Bonds & Interest Rates

would have said faster horses.” – Henry Ford

Last Friday, the government released another disappointing jobs report. The economy created only 113,000 net new jobs last month, and the report for December was even worse — just 75,000 new jobs. In December, we got an advanced warning of the bad news when there was a one-week spike in initial jobless claims.

Strangely, the poor reports calmed some nerves on Wall Street, and stock prices have rallied over the past few days. The Volatility Index, or VIX, in particular, has chilled out in a major way. On Tuesday of this week, the S&P 500 broke above its 50-day moving average for the first time since January 24.

Let me explain what’s been happening. These jobs reports started a debate on Wall Street about the possibility that the Federal Reserve, now under the leadership of Janet Yellen, might abandon its plans to scale back on its monthly bond purchases. After all, the whole purpose of gobbling bonds by the boatload was to help the labor market.

To add some context, for the 12 months prior to December, the economy had created an average of 200,000 jobs per month, so there’s really been some cooling. What’s the reason for the apparent slowdown? Well, that’s hard to say. It could be a temporary blip. Some analysts are blaming poor weather, but this induces a lot of eye-rolling and snarky laughs from market bears. To be fair, some soggy retail sales numbers seem to confirm the notion that inclement weather did keep consumers at home. Retail sales dropped 0.4% last month. The number for November was revised downward from a 0.2% gain to a 0.1% drop.

Yellen Gives Wall Street the All-Clear Signal

Naturally, the gloomy mood put the spotlight on Janet Yellen. On Tuesday, the new Fed chairman ventured up to Capitol Hill for her debut testimony as Grand Poobah. In accordance with the Humphrey-Hawkins Act, the Fed Chairman twice each year tells Congress what it’s been up to. The prepared remarks are the interesting part, and the Q&A is usually pretty embarrassing. To her credit, Yellen made it clear that the Fed is still on course to buy bonds and doesn’t see evidence yet that greater easing is needed. I think we can infer from this that the Fed’s plan is to taper throughout this year, but any rate increases won’t come until next year, or perhaps later.

Naturally, the gloomy mood put the spotlight on Janet Yellen. On Tuesday, the new Fed chairman ventured up to Capitol Hill for her debut testimony as Grand Poobah. In accordance with the Humphrey-Hawkins Act, the Fed Chairman twice each year tells Congress what it’s been up to. The prepared remarks are the interesting part, and the Q&A is usually pretty embarrassing. To her credit, Yellen made it clear that the Fed is still on course to buy bonds and doesn’t see evidence yet that greater easing is needed. I think we can infer from this that the Fed’s plan is to taper throughout this year, but any rate increases won’t come until next year, or perhaps later.

Now here’s the good news. Yellen’s most significant remark was her saying that assets are not at “worrisome levels.” Specifically, she said, “Our ability to detect bubbles is not perfect, but looking at a range of traditional valuation measures doesn’t suggest that asset prices broadly speaking are in a bubble territory.” In plain English, this was her Valentine’s Day gift to Wall Street. This is also a good example of how events that are not really unexpected can still markedly boost the confidence of the bulls, who have been running scared for the past few weeks.

The market’s new optimism has nearly vanquished the late-January slide. From January 15 to February 3, the S&P 500 lost 5.76%. But over the last eight days, the index is up 5.05%. If it weren’t for a minor down day on Wednesday, the S&P 500 would be up for six days in a row. In a four-day stretch, the index gained more than 1% three times. At Thursday’s close, the S&P 500 is almost exactly 1% below its all-time high close from January 15.

Next month, the bull market will celebrate its fifth birthday. The S&P 500 has rallied for an amazing 170% gain. Even though this has been one of the greatest rallies in market history, it’s had several corrections — and a few were quite severe. The latest blip was due to concerns about Emerging Markets and a possible slowdown in China. Traders enjoy worrying about vague threats while ignoring actual good news. While the emerging markets are still a problem, we can now see that not every EM is in such dire straits. We’ve already seen improvements in markets like Italy, Brazil and Australia.

The best news is that earnings continue to churn along. Frankly, I think earnings growth could have been better this season, but there were a lot of folks who expected much worse. Of course, going into earnings season, many companies had pared back their forecasts, so they’ve been beating lowered expectations. According to data from Bloomberg, almost 76% of companies have beaten expectations. Earnings for the S&P 500 are tracking at 8.3% growth for Q4, while sales are on track for a 2.7% increase.

Our Buy List is currently trailing the S&P 500, but not by much. Through Thursday, we’re down 1.37%, while the S&P 500 is off by 1.00%. I’m not happy, but I’m not at all worried. I’m very confident that by the end of the year, we’ll beat the market for the eighth year in a row.

We had more good news on Tuesday when Congress voted to extend the debt ceiling. Please note that I’m not offering an opinion on whether this is a wise move or not, but I will note that the stock market is pleased that we’re not going to have another debt ceiling showdown for at least another year.

We also learned this week that four months into this fiscal year, the federal budget deficit is running 36.6% below last year’s deficit. Compared with last year, revenues are up 8.2%, and spending is down 2.8%. The CBO currently forecasts that this year’s deficit will be a mere $514 billion. Again, I’m not saying that’s ideal, but it’s the lowest deficit in six years. This also helps explain why Treasury bonds continue to do well despite repeated predictions of their demise. Only a few weeks ago, the 10-year Treasury broke above 3%, but it’s already back down to 2.73%. Now let’s take a look at some Buy List earnings coming our way next week.

Earnings from DirecTV, Express Scripts and Medtronic

We’re not quite done with earnings season. Three Buy List stocks are due to report next week: DirecTV, Express Scripts and Medtronic. DTV and ESRX ended their quarter in December, but MDT is our first stock on the January cycle to report. Ross Stores will follow the week after.

Interestingly, DirecTV (DTV) just got a boost thanks to the mega-deal announced between Comcast and Time Warner Cable. The satellite-TV operator has reported outstanding earnings in recent quarters. In November, they reported earnings 26 cents above estimates. For Q3, DTV added 139,000 subscribers, which doubled expectations. The company is also doing a booming business in Latin America.

DirecTV is scheduled to report earnings on Thursday, February 20. The consensus on Wall Street is for earnings of $1.28 per share, which is too low by my numbers. DTV is on track to earn about $5 per share for 2013, which is a nice increase over the $4.44 from last year. For now, I’m going to keep our Buy Price at $72 per share, which is a bit tight, but I want to see solid results before I’m willing to raise our Buy Below. DTV is a sound stock.

Express Scripts (ESRX) is one of our new stocks this year, and it’s already doing well for us, with a 9% YTD gain. One of the things I like about ESRX is that its earnings tend to be very stable. The pharmacy benefit manager is due to report fourth-quarter earnings on Friday, February 21.

In October, Express Scripts told us to expect Q4 earnings to range between $1.09 and $1.13 per share. That’s slightly below what I had been expecting, but not enough to change my outlook on the stock. I’ll be very curious to hear any guidance for 2014. The shares are currently above my $74 Buy Below price. Again, I want to see the results before I feel an increase is warranted. As always, I want to caution investors that there’s no need to chase after stocks. Patience, young Skywalker. Our strategy is to wait for good stocks to come to us.

I’ve been waiting more than 13 years for Medtronic (MDT) to finally break above its all-time high of $62 from December 28, 2000. Well, the stock’s been getting close. Earlier this year, MDT jumped over $60 per share, and I think we may see a new high sometime soon.

Medtronic will report fiscal Q3 earnings on Tuesday, February 18. This is for the quarter that ended in January. The medical-device maker has been doing very well lately, and the CEO noted that they’re outperforming in nearly every business line. I don’t expect much in the way of surprises from MDT. Wall Street expects earnings of 91 cents per share, and that matches my numbers. The company has given us a range for full-year earnings of $3.80 to $3.85 per share. Medtronic remains a solid buy up to $61 per share.

Some Buy List Updates

Several of our Buy List stocks have shown some strength recently. Stocks like Oracle (ORCL) and CR Bard (BCR) have rebounded impressively. Qualcomm (QCOM) just broke out to a 14-year high this week. Shares of Stryker (SYK) are also at a new high. Feast your eyes on this stat: Over the last 35 years, SYK has crushed the S&P 500 by a score of 100,000% to 1,700%.

Some particularly attractive buys on our Buy List include Ford (F), AFLAC (AFL) andQualcomm (QCOM). The big loser for us has been Bed Bath & Beyond (BBBY). The home-furnishing stock has been such an outlier on our Buy List that if its YTD loss were cut in half, it would still be the second-to-worst performer, but our Buy List would be outperforming the S&P 500. I’m not ready just yet to say that it’s a screaming buy, but it’s getting close. BBBY doesn’t report its fiscal Q4 numbers until early April. Until then, it’s a decent buy up to $71 per share.

Ross Stores (ROST) is another stock that looks cheap, but I want to see numbers first. Ross will report its earnings in February 27. One last stock I like a lot is Cognizant Technology Solutions (CTSH). The shares pulled back below $90 recently and came within four pennies of hitting $100 on Thursday. CTSH is a very good buy.

That’s all for now. The stock market will be closed on Monday in honor of President’s Day. (Officially, the NYSE calls this Washington’s Birthday, which is celebrated on President’s Day. Don’t ask me why.) On Wednesday, the Federal Reserve will release the minutes from their last meeting. On Thursday, the government will release its inflation report for January. It will be interesting to see if there’s been any upward pressure on consumer prices. We also have three more Buy List earnings reports next week Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

In recent months we compared the bear market in gold stocks to bear markets of the past. Readers were probably getting sick of seeing our bear analogs chart which made the case that a major bottom was coming. The good news is the major bottom is in and now we can compare the current recovery with past recoveries. GDX and GDXJ continue to form a very bullish bottoming pattern and we want to see how their measured targets (and potential upside) mesh with historical recoveries.

The following chart plots GDX and GDXJ as well as their 400-day moving average, one of my favorite long-term moving averages. Both markets could be forming reverse head and shoulder bottoming patterns. The necklines are the next resistance targets at $30 for GDX and $51 for GDXJ. These targets could coincide in the near future with the declining 400-day moving averages. The left shoulder of the pattern was formed in June 2013 and the head was formed in December. The right shoulder could be formed from a pullback from those aforementioned targets. The pattern projects to upside targets of $40 for GDX and $73 for GDXJ.

Next, we plot the same markets on a monthly chart. The next major (or multiyear) resistance for GDX and GDXJ are essentially the same upside targets from the potential head and shoulders patterns.

The targets equate to a 100% rebound for GDX and over a 150% rebound for GDXJ. This seems excessive but history argues otherwise.

In the chart below we plot the average rebound in gold stocks from major bottoms within secular bull markets. In black we plot the average of the 2000, 2005 and 2008 rebounds and in blue we plot the average of the 1970 and 1976 rebounds using the Barron’s Gold Mining Index. Over the past decade, the HUI averaged a 125% rebound in 12 months while the BGMI averaged about a 60% rebound. We should note that the HUI is a more volatile and leveraged index than the BGMI. A 60% rebound in the BGMI could equate to an +75% rebound in the HUI.

GDXJ does not have as much of a history but thanks to Bob Hoye we can see how it performed following the 2008 and 2005 bottoms. He took the GDXJ components and weightings from 2009 and projected it back to 2004. GDXJ rebounded over 200% following both the 2005 and 2008 bottoms. The chart is Bob’s and the annotations are ours.

Historical analysis shows that the potential upside targets of GDX $40 and GDXJ $73 could be achieved by the end of this year. That would mark a 100% gain for GDX and over 150% rebound for GDXJ in one year. Forecasting these gains is perfectly reasonable given history. A one year gain of 100% in GDX would be below the average of the one year rebounds in 2000, 2005 and 2008. A gain of 150% in one year for GDXJ would be below what its performance following the 2005 and 2008 bottoms.

GDX and GDXJ should continue higher in the short-term until GDX $30 and GDXJ $51. That is 16% and 20% upside respectively. A pullback would create a buying opportunity for those who have missed out and set up the right shoulder of the inverse head and shoulders pattern. Both the short and intermediate term outlook for gold and silver stocks continues to be very positive. Don’t overthink it. Be long, sit tight and have an exit strategy in case things play out differently. If you’d be interested in learning about the companies poised to outperform the sector, then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

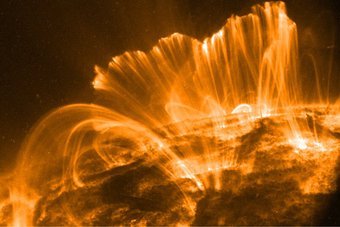

Scientists have at last created fusion in California, albeit not yet hot fusion to power energy plants. Nevertheless, progress is being made and this will be the next energy source after 2032. Based upon our models, there should be a major innovation that changes the economic structure after 2032 and it is most likely going to be fusion energy. This is the energy source that actually powers the sun.

Scientists have at last created fusion in California, albeit not yet hot fusion to power energy plants. Nevertheless, progress is being made and this will be the next energy source after 2032. Based upon our models, there should be a major innovation that changes the economic structure after 2032 and it is most likely going to be fusion energy. This is the energy source that actually powers the sun.

Ed Note: Be sure to read the link Martin provided which is this article below:

US scientists achieve ‘turning point’ in fusion energy quest

Scientists in the United States say they have taken an important step on a decades-old quest to harness nuclear fusion to generate nearly inexhaustible energy.

For the first time, two nuclear fusion experiments succeeded in producing more energy than was used to trigger the reaction, the journal Nature reports.

….to read more click on – “Scientists”

Central bankers need new mottos. I happen to have a few proposals.

Central bankers need new mottos. I happen to have a few proposals.

- It takes effort to fail, and we try harder.

- If at first you don’t succeed, repeat what doesn’t work.

- The 1% are our friends, and we hope it shows.

ECB Seriously Considering Negative Interest Rates

Appropriate mottos out of the way, let’s turn our attention to the silly idea of the day: negative interest rates.

Via translation from El Economista, please consider ECB Seriously Considering Negative Interest Rates.

Coeuré Benoit, a member of the European Central Bank government, said today that the ECB is ‘seriously’ considering negative interest rates.

Mario Draghi has repeatedly recognized that there is a debate within the ECB on the pros and cons of negative rates that would seek to force banks to lend.

Forcing capital impaired banks to lend is blatantly stupid. The expected result is higher losses.

As a fundamental matter, it’s actually mathematically impossible to lend excess reserves. For discussion, please see Notes From Steve Keen on “Lending Reserves”

Regardless of the mathematical impossibility, people (even central bankers) want banks to lend their reserves to stave off deflation.

The deflation-fighting idea is also ridiculous as noted in Deflation Theory Reality Check: Why Inflation is Severely Understated; Feel Good Effect

With the above in mind, additional motto suggestions are welcome.

Addendum:

I received a number of interesting mottos from readers. The best one was from Steve who proposes “We don’t care. We don’t have to, because we own you.”

….also

Deflation Theory Reality Check: Why Inflation is Severely Understated; Feel Good Effect

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

The moment gold passed the $1,300 mark yesterday silver woke up and sprinted ahead with a larger percentage gain. That’s the way it works with these monetary metal twins.

The moment gold passed the $1,300 mark yesterday silver woke up and sprinted ahead with a larger percentage gain. That’s the way it works with these monetary metal twins.