Gold & Precious Metals

This morning the European Central Bank tried something different. As Bloomberg reported:

This morning the European Central Bank tried something different. As Bloomberg reported:

Draghi Takes ECB Deposit Rate Negative in Historic Move

The European Central Bank cut its deposit rate below zero and said it would announce further measures later today as policy makers try to counter the prospect of deflation in the world’s second-largest economy.

ECB President Mario Draghi reduced the deposit rate to minus 0.10 percent from zero, making the institution the world’s first major central bank to use a negative rate. Policy makers also lowered the benchmark rate to 0.15 percent from 0.25 percent.

The promise of further measures today “has stoked up hopes that the ECB is going to unleash a huge bazooka on the market in the press conference,” said Philip Shaw, chief economist at Investec Securities Ltd. in London. While he thinks that quantitative easing is “very unlikely” now, “it may well be that what the ECB just said is stoking up hopes that QE could be on the cards after all. ”

Later in the day, Draghi fleshed out his thoughts in the aforementioned press conference. From Business Insider:

Mario Draghi Explains The Decision

In his introductory statement, Mario Draghi unveiled targeted longer term refinancing operations (TLTROs). The initial size of TLTROs is about €400 billion and all TLTROs will mature in September 2018, or in about 4 years. Two successive TLTROS will be conducted in September and December 2014. “From March 2015 to June 2016 all counter parties will be able to borrow quarterly up to three times the amount of their net lending to the euro area non-financial private sector, excluding loans to households,” said Draghi.

The ECB is “intensifying preparatory work for outright purchases in the ABS [asset backed securities] market.” It will also suspend its weekly securities market program (SMP) sterilization.

The Q&A has begun. Here are the key highlights:

• There will be additional reporting requirement to ensure lending goes to real economy. For all practical purposes the ECB has reached the lower bound of rate policy, Draghi says.

• “The main reason to commit to sterilization by my predecessor first and by myself later was based on the effects that this additional liquidity might have on inflation,” says Draghi. “This decision takes place in a background characterized by low inflation, weak recovery and weak monetary and credit dynamics, that’s the reason for suspending this commitment.”

• “Being able to have unanimity on such a complex set of instruments means a very very extraordinary degree of consensus,” says Draghi. “What is in this TLTRO that makes it different? The cost obviously, it is very low, the term maturity is four years, and the termination that this money not be spent on sovereigns and on sectors that are already experienced or have just come out of a bubbly situation, that’s what in it.”

• We don’t see deflation says Draghi.

• “There is a deep misunderstanding here. The rates we’ve changed are for the banks, not for the people,” says Draghi. It’s wrong to think we want to “expropriate savers. …The concerns of savers should be taken very seriously.” Draghi however adds that the decision to lower rates for households is the decision of banks, not the ECB.

Some thoughts

Anyone who finds this surprising hasn’t been watching Europe’s inflation numbers. As most of the eurozone including, recently, Germany slipped towards deflation, it was clear that the European Central Bank would have to launch a new currency war offensive, and soon. So here it is: negative interest rates on bank excess reserves (though not yet on consumer bank accounts) along with direct infusions of cash into the banking system.

This will have a modest effect on bank lending and economic activity, but it won’t stop the eurozone’s downward spiral because liquidity doesn’t fix insolvency. In other words, if the system’s collateral isn’t as valuable as the debt it supports, then the system is in trouble. And coercing banks into making more loans against inadequate collateral will not help the situation.

So the next, equally inevitable stage in Europe’s offensive will be some form of QE, and apparently the ECB has decided that asset backed bonds will be the instrument of choice. The idea is that by buying, say, mortgage backed bonds with newly-created euros, the ECB will be able to direct those euros back into the housing market, which will in turn get people spending again. If this sounds familiar, it’s the script the US followed in the first half of the 2000s, which lead to the housing bubble and the subsequent crash.

But before this bubble bursts, the euro will fall due to soaring supply, which is the same thing as saying that the dollar will soar. This will be deflationary for the US, producing a string of “unexpected” misses in corporate earnings, GDP and inflation, and will leave Washington with no choice but to respond with renewed debt monetization and money printing and in all probability negative interest rates of its own. And so it will go, until we figure out that depreciating fiat currencies against each other is a zero-sum game that simply makes the rich richer and everyone else much poorer.

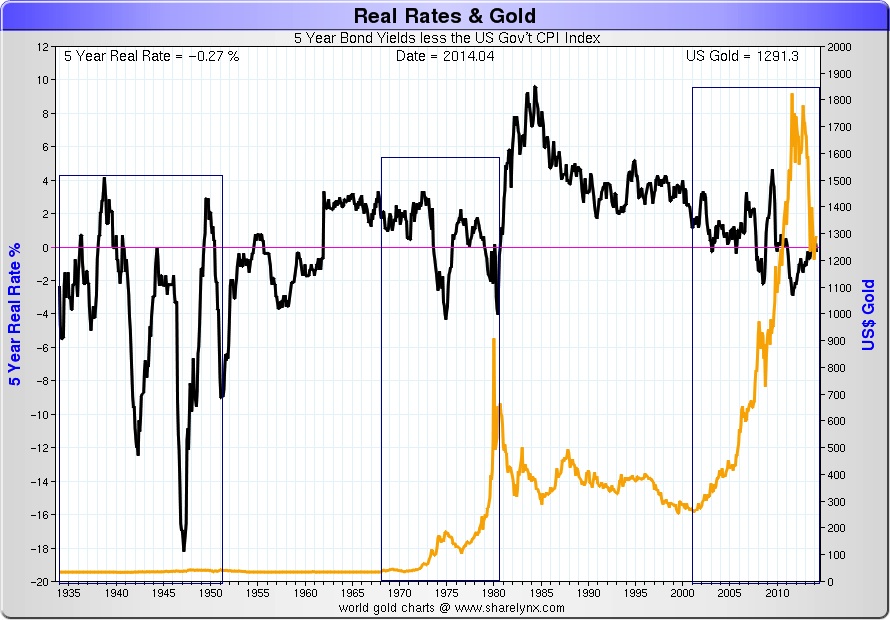

One would expect gold to be the main beneficiary of crazy policies like negative interest rates, and it did pop on Draghi’s news. But the ongoing manipulation of precious metals prices makes this far less of a sure thing than theory and common sense would indicate. Fundamentals always win in the end, but in a world of manipulated markets the timing is completely unknowable.

ALSO ON DOLLARCOLLAPSE.COM

Welcome to the Currency War, Part 14: Russia,China, India Bypass the … 36 comments

Is THIS The End? 16 comments

-

Why We’re Ungovernable, Part 9: Crime Becomes Growth 9 comments

Canadian Oil Sands is a pure investment opportunity in light, sweet crude oil. Co. indirectly owns a 36.74% interest in the Syncrude Joint Venture (“Syncrude”).

Canadian Oil Sands is a pure investment opportunity in light, sweet crude oil. Co. indirectly owns a 36.74% interest in the Syncrude Joint Venture (“Syncrude”).

Syncrude is involved in the mining and upgrading of bitumen from oil sands near Fort McMurray.

Co. also indirectly owns 36.74% of shares of Syncrude Canada Ltd. (“Syncrude Canada”). Syncrude Canada operates Syncrude on behalf of the owners and is responsible for selecting, compensating, directing and controlling Syncrude’s employees, and for administering all related employment benefits and obligations.

Click Chart or HERE for larger view

Briefly: In our opinion speculative long positions are still favored (with stop-loss at 1,885, S&P 500 index).

Our intraday outlook is neutral, and our short-term outlook is bullish, following a breakout above consolidation:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: bullish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

The U.S. stock market indexes gained 0.1-0.4% on Wednesday, slightly extending their recent uptrend, as investors reacted to some mixed economic data announcements. The S&P 500 index has reached the new all-time high at 1,928.63, moving further away from the level of 1,900. The nearest important support level is at around 1,915, marked by recent local lows, and the next support is at the psychological 1,900. On the other hand, a potential level of resistance is at 1,950. There have been no confirmed trend reversal signals so far. However, a profit-taking correction cannot be excluded here:

Ed: Click Charts for Larger View

Expectations before the opening of today’s session are slightly positive, with index futures up 0.1-0.2% vs. their yesterday’s closing prices. The main European stock market indexes have been mixed between -0.1% and +0.4% so far. Investors will now wait for some economic data releases: Challenger Job Cuts report at 7:30 a.m., ECB Rate Decision at 7:45 a.m., Initial Claims at 8:30 a.m. The S&P 500 futures contract (CFD) trades close to yesterday’s high, along the level of 1,925. The support level remains at around 1,915, marked by recent local lows, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract (CFD) is in a similar intraday consolidation, close to its recent high. The support level is at around 3,710-3,720. There have been no confirmed negative signals so far, as the 15-minute chart shows:

Concluding, we remain cautiously optimistic, expecting the continuation of the uptrend, and we continue to maintain our already profitable long position. The stop-loss is at 1,885 (S&P 500 index).

Thank you.