Energy & Commodities

Nuclear power accounts for 5.7% of the world’s energy and 13% of the world’s electricity. Uranium, used in nuclear power, is a relatively clean source of energy that does not produce greenhouse emissions. Uranium is extremely dense – it is nearly as heavy as gold. It is, however, about 500 times more common than gold in the earth’s crust. This infographic covers the history of uranium, its properties, the supply and demand forecasts, the advantages and disadvantages of nuclear power, uranium as an energy source, and military applications.

…Into Cash?

With the Federal Reserve’s bond buying, liquidity injecting, market inflating, volatility suppressing, confidence inspirng, economic supporting, media headline generating, program currently in full swing; one would assume that the daily pushes to new market highs are driven by massive inflows of cash into the equity markets. Well, that assumption would be partially correct.

According to Trim Tabs:

“Fund flows in the past two months were by far the most volatile we have evermeasured. After ignoring equities and dumping bonds at a record pace in June,fund investors poured record sums into U.S. equities and continued to sell bonds in July.“

Of course, this is clear evidence that the “Great Rotation” by investors, from bonds into equities, is upon us which will cause yields to rise as investors bet on a recovering U.S. economy. Right? Maybe not.

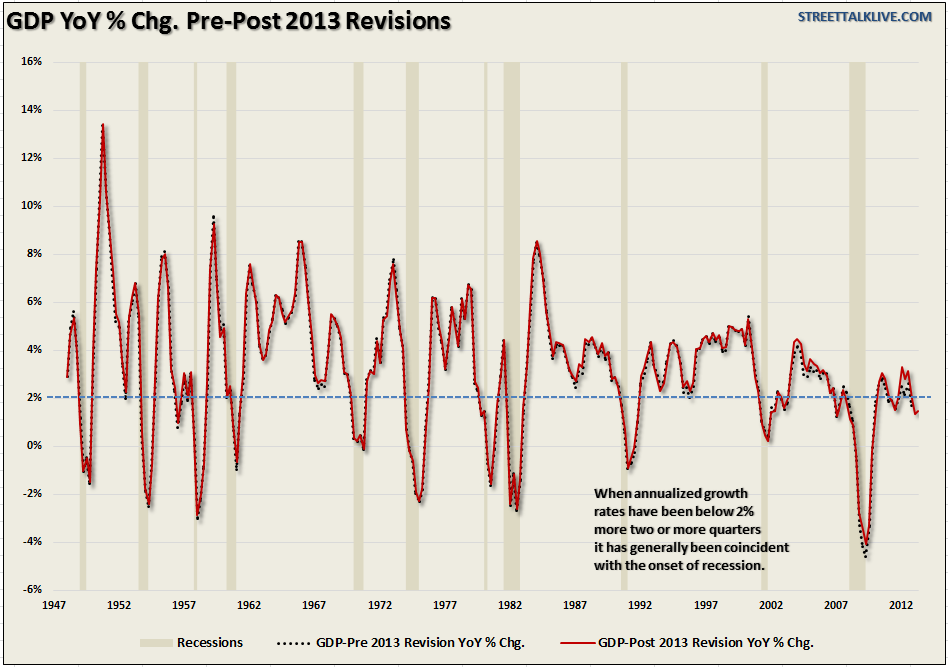

First of all there is scant evidence that the economy is entering into a growth mode. Even after the recent data manipulations by the Bureau of Economic Analysis (BEA) to artificially inflate the economic data by $500 billion through the addition of pension deficits and R&D expenses; the annual growth rate of the economy remained below 2% for the third straight quarter. Historically, such events have only been witnessed prior to the onset of economic recessions – not expansions.

Yet, the markets have continued to rise setting daily records with each minor uptick. This incredible advance….

…..read & view more HERE

Despite opposition from environmentalists who use as much or more fuel as all the rest of us driving their cars, living in & working in buildings and flying all over the continent in fuel guzzling airplanes to make their the case against oil pipelines.

Despite opposition from environmentalists who use as much or more fuel as all the rest of us driving their cars, living in & working in buildings and flying all over the continent in fuel guzzling airplanes to make their the case against oil pipelines.

Given transporting oil by pipelines is the safest method yet known to man to accomplish the task, Michael asks a straightforward question:

{mp3}cccc0812{/mp3}

….One of the Biggest in America. “Major institutions, such as JP Morgan, are predicting that prices will more than double within the next few years.”

There is a remarkable opportunity emerging in a market where demand growth is running into a serious wall of tightening supplies.

And we’re about to witness a dramatic shift in control for this supply.

I have talked about this change before in many of my past letters.

But the time to act on this change is running out. Literally.

By the end of the year this shift will take place. And it will put America at a major disadvantage.

The global market is about to run headlong into its first major supply deficit; one that will be controlled by a major world player that doesn’t play ball with the West.

Major institutions, such as JP Morgan, are predicting that prices will more than double within the next few years.

But I think that’s being conservative.

There is strong evidence that prices will go even higher; including a recent political change in a major economy.

There has never been a better time to speculate on these events.

In this special edition letter, I am not only going to introduce you to this explosive opportunity, but also introduce you to a Company that is poised to take advantage of this upcoming explosive market.

Analysts are already shooting out buy signals for this Company with prices much higher than where the Company trades today.

Industry experts are already touting that, “this Company is primed for growth” and “sees (its) current price as a gold-plated bargain.”

But before we get into the details of the Company, let’s talk about this explosive sector opportunity first.

Uranium: The Next Explosive Commodity

Before you shut down the prospects of uranium, let me explain why I believe this sector is primed for explosive growth in the coming months and years.

Not only is uranium one of the cheapest and most efficient sources of energy in the world, its also one of the cleanest.

While we continue to hear talks of alternative energy such as wind, solar, or hydro, uranium is the only alternative energy source amongst them that actually creates energy – the others simply capture and store it.

Because of its ability to produce constant and uninterrupted energy, it is perfect for baseload capacity – meaning that it’s always on.

There are only three sources of baseload energy available to us: fossil fuels (coal and gas), hydro, and nuclear.

The Cost of Power

No other form of energy is as cost effective as nuclear.

Solar energy is the most expensive at $250 per megawatt-hour (MWh), while nuclear is the cheapest at around $40 per MWh. In some countries, nuclear only costs $30 per MWh.

Nuclear power plants also have the highest percentage of electricity produced relative to the total capacity of the plant. To draw a comparison, nuclear plants have a capacity of 89.6%; coal 72.6%; natural gas 37.7%; heavy oil 29.8%; hydro 29.3%; wind 26.8%; and solar 18.8%.

Environmental Benefits

Many environmentalists have now turned pro uranium.

That’s because every one pound of uranium used instead of coal decreases CO2 emissions (CO2E ) by around 45,000 pounds.

Let’s put that into perspective:

A passenger vehicle produces on average 4.8 metric tons of CO2E every year, or roughly 10,582 pounds.

That means every pound of uranium used instead of coal removes the equivalent CO2E that four cars produces every year.

According to the World Nuclear Association, current reactors require approximately 176.7 million lbs. of uranium each year.

No wonder why public opinion on the nuclear sector is suddenly turning positive.

Even environmentalist Robert Stone, an award-winning documentary filmmaker, has now changed his views on nuclear energy:

“I’ve considered myself a passionate environmentalist for about as long as I can remember…It’s no easy thing for me to have come to the conclusion that the rapid deployment of nuclear power is now the greatest hope we have for saving us from an environmental catastrophe.”

He recently released his latest documentary, “Pandora’s Promise,” which explores the transformation of anti-nuke environmentalists into believers of the benefits of nuclear power.

He recently released his latest documentary, “Pandora’s Promise,” which explores the transformation of anti-nuke environmentalists into believers of the benefits of nuclear power.

The documentary aims at debunking a lot of the nuclear myths that came post-Fukushima.

Japan, Fukushima and Abe

A resource-poor nation, Japan’s economic growth potential is limited by demographic decline and its dependence on energy imports.

That’s why nuclear power has been a key part of Japan’s energy diversification and security strategy for well over 40 years.

But since the Fukushima meltdown in 2011, which devastated the nuclear sector, all but two of the country’s 54 reactors have been taken off line. As a result, imports of fossil fuels have risen dramatically to compensate.

The high cost of continued fuel imports is destroying Japan’s current focus on restoring economic growth and achieving the 2% inflation that Japan Prime Minister Shinzo Abe has promised.

Abe wants to see Japan’s inflation rate at 2% and has told the Bank of Japan (BOJ) to hit that target by printing more money and doing whatever it can to stimulate the cause.

Despite the insane monetary policy, there is no way Japan can achieve growth without first lessening the effects of energy on the economy.

Power utilities in Japan have already increased liquefied natural gas imports by 18% year-on-year in 2011 and by 5% year-on-year in 2012.

According to BP’s 2013 Statistical Review of World Energy, Japan consumed41% more fuel oil in 2012 compared to 2011, from 577,000 barrels per day to 811,000 barrels per day.

In May 2013 alone, Japan spent $5.4 billion on imports of liquefied natural gas, $11 billion on crude oil (electricity accounts for just under 20 percent of oil product consumption) and nearly $2 billion on coal.

If Abe wants to achieve his 2% target of inflation, he needs get those reactors back online.

Abe Gets His Wish

Last month, Japanese voters gave Abe and his Liberal Democratic Party (LDP) control of the upper house of parliament, meaning that for the first time in six years the LDP will have control of both chambers of The National Diet, Japan’s bicameral legislature.

Essentially, Abe’s control over both houses would be like Obama gaining control of both the Senate (upper house) and the House of Representatives (lower house).

With this new control, Abe will undoubtedly make turning nuclear reactors back on a priority.

Growing Demand Worldwide

Despite the growing rhetoric of countries – such as Germany and Switzerland – phasing out of nuclear power, nuclear power continues to march forward.

While Germany immediately took eight reactors offline and has publicly stated it will phase out its remaining nine reactors by 2022, starting in 2015, it ironically still supports foreign nuclear power and will use public money to guarantee the construction of power plants in other countries

Since Fukushima, Germany has become a net importer of power from France, relying on more costly French nuclear power.

For now, Germany has enough money to continue this for some time. But I don’t believe the nation will continue paying for expensive imported French nuclear electricity when it can do it on home turf at a much cheaper price.

China – The Next Largest Consumer

It’s impossible to talk about world energy without talking about China.

The nation, like many others, reevaluated its nuclear power program since Fukushima, and suspended nuclear plant approvals for a couple of months.

However, that didn’t last long as the government has already decided to continue with its nuclear power developments.

That means they’re on track to quadruple their nuclear capacity by 2020.

The country already has 26 reactors under construction.

By 2050, Mainland China is looking to ramp up to 400 gigawatt (GW).

In order to fuel 400 GW, China will need 195.4 million pounds of uranium per year for its power plants – that’s more uranium than all of the world’s current consumption per year.

Don’t Believe Everything You Hear

Despite what you hear, nuclear is isn’t shrinking – its growing rapidly.

Since 2007, total new reactor builds (under construction, planned, and proposed) have increased by 57%, from 349 to 548 as of September 2012.

Meanwhile, China, India, and Russia have all re-affirmed their support for nuclear power. Combined, those three powerhouses will represent 50% of world nuclear reactor construction.

The World Nuclear Association shows that there are currently 433 operational reactors worldwide, with the U.S. leading the way with 104 reactors.

Here’s where the hurt begins.

The Biggest Energy Consumer

Every year, the United States consumes over 51M lbs. of U3O8 at its 104 reactors, with the power representing nearly 20% of the nation’s total electric energy generation in 2011.

The U.S. is the world’s largest supplier of uranium energy.

Yet the nation only produces 4.3M lbs. of uranium per year at home – meaning they have to rely heavily on imports.

Clearly, nuclear energy is a massive part of U.S. society and security.

That’s why the head of the Department of Energy (DOE) announced a fresh start to its nuclear-disposal issue on January 10, 2013, emphasizing the importance of nuclear power to U.S. energy security.

Despite being the largest consumer of nuclear energy, the U.S. imports the majority of its uranium supply – just like oil.

As a matter of fact, the U.S. is more dependent on foreign uranium supplies than it is on oil.

We’ve already seen what happened to oil prices.

Herein lies a massive problem for Americans.

Losing Control of Energy

Much of the oil imported into the U.S. come from friendly sources and is either under the control or direct influence by America.

Uranium, on the other hand, is mainly controlled by a nation that will likely not be willed into uncomfortable terms by the U.S.

Russia – The Energy Powerhouse

Russia already maintains significant control over oil and gas supplied to the European Union.

It has already used this control to gain political advantage, as I mentioned in my Letter, “The Brink of War“.

As the most energy-dependent country in the world, the U.S. will soon be at the mercy of Russia when it comes to uranium supplies.

Knowing this, Russia has taken advantage of the severely depressed uranium price by leading the acquisitions of uranium assets all over the world.

Russian Buying Spree

In 2011, ARMZ, a Russian state-owned company, bought Australian junior Mantra Resources for C$1.15 billion.

Earlier this year, they purchased Uranium One for C$1.3 billion.

With its purchases, it will gain control of major uranium assets in Kazakhstan, Australia, Tanzania, and the U.S.

Earlier this year, Russia signed the long awaited nuclear power agreement, financing $500M for the supply of two 1000 Megawatt reactors with Bangladesh.

The deal was immediately followed days later by a major arms purchase agreement worth a billion dollars for the delivery of armored vehicles and infantry weapons, air defense systems and Mi-17 transport helicopters.

While Russia continues to snap up uranium assets, the United States hasn’t done much in terms of moving nuclear forward.

Unfortunately, that is going to be a major disadvantage for Americans.

More than 40% of U.S. uranium imports come from Russia, or from locations under the influence of Russia.

Russia and Namibia also plan to launch joint development of uranium deposits, while Niger has already granted Gazprom (another Russian owned entity and the largest extractor of natural gas in the world) uranium-exploration licenses in return for guaranteed investments.

Around 16% of U.S. uranium imports come from Africa.

That means Russia could have influence or control over 56% of U.S. uranium supply.

Remember that nearly 20% of U.S. energy comes from nuclear energy. That mean a whopping 10% of American energy currently relies on Russia for its power.

But that’s just the start of the hurt.

Megatons to Megawatts Set to Expire

The Megatons to Megawatts program was a US-Russian agreement implemented in 1993 to convert 1.1 million pounds of highly-enriched uranium (HEU) taken from dismantled Russian nuclear weapons into low-enriched-uranium (LEU) for nuclear fuel.

Over the past years, up to 10 percent of the electricity produced in the United States has been generated by fuel fabricated using LEU from the Megatons to Megawatts program.

The contract ends at the end of this year.

So what happens when this contract runs out?

The Transitional Supply Contract

The Transitional Supply Contract is a multi-year contract that allows the U.S. to purchase about 21 million separative work units (SWU) through 2022 with a mutual option to purchase up to another 25 million SWU during that period.

However, according to the deal terms from USEC, the United States Enrichment Corporation:

“The low enriched uranium supplied by TENEX (a state owned Russian company which trades uranium fuel and fuel processing services abroad) will now come from Russia’s commercial enrichment activities rather than from downblending of excess Russian highly enriched uranium.”

I want to stress the word “commercial” within that paragraph.

Commercial means doing something for profit.

Furthermore, “The pricing terms for SWU under the contract are proprietary, but are based on a mix of market-related price points and other factors.”

In other words, the Russians will begin to sell uranium to the U.S. for profit.

And they get to set the price.

Tension between Russia and the U.S. continue to grow, and Obama recently cancelled his Moscow Putin Summit visit because of their growing differences.

Do you think Russia will sell uranium to the U.S. for cheap?

Uranium Prices: Not All As it Seems

Uranium prices differ dramatically from other commodities and resources such as oil and gas.

While many often reference the spot price of uranium, the long-term price is what really counts.

That’s because less than 15% of uranium is actually traded at spot price. That means more than 85% of uranium is traded in long-term prices.

Take a look, courtesy of UxC and the World Nuclear Association:

We’re now at the tipping point where both reference demand and upper demand will outpace current production, the secondary supply market, and even the supply by mines that are currently under development.

It’s no wonder the world’s richest people are investing in the sector.

The Richest People on Earth

Both Bill Gates and Warren Buffett are strong advocates of nuclear power, and both believe that the markets have overreacted after the Fukushima meltdown.

They are both actively investing in the sector.

Gates is a strong believer in the safety of nuclear reactors and has put his money where his mouth is by investing millions into the private company TerraPower, which is developing a new nuclear design.

During Berkshire Hathaway’s annual meeting, Warren Buffett stated just how important nuclear power is for the world. MidAmerican Energy, a Buffet company, has applied to build a nuclear plant in Iowa and currently operates a 1,760 MW facility in Illinois.

Miners Outperform

Unlike gold miners, uranium miners have been moving in an inverse relationship to spot commodity price.

Despite spot uranium prices dropping below $40, uranium miners such as Cameco are up over 30 percent since the November low.

That’s because uranium doesn’t trade large volumes on a futures exchange and the spot price of uranium doesn’t actually reflect the actual price of uranium that’s being sold in the market.

Unlike other metals such as copper or nickel, uranium is traded in most cases through contracts negotiated directly between a buyer and a seller.

That means the only viable way to play the uranium sector is to invest in companies that mine and explore for it.

But there’s a problem.

There aren’t many uranium producers that trade in North America.

The Supply and Demand Gap

As I mentioned earlier, current nuclear reactors require about 176.7M lbs. annually to operate.

On a global scale, mine supply is only around 137M lbs., while secondary sources (mainly supplied by HEU) add another 26M lbs.

That’s a shortfall of nearly 14M lbs. per year.

When HEU ends, secondary sources will be almost halved, bringing an even bigger shortfall.

New mine production is very much needed, but simply won’t happen due to a low spot price and the growing costs of production worldwide.

I believe that a spot price of at least US$70/lb. will be required to truly spur new mining production; JP Morgan estimates US$80/lb.

What to Do

In the current low spot price environment, in-situ recovery (ISR) mines are preferable over conventional open pit uranium mines simply because the average production cost for a typical ISR mine is US$15-$40 per lb., whereas an open pit mine can average $30-$70 per lb.

Because of lower costs and political security, I prefer to bet on U.S.-based ISR uranium producers.

To learn more about how ISR Mining works, click here:

Click to enlarge

That is why I am about to introduce you to a Company that I believe is poised for considerable growth.

This Company:

- is working with the Wyoming State administrators to complete the documentation for the closing of a $20M financing; expected to close in the fall

- is poised to be the next U.S. uranium producer

- owns one of the largest uranium land package in one of the most prolific uranium regions in America, the Powder River Basin

- and has a management team that has put many uranium projects into production

It’s no wonder why a Dundee analyst is saying this Company “appears to have amongst the best potential to provide long term sustainability form its cluster of projects on a large land package.”

He’s also saying that this Company “is well positioned to take full advantage of the uranium market for the long-term due to its strategic land holdings.”

That’s because this Company not only owns one of the biggest land packages in one of the most prolific uranium regions in America, but it’s en route to production – just as a major international contract for uranium expires.

What happens when you combine an extremely capable and experienced management team, a near-term uranium producer, and one of the most significant land packages in one of the most prolific regions in America?

Ed Note: Equedia is very bullish on a company named Uranerz Energy Corporation (TSX: URZ)(NYSE MKT: URZ). If you click HERE and scroll down you will find their bullish case for Uranerz laid out in detail.

Testing Saudi Arabia’s Ability To Deliver.

We take a look at the latest developments in the oil market, including charts of all the major inventory categories.

The Department of Energy reported this morning that in the week ending Aug. 2, U.S. crude oil inventories decreased by 1.3 million barrels, gasoline inventories increased by 0.1 million barrels, distillate inventories increased by 0.5 million barrels and total petroleum inventories increased by 0.8 million barrels.

….read & view more HERE