Economic Outlook

Donald Trump has made good on one of his most audacious campaign promises by submitting what he describes as the biggest tax cut in U.S. History. For once, at least, this does not appear to be Trumpian braggadocio. It really may be the mother of all tax cuts. But if passed, what may this bunker buster do to the economy? While I have rarely met a tax cut I didn’t like, this one just may be more likely to send the economy into a downward spiral than it is to send up to orbit.

Donald Trump has made good on one of his most audacious campaign promises by submitting what he describes as the biggest tax cut in U.S. History. For once, at least, this does not appear to be Trumpian braggadocio. It really may be the mother of all tax cuts. But if passed, what may this bunker buster do to the economy? While I have rarely met a tax cut I didn’t like, this one just may be more likely to send the economy into a downward spiral than it is to send up to orbit.

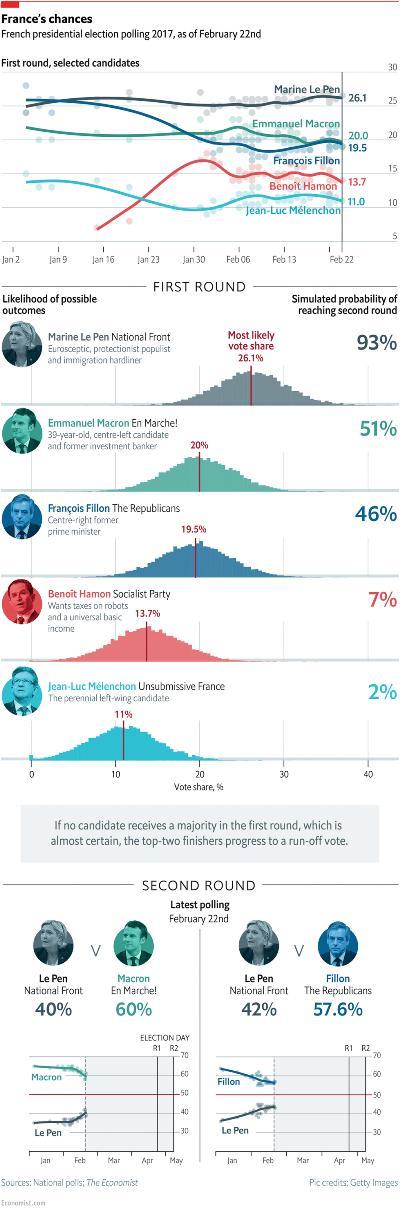

The rise of French far-right presidential candidate Marine Le Pen has made a lot of people nervous since, among many other things, she’s in favor of leaving the eurozone, which would pretty much end the common currency. But since polling has shown her making the two-person run-off round but then losing to a mainstream candidate, the euro-elites haven’t seen any reason to panic.

Here, for instance, is a chart based on February polling that shows Le Pen getting the most votes in the first round, but then – when mainstream voters coalesce around her opponent – losing by around 60% – 40%. The establishment gets a bit of a scare but remains firmly in power, no harm no foul.

Then came the past month’s debates in which a previously-overlooked communist candidate named Jean-Luc Mélenchon shook up the major candidates by pointing out how corrupt they all are. Voters liked what they heard and a significant number of them shifted his way.

Mélenchon: Far-leftist surges in French polls, shocking the frontrunners

(France 24) – In a presidential campaign with more twists than a French braid, Jean-Luc Mélenchon’s sudden play to become France’s third man — or better — is shaking up the race.

With ten days to go before April 23’s first round vote, the colourful, cultured and cantankerous far-leftist has the frontrunners on the defensive.

Suddenly, the grumpy far-leftist — a showman in a Chairman Mao jacket who openly admired late Venezuelan populist leader Hugo Chavez — holds the mantle of France’s most popular politician. In the course of a whirlwind month, the 65-year-old Mélenchon surged nine spots to number one in weekly glossy Paris Match’s opinion poll. A full 68 percent of those surveyed hold “favourable opinions” of the far-left candidate, the poll by the Ifop-Fiducial firm showed.

On some polls, Mélenchon has now bypassed embattled conservative François Fillon for third place in a presidential race that will see the top two advance to the May 7 run-off.

An Ipsos poll on Tuesday put Mélenchon a half-point ahead of Fillon for third place in the race, behind National Front leader Marine Le Pen and the independent centrist Emmanuel Macron. With 18.5 percent, the far-leftist has gleaned 4.5 percent in just two weeks, with Macron and Le Pen tied on 24 percent.

Mélenchon wants to quit NATO, the World Trade Organization, the International Monetary Fund, the World Bank, and block European trade treaties with the United States and Canada. He promises a French referendum on whether to stick with the reworked EU he is pledging to negotiate or leave the bloc altogether.

Here’s a chart from the Washington Post showing just how tight the race for the run-off spots has become:

It’s still unlikely that both Le Pen and Mélenchon will make the run-off, but based on the above chart it’s suddenly possible. This would be the cultural equivalent of a Trump – Bernie Sanders race in the US, but with – believe it or not — even higher stakes because both Le Pen and Mélenchon would threaten the existence of both the euro and the European Union, the world’s biggest economic entity.

So it almost doesn’t matter who wins that run-off. Just the prospect of having one or the other in charge would tank the euro and set off a stampede out of Italian, Spanish and Portuguese bonds, possibly doing irreparable damage to the eurozone before the eventual winner even takes power.

To repeat the theme of this series, when you screw up a country’s finances you take its politics along for the ride. In France, the right feels betrayed by open borders and excessive regulation, the left by an unaccountable elite that always seems to profit at everyone else’s expense. And both sides suffer from soaring debt at every level of society.

So if a fringe candidate doesn’t win this time around, the mainstream will just make an even bigger mess, raising the odds of a fringe victory next a few years hence.

Afghanistan, Iraq, Syria, Iran, North Korea, Russia, China ……..

Afghanistan, Iraq, Syria, Iran, North Korea, Russia, China ……..

In the 1960s Peter, Paul and Mary popularized a song written by Pete Seeger – “Where Have All the Flowers Gone?”

The short version is:

Where have all the flowers gone?

Young girls have picked them.

Where have all the young girls gone?

Gone to husbands.

Where have all the husbands gone?

Gone for soldiers.

Where have all the soldiers gone?

Gone to graveyards.

Where have all the graveyards gone?

Gone to flowers.

And repeat.

When will they ever learn?

Another version of this “cycle of life” is:

Where has all the money gone?

Gone to taxes.

Where have all the taxes gone?

Gone to governments.

Where have all the governments gone?

Gone to bankers for more money.

Where have all the bankers gone?

Gone to buy politicians.

Where have all the politicians gone?

Gone to buy voters.

Where have all the voters gone?

Gone to work for money.

Where has all the money gone?

Gone to taxes.

And repeat.

When will we learn?

Fifty years ago we were bombing North Vietnam “back into the stone age.” That worked out well for the military contractors, killed many, and raised prices for the US people.

Twenty-five years ago we were fighting Iraq and Saddam Hussein. That worked out well for the military contractors, killed many, and raised prices for the US people.

Ten years ago we were fighting in Iraq. That worked out well for the military contractors, killed many, and raised prices for the US people.

Today we are still fighting in the Middle-East and bombing Syria. A taskforce of ships is threatening North Korea. Who benefits?

When will we learn?

Looking ahead:

- War: Not to win, never to end.

- Debt and currency in circulation are rising exponentially.

- Consumer prices will increase… and increase.

- Gold, silver, gasoline and food will become more expensive.

- Voters will continue voting for politicians and wars even though both are expensive and destructive.

- The political and financial elite will be fine. Tough luck for rest of us…

When will we learn?

Gary Christenson

The Deviant Investor

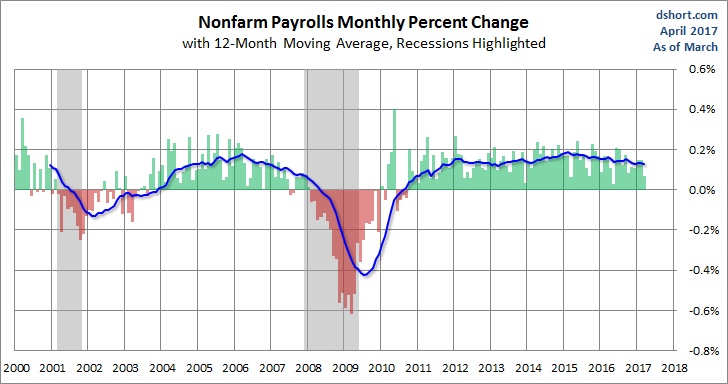

This morning’s employment report for March showed a 98K increase in total nonfarm payrolls. The unemployment rate ticked downward from 4.7% to 4.5%. The Investing.com consensus was for 180K new jobs and the unemployment rate to remain at 4.7%. January and February nonfarm payrolls were revised downward for a total loss of 38K.

Here is an excerpt from the Employment Situation Summary released this morning by the Bureau of Labor Statistics:

The unemployment rate declined to 4.5 percent in March, and total nonfarm payroll employment edged up by 98,000, the U.S. Bureau of Labor Statistics reported today. Employment increased in professional and business services and in mining, while retail trade lost jobs.

Here is a snapshot of the monthly percent change in Nonfarm Employment since 2000. We’ve added a 12-month moving average to highlight the long-term trend.

…continue reading this analysis complete with 8 more charts

…related:

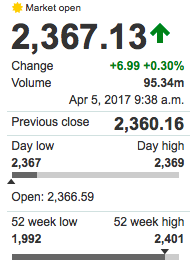

U.S. stocks opened higher on Wednesday as investors shrugged off reports of another North Korean missile launch, focusing instead on a blockbuster reading on private-sector employment. The S&P 500 SPX, +0.29% climbed 7 points, or 0.3%, to 2,368, while the Dow Jones Industrial Average DJIA, +0.40% advanced 91 points, or 0.5%, to 20,782. The Nasdaq Composite Index COMP, +0.23% gained 14 points, or 0.2%, to 5,911. Shares of Panera Bread Co. PNRA, +13.60% soared after the fast-casual restaurant chain reached a deal to be acquired by a private holding company for $7.5 billion. Monsanto Co. MON, +0.69% shares rose after the company’s latest quarterly results beat profit and sales expectations. U.S. employers added 263,000 private-sector jobs last month, according to payrolls processor ADP Inc., surpassing expectations for an increase of 170,000.

U.S. stocks opened higher on Wednesday as investors shrugged off reports of another North Korean missile launch, focusing instead on a blockbuster reading on private-sector employment. The S&P 500 SPX, +0.29% climbed 7 points, or 0.3%, to 2,368, while the Dow Jones Industrial Average DJIA, +0.40% advanced 91 points, or 0.5%, to 20,782. The Nasdaq Composite Index COMP, +0.23% gained 14 points, or 0.2%, to 5,911. Shares of Panera Bread Co. PNRA, +13.60% soared after the fast-casual restaurant chain reached a deal to be acquired by a private holding company for $7.5 billion. Monsanto Co. MON, +0.69% shares rose after the company’s latest quarterly results beat profit and sales expectations. U.S. employers added 263,000 private-sector jobs last month, according to payrolls processor ADP Inc., surpassing expectations for an increase of 170,000.