Current Affairs

A Coastal GasLink work camp near Houston, B.C. is now a crime scene, following an early morning attack on workers yesterday involving an estimated 20 masked, axe-wielding assailants, who threatened workers, hacked up vehicles and caused millions of dollars in damage vehicles, equipment and camp trailers.

Houston RCMP say no arrests have been made yet, and that the camp is now a crime scene, as investigators comb through the wreckage looking for evidence that may lead to arrests.

According to Coastal GasLink and Houston RCMP, workers at a Morice River drill pad site off the Marten Forest Service Road were attacked early this morning in “a highly planned and dangerous unprovoked assault.”

RCMP say an officer responding to the attack was injured when smokes bombs and burning torches were tossed at RCMP by the assailants. This occurred at portion of road that had been blockaded with a bonfire.

The attack occurred in the same area where opponents of the natural gas pipeline had set up an occupation camp and blockade for 59 days, before RCMP enforced an injunction and cleared the protesters out in November.

“This coordinated and criminal attack from multiple directions threatened the lives of several workers,” Coastal GasLink said in a news release…read more.

Interest rates rocket higher

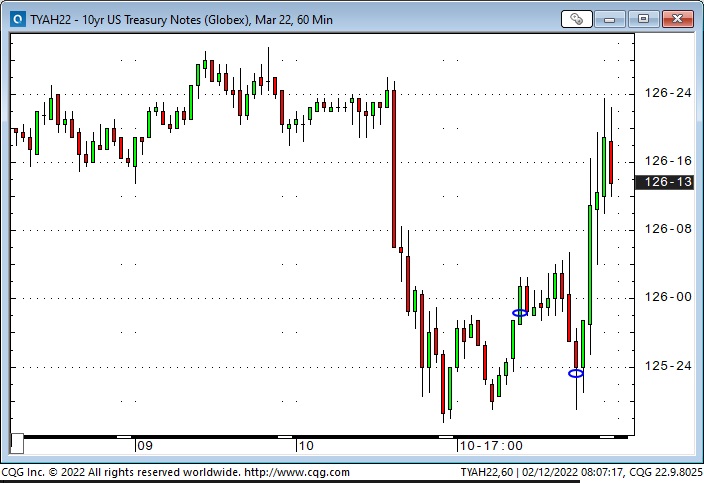

Interest rates have been climbing steadily since early December but rocketed higher this week on the one-two punch of surging CPI and a call from St. Louis Fed President Bullard for the Fed to “immediately” take aggressive hawkish action.

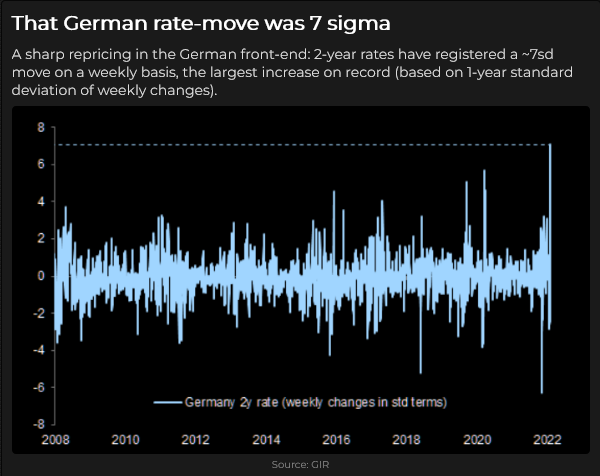

Last week I noted the dramatic “rate of change” in European interest rates when Christine Lagarde surprised the market by opening the door to the ECB raising rates this year. This week the “rate of change” in American short rates was equally dramatic. On Thursday, Eurodollar futures (first chart above – trade at a discount to par) suffered their largest daily drop in over ten years. Ten-year US Treasury yields traded above 2% for the first time in nearly three years.

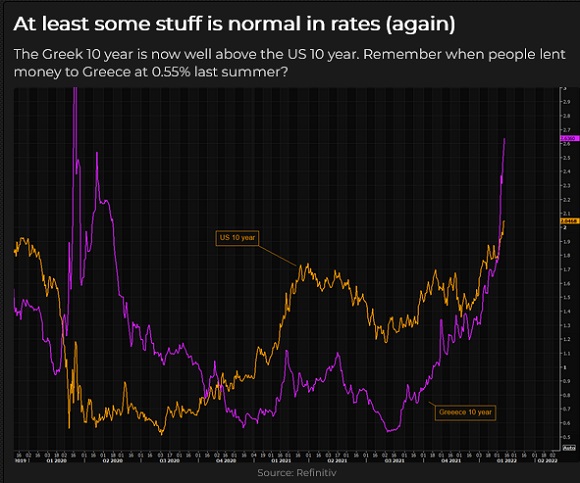

The 10-Year Greek yield rose from 0.55% last summer to 2.63% (Purple line below), while the 10-Year UST rallied from 1.2% to 2.05%. (Gold line.) When interest rates were historically low last summer, weaker credits could borrow “cheap” relative to quality credits. As interest rates have risen, the spreads have “gone out.” This is true for sovereign borrowers as well as corporate. (If you wondered why Greece could borrow at rates substantially below the rates the USA paid, take a bow in the direction of the magnificent ECB bond-buying program.)

(The “rate of change” – the delta – feeds on itself as people (option sellers, for instance) who were unprepared for the speed and magnitude of the recent move capitulate and liquidate their positions, adding weight to the chain of falling dominos.)

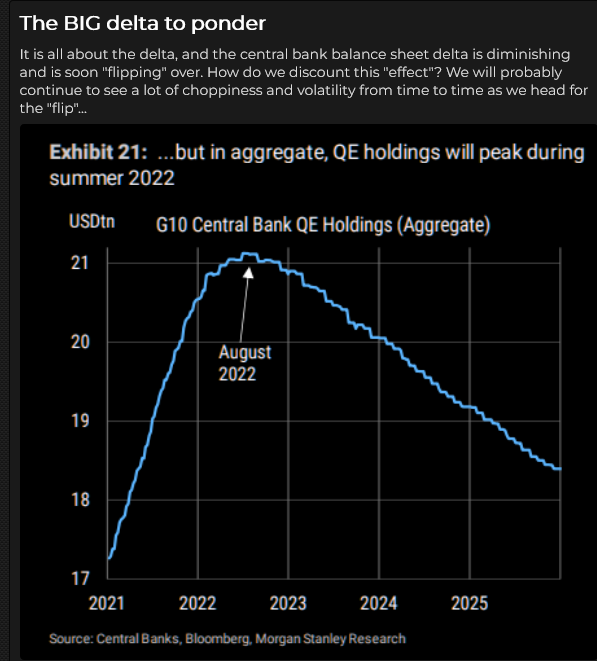

Another “rate of change” to consider is the Fed changing from buying bonds (QE) to selling bonds (QT). The chart below was created on Wednesday. As of Friday, the switch from QE to QT looks more like May than August. (Maybe earlier if Bullard has his way – unless, of course, “Ukraine.”)

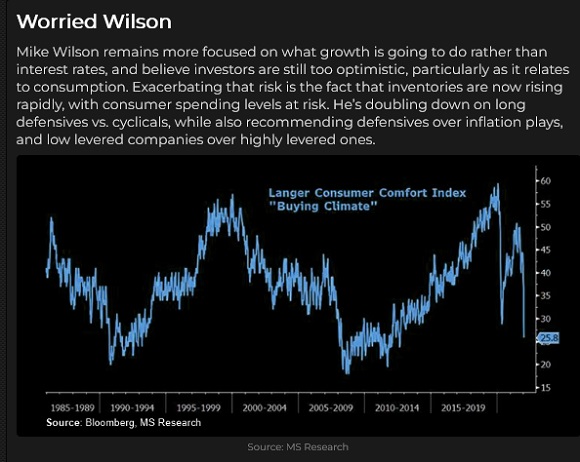

Consumer confidence was reported Friday at the lowest level in more than ten years – consumers are worried about inflation – and may reduce their buying of non-essential items/services.

So what is the Fed going to do?

They are still buying Billions worth of bonds and mortgages every week, and, despite all the talk, they still have interest rates nailed to the floor. The growth in the Fed’s balance sheet since March 2020 is highly correlated with rising stock indices – if they wind down QE and reverse to QT (as they have indicated they will do), will stocks tumble?

I recently suggested that the Democrats, sensing disaster in the mid-terms, may push the Fed to kill inflation, even if it means throwing the stock market under the bus. (Many voters don’t own stocks directly.)

Some analysts are forecasting that the Fed may be tightening into a recession, creating a stagflationary environment, and tightening monetary policy won’t diminish inflation caused by supply chain issues.

And then the Russia/Ukraine wild card problem suddenly got a lot worse

Late Friday morning, the “news” was that the White House expects the Russians to invade Ukraine next week and advised Americans in Ukraine to leave immediately. The US Dollar, Gold and crude oil soared, bonds bounced while stocks and other risk assets fell.

When gold and the US Dollar are rallying simultaneously, it is usually a sign that capital is seeking safety.

The Euro/Yen spread came in as Europe is at risk of Russia (in more ways than one), and the Yen is a go-to haven.

The Russian Ruble fell on the news.

WTI crude oil jumped >$4 on the “invasion” story, with front-month March nearly touching $95. Backwardation steepened with March 2023 at >$14 discount to Mar 2022.

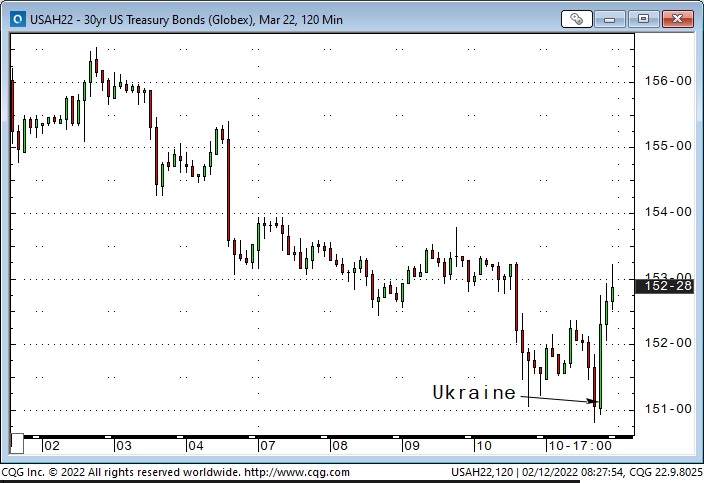

Before the Russian news hit, Treasury bonds were making new lows for the week (10-year yields hit a high of 2.06%). Bonds caught a “haven” and short-covering bid on the news.

My short term trading

I started this week with no position and stayed flat until Thursday. I was waiting for an opportunity to short the stock market, and it was rising Tuesday and Wednesday. The CPI report scheduled for early Thursday was another reason to wait.

One of my favourite topping patterns is an “M” pattern where the right shoulder is lower than the left. The bounce from the January lows ran into resistance at the Fibro 0.618 level.

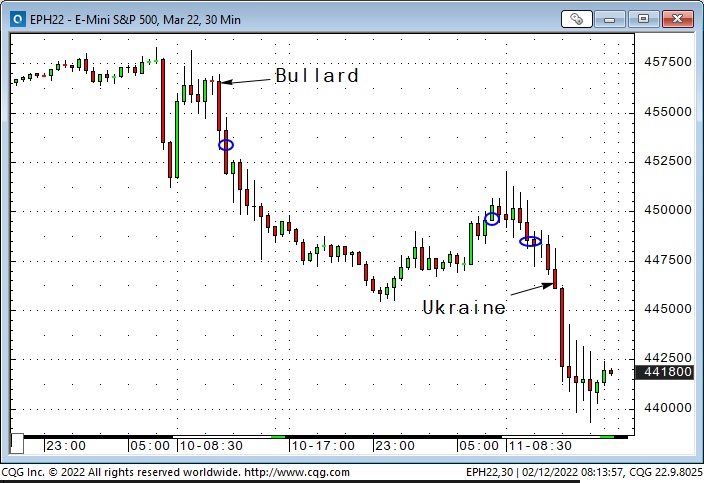

The Thursday CPI report was stronger than expected – interest rates lurched higher and kept rising throughout the day. Stock indices, currencies, gold and crude initially fell on the CPI report but then bounced back – until St. Louis Federal Reserve President Bullard opined that the Fed should “immediately” become aggressively hawkish.

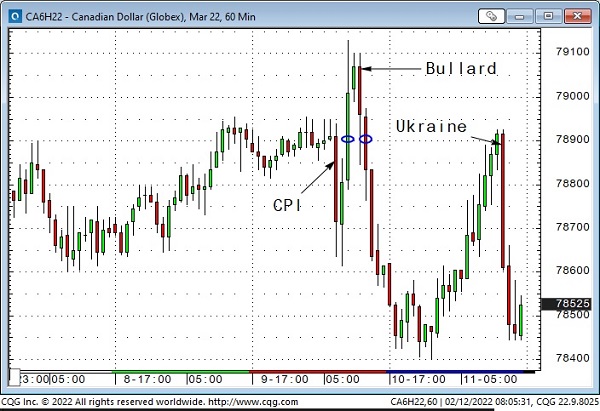

I bought the Canadian Dollar as it rallied back from its CPI-induced dip. The stock market was rallying, crude oil was rallying, and the Euro was rallying – all good news for the CAD, and if it broke above the recent highs ~79 cents, it might soar.

The CAD got to 7910 and then reversed along with other markets on the Bullard comments. When I saw the “across the board” reaction to the Bullard news, I covered my long CAD position immediately at a breakeven.

After covering the CAD, I realized I had a great setup to short the S+P. It had bounced back to last week’s highs on Tuesday, dropped from around those highs on the CPI report, jumped back to the “Bullard” highs and started to fall from there. (Falling away from a lower high.) I got short and watched the market fall ~70 points into the overnight lows.

I covered my short S+P for a gain of ~30 points early Friday morning as the market rallied back ahead of the day session opening. I reinstated the position a couple of hours later when there was no follow-through to the opening range rally. The market then began to break down through technical levels and then plunged on the Russia/Ukraine news. With the market closing near the lows of the month, I decided to stay short into the weekend.

I bought T-Notes during the Thursday overnight session, thinking they were extraordinarily oversold and could bounce, considering the weakness in the stock market. The dramatic rise in short-term interest rates added to my view that the Fed could be tightening into an economic slowdown – yet another reason to buy bonds. My setup was buying the Notes after they bounced from a higher low, but I was stopped for a slight loss very early Friday morning – and missed the “Ukraine” bond rally on Friday.

My P+L on closed-out trades this week was essentially flat; I had unrealized gains on my short S+P of ~0.80%.

On my radar

I’ve thought that the American equity markets may have made a long-term top at the beginning of this year. They’ve had an incredible run from the 2009 lows, with a spectacular run since the 2020 lows, but it may be time for a significant correction – something more than 10 to 15%.

Thoughts on trading

Regular readers know that I believe it is essential to keep the time frame of your analysis in sync with the time frame of your trading/investing. I think this is especially important in terms of risk management – for instance, don’t buy something for a short term flip and then decide to keep it as a long term “hold” because it’s gone against you and you “know” it will be a winner if you “give it a little more time.”

I will sometimes “mix” my time frames to find good entry points. For instance, even though most of the trades I write about are short-term, I definitely have longer-term market opinions. For the past several months, I’ve thought that the multi-year rally in stocks was getting long in the tooth. (Essentially, I thought market psychology had got to the point where too many people thought it was easy to make money buying stocks.)

I have a “bias” that the long-term trend in stocks may have topped out (and I should look for opportunities to make money shorting stocks). Still, I know that “having a bias” is not a timing tool, so I will analyze short-term price action to find setups where I can get short – in sync with my longer-term view of market direction. (I only trade futures and options, so by “stocks,” I mean stock index futures.)

Technical traders would likely describe this technique as “trading in line with the trend.” Depending on their preferences, if a market is in a long-term uptrend and experiences a short-term correction, they might “buy the dip” or buy a breakout to new highs. Either way, they use short-term technical signals to buy a rising market.

Quotes from the notebook

“People have an amazing ability to arrive at a solution before truly understanding the problem.” Chris Blundell P.Eng. 2022

My Comment: Chris is a long-time friend, well-read and well-travelled, who has had great success as an entrepreneur in the Canadian oil patch. He used this quote in a recent email to me. His comment is painfully accurate, and wouldn’t the world be a better place if people put a lot of effort and compassion into understanding a problem before offering their solutions?

“You can always (always) find some indicator, somewhere, that will suggest something is a bubble. If you couldn’t, a legion of bloggers running lucrative doomsday-themed websites would instead be serving gimlets to bankers for tips, rather than lampooning them for click money.” Walt, The Real Heisenberg

My Comment: I’ve been a subscriber to the Heisenberg Report for a few years. It’s well-written, biting, and insightful, and I love black humour!

“The lust for yield has overwhelmed prudence.” Bob Hoye, 2017

My Comment: Bob has been a good friend for 40 years. He is a very well-informed market historian and, as you can see, very quotable! A few years ago, I introduced Bob at a conference as a man who knew a lot about the Dutch Tulip Bubble Mania because he had been there while it happened.

The Barney report

Barney and I were home alone for a couple of days this week when my wife went to Vancouver. He was reasonably patient with me in my office, and I rewarded him (tired him out) with long off-leash walks. He is now five months old and just north of 40 pounds.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

Bitcoin (BTC) broadly held levels at $44,000 and above on Feb. 16 amid fresh optimism that another macro low would be avoided.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding after an overnight dip to $43,725 on Bitstamp.

In a tightening range, the pair looked increasingly primed for a breakout up or down Wednesday, as support and resistance levels stayed within a short distance of spot.

While fears that a stocks correction could cause fresh pain for bears remained, one analyst, in particular, argued that there was now hardly any impetus to sell BTC after three months of downside.

“When I consider everything BTC HODLers withstood in 2021- When I observe global de-risking for 3+ months- When I see 48% of Realized Cap STILL held from 3–12 months ago after a $33k scare- I ask: with all existing FUD priced in, barring surprises, who remains to sell here?” TXMC argued…read more.

Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 30 energy, energy service and pipeline & infrastructure companies with regular updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

EIA Weekly Oil Data: Overall, the EIA data of Wednesday February 16th was moderately bearish for energy prices as US Commercial Crude Stocks rose 1.1 Mb versus the forecast of a decline of 900Kb. The main reason for this difference is that Net Imports rose 230Kb or by 1.6Mb on the week. Motor Gasoline Inventories fell 1.3Mb while Distillate Fuel Oil Inventories fell 1.6Mb. Refinery Utilization fell 2.9 points to 85.3% from 88.2% a week ago and this slower refinery activity lowered inventories of products. US Crude Production remained steady at 11.6Mb.

Total Demand rose 860Kb/d to 22.74Mb/d as Other Oils demand rose by 1.019Mb to 5.80Mb. Motor Gasoline demand fell 556Kb/d to 8.57Mb/d. Jet Fuel Consumption rose 102 Kb/d to 1.51Mb/d. Cushing Crude Inventories fell 1.9Mb to 25.8Mb.

EIA Weekly Natural Gas Data: Weekly withdrawals are rising as the cold weeks of winter are here. Last week’s data showed a withdrawal of 222 Bcf, lowering storage to 2.101 Tcf. The biggest US draws were in the South Central (74 Bcf), the Midwest (64 Bcf) and the East (56 Bcf). While a large draw again, it is by no means one for the record books. The largest US draw occurred in early January 2018 at 359 Bcf and the largest draw last year occurred in mid-February with a draw of 338 Bcf. We have now had four weeks of winter draws over 200 Bcf.

The five-year average for last week was a withdrawal of 177 Bcf and in 2021 was 171 Bcf due to mild weather. Storage is now 9.3% below the five-year average of 2.316 Tcf. Today NYMEX is US$4.52/mcf due to an expected colder spell in the coming days. AECO is trading at $3.59/mcf due to the milder weather in western Canada. February (being the key winter month for natural gas demand), is still likely to see price moves to the upside on very cold days. After winter is over natural gas prices typically retreat and if the general stock market decline unfolds as we expect, a great buying window should develop at much lower levels for natural gas stocks in Q3/22.

OPEC January Monthly: On February 10th OPEC released their February 2022 Monthly Forecast Report (January data). As repeated in the past few months they have not added the 400Kb/d, their stated monthly production increase. In January only 64Kb/d was added. Production rose to 27.981Mb/d but remains below the 29.368Mb/d produced in December 2019 before the pandemic hit. So they still have nearly 1.4Mb/d to bring on just to get back to pre-pandemic levels. Moral suasion by the US, China and India does not seem to be influencing OPEC’s production decisions. OPEC may be watching events in Europe and may be standing by to add more production if energy export sanctions are implemented against Russia upon any invasion of Ukraine. Saudi Arabia and the UAE alone could add 2.5Mb/d if they wanted to.

The biggest increase came from Nigeria at 81Kb/d, followed by Saudi Arabia at 54Kb/d and then by UAE at 44Kb/d. Surprisingly Kuwait only added 27Kb/d to 2.58Mb/d, even though they could have added 130Kb/d more just to get back to 2019 pre-pandemic levels of 2.71Mb/d. Sanctioned Iran saw production rise by 21Kb/d to 2.503Mb/d. Venezuela saw a decline of 51K b/d as they could not get sufficient diluent this month from Iran, China or Russia. OPEC sees 2022 consumption at 100.8Mb/d, up 4.15Mb/d from the 96.63Mb/d consumed in 2021.

Baker Hughes Rig Data: The data for the week ending February 11th showed the US rig count rose by a significant 22 rigs (up three rigs the prior week) to 635 rigs last week. Of the total rigs working last week, 516 were drilling for oil and the rest were focused on natural gas activity. The overall US rig count is up 60% from 397 rigs working a year ago. The US oil rig count is up 69% from 306 rigs last year at this time. The natural gas rig count is up a more modest 31% from last year’s 90 rigs, now at 118 rigs. Texas had the largest increase in rigs with 13 added last week and the total rising to 300 rigs. The Permian (Texas and New Mexico) added seven rigs taking the total rigs working in this lucrative basin to 301 rigs.

Canada had an increase of one rig (up one rig last week as well) to 219 rigs. Canadian activity is up 24% from 176 rigs last year. There was one more oil rig working last week and the count is now 137 oil rigs working, up from 101 last year. There are 82 rigs working on natural gas projects now, up from 75 rigs working last year. Staffing of rigs in Canada is becoming a problematic issue and adding significant more rigs in the near term is unlikely. While day rates are rising, so are costs and margin improvements so far are not what one should expect as the industry activity picks up.

The overall increase in rig activity from a year ago in both the US and Canada should translate into rising liquids and natural gas volumes over the coming months. The data from many companies’ plans for 2022 support this rising production profile expectation. We expect to see US crude oil production reaching 12.0Mb/d in the coming months. Companies are taking advantage of attractive drilling and completion costs and want to lock up experienced rigs, frack units and their crews as staffing issues are difficult for the sector. We expect US production to reach 12.5Mb/d before the end of this year.

Conclusion:

Bearish pressure on crude prices:

1. The Omicron pandemic is far from over but is losing its impact on individuals’ reticence to move about. Usage of energy as mandates are loosened and vaccination rates have risen is increasing especially for Jet Fuel. Covid-19 deaths are rising for the unvaccinated. Deaths in the US have reached 922K (up 16K over the last week) and worldwide has reached 5.83M.

2. The window for Russia to invade Ukraine is closing. If they want to move in they need to do so in the next two-three weeks or they will miss the window. Heading into mid-March the ground of attack will have thawed out and an invasion becomes unlikely. The window for exercises ends on February 20th so around this date is the window for any military action. Some NATO sources now see Russia having 180K troops in position to invade and that Kiev could be a key target.

A few days ago Russia acknowledged that it was willing to go the diplomatic route. Was this part of the poker game or a sign of good faith? They say that they have removed some troops from the front lines, however NATO does not see sufficient evidence of this but rather sees more troops being added across the invasion routes. Is this a removal of troops needing maintenance on their equipment and maybe some R&R, before being brought back to the front lines? Russia has staging areas deeper in Russia and Belarus as well as forward bases close to Ukraine’s border. In the meantime Russian hackers have increased their cyberwarfare attacks in Ukraine. Ukraine’s military (command and control) services and two large banks were targeted in recent days.

3. The Iran nuclear negotiations are working towards sealing a deal and having sanctions removed so that they can sell their oil around the world. Negotiations appear to be making a breakthrough with a timeline of the end of February. President Biden may be giving away more to Iran in order to have sanctioned Iranian oil available if Russia invades Ukraine. If Iran receives sanction relief it could increase production by over 1.5Mb/d almost immediately. Iran also has over 200Mb in storage around the world near its buyers, so those volumes could be added to supplies quite quickly.

Bullish pressure on crude prices:

1. Russia provides over 26% of western Europe’s crude oil needs and around 41% of its natural gas needs. Any sanctions on these sales would not be easily met by other producers. This effectively is a two-edged sword. The US is sending over more cargoes of LNG and has asked Qatar to do the same. While the Nord Stream 1 pipeline is operational with gas flowing into Germany, the second pipeline is part of the potential sanction regime by President Biden. Germany may accede to this but has not done so publicly as they desperately need the natural gas. Current levels of imports into EU countries may stay at current levels but increases (especially of Nord Stream 2) will not be permitted.

2. Russia has threatened increased cyber attacks against Ukraine and NATO countries (including the US) if President Biden escalates pressure on Russia upon any invasion activity. Cyberwarfare against Ukraine’s infrastructure and military control systems has already started. The US and many other countries have ordered their citizens to leave the country and have closed their embassies in the capital Kiev moving some personnel to Lviv in western Ukraine near the Polish border.

CONCLUSION:

The concern about an imminent invasion of all of Ukraine continues to spike crude oil prices higher. WTI rose to over US$96/b this week. WTI today is at US$94.82/b. If Russia just moves on eastern Ukraine then crude could spike to nearly US$120/b. If Russia plans on taking over all of Ukraine and places its military on the borders of Poland, the Baltic countries and Romania, facing off against NATO forces, then crude oil prices could spike even higher. We do not see Russia planning to go that far. It may want to gather the Russian speaking people in eastern Ukraine into its orbit and have a land corridor to Crimea, but anything more would invite insurgency warfare in western Ukraine.

If there is no invasion in the next short while and no sanctions against Russian energy exports occur, then the price of WTI crude should retreat quickly towards US$62-65/b as the war premium is removed and weak economic data around the world hint at recession this year. If sanctions against Iran oil sales are removed by an agreement during March, then crude oil prices would head down quite fast.

Energy Stock Market: The S&P/TSX Energy Index currently trades at 204 (up eight points over the last week) as the war event window closes in.

Our February SER Monthly Report comes out next Friday and covers the latest signs of internal deterioration in the general stock market and increased weakness in key world economies. Significant stock market downside is ahead and investors should be defensively prepared. The MEME stocks have been massacred and a few of the FAANG and related stocks have been severely eroded in value (Meta-FB, Netflix, Roblox, Shopify, Viacom and Zoom are just some of the recent sharp decliners) Remember how you felt in the later stages of bear markets as were seen in 1987, 2000, 2008, and 2020? Prepare yourselves for this impairment risk to your assets. Last week alone we had two down days over 500 points in the Dow Jones Industrials. Much greater daily declines are likely in the weeks ahead.

Our February SER report covers this painful market situation. The Q4/21 and year end results for 2021 are starting to be released for the 30 companies that we cover. In next week’s issue we cover those companies that have reported by the close on Friday February 18th. In the March issues we will cover the rest of the regular reporting run.

Our Q1/22 quarterly SER webinar will be held on Thursday February 24th at 7PM MT. If you want to join/register for this event or access our Interim Report or the upcoming SER Monthly become a subscriber. Go to https://bit.ly/34iKcRt to subscribe.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

Investment lesson/warning:

Twitter’s sales have grown from $535 million at its IPO in 2013 to over $5 billion today.

But its stock is 20% below its 1st day close in 2013. What happened? Investors were paying 41x sales at its IPO and 6x sales today. Lesson — the price you pay matters.

Eg. see Peleton, Beyond Meat, Gamestock, Tilray, Virgin Galatic

Charlie Bilello, CEO Compound Capital Advisors