason as touted by the overly optimistic “hopefuls,” but rather because this could very well mark the “last breakout” of this particular bull market cycle. R. Zurrer for Money Talks

Lance Roberts highlights the breakout to all-time highs in the technology sector as the “Chart Of The Year” for 2018. But not for the reason as touted by the overly optimistic “hopefuls,” but rather because this could very well mark the “last breakout” of this particular bull market cycle. R. Zurrer for Money Talks

Well, I jinxed it.

Technically Speaking: Chart Of The Year?

In this past weekend’s missive I wrote:

“There are generally two events that happen every year – somebody forgets their coat, goggles or some other article of clothing needed for skiing, and someone visits the emergency clinic with a minor injury.”

The tradition continues as my wife fell and tore her ACL. The good news is she tore the right one three years ago, and after surgery is stronger than ever. Now she will get to do the left one.

But, while I was sitting in the emergency clinic waiting for the x-rays to be completed, I was sent a chart of the technology sector with a simple note: “Chart Of The Year.”

Chart Of The Year

Yes, the technology sector has broken out to an all-time high. Yes, given the sector comprises roughly 25% of the S&P 500, it suggests that momentum is alive and well keeping the “bullish bias” intact. (We removed our hedges last week on the breakout of the market above the 50-dma on a weekly basis.)

This is why we are currently only slightly underweight technology within our portfolio allocation models as shown below.

But why “the chart of the year” now? As shown below the technology sector has broken out to all-time highs several times over the last 18-months. What makes this one so special?

The Last Breakout

As stated, breakouts are indeed bullish and suggest higher prices in the short-term. This time is likely no different. However, breakouts to new highs are not ALWAYS as bullish as they seem in the heat of the moment. A quick glance at history shows there is always a “last” break out of every advance.

1999-2000

2007-2008

As I discussed yesterday, the technology sector is once again the darling of “Wall Street” just as it was at the peak of the previous two bull-markets.

“When we compare the fund to Shiller’s CAPE ratio, not surprisingly, since Technology makes up a quarter of the S&P 500 index, there is a high correlation between Technology and overall market valuation expansion and contraction.”

“As was the case in 1998-2000, the fund exploded higher as exuberance over the transformation of the world was occurring before our eyes. Investors globally were willing to pay “any price” to “get in on the action.” Currently, investors are once again chasing returns in the “FANG” stocks with little regard to underlying value. The near vertical ramp in the fund is reminiscent of the late 1990’s as valuations continue to escalate higher.”

I am not suggesting the current breakout is “THE” last breakout, and from a “trading perspective” the breakout is certainly bullish and should be bought.

However, from a long-term investing viewpoint, the problem is knowing the difference in a “breakout” and “the last breakout.”

In both previous instances, there were no warnings, no fanfare, or any glaring impediment to the technology sector, or the markets. Investors were bullishly optimistic, fully invested, margined, and willing to overlook fundamental valuation problems on the “hope” that “reality” would soon catch up with the price.

They were wrong on both previous occasions and suffered large losses of capital not soon thereafter.

Once again, we are witnessing the same mistakes being played out in “real time.”

But there is a “difference this time” as noted by the brilliant Harold Malmgren yesterday;

The importance of the point should not be overlooked as it has been the key source of liquidity pushing markets higher since 2009.

But that is now coming to an end via ZeroHedge:

“Yet the time of this unprecedented monetary experiment is coming to an end as we are finally nearing the point where due to a growing shortage of eligible collateral, the central bank support wheels will soon come off (the ECB and BOJ are still buying massive amounts of bonds and equities each month), resulting in gravity finally regaining control over the market’s surreal trendline.

It’s not just central banks, however: also add the one nation which 5 years ago we first showed has put the central bank complex to shame with the amount of debt it has injected in the global financial system: China.

Appropriately, this central bank handoff is also the topic of the latest presentation by Matt King, in which the Citi credit strategist once again repeats that “it’s the flow, not the stock that matters“, a point we’ve made since 2012, and underscores it by warning – yet again – that “both the world’s leading marginal buyers are in retreat.” He is referring to central banks and China, the world’s two biggest market manipulators and sources of capital misallocations.”

With markets heavily leveraged, global growth beginning to show signs of deterioration, breakeven inflation rates falling, and liquidity support being removed – the markets have yet to recognize the change.

So, yes, the breakout in the Technology sector may indeed be the “Chart Of The Year” for 2018. But not for the reason as touted by the overly optimistic “hopefuls,” rather because this could very well mark the “last breakout” of this particular bull market cycle.

Just something to consider.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

The heart of Tyler’s newletter is how to deal with the fear of missing out. He says the best trades are “easy to find” and to prove it in his Strategy of the Week he selects two stocks that are just breaking powerfully up from a rising bottom with very abnormal price and volume break. – Robert Zurrer for Money Talks

![]()

In this week’s issue:

- Stockscores’ Market Minutes Video – What is Stock Risk?

- Stockscores Trader Training – Don’t Be a Reckless Trader

- Stock Features of the Week – Abnormal Breaks

Stockscores Market Minutes – What is Stock Risk?

Many investors confuse the risk of a stock with the volatility of a stock. This week, I explain this important distinction, provide my analysis of the market and take a different look for the trade of the week on JDST. Click here to watch the video.

To get instant updates when I upload a new video, subscribe to the Stockscores YouTube Channel

Trader Training – Don’t Be a Reckless Trader

Traders, particularly those who need to make money rather than those who would like to make money, tend to have a fear of missing out. They hear about a trading idea or find an opportunity with their own effort and make the trade with less thought than they might put into buying a microwave. They can invest thousands of dollars on an impulse, much like the drunken gambler who throws down $1000 on Five Red.

One reason for this sort of reckless approach to trading is the belief that trading ideas are like gifts. They only come along from time to time and you should feel grateful for the opportunity. If you spend 10 hours researching a company or receive the occasional bit of insight from someone who should know more than the rest of us, it’s easy to understand why you wouldn’t want to let a seemingly promising trade slip through your fingers. The problem is that this gratitude for trading ideas leads you to lower your standards and place trades that are not much more than a gamble.

Have you ever made a trade and then, just a few minutes or days later, asked yourself what the heck you were thinking? If you are normal, then it’s likely that you have because it is easy to focus on the dream of making a profit. You should focus your attention on the trading situation as it has been presented to you by the market rather than the words of an expert. Some trading opportunities are so well marketed that it’s hard to see the truth because you fixate on the profit potential that has been dangled before you as the prize.

It is critical to only take trades that meet the criteria of a strategy that you have found to have a positive expected value. Rather than look for a reason to take the trade, which is easy, look for a reason not to. Ask yourself, “If I buy this stock, who will be selling to me, and what does she know that I don’t know?” Looking at the other side of the argument will often highlight considerations that you have missed.

Being fussy is a lot easier when you recognize that the market-even a slow market-will give you opportunities. The markets have been pretty quiet this year but there are still stocks outperforming the market every day.

And if you can’t find a trade today, tomorrow or in the next week, eventually you will. There is always another bus coming down the road. If you miss one, just wait for the next.

I have found that you will actually make more money by trading less. If you maintain a very high standard for what trades you make, you will always pass on some trades that end up doing very well. By being selective, however, you will also avoid many marginal trades that would tie up your capital and then incur a loss. By being fussy and trading less, you end up taking only the very best trades and your results will be better overall.

It is easy to be fussy when the market is strong and there are lots of opportunities. It’s like fishing when every time you cast your line you get a bite. With that kind of success, you will quickly throw back any fish that is too small because you know there’s going to be something better coming along soon. You only take the best of the best.

When the fish stop biting and you spend hours with no bounty, you take the first fish that grabs your hook. It could be a tiny fish that you would never keep on even an average day, but with your desire to catch something, you keep it anyway. It would be better to have just not gone fishing at all.

You’ll do the same thing when trading a slow market. Eager to make a profit, you will take trades that show some potential even if they don’t meet all of your requirements. You will work hard to uncover a trade rather than wait for the obvious no-brainer trades that you take when the market is in a giving mood.

I like to say that in trading, when the going gets tough, the tough get lazy. You can’t control the market, so if the market is not giving you opportunities, it’s better to do nothing. Your hard work will not change what the market does.

This is hard for many people who have been programmed to relate hard work to success. If you try harder than the next person in a sport, you should get a better result. If you study harder for an exam, you should get a better mark. If you work longer hours at your job, you should make more money. In the stock market, if you work harder to find good trades, you will probably lose money.

The best trades are easy to find. Working hard to uncover something leads you to find questionable trades that you have to talk yourself into. It’s better to walk away when you have doubts.

This is not to say that hard work is not rewarded in trading. Traders who work hard at practicing their analytical skills or developing new strategies will be rewarded. People who devote their time and effort to improving their emotional control will be better traders. These are things that you can control and affect with hard work, but hard work won’t change what the stock market does.

This week, I ran the Action Breaks strategy which is taught in the Stockscores Investor course. It seeks Stockscores Action Candles on the daily interval.

1. VVUS

VVUS made a very abnormal price and volume break today, breaking up from a rising bottom and through the resistance of a downward trend line. Support at $0.47.

2. YRD

YRD breaks out of a pennant pattern on the daily chart with strong volume today. This sets up for a continuation of the long term upward trend after four months of sideways action. Good as a longer-term trade. Support at $39.

If you wish to unsubscribe from the Stockscores Foundation newsletter or change the format of email you are receiving please login to your Stockscores account. Copyright Stockscores Analytics Corp.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Foundation is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of this newsletter may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

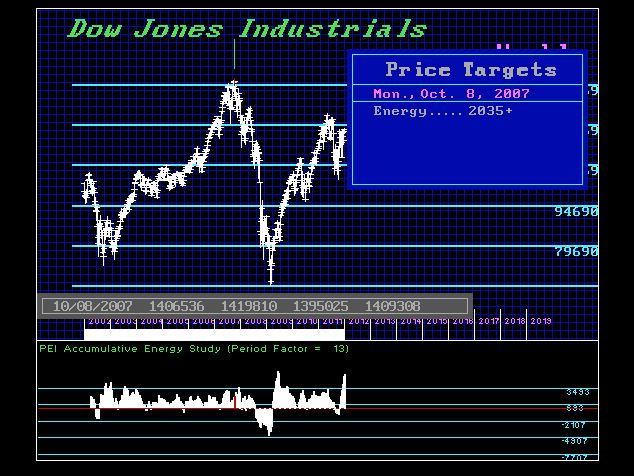

Martin Armstrong has some good news supporting a continuation of the 8 year Stock Market rally to new highs in the market averages. Martin also comments on Sovereign Debt Crisis, rising interest rates, trade wars & the collapsing Interbank Market – Robert Zurrer for Money Talks

CNN Money is reporting the headline “A top JPMorgan Chase executive is warning that stocks could fall as much as 40% in the next few years.” CNN reports that Daniel Pinto, JPMorgan’s co-president, said on Bloomberg Television he believed that market gains should continue for the next year or two. However, he added that nervous investors could result in a “deep correction” of between 20% and 40%, “depending upon the market values at the time the downturn starts.”

Indeed, this was the pause we were looking for from January. We did not see a collapse as in terms of 1987. Instead, this is simply the transition period where the marketplace must come to grips with a Sovereign Debt Crisis and that means rising interest rates will devastate the bond bubble. So exactly how does that equate to a 40% decline in equities?

What is clear is that the initial stages of this consolidation period involved the marketplace coming to grips with the shift from PUBLIC to the PRIVATE rationale. In other words, inflation, rising interest rates, the rapid rise in interest rates, explosion in public debt, and the inability of governments to fund their never-ending deficit spending at the federal, state, and local levels. Then as the economy begins to worsen, this will also historically lead to trade wars.

This is good news. We need the majority of analysts to turn bearish in order to restore the upward bias we have enjoyed for the past 8 years. We can see that our Energy Models are not in a position for a major high. They have been rising, not declining as new highs were made. This strongly suggests we will still see higher highs in the years ahead. The more analysts we get back to bearish, the strong the breakout to the upside later on.

….also from Martin: