Stocks & Equities

There are several “Trade War” gaps down located quite a bit higher than where we are trading presently in the S&P 500 and Nasdaq 100. As a rule trade gaps ususally get filled before returnng to the trend in force. Especially likely in this anxious environment this analyst proposes. In short, should we fill those gaps as you can see on the charts below a very large rally will have to occur. R. Zurrer for Money Talks

SPX & NDX 60 MIN. CHARTS

Well, they got reversed in-day but I am still leaning toward a short-term scenario where the market at least tries to fill a Trade War hype gap or two. It may not be the ‘M’ top scenario but I feel like the last couple of weeks gave a would-be bounce some fuel with all the anxiety that got stirred up. But you’re right, the market does not give a shit what I feel like.

SPX has tested its daily SMA 200 and is still in a potential (60 min.) bounce pattern. A drop below 2590 puts that in peril.

NDX is still in its monthly, weekly and daily up trends and the 60 minute also has a pattern. Both of them are looking to fill their opening gaps. Still leaning toward a bounce to at least one of the upside gaps. I just don’t feel like I buy the bear at this moment. But my positioning is very balanced with longs, shorts, precious metals and a crap load of relatively* good yielding cash.

* Relative to that blight known as ZIRP that Bernanke put upon savers.

from Subscribe to NFTRH Premium for an in-depth weekly market report, interim updates and NFTRH+ chart and trade ideas; or the free eLetter for an introduction to our work.

|

|

|

|

|

Tyler has chosen 3 instruments that go up when the market goes down. In case the long term trend line is broken these vehicles would be very profitable when we see another wave of strong selling pressure. Bottom line, you can make a lot of money in a brief period of time on declining prices by using these instruments – R. Zurrer for Money Talks

For many, this sounds like a bad thing but traders can embrace market weakness for a couple of reasons. First, there are numerous ETFs and ETNs that go up when the market goes down. Second, the market tends to take the stairs up and the elevator down. That means the profits come quickly if you are well positioned early in a correction.

Here are three vehicles to consider, and what to watch for, should the market break its long term upward trend line of support.

– Robert Zurrer for Money Talks

STRATEGY OF THE WEEK

In this week’s Market Minutes video https://youtu.be/KuVEfHab92E, I discuss how the market is threatening to break the long term upward trend line. While we don’t have that break down yet, it could happen soon and if it does, we could see another wave of strong selling pressure.

For many, this sounds like a bad thing but traders can embrace market weakness for a couple of reasons. First, there are numerous ETFs and ETNs that go up when the market goes down. Second, the market tends to take the stairs up and the elevator down. That means the profits come quickly if you are well positioned early in a correction.

Here are three vehicles to consider, and what to watch for, should the market break its long term upward trend line of support.

STOCKS THAT MEET THAT FEATURED STRATEGY

1. T.HXD

T.HXD is a leveraged and inverse fund to the TSX 60 index. If the Canadian market falls, this will go up. Since it is leveraged, it is a short term vehicle that suffers from value decay over time as it has to be rebalanced each day. A good way to take advantage of a quick correction but should not be held long if the trade is not working. Watch for it to break out through $6.60 with higher than normal volume.

2. VXX

The VXX’s value is based on the implied volatility of the S&P500 short term futures contracts. When markets correct, there is typically a sharp increase in volatility and that makes the VXX go up. The VXX is already elevated because volatility rose starting in February. If the long term upward trend line on the SPY is broken, volatility should go up some more. Watch the 3 year chart of the SPY for that break down.

3. SDS

SDS is an inverse and leveraged ETF for the S&P 500. If this benchmark index goes down 1%, the SDS should go up about 2%. Watch the SPY chart for a break of the trend line which should bring a breakout on the SDS through $43.50.

….also Tyler’s Market Newsletter:

![]()

In this week’s issue:

- Stockscores’ Market Minutes Video – Watch the Market Index

- Stockscores Trader Training – Be the Fussy Trader

Stockscores Market Minutes – Watch the Market Index

The trend of the market and whether it is oversold or overbought has an important effect on the movement of individual stocks. This week, I discuss how to assess the market factor, provide my weekly market analysis and look at the trade of the week on EEM.

Click here to watch on Youtube

To get instant updates when I upload a new video, subscribe to the Stockscores YouTube Channel

Trader Training – Be the Fussy Trader

Traders, particularly those who need to make money rather than those who would like to make money, tend to have a fear of missing out. They hear about a trading idea or find an opportunity with their own effort and make the trade with less thought than they might put into buying a microwave. They can invest thousands of dollars on an impulse, much like the drunken gambler who throws down $1000 on Five Red.

One reason for this sort of reckless approach to trading is the belief that trading ideas are like gifts. They only come along from time to time and you should feel grateful for the opportunity. If you spend 10 hours researching a company or receive the occasional bit of insight from someone who should know more than the rest of us, it’s easy to understand why you wouldn’t want to let a seemingly promising trade slip through your fingers. The problem is that this gratitude for trading ideas leads you to lower your standards and place trades that are not much more than a gamble.

Have you ever made a trade and then, just a few minutes or days later, asked yourself what the heck you were thinking? If you are normal, then it’s likely that you have because it is easy to focus on the dream of making a profit. You should focus your attention on the trading situation as it has been presented to you by the market rather than the words of an expert. Some trading opportunities are so well marketed that it’s hard to see the truth because you fixate on the profit potential that has been dangled before you as the prize.

It is critical to only take trades that meet the criteria of a strategy that you have found to have a positive expected value. Rather than look for a reason to take the trade, which is easy, look for a reason not to. Ask yourself, “If I buy this stock, who will be selling to me, and what does she know that I don’t know?” Looking at the other side of the argument will often highlight considerations that you have missed.

Being fussy is a lot easier when you recognize that the market-even a slow market-will give you opportunities. The markets have been pretty quiet this year but there are still stocks outperforming the market every day.

And if you can’t find a trade today, tomorrow or in the next week, eventually you will. There is always another bus coming down the road. If you miss one, just wait for the next.

I have found that you will actually make more money by trading less. If you maintain a very high standard for what trades you make, you will always pass on some trades that end up doing very well. By being selective, however, you will also avoid many marginal trades that would tie up your capital and then incur a loss. By being fussy and trading less, you end up taking only the very best trades and your results will be better overall.

It is easy to be fussy when the market is strong and there are lots of opportunities. It’s like fishing when every time you cast your line you get a bite. With that kind of success, you will quickly throw back any fish that is too small because you know there’s going to be something better coming along soon. You only take the best of the best.

When the fish stop biting and you spend hours with no bounty, you take the first fish that grabs your hook. It could be a tiny fish that you would never keep on even an average day, but with your desire to catch something, you keep it anyway. It would be better to have just not gone fishing at all.

You’ll do the same thing when trading a slow market. Eager to make a profit, you will take trades that show some potential even if they don’t meet all of your requirements. You will work hard to uncover a trade rather than wait for the obvious no-brainer trades that you take when the market is in a giving mood.

I like to say that in trading, when the going gets tough, the tough get lazy. You can’t control the market, so if the market is not giving you opportunities, it’s better to do nothing. Your hard work will not change what the market does.

This is hard for many people who have been programmed to relate hard work to success. If you try harder than the next person in a sport, you should get a better result. If you study harder for an exam, you should get a better mark. If you work longer hours at your job, you should make more money. In the stock market, if you work harder to find good trades, you will probably lose money.

The best trades are easy to find. Working hard to uncover something leads you to find questionable trades that you have to talk yourself into. It’s better to walk away when you have doubts.

This is not to say that hard work is not rewarded in trading. Traders who work hard at practicing their analytical skills or developing new strategies will be rewarded. People who devote their time and effort to improving their emotional control will be better traders. These are things that you can control and affect with hard work, but hard work won’t change what the stock market does.

Follow on Twitter | View Youtube Channel

If you wish to unsubscribe from the Stockscores Foundation newsletter or change the format of email you are receiving please login to your Stockscores account. Copyright Stockscores Analytics Corp.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Foundation is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of this newsletter may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

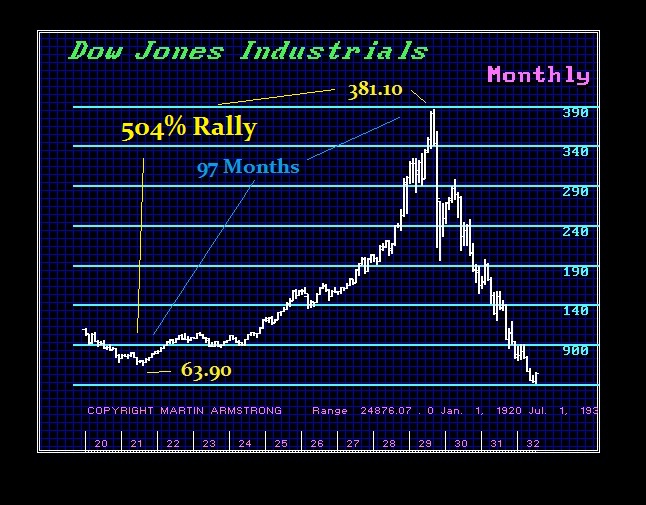

Martin Armstrong has been consistent in forecasting higher prices for stocks, arguing that the market is no where near as overbought as the majority think. Martin just published this proprietary chart above going back to 1915 that makes the case that the market was far more overbought when capital was flooding into the US in the past than it is today – R. Zurrer for Money Talks

QUESTION: Where does your overbought index stand on the stock market?

ANSWER: This Index is proprietary. It peaked at 12.55 during October 1919 as capital had flowed to the United States due to World War I. The Index then declined thereafter into the August 1921 bottom at 10.40. From this point, the Index rallied into October 1925 peaking at 13.16, fell back for 15 months bottoming again in October 1927. The final rally lasted 14 months peaking at 12.95. The bottom came in July 1933 about 13 months after the actually low in nominal dollar terms during June 1932.

In nominal terms, the Dow tested the 1,000 level in 1966, 1968, and 1973 and again in 1980. We can see the shift in trend that came following the historical low in 1981. The core of this index is capital flows so it tends to reflect just how capital flees and concentrates moving relative to US assets. Looking at the most famous bull market of the Roaring ’20s, the duration was 97 months which we exceeded from the 2009 low in April 2017. The 2009 low was 6469.95 and the January high was 24,741.70. which was a rally of only 282% – not anywhere close to the Roaring ’20s.

This index is proprietary and it affords us a look at the asset class from a global perspective. This is part of the reason we have been warning that the bull market is by no means overbought and the bulk of forecasting out there has made this the most hated bull market in history because they look only at the nominal index without placing it within its global context.

…also from Martin: Market Talk- April 2, 2018

Mr. Todd is preparing to buy the plunging Stock Market short term unless it breaks an important level. Today he has also switched from bullish Gold & Silver to Bearish – R. Zurrer for Money Talks

Published @ 3:00pm PST Tuesday March 27, 2018

DOW – 345 on -1031net declines

NASDAQ COMP – 211 on 1564 net declines

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bearish

STOCKS: Here are the factors in today’s selling. Nvidia backed away from driverless cars and this caused a drop of 7% in the stock and that infected other high techs. Then interest rates dropped sharply and this caused trouble for the banks which like higher rates.

And of course, there is the old reliable Facebook which was down over 5% for the session and is now 22% below its high.

Another point. The end of the quarter comes on Thursday and we’ll probably see a lot of choppy action as institutions rearrange their portfolios for the quarterly reports. Of course, computer driven algorithms are a factor and are probably the reason for the extreme point action.

I’m sticking with a short term bullish posture. We’re very oversold and sentiment is extremely negative. However it’s important that we hold the closing lows of Friday.

GOLD: Gold dropped $11. The dollar was higher and the yellow metal was overbought.

CHART: The S&P 500 is doing a retest of the early February lows. This is a support zone since it arrested the last big decline. Most technical measures are oversold and we have a very high put call ratio. It should resolve to the upside unless we have entered a bear market. I’m not of that opinion, but it does require close attention.

BOTTOM LINE: (Trading)

Our intermediate term system is on a sell.

System 7 We are in cash. Stay there for now.

System 9 We’re on a buy for system 9 from Friday March 16 to March 30.

NEWS AND FUNDAMENTALS: Consumer confidence came in at 127.7, lower than last month’s 130.0. The Case Shiller home price index rose 0.8% more than the estimated 0.7%. On Wednesday we get oil inventories, the trade deficit and pending home sales.

INTERESTING STUFF: Shallow men believe in luck. Strong men believe in cause and effect. ——–Ralph Waldo Emerson

TORONTO EXCHANGE: Toronto lost 82.

BONDS: Bonds surged.

THE REST: The dollar rebounded. Crude oil was lower.

Bonds –Change to bullish as of March 27.

U.S. dollar – Bearish as of March 26.

Euro — Bullish as of March 26.

Gold —-Change to bearish as of March 27.

Silver—- Change to bearish as of March 27.

Crude oil —-Change to bearish as of March 27.

Toronto Stock Exchange—-Bullish as of Feb. 12.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 12.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.

“Tesla, without any doubt, is on the verge of bankruptcy.”

“Tesla, without any doubt, is on the verge of bankruptcy.”