Timing & trends

Most Viewed Article This Week: Send Our Troops to Ukraine? “The bubble must find its pin somewhere!”

Coming off successes in Iraq and Afghanistan, it makes sense that the US should send troops to Ukraine, no?

When we first read this in the Washington Post, we thought it might be a late April Fools’ Day joke. Then we discovered the writer was sincere about it; apparently, James Jeffrey is a fool all year round:

To its credit, the administration has dispatched fighter aircraft to Poland and the Baltic states to reinforce NATO fighter patrols and exercises. But these deployments, like ships temporarily in the Black Sea, have inherent weaknesses as political signals. They cannot hold terrain – the ultimate arbiter of any military calculus – and can be easily withdrawn if trouble brews.

Troops, even limited in number, send a much more powerful message. More difficult to rapidly withdraw once deployed, they can make the point that the United States is serious about defending NATO‘s eastern borders.

And why not?

The US has a global empire, supported by an unprecedented mountain of debt. All bubbles need to find their pins. And all empires need to blow themselves up. What Jeffrey is proposing is to speed up the process with more reckless troop deployments.

An Awful Mess

We’re with him all the way…

Push ol’ Humpty Dumpty off the wall and get it over with… so the US can go back to being a decent, normal country without phony “red alerts”… “see something, say something” snitches… and a trillion-dollar “security” budget that reduces our safety.

But we doubt it will be that easy. Empires do not go gently into that good night. Instead, they rail… rant… and rave against the dying of the light.

They also make one awful mess of things. Empires depend on military force for their survival. And to meet their budget goals.

Typically, they steal things. In the Punic Wars, for example, the Romans filled an alarming budget gap by conquering the city of Tarentum. They then stole all that was portable… and sold its citizens into slavery.

Problem solved… for a while.

The US is unique in the annals of imperial history. It always imagines it will reap a rich reward – at least in status, if not in money – from its conquests. It never does.

President Wilson believed he would be hailed as a great international statesman. Instead, Europeans laughed at him and his 14 Points. (“Even God himself only needed 10,” quipped French prime minister Georges Clemenceau.)

President Johnson imagined a big “thank you” from the Vietnamese. Instead, he got a “no thanks” from Americans.

And President George W. Bush imagined the oil riches of Iraq flowing back to the homeland… only to end up with the most costly and unrewarding war in US history.

It is only because the US is so rich that it has been able to afford this kind of malarkey. But that is coming to an end. For much of the last 30 years, the imperial war machine has been financed mainly on credit – aided and abetted by a credit-crazed central bank.

How long this can go on is anyone’s guess. Probably no longer than the Fed’s credit bubble can continue to inflate.

In the meantime, the defense contractors, the military lobbyists, and the other zombies in the security industry will continue to push for more meddling – in Syria… Ukraine… heck, wherever…

The bubble must find its pin somewhere!

Regards,

Bill

Editor’s Note: To learn how to protect your savings before bubble finally meets pin, claim your FREE copy of Bill’s book The New Empire of Debt, which he co-wrote with Agora Financial’s Addison Wiggin. As the Times of London put it, Bill and Addison’s book “tells the stories of how empires are eventually undone by the same ‘vain overreaching.'” It also details what steps you should take before the US Empire of Debt collapses. Claim your copy here.

What’s next? Veteren Fund Manager Jeremy Grantham gives his reasoning behind his belief that he believes the market bubble will burst around or after the 2016 presidential election. He also makes another prediction and you can see his reasoning HERE – Money Talks Editor

What’s next? Veteren Fund Manager Jeremy Grantham gives his reasoning behind his belief that he believes the market bubble will burst around or after the 2016 presidential election. He also makes another prediction and you can see his reasoning HERE – Money Talks Editor

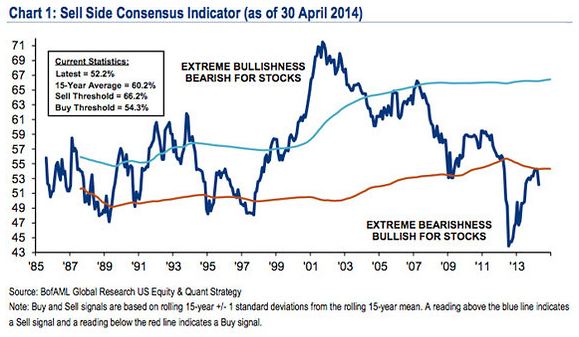

Subramanian noted that B. of A. Merrill Lynch’s Sell Side Indicator, which has been on the rise lately, took a sharp downturn recently to 52.2 from 54.1. The contrarian indicator denotes the average stock-allocation weighting from strategists. The lower the indicator, the more likely stocks will have a positive return.

Subramanian writes:

Given the contrarian nature of this indicator, we remain encouraged by Wall Street’s ongoing lack of optimism and the fact that strategists are still recommending that investors significantly underweight equities, at 52% vs. a traditional long-term average benchmark weighting of 60-65%. Even though the S&P 500 has risen by over 35% since sentiment bottomed in 2012, history suggests that strong equity returns can last for years after the indicator troughs.

In the meantime, stocks are clawing their way back from a rough 2014. On Wednesday, the Dow Jones Industrial Average DJIA reached its first record high close of the year, topping a Dec. 31 high, while on Thursday, the S&P 500 IndexSPX traded within 0.3% of its closing high set on April 2.

In the past, the strategist notes, the indicator has had a pretty good track record with the next 12 months logging gains 97% of the time when the indicator has been this low or lower, with a median 12-month return of 27%.

Another period of sideways, with a few sharp turns along the way to keep traders on their toes. We basically stand where we were a month ago and we’re still waiting to see if we get a spring rally in resource stocks that lifts us above the March high for the Venture index. Admittedly, there isn’t a lot of “spring” left to work with and we all know how boring things can get as we exit May.

Like the last issue, I held this one for a few days hoping to see more news to report on and, like the last issue, not too much arrived. Things are warning up (weather wise). Summer exploration is beginning in the northern hemisphere so news should pick up. For the record, I did add a new company at the SD level and you can expect to see some new choices in these pages soon. I am waiting on technical data for a couple of stories I like. I need the data to cover them properly but I don’t expect it to change my basic opinion so odds are you see one of these in the next issue.

The editorial in this issue helps make the case for physical demand underpinning the gold market. I think a lot of the obvious sellers are out and the price has found a higher base than late 2013. There is always room for a Ukraine boost but I hope for both humanitarian and practical reasons people just buy the yellow stuff because they think it’s cheap.

***

For all the recent fear in the market after another flare up in the Ukraine its hard to complain about how the big indices are holding up. All are near their highs. That’s good but there are some strange cross-market correlations that make one wonder.

Take the chart at the top of the next page. It displays the last year’s trading for TNX, the ETF that mirrors the yield on the US 10 year treasury bond. Late last year the yield climbed consistently as the US Fed continued to threaten a start to the QE taper. It reached a high of 3% just before year end after the Fed made good on its promise. So far so good.

I noted at the start of the year that I expected the yield could rise to the 3.5-4.0% range by year end. Not at all a scary prospect. Slowly increasing yields is exactly what should be expected as an economy improves.

A funny thing happened after the start of the year though. Instead of continuing to climb bond yields dropped back as weather spooked traders got defensive. Even as markets recovered through February bond traders appear unmoved. Yields have stayed in a tight range well below their late 2013 highs.

What are we to make of this? It would be easy to blame Ukraine but the timing is wrong. Bond traders have steadfastly refused to generate the bear market that was universally expected last year. Indeed, long dated bonds have outperformed equities by a wide margin so far this year.

While I’m not sure bond traders will be “right” I do find their lack of conviction about accelerating growth in the US disquieting. The bond market is very large and, as a group, bond traders have as good a track record as anyone when it comes to gauging forward growth. Clearly, they are not sold on the higher economic growth estimates for the US. They are still taking a wait and see attitude, even with the Fed tapering its bond purchases and increasing supply.

The same could be said for the currency market. Most expected the US Dollar index to be much higher than current levels by now. It has gone basically nowhere since the start of the year and recently failed to break through its 50 day average.

Both of these markets have traded in tighter and tighter ranges. Markets tend to break out and make a sustained move after a period like this. At this point the move could still go either way. It still seems logical to me that both bond yields and the Dollar would rise but traders need to be convinced.

There will be a deluge of economic data in the next few days. A Fed meeting, April payroll numbers, Q1 GDP numbers and flash PMI numbers across the G8 among others will all be hitting traders screens over the next week. There could be enough “news” in this flood of readings to move the needle one way or the other and push both the USD and bond yields from their recent ranges.

Anything big enough to move both those markets will ripple through equity markets too. I don’t expect big surprises from the next batch of readings, though a weak PMI or payroll number could have a big impact. I don’t expect a change in Fed posture or timing.

Any of the above can impact metals. Strong numbers from Europe would put a floor under the Euro (even though that isn’t a good thing for anyone) and the gold market with it. A strong PMI number from China would surprise just about everyone and could boost base metals and gold too. There are still too many funky statistics in China to bother even guessing at that one.

Hanging over all of this is the situation in the Ukraine. More gunfire will bring out insurance buyers in the gold market though, again, it’s surprising not too see the USD getting more of a bid from all that.

The latest bounce in the gold price was related to the deaths of several “pro-Russian agitators” in east Ukraine. It came as gold tested and fell through the $1280 level, reaching a lower resistance level that many technical analysts thought was a necessary stopping point.

Gold briefly recaptured the $1300 level and is trading just below it as this is written. I think it will have to reclaim its 50 day moving average at the $1320 level at a minimum for traders to take this advance seriously.

The top chart on this page displays weekly addition or redemption of gold by GLD, the most broadly held gold ETF. The chart comes from iaconoresearch.com, the website of Tim Iacono who is one of the more sensible commentators on the gold market in my opinion. It’s a good proxy for “western” investment demand for gold.

Not surprisingly, purchases and disinvestments by GLD closely mirror movements in the gold price itself. During most periods GLD is following not driving the gold price. Retail traders react to large price moves or changes in direction of the spot market by buying and selling GLD shares in the market. You can see that in late 2013/early 2014 the buying started after the gold price started to rally and it was heaviest at the top.

For the past few weeks the gold price and GLD holdings have gone the other way. GLD traders have been selling and GLD has been divesting gold, though redemptions have recently dried up. Cumulatively, GLD gold holdings have now fallen back to the levels they were at when the gold rally started last December. I assume the pattern is the same for other ETFs. It may be significant that even after the reversal of recent ETF holdings bullion is still $110/oz above where the rally started.

The chart below shows the last two and a half years for the Gold Forward Rate (GOFO) as calculated by the London Bullion Market Association. The GOFO measures the interest rate on gold/dollar swap transactions. It’s generally positive but when negative it indicates LBMA participants are willing to pay interest in order to borrow gold using USD as collateral.

This measure is a proxy for how tight the physical gold market is. When GOFO is negative, and its strongly negative now, the implication is that traders are finding it tougher to source bullion for good delivery.

It’s not perfect but this indicator has a good track record as a leading indicator of gold price rallies. GOFO was negative at the start of the last few gold price rallies and larger rallies accompanied more strongly negative GOFO rates. The rate is currently near the lowest level in recent memory. It’s hard to reconcile mainstream media reports of weak physical demand with GOFO near record lows.

Another big factor in gold’s recent price decline was comments in a World Gold Council report that estimated there is 1000 tonnes of gold being used as loan collateral in China. That number freaked the market out, not surprising after recent drops in both copper and iron ore that were blamed on sales of metal held as loan collateral in China.

Is the number accurate? I have no idea and neither do the authors of the study. They made it clear that the estimate was effectively a plug number since there are no public records for this sort of thing. It’s possible but that doesn’t mean 1,000 tonnes can or will be sold tomorrow or that more than a small fraction is in danger of being sold for that matter.

Gold is not an overextended sector. Steel making in China is which is why I am more concerned about iron ore, and to a lesser extent copper, as collateral than I am about gold. I suspect the true number is quite a bit smaller than the one that made the rounds after the WGC report. Copper has had a decent bounce after loan collateral related selling though is still below start of the year levels.

As expected, March gold imports to China through Hong Kong dropped from the record level last year. There were the usual “gold demand plummets” headlines but the more relevant number is the Q1 total since monthly numbers are extremely volatile. Gold imports by China grew 27% in Q1 compared to Q1 2013. There is still every reason to expect another record year for demand.

We may get an assist from India soon as well. Results of the national election will be out mid-May and everyone expects the BJP to be the winner. Many reports indicate the BJP will ease gold import restrictions. Personally, I have had trouble figuring out any of the BJP economic platform. They have done a brilliant job of promising everything and nothing. It seems that the current restrictions are a reasonable “worst case scenario” for Indian gold demand. Odds are imports by India increase in coming months.

All this should generate a stable gold market, with room for some upside if there are disappointing US stats. I will probably add a couple of explorers in the next issue or two that I’m waiting on technical data for.

It’s still a “watching paint dry” market out there. The Venture has had its pullback and stable metals prices should give it at least a bit of lift in coming weeks. Excitement, if there is any, will be reserved for that small set of companies that are promising actual news. As noted in the last issue a broader rally needs a bigger list of active companies delivering real, new, results. That list is slowly growing.

Ω

The HRA–Journal and HRA-Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

©2014 Stockwork Consulting Ltd. All Rights Reserved.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ, 85071

Toll Free 1-877-528-3958

There is an old adage in the investment industry that says it is easier to know when to buy a stock then it is when to sell a stock. From our experience this statement has genuine merit. The decision to sell is often a difficult one, particularly if the company has done well and the outlook remains positive. But as many investors can attest, holding a stock too long can not only erase your profit but can also result in an eventual net loss. Every stock is different and there is not precise tool for knowing when to sell. When we make the decision to hit the exit doors, on all or on a portion of a stock position, it is typically for one or more of the following four reasons.

1. Valuation Increase: We discussed the concept of valuation in an earlier chapter and have reiterated several times that value is the principle component in our investment methodology – we want to buy stocks at an attractive price. This same methodology is also applied to the sell side of the equation – we want to sell companies that have become overvalued. When we initially recommend a stock, we generally have a target valuation in mind that we would consider fair. We may recommend a company that is trading with share price of 8 times earnings and set a rough fair value target of 12 times earnings. If the share price appreciates beyond that target then it is time to consider selling at least a portion of the position.

2. Profit Realization: When we generate a significant return in a company it is often prudent to consider realizing some profit on the stock even if you think there is more room for price appreciation. Most stocks to not move up continuously in a straight line. If you are in a situation where you have doubled or tripled your initial investment then there is nothing wrong with taking some capital off the table, particularly if the valuation has become more expensive, growth has slowed, or the outlook has become less attractive or less certain.

3. Rebalancing the Portfolio: This reason is very similar to profit realization but with a different objective in mind. If in the previous example you double or triple your initial investment in an individual stock, that stock likely now accounts for a larger percentage of your portfolio. Your portfolio may then suffer from concentration risk by over-weighting to one company. By reducing your position in that one company (perhaps selling 1/3 or 1/2 of the position) you can both realize some profit on the investment and rebalance your portfolio while still maintaining good exposure to the company.

4. Deteriorating Fundamentals: In even the most stable economic environments the fundamentals or outlook for a company can change for the worse. Industries and economic backdrops change. Competition can heat up and margins can decline. Even a good company can make poor decisions and put themselves in a position of risk. When you purchase a company it should be because you like the fundamentals of the business. But if those fundamentals change that it may be necessary to reconsider your investment decision and sell the stock.

KeyStone’s Latest Reports Section

Disclaimer | ©2014 KeyStone Financial Publishing Corp.

Regards,

Jenny McConnell,

Administrative Assistant/Office Manager