Mike's Content

1) The total amount of margin debt has risen by 50 percent since January 2012 and it is now at the highest level ever recorded. (The last two times that margin debt skyrocketed like this were just before the bursting of the dotcom bubble in 2000 and just before the financial crisis of 2008.)

2) In the United States, Google searches for the term “stock bubble” are at the highest level since November 2007.

3) Facebook is trading at a valuation that is equivalent to approximately 100 years of earnings, and it is currently supposedly worth about 115 billion dollars.

4) Issuance of bonds linked to loans for the shakiest borrowers hit $17.2 billion this year, more than double the amount sold during the same period in 2010. (Deutsche Bank)

5) The proportion of so-called “cov-lite” loans (loans that are made to borrowers without the normal protections for the lenders) is twice as high as the period immediately preceding the credit meltdown in 2007/2008.

This is just part of the context that you and I are dealing with as investors. Throw in facts like there are more people without jobs in the US, France, Spain and Greece than at any time in history while markets hover around all time highs and you can forgive people for being confused.

That’s why big name investors like Jim Rogers recently stated, “we are all floating around on a sea of artificial liquidity right now. We in the West have staggering debts. The United States is the largest debtor nation in the history of the world,” adding that “this is going to end badly.”

I talk to so many analysts and virtually all of them think the Fed driven market is fundamentally flawed. PIMCO’s Bill Gross, the man who manages the most money in the world tweeted earlier this week that, “all markets are in a bubble.” And like Jim Rogers, he worries about a day of reckoning – the big question is when.

John Maynard Keynes famously warned that markets can stay irrational far longer that investors can remain solvent. In other words, markets can run in either direction farther than reason would suggest possible.

This Is Where We Can Help

What I love about the markets is that when all is said and done there is no B.S., no stories, no excuses – just results. And the results of the World Outlook Financial Conference are clear.

This year our Small Cap Portfolio released at the conference this past February is up over 32%. And that was an off year. In 2012 the portfolio was up 82%. In 2011 6 out of the 11 recommendations were up over 100%. In 2010, 9 out of the 10 stocks recommended went up significantly.

I am not aware of any other conference that consistently recommended gold from 2002 to 2012 but then recommended taking profits in February 2012, and warned of a steep decline in February 2013 as a follow-up to the written warning in the first week of October 2012 that gold was heading several hundreds of dollars lower.

And if you are interested in real estate, consider that the number one recommendation 2010 for investors was to buy the Phoenix market and we added Las Vegas in 2011. People who followed our advice made a killing.

In the currency markets the number one recommendation at last year’s conference was to play the Japanese yen to go down. We exited that trade in May with a 300% gain.

I could go on but the track record of the recommendations has been exceptional. Any one of them would have paid for the ticket price many times over.

Paying For Your Ticket Many Times Over

While past performance is no guarantee of future success we are proud of the fact that our recommended Small Cap Portfolio has never failed to deliver double-digit gains every single year. But please be clear that the results we have achieved over the years have not been by accident.

Our analysts have been chosen precisely because they do have strong track records. No, they are not right every time but their uncanny ability to read the various investment markets while employing proven risk management techniques has clearly raised their probability of success dramatically.

Which, by the way, explains why our analysts like Timer’s Digest Timer of the Year, Mark Leibovit, the incredible Martin Armstrong, Canada’s best known independent real estate analyst, Ozzie Jurock and Keystone Financial’s Ryan Irvine charge in excess of $1,700 for personal consultations. Yet at the World Outlook Financial Conference you can get access to them and get your individual questions answered for as little as $119.

Our Special Bonus

If you go to Moneytalks.net you will see a number of tremendous bonuses that you’ll receive when you buy your ticket but today I want to tell you about just one that could pay for our ticket many times over.

Keystone Financial is about to release their first Small Cap Report of US Stocks. You will get that report as soon as it’s published in early January with the purchase of your ticket. Personally I can hardly wait to see what Ryan Irvine and his team are recommending.

The Point

Our goal is to literally change your investing life. I think we can do it but we need your help. You’ve got to be interested. Come to the World Outlook Financial Conference Jan 31st & Feb 1st in Vancouver. Make a weekend of it. Maybe even take advantage of our special rates at the Westin Bayshore Hotel, whether you live in Greater Vancouver or farther afield. By the way, I think that would make a terrific and meaningful Christmas gift.

I am very confident in saying that the Conference is going to be great.

Sincerely,

Mike

P.S. As you may know I am hugely interested in educating our younger generation and to that end we have a special offer – if you buy a ticket, you can bring a student absolutely free.

The only thing that we ask is you let us know you want a student ticket when you purchase your ticket because we have a limited number of tickets set aside. And I might add that the students have really enjoyed the conference. It is also a great way to share/create a common interest with your children – no matter what their age.

Conference Details

- Where: Westin Bayshore Hotel & Conference Centre, Downtown Vancouver

- When: Friday evening, January, 31 and all day Saturday, February 1, 2014

- To book Your Ticket: CLICK on the icons below

- Cost: $119 for a two day pass and only $199 for the VIP pass.

Michael’s Money Talks Show for December 7th.

Michael’s Money Talks Show for December 7th.

Michael Campbell’s MoneyTalks Show December 7th (First 1/2 Hour) starts withh Michael’s commentary where he elaborates on the major disagreement he has with who he thinks some days “is with the majority of people”.

{mp3}mtdec7leadfp{/mp3}

The Final Hour begins with Michael interviewing Robert Levy about Friday’s Unemployment Rate in the US, how it is constructed, how accurate it is, whether it will nudge interest rates higher and the effect that it will all have on Gold, the Canadian Dollar as well as other markets.

For the primary interview Michael interviews Martin Murenbeeld, Chief Economist of Dundee Wealth, an interesting economist in Michael’s opinion about whether that more positive Unemployment Statistic will finally be the trigger for the Fed to begin tapering. Whether they are likely to reduce the amount of Bonds they are buying each month from the current 85 Billion to what, will it be a light touch to 75 Billion month, a firmer one to 50 Billion a month? What would happen to markets and interest rates it they were much more aggressive and reduced that monthy Bond buying to 25 Billion, 10 Billion….possibly even 0 per month? Bottom line Michael and Martin analyse the current interest rates, whats likely to happen and where those rates are likely headed in the near future. Michael also has his take your breath away head shaking “Shocking Statistic” of the week as well as this weeks Goofy award which Michael thinks will bring on the real “we don’t like you very much” hate mail. Ozzie Jurock has a warning for you as well as offering some real do’s and don’ts if you are thinking about purchasing a ski related property. Victor Adair also answers some of Michaels questions about the markets in this jam packed final hour of this weeks Money Talks.

{mp3}mtdec7hour1fp{/mp3}

In the past three years our suggested real estate portfolio featuring where and what to buy is up over 53%. This year’s Small Cap Portfolio rose over 32% while the 2012 portfolio rose 82%. The top currency pick last year (playing the yen to go down) made 300% in just four months.

Mike

RIP The American Dream – by Zero Hedge

Prepare yourself before listening to this… calling on her self-admitted Obamaphone, Texas welfare recipient Lucy, 32, explains why “taxpayers are the fools”…

“…To all you workers out there preaching morality about those of us who live on welfare… can you really blame us? I get to sit around all day, visit my friends, smoke weed.. and we are still gonna get paid, on time every month…”

She intends to stay on welfare her entire life, if possible, just like her parents (and expects her kids to do the same). As we vociferously concluded previously, the tragedy of America’s welfare state is that work is punished.

WHEN WORK IS PUNISHED: THE TRADGEDY OF THE AMERICA’S WELFARE STATE

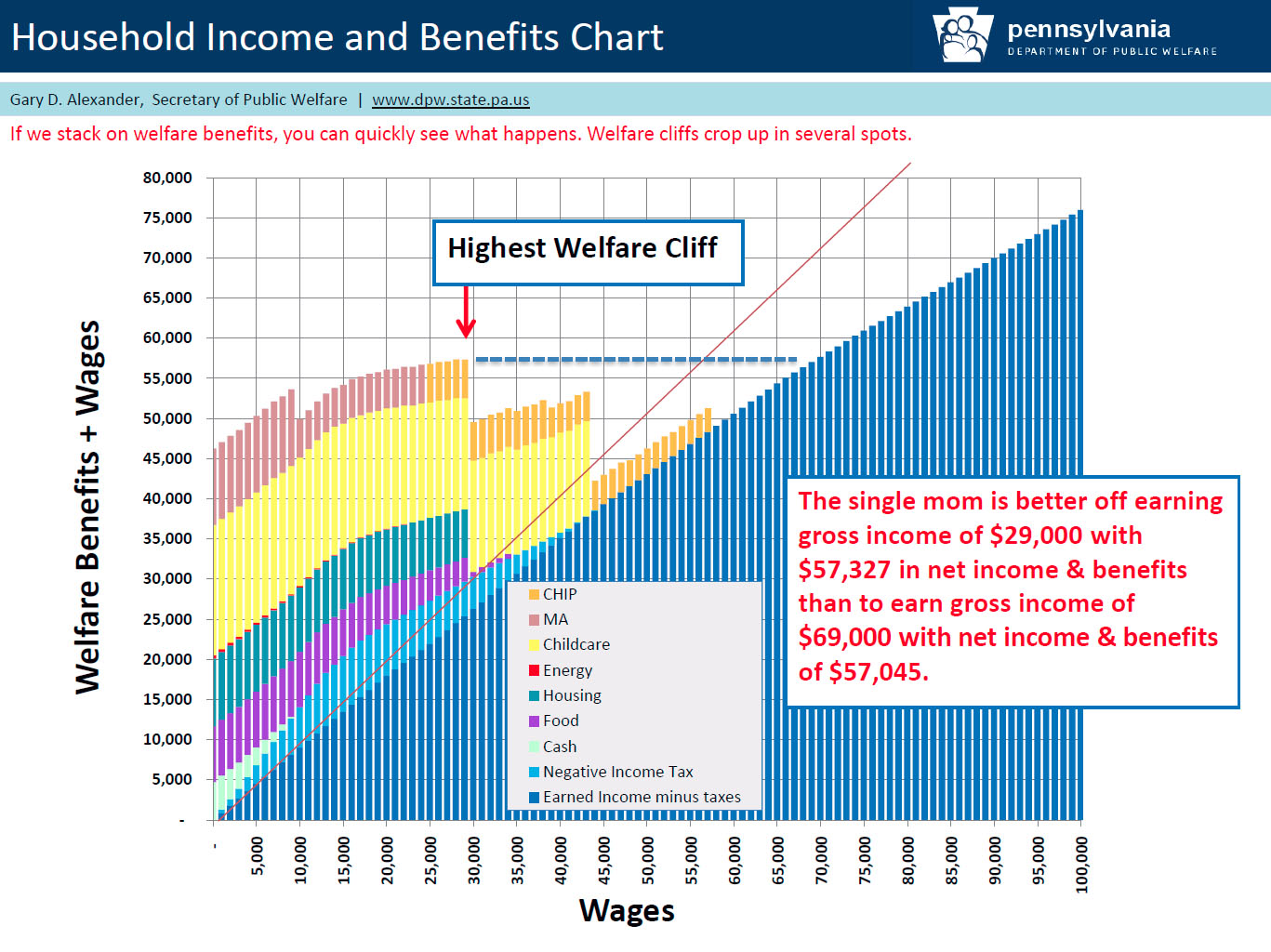

Exactly two years ago, some of the more politically biased progressive media outlets (who are quite adept at creating and taking down their own strawmen arguments, if not quite as adept at using an abacus, let alone a calculator) took offense at our article “In Entitlement America, The Head Of A Household Of Four Making Minimum Wage Has More Disposable Income Than A Family Making $60,000 A Year.” In it we merely explained what has become the painful reality in America: for increasingly more it is now more lucrative – in the form of actual disposable income – to sit, do nothing, and collect various welfare entitlements, than to work. This is graphically, and very painfully confirmed, in the below chart from Gary Alexander, Secretary of Public Welfare, Commonwealth of Pennsylvania (a state best known for its broke capital Harrisburg). As quantitied, and explained by Alexander, “the single mom is better off earnings gross income of $29,000 with $57,327 in net income & benefits than to earn gross income of $69,000 with net income and benefits of $57,045.”

Ed Note: Much more in this article “WHEN WORK IS PUNISHED: THE TRADGEDY OF THE AMERICA’S WELFARE STATE“including this terrifying statistic:

- For every 1.25 employed persons in the private sector, 1 person receives welfare assistance or works for the government.

Michael Campbell’s MoneyTalks Show Nov 30th (First 1/2 Hour) including Michael’s shocking commentary on the Bear Market in Jobs

{mp3}mtnov30lead3fp{/mp3}

In the Final Hour Michael interviews the impressive John Johnston, Chief Strategist for Davis Rea. Someone who offers a compelling alternative view to the economic/investment environment. The evidence points to a great deleveraging.

{mp3}mtnov30hour1fp{/mp3}