Gold & Precious Metals

- Weekly Commentary

- Strategy of the Week

- Stocks That Meet The Featured Strategy

WEEKLY COMMENTARY

– Stockscores’ Market Minutes Video – Out of Control, Trading the Market Cycle

– Stockscores Trader Training – Doing the Hard Things

– Stock Features of the Week – 2 Long Term ETF Trades

Stockscores Market Minutes Video

You can’t control the market but you can control how you react to it. Work hard only when the market is hot and trade the sectors of the market that are in play. Learn more plus Tyler’s weekly market analysis at

Doing the Hard Things

I believe that making money in the market requires doing what is hard. Often, when your emotions are telling you to take one course of action, you have to go the other way. Here are 10 hard, but necessary, things to do if you want to beat the stock market.

1. Take losses when you are wrong

No one likes to take a loss but losing is part of making money. You have to recognize that the stock market can not be predicted with 100% certainty and accept that being wrong is ok. When the market proves your decision wrong, take the loss!

2. Let profits run when you are right

Never be satisfied with a trade unless it returns you at least twice what you risked on the trade. Of course, more is better; one trade that returns 10 times your risk will pay for 10 losers. Our natural tendency is to fear letting our winners turn in to losers and so we are quick to sell our winners at the first sign of weakness. But realize that is what most people are thinking which means trends will start with a lot of back and forth moves because many investors lack commitment. It is only after a sustained trend upward that the fear diminishes and the trend really starts to accelerate. That is where investors can make the most money, if they stay in the stock long enough to enjoy it.

3. Buy when there is panic selling

The emphasis here is on panic selling, where the overwhelming pessimism has people accepting prices that make no rational sense. Don’t confuse a bear market with panic selling; weakness is not a reason to buy unless it is motivated by panic. Contrarian investing is only effective when emotion causes stocks to be mispriced and that comes with panic selling.

4. Sell when there is irrational buying

When the mass media is espousing the virtues of an investment, when people who know less than nothing about investing are dumping money in to the market, it is probably time to be a seller. If the upward trend goes from being linear to a curve, watch for signs of weakness as the upward trend is nearing its end. At this point, volume will often be much higher than normal and it will seem as though the stock can do nothing wrong.

5. Judge success in groups

Most of us judge our success one trade at a time. Trading is a probability game; you will not make money all of the time so why beat yourself up over a few losses? The only way to judge success is by the amount of money in your account over a large number of trades. Don’t even judge success by how often you are right, it is only about how much money you make over a large number of trades.

6. Test before you trade

To make money in the market, you need a strategy that has an edge. Don’t make investments on a hunch or what someone else tells you to do. Make investments based on a set of rules that you have tested and proven to be successful. Every great trader has a formula, what is yours?

7. Don’t follow the crowd

Average is what most people are doing; do you want to be average? It is only a small percentage of the population that has most of the money and they are making it from the largest group. If you want the money to flow your way, you have to be ahead of the crowd, do things before it is popular.

8. Avoid the headlines

The mainstream media seems to do their big features at or near market tops. If a media outlet has a large audience then their information is going to be priced in by a large number of people. Always remember that it is only a small number of people who beat the stock market which means if you are doing what the large numbers of people are doing, you are probably on the losing side. Going against the headlines will often be the winning strategy.

9. Don’t find comfort in the news

You buy a stock on a tip, based on a trading strategy or maybe after some in depth research. The stock goes down and the market tells you that you made a decision that was wrong. Rather than take the loss, you dig in to the news and find a reason to hang on. Perhaps it is that there are more results coming or that management has a proven track record. Any bit of fundamental information to justify holding the stock when the market tells you not to will help you avoid that negative feeling of taking a loss. Remember, the market never lies and the collective opinion of investors is based on all the information you are looking at. If what you are using to justify the hold is such good information, why are others selling?

10. Keep it simple

Investors have a tendency to get more sophisticated as they lose money. If there set of rules are not working, they add more rules. However, it is not usually the rules that are the problem; it is the application of the rules. People who make money keep it simple but work very hard at being disciplined and unemotional. Easy to say, hard to do.

STRATEGY OF THE WEEK

When looking for a long term position in an Exchange Traded Fund, I look to sectors that have underperformed the overall market in the last year but are showing signs of optimism. Following are two ETFs that fit those criteria as they are coming out of long term downward trends but have Sentiment Stockscores of greater than 60. These ETFs are showing signs that they could play catch up in the next year.

STOCKS THAT MEET THE FEATURED STRATEGY

1. T.XMA

T.XMA has been trending sideways since it broke its downward trend at the start of 2014. The stock built a rising bottom, a sign of optimism, in June and is now trading with low volatility under resistance at $15. I like it if it can make a weekly close above $15.

2. KOL

Coal stocks have not had any respect since 2011 but in the last year they have stabilized and in the last month have started to move higher. The ETF representing this group is KOL. This ETF will encounter some resistance at $20 in the short term but the longer term outlook is good.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

-

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligence.

Last week Market Psychology was driven by rapidly escalating Geopolitical Stress (Ukraine, Gaza, Syria/Iraq) with the major stock indices hitting 2 month lows Thursday night as Russian troops massed on the Ukraine border and the US began air strikes in Northern Iraq….BUT…the market reversed sharply higher Friday on reports that the Russians were “standing down.”

For the past couple of months we’ve been warning that bullish Market Psychology was getting way overdone and that investors should get defensive…we’ve been expecting a shift from “Risk-On” to “Risk-off.” When asked, “What is the biggest mistake investors are making at this time?” We answered, “Reaching for yield!”

We thought the shift in risk attitudes would be caused by:

1) A realization that the Fed would raise interest rates more and faster than expected and/or

2) Increasing Geopolitical Stress.

We thought the “turn” in Market Psychology would cause:

1) A rising US Dollar: it traded at 2 year lows in early May…it rallied to 11 month highs last week,

2) Widening credit spreads: they began to widen at the beginning of July…then widened sharply the second half of the month,

3) A fall in the stock market: the DJIA and the S+P traded to all-time highs by mid-July…then fell ~5% to Thursday’s over-night lows.

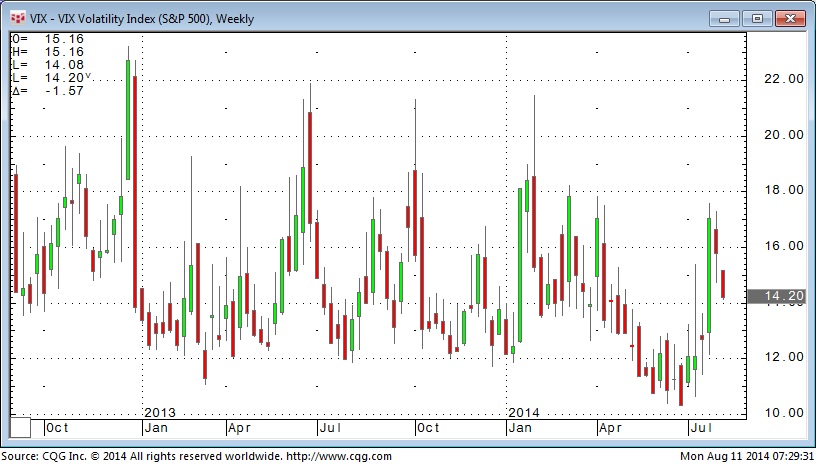

Last week we used the term “Risk happens fast” to describe the sharp sell-off in the stock market. Another example of “Risk happens fast” is the huge move in the Vix…the Fear Index. In early July option volatility across markets was near All Time Lows with the VIX at 10.25%…2 weeks later it was over 17%…a 70% jump. (To put this in perspective the market isn’t “really scared” until this index is at 30% or more….during the panic of late 2008 the VIX traded at life-time highs above 90%.

CAPITAL FLOWS:

Top quality long-dated bonds have been a magnet for capital in 2014 even with yields near historical lows…Smart Money has been getting defensive, returning “to the center”…reducing leverage and looking for safety.

While the leading US stock market indices fell ~5% the DAX (the principle German Index) fell ~10%.

The US Dollar continues to rally. Mario Draghi (ECB head) appears to want a weaker Euro…the currency wars continue…in a deflationary environment there is a strong temptation to “gain market share” with a cheaper currency! The Euro fell to a 9 month low last week…but bounced Friday as the “relief rally” rippled across all markets.

Investors are fleeing high yield junk bond funds.

TRADING:

Is this another “Buy the Dip” opportunity? We think not…BUT…we covered our short S+P position very early Friday. We entered the trade in late July on “gut feel” that the market was ready to break…we took profits on the trade because our “gut feel” told us that the market wanted to bounce.

The 5 year rally off the 2009 lows has created tremendous buying momentum…traders have time-and-again been rewarded…BIG TIME…for buying the dip…BUT…we think the very rare July Monthly Key Reversal Down in the DJIA signaled a KEY turn in Market Psychology (reinforced by the rising US Dollar and widening credit spreads)…BUT…we wouldn’t be surprised to see a bounce from Thursday’s lows. From our short term trading perspective we’d look for that bounce to fail to make new highs…and then we’d look to re-establish short positions.

We’d also not be surprised to see the Friday rally as a “one day wonder” and the market continue to sell off if/when Geo-Political Stress escalates.

We remain long the US Dollar in our short term trading accounts. We expect European currencies to weaken sharply into year-end.

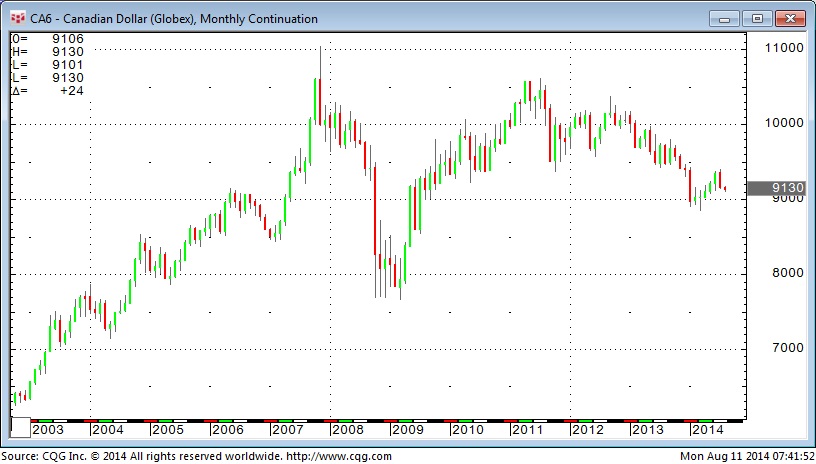

LONG TERM CURRENCY DIVERSIFICATION STRATEGY:

We continue to hold ~30% of our net worth in US Dollars as a long term currency diversification away from the Canadian Dollar. We were lucky to be “in the right place at the right time” when the Canadian Dollar rallied (actually when the US Dollar fell) from 2002 to 2008, and then again from 2009 to 2011. We decided to “take some money off the table” and converted ~30% of our net worth to US Dollars at an average of around par. We live and pay our bills in Canada so we have 70% of our net assets in CAD…BUT…we like the currency diversification idea.

On September 9th, 1965, US Navy pilot James Stockdale was shot down over North Vietnam and seized by a mob.

On September 9th, 1965, US Navy pilot James Stockdale was shot down over North Vietnam and seized by a mob.

He would spend the next seven years in Hoa Lo Prison, the infamous “Hanoi Hilton”.

The physical brutality was unspeakable, and the mental torture never stopped. He would be kept in solitary confinement, in total darkness, for four years.

He would be kept in heavy leg-irons for two years and put on a starvation diet.

When told he would be paraded in front of foreign journalists, he slashed his own scalp with a razor and beat himself in the face with a wooden stool so that he would be unrecognizable and useless to the enemy’s press.

When he discovered that his fellow prisoners were being tortured to death, he slashed his wrists to show his torturers that he would not submit to them.

When his guards finally realized that he would die before cooperating, they relented.

The torture of American prisoners ended, and the treatment of all American prisoners of war improved.

Jim Collins, author of the influential study of US businesses, ‘Good to Great’, interviewed Stockdale during his research for the book. How had he found the courage to survive those long, dark years ?

“I never lost faith in the end of the story,” replied Stockdale.

“I never doubted not only that I would get out, but also that I would prevail in the end and turn the experience into the defining moment of my life, which in retrospect, I would not trade.”

Collins was silent for a few minutes. The two men walked along, Stockdale with a heavy limp, swinging a stiff leg that had never properly recovered from repeated torture.

Finally, Collins went on to ask another question. Who didn’t make it out ?

“Oh, that’s easy,” replied Stockdale. “The optimists.”

Collins was confused.

“The optimists. Oh, they were the ones who said, ‘We’re going to be out by Christmas.’

And Christmas would come, and Christmas would go. Then they’d say, ‘We’re going to be out by Easter.’

And Easter would come, and Easter would go. And then Thanksgiving. And then it would be Christmas again. And they died of a broken heart.”

As the two men walked slowly onward, Stockdale turned to Collins.

“This is a very important lesson. You must never confuse faith that you will prevail in the end – which you can never afford to lose – with the discipline to confront the most brutal facts of your current reality, whatever they might be.”

At the risk of stating the blindingly obvious, this is hardly a ‘good news’ market. Ebola. Ukraine. Iraq. Gaza.

In a more narrowly financial sphere, the euro zone economy looks to be slowing, with Italy flirting with a triple dip recession, Portugal suffering a renewed banking crisis, and the ECB on the brink of rolling out QE.

What are the implications for global stocks?

On any fair analysis, the US market in particular is a fly in search of a windscreen.

Using Professor Robert Shiller’s cyclically adjusted price / earnings ratio for the broad US stock market, US stocks have only been more expensive than they are today on two occasions in the past 130 years: in 1929, and in 2000.

Time will tell just how disappointing (both by scale and by duration) the coming years will be for US equity market bulls.

But we’re not interested in markets. We’re interested in value opportunities incorporating a margin of safety.

If the geographic allocations within Greg Fisher’s Asian Prosperity Fund are any guide, those value opportunities are currently most numerous in Japan and Vietnam.

The Asian Prosperity Fund is practically a poster child for the opportunity inherent in global, unconstrained, Ben Graham-style value investing.

Its average price / earnings ratio stands at 9x (versus 17x for the S&P 500); its price / book ratio stands at just one; average dividend yield stands at 4.2%.

And this from a region where long-term economic growth seems entirely plausible rather than a delusional fantasy.

Vice Admiral Stockdale was unequivocal: while we need to confront the “brutal facts” of the marketplace, we also need to keep faith that we will prevail.

To us, that boils down to avoiding conspicuous overvaluation and embracing equally conspicuous value – where poor sentiment is likely to intensify subsequent returns.

In this uniquely oppressive financial environment where the skies are darkening with the prospect of a turn in the interest rates, optimism could be fatal.

Until next time,

Tim Price

[Editor’s note: Tim Price, frequent Sovereign Man contributor and Director of Investment at PFP Wealth Management, is filling in while Simon is teaching at his entrepreneurship camp.]

Sovereign Man provides actionable intelligence for personal liberty and financial prosperity, in good times and bad, to thousands of individuals around the world.

Customer Service:

Follow Us: