…Into Cash?

With the Federal Reserve’s bond buying, liquidity injecting, market inflating, volatility suppressing, confidence inspirng, economic supporting, media headline generating, program currently in full swing; one would assume that the daily pushes to new market highs are driven by massive inflows of cash into the equity markets. Well, that assumption would be partially correct.

According to Trim Tabs:

“Fund flows in the past two months were by far the most volatile we have evermeasured. After ignoring equities and dumping bonds at a record pace in June,fund investors poured record sums into U.S. equities and continued to sell bonds in July.“

Of course, this is clear evidence that the “Great Rotation” by investors, from bonds into equities, is upon us which will cause yields to rise as investors bet on a recovering U.S. economy. Right? Maybe not.

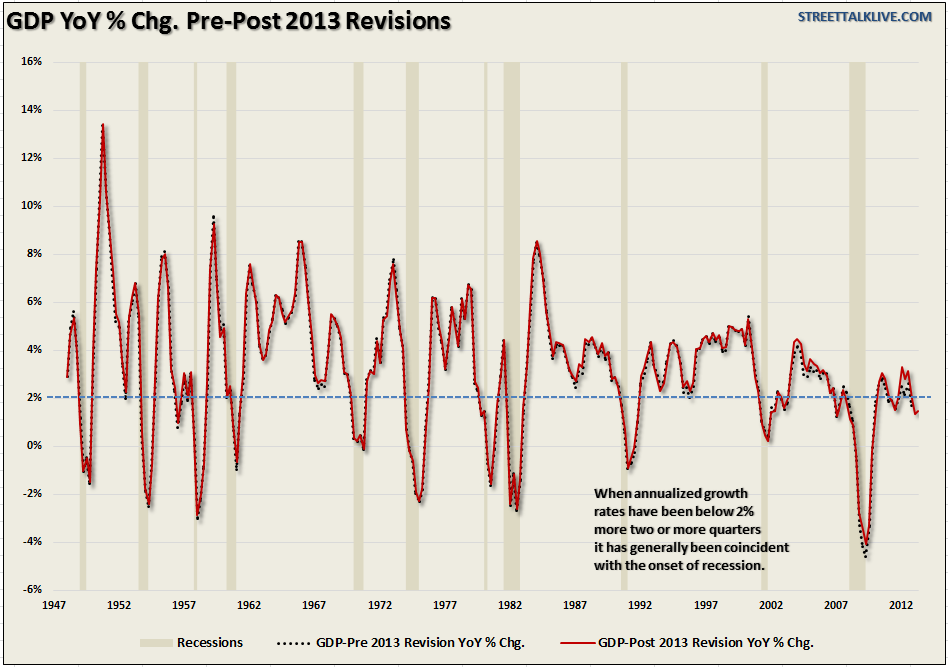

First of all there is scant evidence that the economy is entering into a growth mode. Even after the recent data manipulations by the Bureau of Economic Analysis (BEA) to artificially inflate the economic data by $500 billion through the addition of pension deficits and R&D expenses; the annual growth rate of the economy remained below 2% for the third straight quarter. Historically, such events have only been witnessed prior to the onset of economic recessions – not expansions.

Yet, the markets have continued to rise setting daily records with each minor uptick. This incredible advance….

…..read & view more HERE