Currency

Tuesday 4 February 2014

Quotable

“Everything that seems to us imperishable tends towards decay; a position in society, like anything else, is not created once and for all, but, just as much as the power of an empire, is continually rebuilding itself by a sort of perpetual process of creation, which explains the apparent anomalies in social or political history in the course of half a century. The creation of the world did not occur at the beginning of time, it occurs every day.”

Marcel Proust

Commentary & Analysis

I floated the idea in Currency Currents a year or so ago, suggesting maybe the euro was becoming the new yen given its economic backdrop relative to the price action. I.E. no matter the seeming malaise across Europe, its currency continued to remain supported, relatively. The yen of did something similar if you look back: it rallied for years even though Japan’s debt kept rising and its GDP kept falling and its interest rates went to zero (threw a monkey wrench into the whole yield spread argument). Two questions here: Will Europe become mired in the same deflationary trap as Japan’s economy once was? And if so, will its currency react the same way—rally?

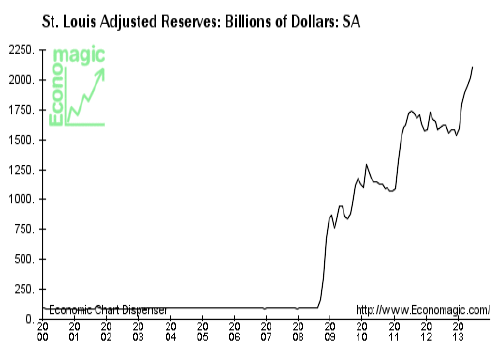

I am not picking on Europe here, so let’s be clear. Everyone knows US policymakers are doing all they can to follow down the same debt and monetary death trap Japan has already blazed. Remember about three or four years ago when Ben “Blitzkrieg” Bernanke assured us the Fed had plenty of tools available to generate inflation? The implicit meaning was the central bank will do all it can to help the Federal government turn its bonds into certificates of confiscation. Well Ben, you’ve done your part by pumping up reserves in the banking system by 2516% since the credit crunch…

…and what do you have to show for it: Falling inflation rates across the G6…not the same as deflation but proves Ben’s toolbox isn’t all that.

Black Swan Capital’s Currency Currents is strictly an informational publication and does not provide personalized or individualized investment or trading advice. Commodity futures and forex trading involves substantial risk of loss and may not be suitable for you. The money you allocate to futures or forex trading should be money that you can afford to lose. Please carefully read Black Swan’s full disclaimer, which is available at http://www.blackswantrading.com/disclaimer

Laura Parsons helped her son buy his first home four years ago, and she’s ready to help her daughter do the same, making her part of what many say is a growing trend across Canada, where home prices have soared 84 percent in 10 years.

“I am going to give her the downpayment,” said Parsons, 54, a mortgage banker in Calgary, Alberta, where an oil industry boom has pushed home prices to record highs. “We’re the baby boom generation, we have more money than we ever thought we would, we have two incomes, we’re saving, so I’m going to help.”

Neither the government nor the real estate industry has collected data on parental aid to homebuyers. But experts say they are seeing more moms and dads helping their children, especially in the priciest markets.

“It is increasingly common in the city of Toronto, where prices are pressing the limits of affordability, for most buyers looking to get a foot into the market,” said Steven Fudge, a sales representative at Bosley Real Estate in Toronto. The 25-year industry veteran says at least 50 percent of his buyers are bolstered by parental money.

A 2013 survey of 2,000 people for Bank of Montreal found that 27 percent of first-time buyers in Canada expect their parents or other family members to help them purchase a house.

That young adults need help with a first home should come as no surprise. Home prices in Canada hit record highs in late 2013, according to the Teranet-National Bank house price index. Industry data showed the average home price nearing C$400,000 ($358,800) in December. That’s up 10 percent from a year earlier and 84 percent from December 2003, when the average price was

C$211,768.

While the U.S. housing market is still recovering from a collapse in 2008 that triggered the global financial crisis, Canada’s market never crashed. Partly that is because prices didn’t rise as much during the U.S. boom, as Canadian lenders were more conservative than their U.S. counterparts. Continued…

New orders for U.S. factory goods fell in December, but rose with the volatile transportation sector excluded. … full article

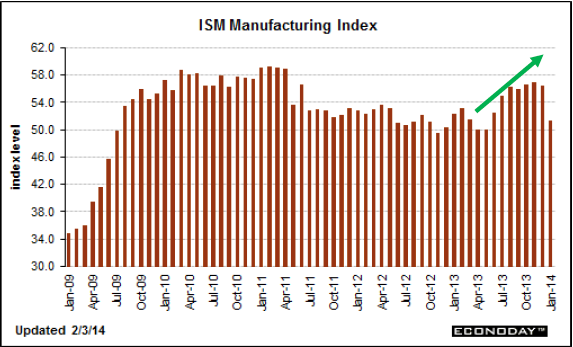

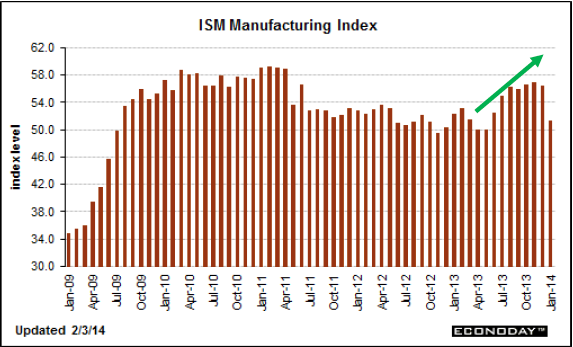

- While the survey still indicated growth in the US Manufacturing sector (at a reading of 51.3), the consensus estimate called for a reading of 56.

- This was a substantial “miss” and equity markets collapsed with the Dow falling 326 points, or over 2%.

- The ISM reading, coupled with increased volatility in emerging markets such as Argentina and Turkey, have many thinking that the long awaited correction and rebalancing of growth in financial markets is upon us.

- Two questions remain – First, have the Emerging Markets entered a crisis phase or is slowing growth in the developed world a bigger issue? Second, Can the Fed continue to taper asset purchases in the wake of this volatility and possible economic weakness in the US?

…..continue reading HERE