Currency

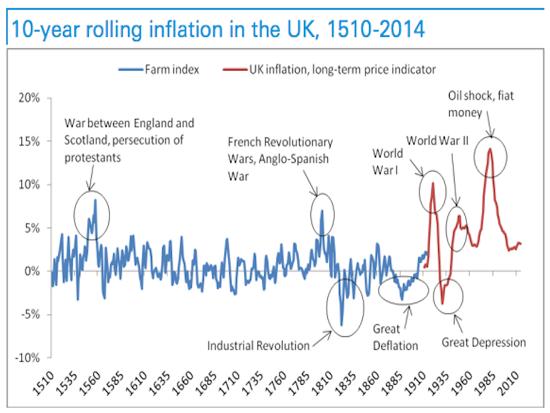

Business Insider just posted a Deutsche Bank chart that illustrates the difference between life under the Classical Gold Standard and today’s “modern” forms of money. It’s for the UK only but is a pretty good representation of the world in general:

For the first four hundred years depicted here, money was gold and silver — the quantity of which rose at roughly the same rate as the human population. Prices during that time fluctuated, but only modestly by today’s standards, and they always returned to more-or-less the same level. In other words, money held its value for not just years but centuries. It was a fixed aspect of the financial environment and was therefore not a tool of economic policy. Governments and individuals had to adapt to unchanging money rather than forcing money to adapt to political circumstances.

A phase change occurs in the 20th century when the US created the Federal Reserve and World Wars I and II placed survival above monetary stability for most of Europe and Asia. Violent swings in the value of money became the norm, and with the subsequent worldwide adoption of fiat currencies — which governments can create at will — volatility has soared.

Clearly, something bad has happened — and just as clearly something really bad is coming. The question is what. Inflation and deflation both have their articulate proponents, many of whom (adding yet another layer of complexity) expect both but disagree on the order in which they’ll occur. See here, here, here, and here. This is a fascinating debate, with huge implications for personal financial planning. We all have to choose a side with our investments, and the risks and potential rewards have never been higher.

The follow-on question is also fascinating: What do we use for money once fiat currencies inevitably fail? Will central banks adopt some version of Milton Friedman’s computer that increases the supply of base money by a pre-set amount each year, removing the temptation to inflate? Will cyber-currencies like bitcoin turn out to be secure enough to gain worldwide acceptance, eliminating the need for underlying physical reserves? Is a high-tech gold standard possible, in which physical bullion backs an electronic currency that circulates in place of unbacked fiat currencies? Again, this is interesting in its own right but crucially important for everyone with money to invest. Stay tuned.

Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): bullish

The U.S. stock market indexes lost between 0.8% and 1.5% on Friday, as investors reacted to economic data announcements, quarterly corporate earnings releases. The S&P 500 index is at its support level of 1,990-2,000. On the other hand, level of resistance is at around 2,020-2,025, marked by recent local highs. It still remains within three-month long consolidation, as we can see on the daily chart:

Expectations before the opening of today’s trading session are slightly positive, with index futures currently up 0.2%. The main European stock market indexes have been mixed so far. Investors will now wait for some economic data announcements: Personal Income, Personal Spending, PCE Prices – Core number at 8:30 a.m., ISM Index, Construction Spending at 10:00 a.m. The S&P 500 futures contract (CFD) is in an intraday consolidation, following Friday’s decline. The nearest important level of support remains at around 1,980-1,985. On the other hand, resistance level is at 1,995-2,000, among others:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades along the level of 4,150. The nearest important level of support is at around 4,130, marked by Friday’s local low, as the 15-minute chart shows:

Concluding, the broad stock market sold off on Friday, following some uncertainties, ending of the relatively volatile month, among others. It continues to look like a medium-term consolidation following last year’s October-November rally, however, the index trades at this consolidation’s lower limits. We still prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

A clip on technology from Martin D. Weiss, Ph.D. – “One broad stock sector that was the single best performer when energy markets collapse — technology.

Historically, it has surged an average of 64% during major oil-price declines, plus another 35.1% within 12 months after oil prices hit bottom.

And it makes all the sense in the world: Consumers and corporations save fortunes on energy. So they promptly shift those resources to the one thing that can most efficiently improve their lives or their business — hardware and software.

Two weeks ago, I drilled down deeper and demonstrated that, in the world of technology, the single subsector that had the best performance of all was software and related services — up 77.5% during the oil-price decline and up another 49.9% twelve months later.

And today, I’m going to tell you about one massive, explosive example of a new techno-megatrend few people are talking about. Our overarching goal:

To show you how to invest safely in the most advanced tech companies by using the most advanced investment technology.

Why are we taking this crucial step right here and right now? For four critical reasons …

First, because that’s where all the facts are steering us — forcefully and unambiguously:

I repeat: Up 77.5% during oil-price collapses, then up another 49.9% one year later.

More ordinary investors becoming millionaires than in any other place or time.

Greater improvements to our lives than from any other material source.

Second, because, in the past, too many investors made too many fortunes on paper only … and then gave it all back. They never quite learned how to do it prudently, safely, and permanently (our forté).

Third, because technology — and especially software — is probably the only constructive megatrend on the entire planet that can pierce through the many destructive forces I told about last week — Turmoil, QE, Deflation, War and Terror.

And last, because technology has always been such an important part of (your) own life.

….read the entire article HERE

A week ago we learned that the king of Saudi Arabia, Abdullah bin Abdulaziz Al Saud, passed away at the age of 90. Following the announcement, crude oil immediately spiked 2.5 percent over uncertainty of how this might affect the Middle Eastern kingdom’s position on keeping oil production at current levels.

But the new leader, King Salman bin Abdulaziz Al Saud, has already tamped down this uncertainty, stating that Saudi Arabia will hold to the decision made at last November’s Organization of Petroleum Exporting Country (OPEC) meeting.

All of this speculation just shows that Saudi Arabia is indeed the 800-pound gorilla when it comes to oil. Until very recently, it was the world’s top oil producer and exporter, before the American shale boom catapulted the U.S. into first place. Now, however, with prices less than half of what they were in July, many U.S. oil companies have been forced to shut down rigs, effectively slowing down output.

These events got me curious to dive deeper into Saudi Arabia’s economy and the extent to which it’s dependent on crude revenues. Below are some of the most interesting facts, gathered from a September case study by Richard Vietor and Hilary White of Harvard Business School.

Despite beliefs to the contrary, Saudi Arabia requires a breakeven price of $80 per barrel of oil. True, the stuff is easy and inexpensive to extract in Saudi Arabia’s desert—the prevailing notion is that one need only stick a straw in the ground and oil comes gushing out—but to afford its bloated social spending program, the government needs prices to be much higher. Right now, oil revenues make up a whopping 90 percent of the country’s budget.

Despite beliefs to the contrary, Saudi Arabia requires a breakeven price of $80 per barrel of oil. True, the stuff is easy and inexpensive to extract in Saudi Arabia’s desert—the prevailing notion is that one need only stick a straw in the ground and oil comes gushing out—but to afford its bloated social spending program, the government needs prices to be much higher. Right now, oil revenues make up a whopping 90 percent of the country’s budget.

- Recognizing that its economy and energy portfolio are too oil-dependent, the kingdom is seeking ways to diversify. Before his death, King Abdullah ordered that other sources of energy be pursued, including nuclear and renewable energy. State-owned Saudi Aramco, the largest oil producer in the world, is currently ramping up exploration for natural gas. The company estimates that only 15 percent of all land in the nation’s borders has been adequately explored for the commodity.

Saudi Arabia is nearing completion of a 282-mile high-speed rail line connecting the holy cities of Mecca and Medina. It’s unclear how many Saudis will use the trains, though, since fuel prices are extremely low as a result of government subsidization. Prices are so low, in fact—a gallon of diesel is less than $0.50—that it has led to excessive and wasteful use of energy resources that could be reserved or exported instead.

Saudi Arabia is nearing completion of a 282-mile high-speed rail line connecting the holy cities of Mecca and Medina. It’s unclear how many Saudis will use the trains, though, since fuel prices are extremely low as a result of government subsidization. Prices are so low, in fact—a gallon of diesel is less than $0.50—that it has led to excessive and wasteful use of energy resources that could be reserved or exported instead.

- Saudi Arabia maintains a strong pro-business climate to reel in foreign investors. It offers low corporate taxes (20 percent), no personal income taxes and attractive perks, including land, electricity and free credit. Because of these efforts, the country boasts the highest amount of foreign investment in the Middle East—$141 billion in the past five years alone.

- Saudi Arabia, believe it or not, has the largest percentage of Twitter users in the world. One of the main reasons for this is that more than half of its 29 million citizens are under the age of 25. As is the case in India, which also has a high percentage of young people, this is seen as an opportunity for the country’s future productivity.

However, the kingdom has high unemployment among not just young people but also women. About 30 percent of working-age young people are without jobs; the figure is 34 percent for women. The country also has a shockingly low labor force participation rate of 35 percent. Saudi Arabia relies on cheap migrant workers, who now make up about 30 percent of the population.

However, the kingdom has high unemployment among not just young people but also women. About 30 percent of working-age young people are without jobs; the figure is 34 percent for women. The country also has a shockingly low labor force participation rate of 35 percent. Saudi Arabia relies on cheap migrant workers, who now make up about 30 percent of the population.- A vast majority of Saudis work for the government. Only about 10 percent of working Saudis are employed by private companies. Why? Workers can make either $400 a month on average in the private sector, where working conditions tend to be dubious at best, or $2,000 a month in the public sector. In 2011, about 800,000 new private-sector jobs were created, but of these, 80 percent went to foreign workers.

But this trend is not restricted to Saudi Arabia. As you can see in the chart below, here in the U.S., government jobs growth has broadly outpaced all other industries over the years.

This saps intellectual capital from the real engine of innovation and ingenuity, the private sector. A robust private sector is necessary to create and foster successful companies such as Apple, held in our All American Equity Fund (GBTFX) and Holmes Macro Trends Fund (MEGAX). The tech giant’s iPhone 6 sales led the way to a record earnings report of $74.6 billion—the largest corporate quarterly earnings of all time.

Larger Image

Larger Image