Gold & Precious Metals

Gold is now above $1,330 and setting a pattern of short consolidations up against overhead resistance before breaking through and moving higher. This seems to contradict the popular opinion that gold should be sold and funds invested in equity markets.

In 2013, the hope that the economic recovery would gain traction in the U.S. caused a persistent trend of selling gold from U.S. based gold Exchange traded Funds. In April 2013, after Goldman Sachs forecast a heavy fall in the gold price, together with their clients and J.P. Morgan Chase, they unloaded around 400 tonnes of physical gold into the market in short time. The gold price buckled as a result. It pulled back to $1,180. It recovered over $1,200 over time in the face of many forecasts that it would fall to $1,000 an ounce. During the rest of the year the persistent heavy selling from Gold Exchange Traded Funds amounted to 880 tonnes by the end of the year. Institutions sold gold from these funds to turn to what appeared to be a far better prospect of profits. How do we know that it was financial institutions that were sellers? Because it was at the creation of these gold ETFs that allowed financial institutions to buy gold almost directly at cheap normal brokerage rates. Before that, they could not own gold bullion. With the gold ETF issuing shares against purchases of gold bullion, suddenly this market was opened to them. The tonnage sold through the year was around 20 to 30 tonnes a week.

In total, the U.S. supplied around 1,300 tonnes over the course of 2013. With total newly-mined gold supply at 2,969 tonnes and recycled gold supply at 1,371 tonnes, totaling 4,340, the additional 30% supply from the U.S. took supply up to 5,640 tonnes.

But at the end of 2013, the supply from the U.S. slowed to a trickle and looks like drying up now. While the focus of U.S. investors in the gold market has been switching out of gold and the expectation it would fall further in price, most overlooked the fact that these funds would have a finite amount of gold to sell. Many investors in these funds are very long-term holders and will not contemplate selling their gold. The profit-seekers appear to have completed their sales now, and we’re seeing U.S. investors starting to buy gold back into these funds. The conclusion is that we’re very close to if not at the point where the gold market has lost a 1,300 tonnes line of supply -that is huge for any market. This fact alone is changing the structure of the gold market and taking the gold price back to the uptrend.

Please note that we haven’t mentioned what’s happening on the demand side and what’s expected to happen on that side in the near future. In future articles, we will look at these reasons and why the gold market has changed to the positive and will stay there.

Subscribe – www.GoldForecaster.com

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold Forecaster – Global Watch / Julian D. W. Phillips / Peter Spina, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold Forecaster – Global Watch / Julian D. W. Phillips / Peter Spina make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold Forecaster – Global Watch / Julian D. W. Phillips / Peter Spina only and are subject to change without notice. Gold Forecaster – Global Watch / Julian D. W. Phillips / Peter Spina assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Ed Note: Baron Rothschild, an 18th century British nobleman and member of the Rothschild banking family, is credited with saying that “The time to buy is when there’s blood in the streets.”

He should know. Rothschild made a fortune buying in the panic that followed the Battle of Waterloo against Napoleon. But that’s not the whole story. The original quote is believed to be “Buy when there’s blood in the streets, even if the blood is your own.“

This is contrarian investing at its heart – the strongly-held belief that the worse things seem in the market, the better the opportunities are for profit.

While this analyst thinks that Natural Gas is not only sold out, but that the prospect for future growth are exceptional. We strongly recommend that you focus on the risk you are going to take. Whether it be extremely high risk highly leveraged commodity futures as this analyst recommends, or a Junior company with both high profit potential high risk attractive to the aggressive investor. And if futures are going to rise strongly, so to probably will the blue chip dividend paying more conservative investment – Money Talks

The natural gas market is too complacent.

Anyone who’s been following energy markets is well aware that natural gas prices have been spiking. Just today they reached a fresh five-year high at $6.49/mmbtu before tumbling to last trade at $5.60.

But while the front-month natural gas futures contract have touched relatively lofty levels and seen extreme levels of volatility, that hasn’t been the case for longer-dated contracts. The March contract is down 10 percent today, but the April contract is down a little more than 5 percent. Even further out on the curve, the April 2015 contract is down a mere 1 percent.

The difference comes down to the weather. The 2013/14 winter has been especially brutal, and may turn out to be the coldest in decades when all is said and done. That’s led to a surge in heating demand and plunging inventory levels.

With supplies scarce and daily demand running at record levels, consumers of natural gas have had to bid up spot and front-month natural gas prices significantly. They need the gas now—during the cold—not later, when temperatures moderate and demand plummets.

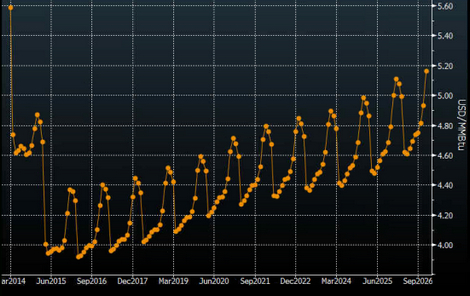

This has created a massive backwardation in the natural gas futures market. Front-month natural gas for March delivery is trading at $5.60, but the second-month contract—for April delivery—is just below $4.80. Further out on the curve, some of the months in 2015 are even trading below $4.

Natural Gas Futures Curve

The market is essentially implying that this cold blast changes nothing from a longer-term perspective, and that prices will normalize at lower levels by 2015. The 2015 natural gas futures strip currently averages $4.18, up just slightly from where it was a year ago at $4.05.

That said, the market isn’t always “right.” As we wrote last week (see NatGas Supplies Fall To Critical Level; How Bulls & Bears See This), if production does not increase as much as anticipated; or a hot summer dampens injections; or inventories are not adequately filled ahead of next winter, then prices may spike again. In that case, natural gas for 2015 delivery may rise from an average of $4.18 to $5, $6 or even higher.

On the other hand, if the market is right, and inventories are easily refilled during the spring and summer months, prices still may not fall much from the $4.18 level.

Thus, we see a good risk/reward opportunity for deferred-month natural gas futures given the market’s complacency. We are buyers of natural gas below $4.50 for the front month, and below $4 for the 2015 strip.

The principal contention of this article is that most investors who think they own gold or silver bullion really don’t. Most precious metals investments – including many touted as physical – are nothing more than paper promises. Townsend discusses the details of counterparty risk in precious metals investing, and evaluates ‘paper’ vs. ‘physical’ bullion investments, as well as allocated vs. unallocated bullion accounts. The executive summary:

- The rationale most commonly cited for investing in precious metals is wealth preservation: precious metals provide a durable store of value that eliminates counterparty risk inherent to other investments;

- Counterparty risk is only eliminated if the investor actually owns the precious metals he invests in free and clear of any encumbrances;

- Most precious metals investments, including many touted as ‘physical gold’ do not actually convey legal ownership of precious metals to the investor. As a result, the elimination of counterparty risk rationale for the investment is defeated!

- You do not own gold unless you have taken delivery of coins or bars personally or have received legally binding documentation showing you to be the legal owner of specific coins or bars (identified by bar serial numbers) stored with a bullion bank in an allocated account that is allocated in your name;

- The physical gold vs. paper gold debate is revisited with an emphasis on counterparty risk. It turns out there are many layers of both ‘physical’ gold and ‘paper’ gold and these are explored;

- Critics of ‘paper gold’ ETFs are sometimes guilty of scaring investors away from the ‘paper’ aspect of the ETFs, only to go on to sell the investor a competing ‘physical gold’ investment that is really nothing more than another form of paper promise;

- The LBMA chain of custody system (and other similar systems worldwide) provides a way to own physical bullion stored in a commercial vault without the need to re-assay the bars each time the bullion changes hands.

Click to read full article

Natural-resource-based industries are very capital intensive, and hence extremely cyclical. It is not unreasonable to say that as a natural-resource investor, you are either contrarian or you will be a victim. These markets are risky and volatile!

Natural-resource-based industries are very capital intensive, and hence extremely cyclical. It is not unreasonable to say that as a natural-resource investor, you are either contrarian or you will be a victim. These markets are risky and volatile!

Why cyclicality?

Let’s talk about cyclicality first. Some of the cyclicality of these industries is a function of their being extraordinarily capital intensive. This lengthens the companies’ response times to market cycles. Strengthening copper prices, for example, do not immediately result in increased copper production in many market cycles, because the production cycle requires new deposits to be discovered, financed, and constructed—a process that can consume a decade.

Price declines—even declines below the industry’s total production costs—do not immediately cause massive production cuts. The “sunk capital” involved in discovery and construction of mining projects and attendant infrastructure (such as smelters, railways, and ports) causes the industry to produce down to, and sometimes below, their cash costs of production.

Producers often engage in a “last man standing” contest, to drive others to mothball productive assets, citing the high cost of shutdown and restart. They fail to mention their conflicts of interest as managers, whose compensation is linked to running operational mines.

Interest-rate cycles can raise or lower the cost and availability of capital, and the accompanying business cycles certainly influence demand. Given the “trapped” nature of the industry’s productive assets, local political and fiscal cycles can also influence outcomes in natural-resource investments.

Today, I believe that we are still in a resource “supercycle,” a long-term period of increasing commodity prices in both nominal and real terms. The market conditions of the past two years have made many observers doubt this assertion. But I believe the current cyclical decline is a normal and healthy part of the ongoing secular bull market.

Has this happened in the past?

The most striking analogy to the current situation occurred in the epic gold bull market in the 1970s. Many of you will recall that in that bull market, gold prices advanced from US$35 per ounce to $850 per ounce over the course of a decade. Fewer of you will recall that in the middle of that bull market, in 1975 and 1976, a cyclical decline saw the price of gold decline by 50%, from about $200 per ounce down to about $100 per ounce. It then rebounded over the next six years to $850 per ounce.

Investors who lacked the conviction to maintain their positions missed an 850% move over six short years. The current gold bull market, since its inception in 2000, has experienced eight declines of 10% or greater, and three declines—including the present one—of more than 20%.

This volatility need not threaten the investor who has the intellectual and financial resources to exploit it.

The natural-resources bull market lives…

The supercycle is a direct result of several factors. The most important of these is, ironically, the deep resource bear markets which lasted for almost two decades, commencing in 1982.

This period critically constrained investment in a capital-intensive industry where assets are depleted over time.

Productive capacity declined in every category; very little exploration took place; few new mines or oilfields replenished reserves; infrastructure and processing assets deteriorated. Critical human-resource capabilities suffered as well; as workers retired or got laid off, replacements were neither trained nor hired.

National oil companies (NOCs) exacerbated this decline in many nations by milking their oil and gas industries to subsidize domestic spending programs for political gain. This was done at the expense of sustaining capital investments. The worst examples are Mexico, Venezuela, Ecuador, Peru, Indonesia, and Iran. I believe 25% of world export crude capacity may be at risk from failure of NOCs to maintain and expand their productive assets.

Demands for social contributions in the form of taxes, royalties, carried equity interests, social or infrastructure contributions, and the like have increased. Voters are not concerned that producers need real returns to recover from two decades of underinvestment or to fund capital investments to offset depletion. Today this is actively constraining investment, and hence supply.

Poor people getting richer…

The supercycle is also driven by globalization and the social and political liberalization of emerging and frontier markets. As people become freer, they tend to become richer.

As poor countries become less poor, their purchases tend to be very commodity-centric, especially compared to Western consumers. For the 3.5 billion people at the bottom of the economic pyramid, the goods that provide the most utility are material goods and consumables, rather than the information services or “high value-added” goods.

A poor or very poor household is likely to increase its aggregate calorie consumption—both by eating more food and more energy-dense food like meat. They will likely consume more electrical power and motor fuel and upgrade their home from adobe or thatch to higher-quality building materials. As people’s incomes increase in developing and frontier markets, the goods they buy are commodity-intensive, which drives up demand per capita. And we are talking billions of “capitas.”

Rising incomes and savings among certain cultures in the Middle East, South Asia, and East Asia—places with a strong cultural affinity for bullion—have increased the demand for gold, silver, platinum, and palladium bullion. Bullion has been a store of value in these regions for generations, and rising incomes have generated physical bullion demand that has surprised many Western-centric analysts.

Competitive devaluation

The third important driver in this cycle has been the depreciation of currencies and the impact that has had on nominal pricing for resources and precious metals.

Most developed economies have consumed and borrowed at worrying levels. The United States federal government has on-balance-sheet liabilities of over $16 trillion, and off-balance-sheet liabilities estimated at around $70 trillion.

These numbers do not include state and local government liabilities, nor the likely liabilities from underfunded private pensions. Not to mention increased costs associated with more comprehensive health care and an aging population!

Many analysts are even more concerned about the debts and liabilities of other developed economies—Europe and Japan. In both places, debt-to-GDP ratios are greater than in the US. Europe and Japan are financing themselves through a combination of artificially low interest rates and more borrowing and money printing. This drives down the value of their currencies, helping their exports.

But which nations’ leaders will stand firm and allow their export industries to wither as their domestic producers suffer from cheap competing foreign goods? If Japan’s Abe is successful at increasing his country’s exports at the expense of its competitors like Taiwan, Korea, or China, then his policies could lead to competitive devaluation. And how will the European community react, for that matter?

Loss of purchasing power in fiat currencies increases the nominal pricing of commodities and drives demand for bullion as a preferred savings vehicle.

The factors that have driven this resource supercycle have not changed. Demand is increasing. Supplies are constrained. Currencies are weakening. Thus I believe we remain in a secular bull market for natural resources and precious metals.

With that in mind, I would call the current market for bullion and resource equities a sale.

Where to invest?

Let’s talk about a type of company most of us follow: mineral exploration companies, or “juniors.” We often confuse the minerals exploration business with an asset-based business. I would argue that is a mistake.

Entities that explore for minerals are actually more similar to “the research and development” space of the mining industry. They are knowledge-based businesses.

When I was in university, I learned that one in 3,000 “mineralized anomalies” (exploration targets) ended up becoming a mine. I doubt those odds have improved much in 40 years. So investors take a 1-in-3,000 chance in order to receive a 10-to-1 return.

These are not good odds. But understanding the industry improves them substantially.

Exploration companies are similar to outsourcing companies. Major mining companies today conduct relatively little exploration. Their competitive advantage lies in scale, financial stability, and engineering and construction expertise. Similar to how big companies in other sectors outsource certain tasks to smaller, more specialized shops, the big miners let the juniors take on exploration risk and reward the successful ones via acquisitions.

Major companies are punished rather than rewarded for exploration activities in the short term. Majors therefore tend to focus on the acquisition of successful juniors as a growth strategy.

Today, the junior model is broken. Many public exploration companies spend a majority of their capital on general and administrative expenses, including fundraising. Overlay a hefty administrative load on an activity with a slim probability of success, and these challenges become even more severe.

One response from the exploration and financial community has been to put less emphasis on exploration success and focus instead on “market success.” In this model, rather than “turning rocks into money,” the process becomes “turning rocks into paper, and paper into money.”

One manifestation of that is the juniors’ habit of recycling exploration targets that have failed repeatedly in the past but can be counted on to yield decent confirmation holes, and the tendency to acquire hyper-marginal deposits and promote the value of resources underground without mentioning the cost of actually extracting them.

The industry has been quite successful, during bull markets, at causing “sophisticated” investors to focus on exciting but meaningless criteria.

Being successful in natural-resource investing requires you to make choices. If your broker convinces you to buy the sector as a whole, they will have lived up to their moniker—you will become “broker” and “broker.”

We have already said that exploration is a knowledge-based business. The truth is that a small number of people involved in the sector generate the overwhelming majority of the successes. This realization is key to improving our odds of success.

“Pareto’s law” is the social scientists’ term for the so-called “80-20 rule,” which holds that 80% of the work is accomplished by 20% of the participants.

A substantial body of evidence exists that it is roughly true across a variety of disciplines. In a large enough sample, this remains true within that top 20%—meaning 20% of the top 20%, or 4% of the population, contributes in excess of 60% of the utility.

The key as investors is to judge management teams by their past success. I believe this is usually much more relevant than their current exploration project.

It is important as well that their past successes are directly relevant to the task at hand. A mining entrepreneur might have past success operating a gold mine in French-speaking Quebec. Very impressive, except that this same promoter now proposes to explore for copper, in young volcanic rocks, in Peru!

In my experience, more than half of the management teams you interview will have no history of success that shows that they are apt at executing their current project.

Management must be able to identify the most important unanswered question that can make or break the project. They must be able to say how that question or thesis was identified, explain the process by which the question will be answered, the time required to answer the question, how much money it will take. They also need to know how to recognize when they have answered the question. Many of the management teams you interview will be unable to address this sequence of questions, and therefore will have a very difficult time adding value.

The resource sector is capital intensive and highly cyclical, and we expect that the current pullback is a cyclical decline from an overheated bull market. The fundamental reasons to own natural resource and precious metals have not changed. Warren Buffett says, “Be brave when others are afraid, be afraid when others are brave.” We are still “gold bugs.” And even “gold bulls.”

Rick Rule is the chairman and founder of Sprott Global Resource Investments Ltd., a full-service brokerage firm located in Carlsbad, CA. He has dedicated his entire adult life to different aspects of natural-resource investing and has a worldwide network of contacts in the natural-resource and finance worlds.

Watch Rick and an all-star cast of natural-resource and investment experts—including Frank Giustra, Doug Casey, John Mauldin, and Ross Beaty—in the must-see video “Upturn Millionaires,” and discover how to play the turning tides in junior mining stocks, for potentially life-changing gains. Click here to watch.