As we move into a historically strong period for stocks in the final two months of the year, the S&P 500 Index is already up 26 percent in 2013.

And there’s no sign that the Federal Reserve, which has pumped almost //www.gliq.com/cgi-bin/click?weiss_mam+283801-14+MAM2838+vgbb@shaw.ca+++2+4422655++“>$4 trillion into the economy to support companies, will end its stimulus program soon.

That begs the question: Will the rally continue?

To fully answer this key question, it’s important to look at three major factors that influence the stock market’s direction: valuation, trend and sentiment.

Today I’ll cover the first of these market indicators: valuation. And over the next two weeks, I’ll tackle trend and sentiment.

Stocks More Than Double

Market valuation is one of the most hotly debated topics among investors. Stock prices and earnings have come a long way since the darkest days of the financial crisis, which caused the S&P 500 to plunge to as low as 666 in March 2009.

Since then, the benchmark index has surged 158 percent (184 percent with dividends reinvested). Earnings for the 500 companies in the blue-chip index are up 100 percent.

The difference between price appreciation and actual profits has been accounted for by an expansion in the price-to-earnings ratio (P/E).

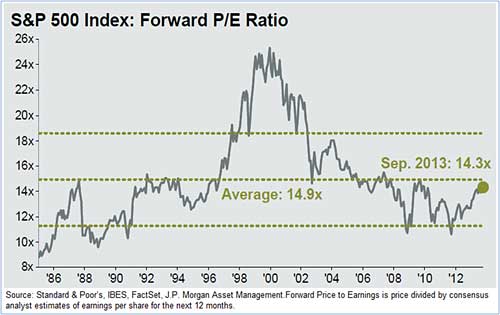

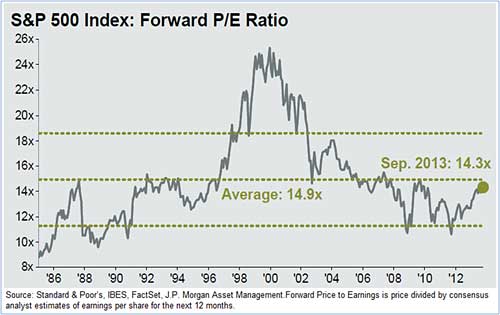

* In 2009, when nobody wanted to own stocks, the P/E ratio briefly dipped below 10.

* Today, based on expected earnings over the next 12 months, the P/E has risen to 14.3.

Historically, stocks aren’t overpriced based on this metric. In fact, the average forward P/E ratio for the S&P 500 has been 14.9 over the past 30 years, as you can see in the chart above.

Based on this picture, the market’s valuation still has some room to expand. The caveat is that any P/E expansion from here must rely more on rising prices than profits because earnings aren’t growing much anymore.

Profit Margins Maxed Out

After stocks bottomed in 2009, earnings exploded. In the first and second quarter of 2010, S&P 500 earnings surged an annual 92 percent and 51 percent, respectively, as business rebounded from the Great Recession.

But since then, earnings growth has slowed to a rate of only 5 percent, and revenue is growing even more slowly.

Third-quarter earnings have been upbeat, with more positive than negative surprises. But according to FactSet Research, S&P 500 profits are on pace to grow just 2.3 percent from the third quarter of 2012.

Over the past few years, businesses have cut costs to widen profit margins and lift earnings at a faster clip. But today, corporate profit margins are near an all-time high at 10 percent of gross domestic product (GDP).

That’s far above the average profit margin of 6.3 percent over the past 50 years.

As a result, investors shouldn’t expect cost-cutting and fatter margins to drive earnings higher. Instead, stronger revenue growth must do the heavy lifting for earnings to accelerate. And higher sales growth will only come from faster-than-expected GDP growth, or a sharp decline in the dollar.

So where does that leave us? Based on traditional valuation measures, like the P/E ratio, stocks don’t appear overly expensive today, but neither are they cheap. And I wonder how much higher the numerator (prices) can rise without much help from the denominator (earnings).

Next week I’ll explore two time-honored principles of stock-market behavior — the strong persistence of trends and the inescapable presence of mean reversion — and explain why they are at odds with each other.

Good investing,

Mike Burnick

Indeed, even investment legend Warren Buffett, who has virtually never advocated against investing in stocks (with the exception of the Tech Bubble) has stated the market is “fully valued” at today’s levels.

Indeed, even investment legend Warren Buffett, who has virtually never advocated against investing in stocks (with the exception of the Tech Bubble) has stated the market is “fully valued” at today’s levels.