Timing & trends

This past week, I penned a piece entitled “You Think Like A Bear But Invest Like A Bull?” that discussed the disconnect between my writings and the “Bullish” posture of the portfolio. To wit:

This past week, I penned a piece entitled “You Think Like A Bear But Invest Like A Bull?” that discussed the disconnect between my writings and the “Bullish” posture of the portfolio. To wit:

However, when that reversion process occurs is anyone’s guess.

Therefore, while the analysis suggests that portfolios should be heavily underweighted ‘risk,’ having done so would have led to substantial underperformance and subsequent career risk.

This is why a good portion of my investment management philosophy is focused on the control of ‘risk’ in portfolio allocation models through the lens of relative strength and momentum analysis.

The effect of momentum is arguably one of the most pervasive forces in the financial markets. Throughout history, there are episodes where markets rise or fall, further and faster than logic would dictate. However, this is the effect of the psychological, or behavioral, forces at work as ‘greed’ and ‘fear’ overtake logical analysis.

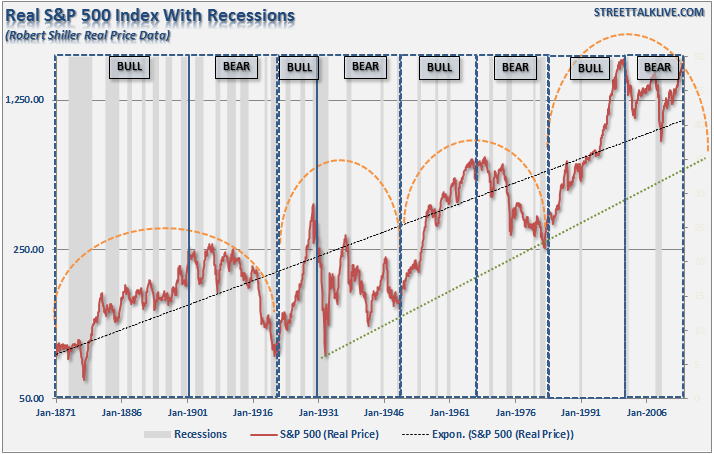

I have discussed the effect of ‘full market cycles previously as shown in the chart below”

A list of contents in this newsletter:

This will be about the weirdest thing you see today….

This will be about the weirdest thing you see today….

You know that we talk a lot about the insane level of government interference in our lives. About what we can and cannot put in our bodies. The amount of interest we’re entitled to receive on our savings. Etc.

But I’m noticing now even more ridiculous trends of governments wanting to get involved in people’s sex lives.

Last year the Danish government promoted an initiative called “Do it for Denmark”, encouraging Danes to travel abroad and have sex while on holidays. They even have a pretty racy Youtube video featuring a scantily clad gorgeous blonde waiting to do her duty for her country and procreate.

Singapore as well has a catchy jingle about going out and making babies, brought to you by the same guys who did the Mentos theme song.

The Swedish government actually spent taxpayer money on its new genitals song, so it can start indoctrinating children early on how they can make babies.

Here in Japan, which has one of the lowest birthrates in the world, the government is desperate to find solutions to what it calls its libido crisis.

According to their data, Japanese men aren’t terribly interested in sex and the women find sex to be bothersome.

Japanese being expert process engineers are coming up with a government solution to reengineer sexual desire in their country.

(I have to imagine that if this solution reached US soil, the government option would include the smooth sounds of Barack Obama whispering some pillow talk: “C’mon, lemme give you this big tax cut, baby…”)

Easily the most ridiculous solution they came up with is to impose a ‘handsome tax’ on attractive men. I thought this was a headline from the Onion, the greatest news source in the world, but it turned out to be true.

The idea being that if you tax handsome men, then less attractive men would have more money and hence be able to attract women.

Zerohedge covered this in fantastic detail—I encourage you to check it out. This is not a joke.

The thing that many of these countries have in common, Japan, Denmark, etc., is a rapidly declining birthrate.

A declining birthrate is disastrous for an economy, particularly for an ageing place like Japan.

Ironically, the oldest person in the world turned 117 years old yesterday—and no surprise that she’s Japanese. In fact, Japan is home to one of the oldest populations in the world and has one of the longest life expectancies.

Curiously they also have one of the largest pension programs in the world. You put all that together and you have fewer and fewer young people paying more and more of their income to support a disproportionately large population of retirees who are living for decades after they stop working.

Each one of these governments is trying to find a solution to fix this unsustainable fiscal problem.

In Denmark they seem to think that people aren’t going on vacation enough. In Japan they think it’s a problem of sexual desire. But in actuality it has everything to do with cost of living.

Month to month, year to year, it’s hard to notice the subtle changes in costs of living and standards of living, but after a long period of time it’s easy to look back and remember how things used to be.

You used to be able to support a family on a single income. You used to be able to afford medical care and higher education.

It’s often said that the greatest expense that someone will have in their life is his or her home. That’s total nonsense.

Now, I’m not saying it’s not worth it, but the biggest expense most people will have is family, and particularly children.

And after years and years of suffering through pitiful, destructive policies that have chronically made people less prosperous, it’s no surprise that they’re coming to the conclusion—you know, we can’t really afford to have a child right now.

There are consequences to conjuring money out of thin air. There are consequences to destructive policies.

So destructive in fact that central bankers and politicians even have the power to make a population disappear.

How ironic that they try to fix their own problem by trying to introduce themselves into our bedrooms.

Today, we’re going to revisit yesterday’s subject – something so surprising and counterintuitive that almost no one expects it or is prepared for it.

We’re talking about a sudden disappearance of dollars.

For a brief time – perhaps three days… maybe three months – Americans will wonder what happened to their money. The greenback will become more precious than gold… perhaps even a matter of life and death.

But we’ll come to that in a moment…

First, a dear reader wrote to ask about our new “Trade of the Decade.”

The trade in question is not based on any forecast. We simply take a look at what has gone up the most in the last 10 years and sell it (or “go short,” as they say on Wall Street). On the other side, we look for what has gone down the most and buy it.

We let mean reversion do the rest…

(In statistics, “mean reversion” describes the phenomenon whereby extreme variables – such as stock and bond prices – tend to move back toward their average over time.)

More Juice in Japan

At the beginning of this decade, the best trade we saw was to buy Japanese stocks, which had gone nowhere but down for the preceding 20 years, and to sell Japanese bonds, which had gone nowhere but up.

The trade had a not-so-hidden logic, too.

Japan was clearly borrowing itself into bankruptcy. At some point, people would realize that Japanese government debt was not worth what they had thought it was worth. They’d sell their Japanese government bonds (JGBs).

But what would they do with the money?

They would have to buy Japanese stocks.

So, how are we doing so far?

The Nikkei 225 – Japan’s equivalent of the Dow – has gone up from 10,654 to 18,703 points. In yen terms, that’s a gain of 75% since the start of 2010.

JGBs, on the other hand, have not gone down as expected – yet. They’re still going up in price (with yields falling). The price of the 10-year JGB has risen from 139 to 147, in yen terms – or about 6%

That leaves us with a net gain of about 69% in yen terms.

Not too bad. But if we are keeping score in dollars, we have to adjust for the drop in the yen. This takes our net dollar gain down to about 30% so far. (Remember, this is a trade of the decade; we still have another five years to go.)

Still, we’re happy with that. And we’re going to be a lot happier when investors finally wake up and realize their JGBs are worthless.

There’s still a lot of juice in this trade…. especially because Japanese stocks are still relatively inexpensive.

As colleague Steve Sjuggerud put it in his new True Wealth Market Intelligence service, “The best value in developed markets this month is Japan.”

A 50% Drop…

Now, let’s return to the line of thinking we took up yesterday.

We remind readers that we live in such a topsy-turvy financial world that it is hard to tell up from down and backward from forward.

Central banks and central governments issue more and more debt. But the price of debt goes up… so that the yield on $2 trillion of developed-world sovereign debt is now negative!

In other words, lenders pay borrowers to take their money. Go figure.

Meanwhile, the world economy is slowing. US corporate profits are falling. And US stock prices are so high relative to the earnings they produce that it would take a miracle to give investors a decent rate of return over the next 10 years.

Former Value Line equity analyst, and our go-to guy on stock market valuations, Stephen Jones tells us that the rate of US stock market gains is slowing.

There aren’t many examples from the past, says Stephen, but they suggest that gains will go lower and lower, until they become negative:

On October 3, when I last wrote the note, stocks were up 17.2% from one year earlier. Today, March 5, stocks are up 12.2% from a year earlier.

Forecasts are always tough, and there is not a lot of precedence at these high valuation levels. But this slowdown appears likely to continue, and thus position us with 0% year-over-year returns sometime over the coming year.

Again, precedents are few, but they have resulted in roughly 50% market declines.

A Monetary Shock

Whether that 50% collapse happens next week or five years from now, we don’t know.

But when it happens it is likely to set in motion an alarming series of events that will lead to a temporary, but violent, monetary shock…

People will go to their banks to get cash. But the banks won’t have any cash. The ATMs will run dry.

There will be a “run on the banks,” to use the old-fashioned term. People will line up, desperate to get cash. Not because they fear the bank will fail… but because they need cash to pay for the necessities.

“Wait a minute,” says French colleague Simone Wapler (or words to that effect).

“Governments are already trying to stop people from using cash. In France, transactions of more than €3,000 [$3,292] in cash are forbidden.”

In the US, too, cash is suspect.

Ask your bank for “too much” cash… and the bank is obliged to report you to the feds. And if the police stop you and find a lot of cash, they are likely to confiscate it.

“You must be doing something illegal,” they’ll say.

(In fact, the Justice Department recently revealed that US police departments seized more than $6 million from citizens in roadside stops in the recent fiscal year – despite not pursuing any criminal charges against their “suspects.” It’s all part of the Justice Department’s “Civil Asset Forfeiture” program.)

So, what would cause cash to come back into style… suddenly and overwhelmingly?

What would cause a panic into dollars?

Stay tuned…

Regards,

Bill

Market Insight:

The “Buffett Indicator” Flashes a Warning

by Chris Hunter, Editor-in-Chief, Bonner & Partner

Take your pick of valuation ratios. They’re all at or near extremes.

But today, let’s look at Warren Buffett’s favorite – the total value of the stock market relative to GDP.

In 2001, Buffett told Fortune magazine that market cap to GDP was “probably the best single measure of where valuations stand at any given moment.”

That’s bad news for investors. Because the US stock market is the most expensive it’s been relative to GDP in the last 100 years… bar an eight-month period in 1999 and 2000 at the peak of the dot-com boom.

And you know what happened next…

Add in the contraction in US corporate profits in 2015… and the picture becomes even bleaker.

According to Bloomberg, profits for S&P 500 companies are expected to come in at 2.3% for 2015 versus 5% last year.

So, what’s keeping this market afloat?

One big tailwind for stocks, as we mentioned on Wednesday, is the record level of share buybacks. (Remember, when companies buy back their shares, they cancel them. This means each outstanding share represents a higher percentage of earnings, which makes them more valuable.)

Bloomberg reports that the biggest source of funds going into the US stock market is companies buying their own shares.

They’re outspending speculators and exchange-traded funds by a 6-to-1 margin.

Stock Markets

Clearly, William McChesney Martin’s job description of the Fed is no longer applicable. The Fed and other senior central banks are not only drinking, but have embraced the punchbowl. What’s worse, they are too far into the party to quit. Compulsive policymaking, so to speak.

When opportunity presents, the Chartworks notes excesses as they occur in commodities ranging from copper to coffee to cotton as they reach identifiable peaks. This would also include precious metals as such opportunities show that “overboughts” do work in un- manipulated markets.

Overboughts in most Euro-Bonds have not worked.

Central bank manipulation of stock and bond markets is celebrated and regarded as ongoing. After all, policymakers will know when it is time to quit. Our view is that they will not willingly quit. At some point, Mother Nature and Mister Margin will take away the punchbowl.

This formidable tag team ended the rally in Junk in June. Using seasonal forces, the price peaked and fell into a Springboard Buy in December. This put an end to the decline and associated widening credit spreads. Both needed a correction and now JNK has bounced enough to register a Springboard Sell.

Resumption of widening spreads will be a negative.

The Treasury curve continues flattening, which is a positive. The Advance/Decline line on the S&P remains positive.

We have been using the NYA to keep track of the broad market. It stayed above the 50-Day ma and then popped to a new high yesterday. Widely followed senior indexes jumped to new highs as well.

The overall stock market is stretched as to duration of the run and intensity of speculation. One should be watching for change and on Valentine’s Day Ross reviewed his unique approach to the Dow Theory.

Both the Dow and the Transports set new highs on December 29th. DJIA set a fresh high yesterday. Transports have not set a new high. Non-confirmations that last for less than six weeks tend to generate modest corrections. This week is number eight, which suggests a more-than-modest correction is at hand.

Transports accomplished an Outside reversal yesterday and were weak earlier today. Can the Venerable Dow Theory overwhelm Modern Portfolio Theory?

Another timing item is the Chartworks review on the S&P rally following a severe low in crude oil prices. It counts out to around March 6 to 13.

A loss of momentum in the senior indexes would suggest an important change.

Commodities

This week, Business Insider repeated the standard definition of inflation as “Too much money chasing too few goods”. Considering the unprecedented “accommodation” by frantic central bankers, goods should be at the moon. But they are not. The problem is not in the markets but in the definition. The classic definition was “An inordinate expansion of credit”, which explains today’s rampant inflation in financial assets.

Both in base and precious metal circles the notion remains that all of that “ease” will eventually drive up commodity prices. Well, that’s how it worked in the 1970s and the link should be continuous.

Shouldn’t it?

Please!

Afraid not, the inflation in credit has been associated with soaring prices for financial assets. Eventually there will be “too many goods (paper) and not enough bids”. Have you ever seen a hot IPO market last forever? New issues always satisfy excessive demand, and then some. A future Pivot will tell some stories about the 1968 example, which was outstanding.

If history continues to guide, the failure of speculation in a bubble in financial assets will not see a massive rotation into tangible assets.

Crude continues in the forefront and satisfied our target of a possible low in January. Following previous such crashes, it took months to set a bottom. The shortest was two months and the longer the process extends, the closer it will be to the start of the next global recession when most commodities will be weak.

Rallies in crude have prompted minor rallies in other commodities, which could last for a while.

Lumber fell out of its sideways pattern and the March contract has dropped to 282. The last high was 364 in August. On the continuous contract the cyclical high was 411 set in early 2013. Importantly, it has taken out the slump in June to 295.

Rice set its cyclical high at 17.75 in 2011 and traded in a range from 14 to 16 from 2012 to early 2014. It is now at 10.45.

The old formula that a reckless Fed drives commodities is not working.

Currencies

Last June we thought that the action in the DX would go from overbought to super- overbought. That was accomplished at 95.85 on January 26th. The trading range has been between 93.85 and 95. This could be easing the overbought condition and the range could continue for a month or so.

The “World” is short the dollar. Just think about all of that debt service payable in US dollars into New York.

The Canadian dollar plunged to a “super-oversold” and has been stabilizing. The low was 78.13 set in late January. The trading range has been between 78.75 and 80.80. This could continue for some weeks.

Credit Markets

The key to a number of successful trades in lower-grade bonds as well as the stock market has been the action in JNK. At the plunge-low of 37.26 in December it registered a Springboard Buy. Last week the rally was strong enough to register a Springboard Sell.

It is now giving the latter signal on the Weekly as well as a Daily Upside Exhaustion. The latter has only been seen only 7 times since 2007 and each was followed by a significant setback.

Credit spreads which seriously widened from June until January have enjoyed a very good correction. The worst was 213 bps and the best was 191 bps on Friday. The spread is now at 193 bps. Not much but the correction could be over.

We were positive on long-dated Treasuries from January 2014 until early in December when this page started looking for “Ending Action”. The ChartWorks identified the top and we have been expecting a significant price decline.

The high for the future was 152 set at the end of January. The initial slump was a quick 8 points to 144. Most quick breaks are around 4 1/2 points. The rebound reached 147.7 earlier today, which was right at the 50-Day ma.

This is close to a 50 percent retracement and looks like a good test of the high. The forecast has been for much lower prices.

Comments on European bonds will be updated next week.

Precious Metals

When looking at gold’s real price, as in relative to commodities, it has been becoming more precious. The long decline reversed in June and increased to 505 in January. It has corrected to 451 on February 14. Now at 461, rising above 463 would end the correction. The rise of real gold prices has been one of the main features of a post-bubble contraction.

Silver’s price relative to the CRB soared to 323 (moved the decimal point) in May 2011 and plunged to 117 in December. Cleary silver was vulnerable to the crash in crude. The index has recovered to 144 in the middle of the month and has checked back to 135, which is support at the 50-Day ma.

Another feature of the post-bubble condition is silver underperforming gold. It could modestly outperform most commodities as gold outperforms “most everything”.

With our special study in November, we began to accumulate gold stocks on weakness. The sector is in a bottoming process and we are not yet fully invested.

Gold stocks are for traders and investors, gold itself is a trade against whatever currency you are in.

Link to February 27 Bob Hoye interview on TalkDigitalNetwork.com: