Timing & trends

A bad dream jolted me awake one morning last week: the economy had crashed, the banks were shuttered, commerce had ceased, the stores were stripped bare and rioting was everywhere. This bleak vision is not unusual for anyone who has imagined what the U.S. economy is going to look like when the ponderous hoax that sustains it has been fully revealed.** What was most troubling about the dream was that the collapse evidently had taken me and my friends by surprise. The survivalist inventory that we were supposed to have kept in our basements had gone unfulfilled. Still worse, the things we needed most were nowhere to be acquired: food for six months, medical supplies, batteries, ammo, emergency generators, toilet paper, etcetera. In the dream, a friend, a successful financial adviser who has provisioned his retirement generously, was scurrying around town on a vintage motorcycle with a sidecar, trying to scrounge essentials that he had not thought to store against a civilizational emergency.

A bad dream jolted me awake one morning last week: the economy had crashed, the banks were shuttered, commerce had ceased, the stores were stripped bare and rioting was everywhere. This bleak vision is not unusual for anyone who has imagined what the U.S. economy is going to look like when the ponderous hoax that sustains it has been fully revealed.** What was most troubling about the dream was that the collapse evidently had taken me and my friends by surprise. The survivalist inventory that we were supposed to have kept in our basements had gone unfulfilled. Still worse, the things we needed most were nowhere to be acquired: food for six months, medical supplies, batteries, ammo, emergency generators, toilet paper, etcetera. In the dream, a friend, a successful financial adviser who has provisioned his retirement generously, was scurrying around town on a vintage motorcycle with a sidecar, trying to scrounge essentials that he had not thought to store against a civilizational emergency.

A Stark Fact

Do we dare doubt that such a day awaits? If you’re having trouble sorting out the possible reasons why, and if you can’t quite wrap your mind around the certain, deflationary collapse of the banking system’s quadrillion-dollar derivatives bubble, consider just this one fact: Millions of 20- and 30-somethings working in low-wage jobs and in debt up to their eyeballs will be footing the bills for the Baby Boomers’ Social Security and Medicare. And now consider this stark fact: Each and every day between now and 2030, 10,000 Baby Boomers, relatively few of whom are financially prepared for retirement, will reach the age of 65. If you think there must be a workaround , some path other than mass destitution and tightly rationed health care, then you don’t understand the problem.

So why, if I’m so certain that economic catastrophe awaits, have I not completed the steps needed to prepare for it? A similar question must have troubled Jews in Germany as the Nazi threat turned genocidal. Even before Kristallnacht, the handwriting was literally on the wall for them, just as it is for those who understand that a global economy sustained by statistical lies, bread-and-circuses government, promiscuous consumer borrowing and a financial shell game of cosmic size cannot end other than badly. Very badly. But like those Jews who chose not to leave Europe, I find myself frozen in place by the very small hope that my worst fears will somehow not come to pass. To imagine otherwise is to court visions of ruin that, for me at least, are just too unsettling to think about.

Edicts Won’t Revive Trust

Meanwhile, I wonder whether those of us who are only half-prepared will ultimately fare any better than those who have taken no steps at all. Anyone in the latter category is implicitly betting that Big Government will take care of each of us if the economy collapses. This is not merely stupid, it is crazy. Washington can’t even run a web site, much less manage the hardships of a Second Great Depression. More likely is that the Government will ratchet up its current campaign of statistical lies to persuade us that things aren’t nearly as bad as they seem. On the inevitable day that the banks don’t open, we will be told that the Obama administration is working on a plan to keep money and credit flowing. This problem will remain unsolved for a week, and then a month, at which point people will come to understand that barter among themselves is the only answer. President Obamacare and his political toadies will discover then that credit flows on trust alone, and that once that trust fails, it cannot be revived by issuing edicts, or extending deadlines, or forgiving the “non-compliant”. We can only pray that when that point is reached, distrust in Big Government has become so deep and pervasive that neighborhoods, towns, cities, county and states will be left alone to practice the long-lost virtue of self-sufficiency.

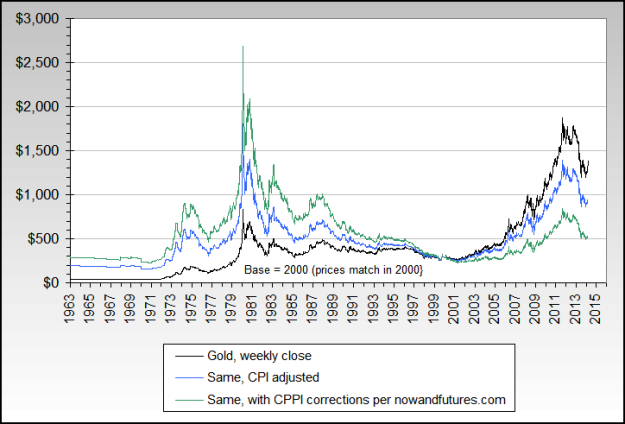

“If the U.S. inflates and devalues the dollar, gold will go much higher in price” Jim Rickards. (See here).

The last dollar devaluation took place under President Roosevelt in 1934, when from being worth 1/20.67th of an ounce of gold in 1933, the dollar was devalued to 1/35th of an ounce of gold.

The last dollar devaluation took place under President Roosevelt in 1934, when from being worth 1/20.67th of an ounce of gold in 1933, the dollar was devalued to 1/35th of an ounce of gold.

The last opportunity for devaluing the dollar took place in August 1971, when the dollar was still pegged at 1/35th of an ounce of gold. Nixon took the advice of Milton Friedman and made the worst mistake in history; Nixon did not devalue the dollar as he should have done, but simply took the US off the gold standard, such as it was, and thence forth the US refused to redeem dollars held by Central Banks around the world at any price.

Since August 15, 1971, the dollar can no longer be devalued.

Since the dollar is the reserve currency of all Central Banks in the world, all other currencies – the euro included – are only derivatives of the dollar. The proof of this statement is that the value of each and every currency in the world is calculated in dollars,

The world’s currencies are devalued or revalued against the dollar in the world’s currency markets every day of the year.

There is a “Dollar Index” which shows a value of the dollar against a basket of other currencies. However….continue reading HERE

Since the start of the year, the markets have not been able to advance or decline. Earlier this year we upgraded our allocation model, due to the breakout of the S&P 500 index above 1850, but have not made any real net progress since. That’s the bad news.

The good news is that, despite plenty of headwinds from geopolitical events, ongoing tapering of bond purchases by the Federal Reserve which is reducing liquidity and weak economic data, the markets have not declined. The index has consistently held support at 1850 and on a very short term basis is beginning to get oversold.

From a bullish perspective, it would appear that the markets are consolidating the advance from the lows of February which should allow markets to stage another advance into late spring. That analysis would align with both seasonal tendencies and the fact that the Fed is still pushing liquidity into the financial markets presently.

It is for these reasons that we are currently keeping our allocation models aligned with the overall market.

However, the bearish view would suggest a topping pattern. It is from this view from which we maintain and monitor our risk control measures. If the market rises, great – it is a decline in markets with which we are far more concerned. It is market declines, not advances, that destroy two of the most precious and finite items that we have – capital and time.

As will be discussed below – I have the “worry gene.” It is from that perspective that I continue to watch for what might go wrong, rather than “hoping” everything continues to go right indefinitely. With the Federal Reserve now extracting support from the markets, the risk of something going wrong has risen.

….much much more HERE

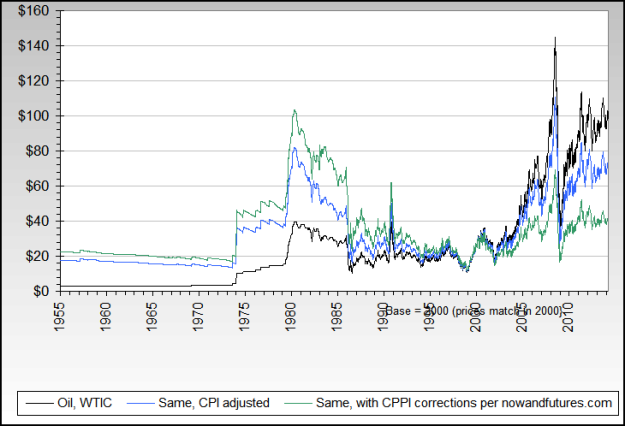

A 50 year look at commodities, their current prices & inflation adjusted prices. These 5 & 6 Decade charts provide a perspective that is not found easily. If nothing else, a quick scan is recommended – Editor Money Talks

get a lot of comments from various investors wondering why I am so bullish commodities, and in particular Agriculture. They claim that commodity prices are way too high and will collapse soon enough. Who knows… maybe these investors are right.

Having said that, today I thought I’d share with you some great long term charts from Now And Futures blog showing the nominal and inflation adjusted prices of various commodities. When I look at these charts, I wonder how on earth could some of these cheap commodities “collapse”? I mean, they are already so depressed… and so beaten down… relative to history… relative to inflation… relative to other asset classes.

I think a lot of investors are stuck with their annual charts, looking back only 365 days of the year. I think it is time to look back five to six decades of data to see where we truly are. Enjoy!

(2 examples of the 10 Commodities examined – Editor Money Talks)

….view all 10 Charts including the Agricultural Commodities HERE

“So, what gives, Larry? For years, you have been right as rain on gold and silver, and now, it seems like you’re striking out left and right?”

“So, what gives, Larry? For years, you have been right as rain on gold and silver, and now, it seems like you’re striking out left and right?”