Bonds & Interest Rates

Treasury bonds fell sharply this week as the market received clarity on the Fed’s intentions, with the equity market sell-off also providing support. The two-year Treasury yield spiked higher in mid-March, after Fed Chairman Janet Yellen inferred in her inaugural press conference, that interest rates could head higher within six months after the end of quantitative easing (QE), which implied roughly the first quarter of 2015. This timeline was a bit more aggressive than the market had expected and sold off only to completely reverse within the past three weeks. This came as various Fed speakers and Federal Open Market Committee (FOMC) minutes have clarified the Fed’s position, which could mean it is in no rush to raise interest rates.

Strengths

- Preliminary same-store sales data for March was better than expected, rising 2.8 percent even with an onslaught of poor weather for a good portion of the month.

- Initial jobless claims fell to a seven-year low, suggesting that the job market is improving. Job openings also hit a six-year high, showing there are positions to be filled.

- The NFIB Small Business Optimism Index rose in March as business owners expect the economy to improve.

Weaknesses

- PPI rose faster than expected in March, jumping 0.5 percent versus the expectation of 0.1 percent.

- Consumer debt rose by $16.5 billion in February, with student loans being a driver. There has been a lot of negative press recently on the total size of student loans and the potential for another government “bailout” or loan forgiveness.

- Economic data out of China was disappointing this week and the market continues to look to the government for some form of fiscal stimulus.

Opportunities

- The Fed has reiterated its intention to not raise interest rates before economic data supports that decision.

- The International Monetary Fund (IMF) recently released a report highlighting the deflation risk in Europe. This is the type of thinking that could spur additional easing policies from the European Central Bank (ECB).

- There are many moving parts to the taper decision and while the Fed began the process, it is very possible that tapering could be delayed if the economy stumbles.

Threats

- In addition to the inherent difficulties in exiting the QE program and the potential for a misstep, there is also the potential for miscommunication from the Fed with the recent change in leadership.

- Trade and/or currency “wars” cannot be ruled out which may cause unintended consequences and volatility in the financial markets.

- China remains a wildcard for economic recovery and the economy has shown some cracks in recent months. This is similar to how last year started and China found its footing. Something similar needs to happen this time around.

CEO and Chief Investment Officer

U.S. Global Investors

“Japan Moves To Fire Up Japan’s Nuclear Facilities“

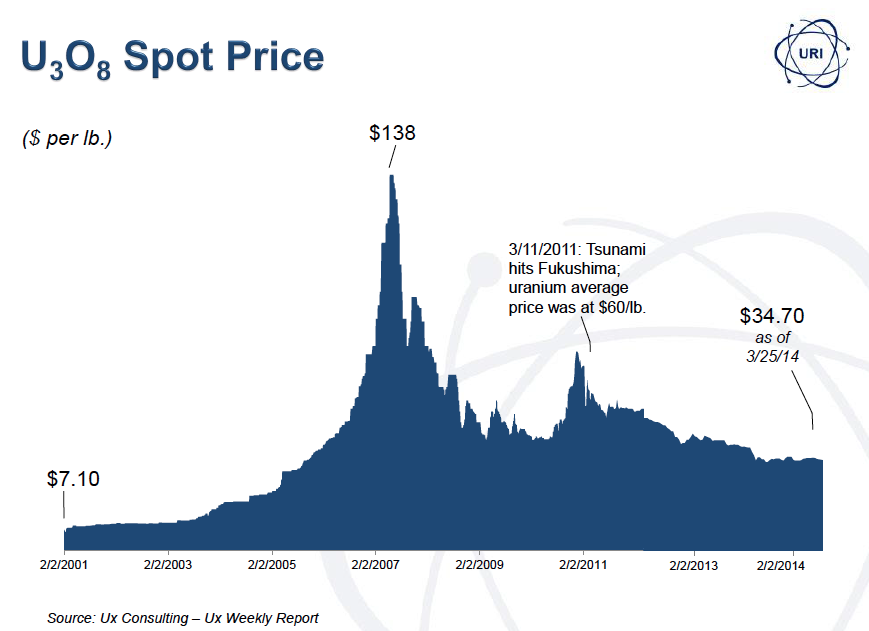

Japan has 50 operable nuclear reactors. Before the tsunami in 2011 that ripped apart the Fukushima complex, those 50 reactors provided about 26 percent of Japan’s electrical power generation capability. Regardless the Japanese government of the time idled those nuclear reactors.

Now much to the chagrin of Japan’s embattled anti-nuclear activists, the current government of Prime Minister Shinzuo Abe is moving to restart those reactors, doubtless because they simply need the power. Even more agressively he is also going to open a Plutonium Nuclear Fuel Reprocessing Plant with an annual capacity of 800 tons of uranium or 8 tons of plutonium, enough to build as many as 2,000 bombs. Who knows what the threat of nuclear war will do for the demand of uranium, but I doubt it will be negative. Especially when you see how far uranium has fallen from it’s last top.

Ed Note: The last price April 7th was $33.75 USD/lb. To follow up to date pricing go HERE

With uranium at rock-bottom prices, its more likely you’d be following Baron Rothchild’s advice to “Buy When there’s blood in the streets” if you bought in this area than not.

Here are some of the world’s largest uranium companies by deposits:

1. Cameco is one of the world’s largest uranium producers. The company’s uranium products are used to generate electricity in nuclear energy plants around the world, providing one of the cleanest sources of energy available today.

2. Paladin Energy is a uranium production company with projects currently in Australia and two operating mines in Africa with a strategy to become a major uranium mining house.

3. Rio Tinto is one of the world’s largest uranium producers. A leading international mining group headquartered in the U.K., combining Rio Tinto plc, a London and New York Stock Exchange listed company, and Rio Tinto Limited, which is listed on the Australian Securities Exchange.

Rio Tinto’s business is finding, mining, and processing mineral resources. Major products are aluminium, copper, diamonds, thermal and metallurgical coal, uranium, gold, industrial minerals (borax, titanium dioxide and salt) and iron ore. Activities span the world and are strongly represented in Australia and North America with significant businesses in Asia, Europe, Africa and South America.

On March 2 AngloGold Ashanti agreed to acquire First Uranium‘s (OTC:FURAF), the owner of Mine Waste Solutions, a recently commissioned tailings retreatment operation located in South Africa’s Vaal River region and in the immediate proximity of AngloGold Ashanti’s own tailings facilities, for an aggregate cash consideration of $335 million.

Following the transaction, combined with AngloGold Ashanti’s Vaal River tailings (491Mt, containing 4.9Moz of gold and 92.3Mlbs of uranium), AngloGold Ashanti will own tailings facilities in the Vaal River region containing a combined mineral resource of 7.7Moz of gold and 154.4Mlbs of uranium.

AngloGold Ashanti has 20 operations in 10 countries on four continents, employed 61,242 people, including contractors and produced 4.33Moz of gold (2010: 4.52Moz), generating $6.6bn in gold income, excluding joint ventures.

4. Uranium Energy Corp is a U.S. based uranium production & exploration company operating North America’s newest uranium mine.

Their operations also include the Hobson Processing Plant, the producing Palangana Mine, the fuly permitted for production Goliad ISR Project plus 21 other exploration projects.

5. Energy Fuels Inc. is the largest U.S. conventional uranium producer

…3 exploration companies:

6. Denison is a uranium exploration and development company with interests in exploration and development projects in Canada, Zambia, Namibia, and Mongolia. Including the high grade Phoenix deposits, located on its 60% owned Wheeler project, Denison’s exploration project portfolio includes 45 projects and totals approximately 584,000 hectares in the Eastern Athabasca Basin region of Saskatchewan.

7. Uranerz Energy Corp. (URZ:TSX; URZ:NYSE.MKT) and Laramide Resources Ltd. Right now, you can get in at eight-year lows on the top uranium assets that are in the control of the juniors. Uranerz Energy has some of the top assets in the Powder River Basin that are coming into production, and Laramide has one of the top resources with over 50 million pounds (50 Mlb) near surface in Australia, which has now overturned a ban on uranium mining in the district. Now Laramide can go ahead with that Westmoreland project.

Laramide Resources Ltd. has one of the top advanced resources that provides huge leverage for an investor for the uranium price. For investors who are looking for leverage and for advanced assets, Laramide is a good candidate. There are very few candidates in the junior sector that have 100% control of such a large asset. Investors must realize that there are so few high-quality junior uranium miners. When investors and funds return, the move could be dramatic—like an elephant trying to get through the eye of a needle.

This Week’s Trading Lesson

“Anything worth doing is worth doing for money.” – Gordon Gecko, Wall Street

It is generally accepted that money is a motivator; if you link pay to performance, performance will improve. For that reason, many people’s salaries vary with their performance. This is most prevalent on Wall Street where bankers and traders receive most of their compensation in the form of incentive based pay.

In his book, “Drive”, Dan Pink considers whether pay for performance really works. Does dangling a carrot and threatening with a stick cause people to deliver better results? The research finds that this is not always the case.

For very mechanical tasks, incentive based pay does work. A brick layer who is paid by the brick will work more effectively than one who is paid by the hour. However, for tasks that require analytical thinking, performance is actually worse when it is linked to pay.

Pink cites research involving the solving of puzzles. The person who was told she would receive a financial reward if she solved the puzzle in the shortest time performed worse than a person who had no potential for financial reward if the puzzle was solved quickly. The person who was solving the puzzle for the sake of solving the puzzle did it quickest.

I have been teaching people how to trade the stock market for over ten years, teaching a lot of people from many different backgrounds. One constant that I have seen is those who perform the best as traders are those who don’t care about the money. They trade with a set of rules and the discipline to follow the rules, making the money irrelevant.

The market is a puzzle that we want to solve. Why does a focus on money make us ineffective traders, or puzzle solvers?

I am not a behavioral scientist and I have not done the kind of research necessary to really answer that question. However, I do have an opinion based on what I have learned from trading.

Money causes us to focus on something that is irrelevant to the problem. In doing so, it complicates the puzzle, making it more difficult to solve.

If we aspire to make money from the market, we should change our focus to find trading opportunities with a positive expected value. Money will be the determinant of success, but it will not be something that is part of the problem to be solved.

Suppose you buy a stock and it is showing you a profit of $1000. It is near to the end of the month and you need $1000 to pay your rent. There is a good chance you will sell the stock because of your need, regardless of what your analysis would tell you about the stock’s potential to move higher.

Money causes a greater problem to our trading when it comes to taking losses. A stock may remain a good hold despite the fact it is showing as a loss. The size of the loss often causes traders to exit the trade simply because the money, and the potential loss of more, causes them too much concern.

Not only can money bring an irrelevant condition in to our problem solving equation, it also tends to bring emotion which hurts our ability to make good decisions. Most people function poorly under stress and the fear of losing money brings stress. When we focus on the money, we trade with emotion and that means we make bad trades.

Every trader has to overcome their emotional attachment to money. Trades have to be based solely on the merit of the trade. Our pursuit must be on doing the right trade, doing good analysis. If we trade to make money, we will lose it! Our chances for success improve when we simply trade to solve the market’s puzzle.

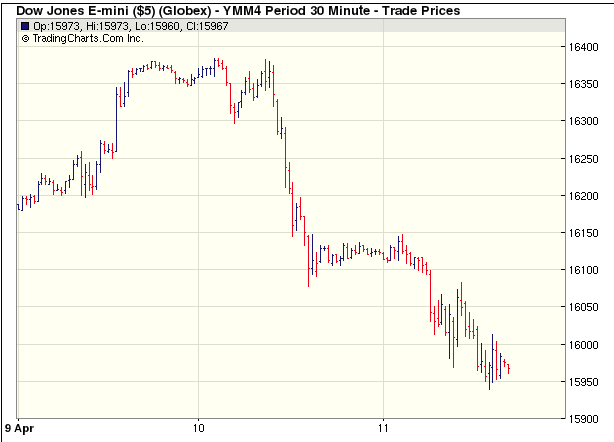

The US markets had a round of profit taking last week and appear likely to stall their upward trend in the short term. While the selling pressure mid-week rattled the confidence of the Bulls, it is not yet a strong signal of a trend reversal. Instead, it is likely the start of a pullback that will take some of the emotion out of the market.

Generally I remain Bullish on US stocks but I think some caution is warranted in the short term. We are at a point where the market has a good chance to go sideways but it is still pretty aggressive to short the market for anything more than a short term trade.

Canadian markets have underperformed the US markets but that also means they have less risk right now, simply because they don’t have far to fall until they hit support. Canadian junior, which tend to be speculative mining and energy stocks, have been dismal since early 2011 and should generally be avoided. However, the TSX Venture index is trying to make a rising bottom which could be the start of a turnaround. These stocks have lots of work to do but a glimmer of hope for the juniors.

Nothing to feature this week, I would like to see if last week’s selling pressure is the start of something bigger or just another speed bump in the long term upward trend.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

1. RISING THREAT OF INTERNATIONAL WAR by Martin Armstrong

1. RISING THREAT OF INTERNATIONAL WAR by Martin Armstrong

Robert Levy

Robert Levy 2

2