Stocks & Equities

Yesteray’s explusion of GE from the Dow Industrial Average means several things. First, GE was the last of the original Dow Industrial Average components, tossed out like all the others for moving from a world-beating company to something different…….which the FAANG (i.e., Facebook, Apple, Amazon, Netflix, and Alphabet’s Google) companies are as vunerable – R. Zurrer for Money Talks

One of the big pieces of news in the financial world today focuses on General Electric (GE). The iconic American conglomerate has been removed from the Dow Jones Industrial Average, and its stock will no longer be included when the index is calculated. It will be replaced by the drugstore chain Walgreens.

No surprise here?

In some respects, this is neither a surprise nor a big deal. GE has had enormous problems over the past couple of years, and the stock has dropped significantly. GE simply is not as big or successful as it has been; therefore, it is less representative of the broader economy and market than it was. It should be dropped.

On the other hand, this is GE! It has been part of the Dow for almost all of the Dow’s existence. It used to be the largest company of them all, by market cap, and for years was one of the most admired. For GE to fall this far means, if you think about it, that you can’t take the continued success of any company for granted.

A story of high flyers

That view, I think, is the correct way to look at this. It is not a valedictory for a once-great company but a lesson that no company is guaranteed success. Even the best will face tough times—and may not survive them. This story is not about GE per se but about all the other high flyers out there.

The FAANG (i.e., Facebook, Apple, Amazon, Netflix, and Alphabet’s Google) companies come immediately to mind. Right now, they are the largest and most admired companies out there, just as GE was at its peak. Right now, they seem to own the world, just as GE did. Right now, their fall is almost unimaginable. How could any of them fail to grow forever?

Actually, that last point isn’t quite true. We have the example of GE in front of us. Plus, if we look back a generation to the dot-com boom and bust, we can see the last round of tech companies that could do no wrong. A couple of them are still here and, indeed, still changing the world. But most are gone and forgotten. Even the ones that have survived and flourished ran into very tough times along the way.

The bigger picture

The story of the fall of GE is bigger than that, as well. It highlights that it is not just companies that rise and fall; it is industries as well. GE rose on its industrial prowess. As industry faded, GE moved into other areas—but never really matched its initial mojo. Industries grow and decline just like any other economic entity. In 2006, for example, the financial sector was 22 percent of the S&P 500 market cap. Today, it is less than 15 percent. In 1999, tech was almost 30 percent; in 2002, it was less than 15 percent and has since moved back up to almost 21 percent. These are big swings, and they reflect real changes in the economy and the markets.

What does GE mean for us today?

For people who owned the stock, not much immediately. The damage has already been done. For the rest of us, it should mean that we need to keep an eye on our investments and make sure we understand them. GE moved from a world-beating company to something different. It took markets—and investors—quite a while to understand that.

Don’t be caught by surprise. Pay attention to what you own and what is really happening. That is what we do here at Commonwealth every day. If you do your own investing, it is what you need to do as well.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by Brad McMillan. Forward-looking statements are based on our reasonable expectations and are not guaranteed. Diversification does not assure a profit or protect against loss in declining markets. There is no guarantee that any objective or goal will be achieved. All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance is not indicative of future results.

After 6 consecutive declines in the Dow Jones, the longest stretch since March 2017, and erasing all of 2018’s gains, the cash index is finally set for a rebound, trading some 130 points higher in the premarket, as trade war panic fades for now (even if the list of what can go wrong next is long). As a result, the market snapshot this morning is a sea of green…

Tyler has run a scan that looks for stocks making abnormal price and volume moves on the daily chart. Below are three charts that really stand out: – Robert Zurrer for Money Talks

In this week’s issue:

![]()

In This Week’s Issue:

- Stockscores’ Market Minutes Video – Be Patient for Proof

- Stockscores Trader Training – Effective Strategy Testing

- Stock Features of the Week – Abnormal Breaks

Stockscores Market Minutes – Be Patient for Proof

Traders often get out of trades too early because they don’t see the proof that they are right. Take time and stick with the trade until there is proof that you are wrong. That plus my weekly market analysis and the trade of the week on SRRA. Click here to watch on Youtube

To get instant updates when I upload a new video, subscribe to the Stockscores YouTube Channel

Trader Training – Effective Strategy Testing

We have all heard the story about the King who asks a group of blind men to feel an elephant and report back on what an elephant is. Each feels a different part and as a result, each has a very different perception of what the elephant is. They fail to accurately understand the Elephant because each does not touch the entire animal.

Many traders fall in to a similar mistake when evaluating their approach to the market. It is very easy to misjudge the effectiveness of trading rules by looking at the result of the last trade. If you buy a stock because it is breaking to new highs and the trade ends up failing, it is easy to say that buying stocks breaking to new highs is not an effective strategy.

This concept is referred to by some as being fooled by randomness. By drawing conclusions from a small sample of data, the trader makes an incorrect assessment of cause and effect.

To really judge the effectiveness of strategy rules requires they be tested over a large sample size, at least 30 trades but more is better. Only then can you start to see patterns and correlations. Only then can you assess cause and effect.

Suppose you are sitting in front of your computer and you decide that you will buy shares in Herbalife (HLF) if the next car that drives past your window is blue. The next car that drives by is blue so you buy HLF and the trade ends up making you a $1000 profit.

Encouraged by your result, you take a look at Pfizer (PFE) and again determine that you will buy the stock if the next car that drives past your window is blue. The next car surprises you by being blue so you buy and again, you make a profit. Trading seems easy!

What do you think would happen if you carried out this rule for your next 30 trades? Since most will realize that there can be no cause and effect between a blue car and a winning trade, most will say that the overall result should not be positive. Intuitively, you know what there can be no correlation between the color of the car that drives past your window and the performance of your trades.

However, what if your test actually finds that 25 out of the 30 trades you do end up being winners? Is there now reason to believe that blue cars predict strong stocks?

The problem is that even when there seems to be a correlation between one factor and a result, it could simply be that there is another cause at work. The reason that there was 25 winners out of 30 could simply be due to a strong trending market that makes most stocks rise.

This example highlights two important considerations when assessing the effectiveness of strategy rules.

First, make sure you test a rule over a large sample to get data that is reliable.

Second, test your strategy rules over varying market conditions so you can remove bias.

When testing the rules of a strategy, do not stop at the entry rules. Evaluate the exit strategy and how you size positions and do risk management. Small changes in any of these areas can have dramatic effect on your profitability. I recently completed a two week test of one of my day trading strategies and found that a couple of minor changes to the exit strategy more than doubled the profitability of the strategy during the test period.

If you want to truly understand how well your trading strategy works, take the time to compile data on a large number of trades across varying market conditions. Avoid looking at just one factor or the results of your last trade.

This week, I ran the Stockscores Abnormal Breaks Market Scan. This looks for stocks making abnormal price and volume moves on the daily chart. Here are three charts that stand out:

1. T.NEPT

T.NEPT (NEPT) is breaking a pull back with abnormal price and volume action today and looks like it will resume the long term upward trend. Support at $3.20.

2. BLPH

BLPH is breaking from an ascending triangle pattern, a good sign of building optimism. Support at $2.60.

3. CLSN

CLSN has been trading sideways for 7 months and is breaking higher with abnormal price and volume activity today. Support at $2.75.

Follow on Twitter | View Youtube Channel

If you wish to unsubscribe from the Stockscores Foundation newsletter or change the format of email you are receiving please login to your Stockscores account. Copyright Stockscores Analytics Corp.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Foundation is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of this newsletter may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

Most investors don’t know it, but wholesaling used cars is a red-hot business. The effort by the Barack Obama administration to get older, less fuel efficient and higher polluting cars off the street by offering incentives to trade them in triggered a huge response. The unintended consequence of Obama’s move was it made used cars harder to come by since the older models couldn’t be resold in the U.S. Cleverly Companies like Copart rode this opportunity from its humble roots in California to a global used vehicle seller to all manner of customers in 200 locations in 11 countries. It now has 125,000 vehicles up for auction every day online and its making money. This year Copart as returned 30%-Plus YTD in competition with its 20 or so competitors listed HERE. R. Zurrer for Money Talks

Most investors don’t know it, but wholesaling used cars is a red-hot business. The effort by the Barack Obama administration to get older, less fuel efficient and higher polluting cars off the street by offering incentives to trade them in triggered a huge response. The unintended consequence of Obama’s move was it made used cars harder to come by since the older models couldn’t be resold in the U.S. Cleverly Companies like Copart rode this opportunity from its humble roots in California to a global used vehicle seller to all manner of customers in 200 locations in 11 countries. It now has 125,000 vehicles up for auction every day online and its making money. This year Copart as returned 30%-Plus YTD in competition with its 20 or so competitors listed HERE. R. Zurrer for Money Talks

This Used Car Empire is Shifting Into Overdrive

That business is about to get even hotter. No need to spend all day at the car dealer anymore. You can attend online auto auctions and get a treasure that was relegated to the trash heap. And Copart is making a mint in the meantime.. Twenty years ago, the used car business consisted of trade-ins. Buyers traded their old car for a new one. And then the dealer put it at the back of the lot, or wholesaled it at a small local auction. It was an ecosystem …

One of the superb Market Analysts of the last 100 years, Richard Russell, who died in 2015 at 91 years old was a proponent of the Dow Theory. A system whose goal was to “get you out at the top and in at the bottom of major, long-term market moves.” Presently this analyst points out the Dow Theory is setting up for another change in market trend. – R Zurrer for Money Talks

New technologies

Investors like new ideas. New technologies bring rapid growth. And growth leads to big gains in stock prices.

But old ideas also have value. As things change, it can help to look at how they also stay the same.

In the 21st century, the blockchain helps shipping companies identify where everything is. That’s important. But the industry really is a lot like it was in the 1880s.

Shipping means getting something from point A to point B. Ideally, it gets there on time. This hasn’t changed in hundreds of years.

Railroads worked to deliver things on time in the 1880s. They do the same today.

In the 1880s, the amount of stuff shipped depended on economic growth. When growth was strong, the shipping industry was strong. A slowing economy caused weakness in the railroad industry.Charles Dow, founder of The Wall Street Journal, recognized that link. He also recognized that stock market trends mirrored economic trends. To profit from that, he developed the Dow Jones Transportation Average (DJTA) to track the economy in 1884.

Dow also developed a theory to spot trend reversals in stock prices. He combined the DJTA with the Dow Jones Industrial Average to identify reversals.

Dow’s Theory

Dow realized both transportation and industrial companies do well in an expanding economy. Railroads deliver raw materials to factories. Factories, which are industrial companies, manufacture finished goods, and then the rails transport those goods to markets.

If industrials are doing well but railroads aren’t, the economy is slowing. That’s because the industrial companies don’t have new orders, so railroads don’t deliver new raw materials.

When railroads do well but manufacturers struggle, it means the economy is breaking out of a recession. Factories see new orders in that scenario, and raw materials flow to factories. In a few months, the economy should be expanding as finished goods stream out of factories.

Even in 2018, this theory is still true. Railroads remain important to the modern economy. But so are trucks. So investors must track both.

And the trucking industry is growing at a record pace.

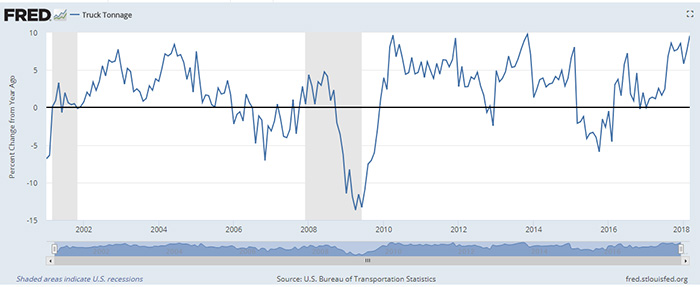

(Source: Federal Reserve)

The chart above shows the annual change in truck shipments. Right now, it’s at the highest level since 2013. It was also this high in 2010.

Growth in trucking shows the industry is transporting raw materials to factories and finished goods to markets. This is good news.

Under Dow’s theory, when the news is good, stocks rise rapidly. This is the final, speculative phase of a bull market. It’s a chance to make big gains. But it also signals a reversal is near.

This is both the most rewarding and most dangerous times to own stocks.

Regards,

Michael Carr, CMT