Personal Finance

Vancouver 84% bearish – Calgary 33% bearish –Toronto 71% bearish

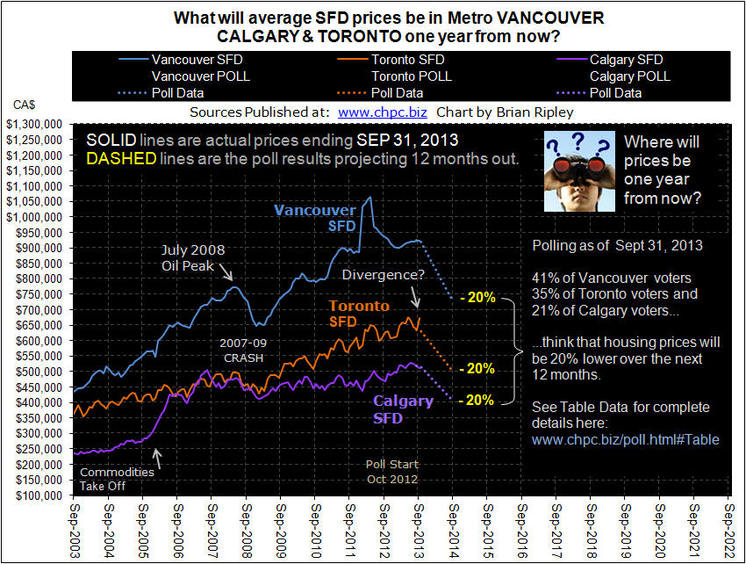

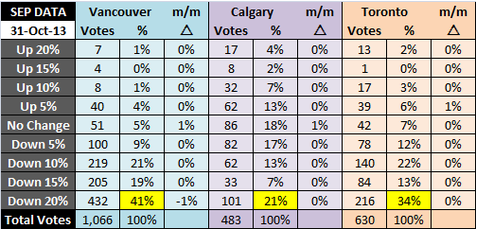

Oct 31/13 Poll based on Sept sales and pricing data: If you ignore the “No Change” and calculate the difference between the total “Ups” and the total “Downs” then the opinions are:

- Vancouver 84% bearish

- Calgary 33% bearish

- Toronto 71% bearish

Total bearish sentiment ticked down 1% M/M in Vancouver and Calgary. Toronto bearishness dropped 2% M/M.

The previous month was:

- Vancouver 85% bearish

- Calgary 34% bearish

- Toronto 73% bearish

A plurality on this page still opines that a 20% price drop will unfold over the next year.

Polling Results of where you think average Vancouver, Calgary and Toronto single family detached prices will be 1 year from now. Charts going back to Dec 2012 HERE (scroll down a touch)

Want to give your opinion – go HERE

{mp3}mcbuscomnov6fp{/mp3}

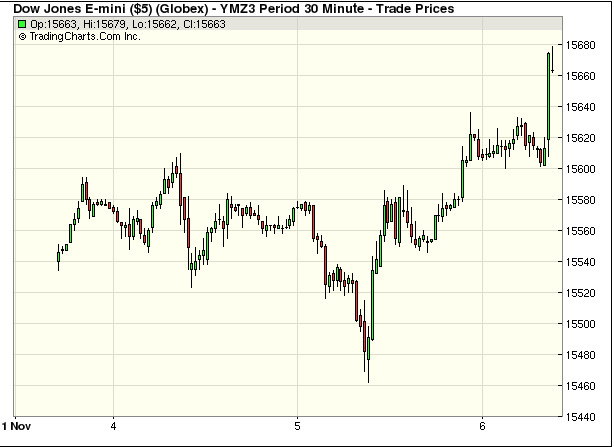

The remarkable bull run in the stock market continues.

Moments ago, the Dow Jones Industrial Average got as high as 15,731. This is an all-time intraday high.

The S&P 500 is within points of its all-time high.

This comes amid little market-moving news.

Some experts have warned that stocks may be in the process of forming a bubble. But relative to previous all-time highs, other experts note that the fundamentals of the stock market are much more robust.

On Friday, the Bureau of Labor Statistics will publish its October jobs report.

“If one word characterizes the market’s likely reaction, it’s asymmetric,” reported BI’s Matthew Boesler previewing the jobs report. “Most seem to agree that, as Citi global head of G-10 FX strategy Steven Englander puts it, “a good number is unambiguously good, whereas a bad number is ambiguously bad.””

Wall Street economists polled by Bloomberg are looking for 120,000 nonfarm payrolls in October, down from 148,000 in September.

October Ivey PMI in Canada jumped to 62.8 vs an expected level of 51. This print is the highest level since June of this year.

On the release the Canadain Dollar futures have jumped, trading up 40pts to 95.89.

Drew Zimmerman

Investment & Commodities/Futures Advisor

604-664-2842 – Direct

604 664 2900 – Main

604 664 2666 – Fax

800 810 7022 – Toll Free

Commodities can be a portfolio hedge

Commodities can be a portfolio hedge

The most unsettling thing about commodities investments—their inherent risk—is also their best feature as an alternative investment strategy, financial advisors say.

Because the performance of commodities does not correlate with that of equities or fixed income, allocating a small percentage of a portfolio to natural resources can actually lower the overall risk in the long term, said Patrick Robert, co-founder and CEO of PKR Investments, a financial consulting firm.

“For people who want [their portfolios] to be diversified, if they’re not hitting a home run right out of the gate [with equities], commodities can act as a hedge,” said Robert, who is also a certified financial planner.

….read more HERE