Currency

Last month in Venezuela’s capital city of Caracas, a cup of coffee would have set you back 2 million bolivars. That’s up from only 2,300 bolivars 12 months ago, meaning the price of a cup of joe has jumped nearly 87,000 percent, according to Bloomberg’s Café Con Leche Index. And you thought Starbucks was expensive.

But that was July. Prices in Venezuela are doubling roughly every 18 days. The International Monetary Fund (IMF) now projects inflation to hit an astronomical 1 million percent by the end of this year. This puts the beleaguered Latin American country on the same slippery path as Zimbabwe a decade ago and Germany in the 1920s, when a wheelbarrow full of marks was barely enough to get you a loaf of bread.

Venezuela’s socialist president Nicolas Maduro—who only this past weekend survived an assassination attempt involving several explosive-laden drones—announced recently that the country plans to rein in hyperinflation by lopping off five zeroes from its currency. If you recall, Zimbabwe similarly tried to combat soaring prices of its own by issuing a cartoonish $100 trillion banknote—which in 2009 was still not enough to buy a bus ticket in the capital of Harare.

Without structural governmental reforms, a new bolivar is just as unlikely to steady Venezuela’s skyrocketing inflation or remedy its crumbling economy.

Gold Could Save Your Life

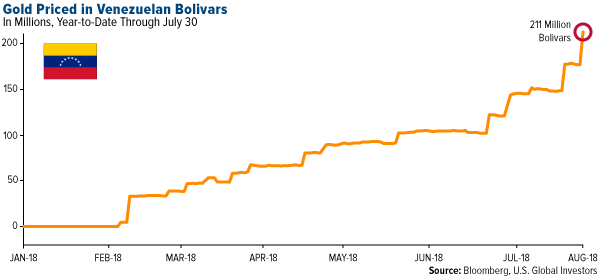

So where does this put gold? At some point, hyperinflation gets so ludicrously out of control that discussing exchange rates becomes pointless. But as of July 30, an ounce of the yellow metal would have gone for 211 million bolivars—an increase of more than 3.1 million percent from just the beginning of the year.

My point in bringing this up is to reinforce the importance of gold’s Fear Trade, which says that demand for the yellow metal rises when inflation threatens to destroy a nation’s currency—as it’s doing right now in Venezuela.

A Venezuelan family that had the prudence to store some of its wealth in gold would be in a much better position today to survive or escape President Maduro’s corrupt, far-left regime.

In extreme cases like this, gold could literally help save lives.

Such was the case following the fall of Saigon in 1975. If not for gold, many South Vietnamese families might not have managed to escape the country. A seat on one of the thousands of fleeing boats reportedly went for eight or 10 taels of gold per adult, four or five taels per child. (A tael is slightly more than an ounce.) Gold was their passport. Thanks to the precious metal, tens of thousands of Vietnamese “boat people,” as they’re now known, were able to start new lives in the U.S., Canada, Australia and other developed countries.

Venezuela’s Once Prosperous Economy Destroyed by Corruption and Mismanagement

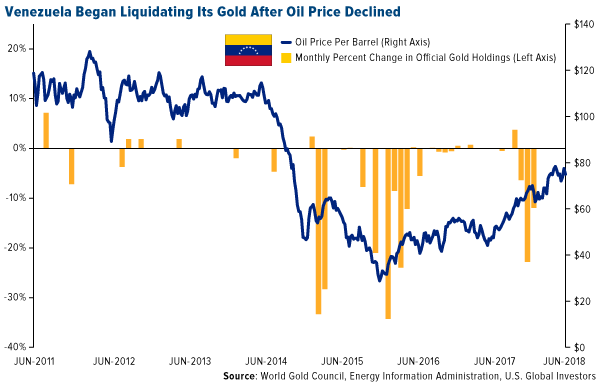

But back to Venezuela. Amid the corruption and mismanagement, the only thing helping the country pay its bills right now is gold. Two years ago, it had the world’s 16th largest gold reserves. Today it stands at number 26 as it’s sold off more than half its holdings since 2010. While countries such as China and Russia continue to add to their holdings, Venezuela has been the world’s largest seller of gold for the past two years.

It’s hard to remember now, but as recently as 2001, Venezuela was the most prosperous country in all of South America. Like Zimbabwe, the OPEC nation is rich in natural resources, home to the world’s largest oil reserves and what’s believed to be the fourth largest gold mine. Oil exports account for virtually all of its export revenue.

In 2016, Venezuela was the third largest exporter of crude to the U.S. following Canada and Saudi Arabia, but with output in freefall, this is changing rapidly. For the first time ever in February, Colombia sold more crude oil to the U.S. than its eastern neighbor did. And in June, Venezuela’s state-owned oil and gas company, Petróleos de Venezuela (PDVSA), informed at least eight foreign clients that it would be unable to meet supply commitments. According to GlobalData, production is on track to fall to only 1 million barrels per day by 2019, down from 3 million a day in 2011, meaning the petrostate might soon have nothing left to deliver.

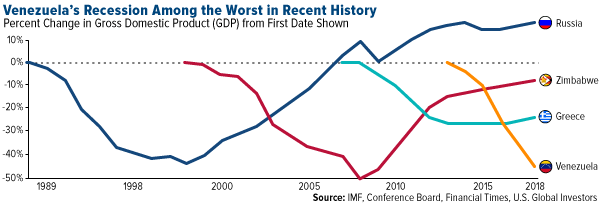

President Maduro now has the ignoble distinction of reigning over an economic recession that rivals the very worst in modern history. Last month, the IMF forecast that the country’s real gross domestic product (GDP) would fall 18 percent this year—the third straight year of double-digit declines.

A mass exodus of young, working-age Venezuelans, many of them college-educated, is unlikely to help. Estimates of the number of people who have fled the country in the past two years alone range from 1.7 million to as high as 4 million.

Their escape is no easy task, as numerous international airlines, citing rampant crime and a lack of electricity, have canceled all flights in and out of Caracas. The only U.S. carrier still operating in the country is American Airlines, which offers a single daily flight from the nation’s capital to Miami. Just two years ago, there were as many as 40 nonstop American flights, not to mention those of rival carriers, between the two cities—a sign of just how dramatic and swift Maduro’s mismanagement has been in crippling Venezuela’s once-robust economy.

The Diversification Benefits of Gold

The gold bears were on top last week, with the metal trading as low as $1,205 on Thursday. That’s the closest it’s come to dipping below $1,200 since February 2017. Friday’s lower-than-expected jobs report gave gold a modest boost, but it wasn’t enough to prevent a fourth straight week of price declines.

|

| click to enlarge |

In times like this, it’s important to remember that, according to gold’s DNA of volatility, it’s a non-event for the metal to close up or down 1 percent at the end of each session, 2 percent for the 10-day trading period. And guess what? The S&P 500 Index has the same level of volatility.

Ten days ago, gold was trading just under $1,230 an ounce, or 0.6 percent more than today. The math is sound.

It’s also worth remembering that gold has traditionally had a low to negative correlation with other assets such as equities. This is why many investors over the years have used it as a portfolio diversifier.

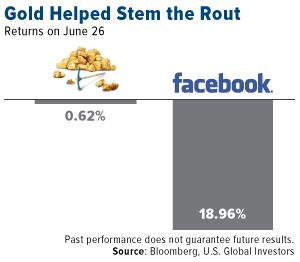

Case in point: On June 26, Facebook suffered its worst single-day decline since the company went public in 2012. Its stock plunged 19 percent, erasing some $120 billion in market capitalization—the most ever in history for a single trading session.

Gold, meanwhile, held relatively steady, slipping only 0.62 percent.

Curious about learning more? Explore the two main drivers of gold, the Fear Trade and Love Trade, by clicking here!

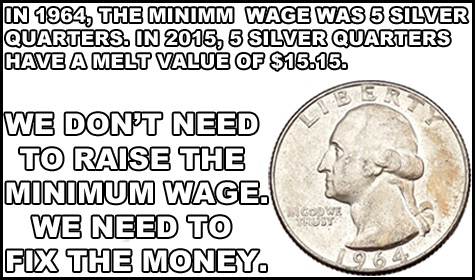

Consumer price inflation is real. It sneaks into every facet of life. Bags of coffee shrink from 16 ounces to 12 ounces and then to 10 ounces. “Shrinkflation” is policy. That Snickers candy bar is smaller but costs the same or more.

But don’t blame the candy industry, coffee distributors or automobile manufacturers. Fiat currencies create the problems.

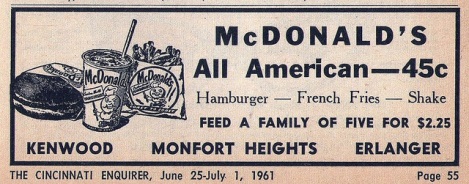

Why do we need to fix our currency? Because commercial banks (via fractional reserve banking) and the Federal Reserve print dollars by the trillions, devalue all existing dollars, and increase prices on almost everything. Do you remember McDonald’s prices in 1961?

The problem is the currency unit. It shrinks in value!

How well would the military perform if the government changed the units of measurement every year? Example: The diameter of the rocket fuel tank is 47 inches. The next year the diameter measures 49 inches, but the rocket didn’t change! Chaos, craziness, and a dysfunctional military would result.

Reducing the value of currency units is like changing the measuring units for length. The chaos becomes unmanageable.

Most unbacked paper currencies have failed. Others, such as the pound and dollar, are worth a tiny fraction of their initial value. However we delude ourselves and believe flawed currencies will survive and prosper.

When insanity and delusions persist, there are reasons. One might think the powers-that-be prefer a flawed system that enriches them at the expense of the savers, pension plans, taxpayers and future workers…

Whatever the reason, the process continues. Devalue the dollar, increase prices, pretend and extend, and work the scam.

Rather than curse the darkness, light a candle within your financial world! Buy silver and gold.

The following is a quick history lesson on prices, devaluing dollars, and preserving purchasing power with gold.

In 1913 gold sold for $20.67, potatoes cost 1.6 cents per pound, a pack of cigarettes cost ten cents, and an average house sold for about $3,000.

Prices are higher today! I used $0.60 per pound for potatoes, $6.00 for cigarettes, and $392,000 for an average house (source: St. Louis Federal Reserve.) Consider the following.

Other Examples of “Excessive Printing” – Argentina and Venezuela:

During the past 70 years Argentina devalued their peso by lopping off 13 zeros. That is ten trillion-to-one devaluation against the dollar which also devalued. One year ago Argentina sold 100 year bonds to yield hungry “investors” who should have studied history. Read this. Interest rates have risen to about 40% per year and the peso is devaluing.

Inflation is out-of-control and hurting everyone in Venezuela. Those who placed their savings in gold bullion are better protected. A recent article tells about a cardiologist who received severance pay after working five years. It purchased a cup of coffee!

CONCLUSIONS:

- Prices rise as currencies devalue, sometimes rapidly.

- Huge devaluations have occurred in many other countries but not recently in the U.S.

- Printing the global reserve currency creates advantages. One advantage is that the U.S. can import real goods and pay for them with “printed” debt—Treasury notes. Exchanging real goods for “IOUs” can work for a long time, but not forever.

- Imagine the impact upon the U.S. economy if it could not exchange paper debt for real goods. Other countries strive to eliminate these exchanges. Treasury Notes are accepted for imports, but for how many more years?

- Prices in the U.S. will rise when there is less demand for the dollar in global trade. (Think crude oil!)

- Politics and military posturing may delay the loss of reserve currency status, but not indefinitely.

TAKE ACTION:

- Financial changes are inevitable. Most of those changes devalue dollars. (Name one politician who wants a return to stable prices, a strong dollar, and a balanced budget…)

- Silver and gold preserve purchasing power. See the above graphics regarding trucks and houses priced in gold ounces.

- Buy silver and gold to protect your assets, retirement and purchasing power.

- Call Miles Franklin or WhyNotGold to exchange digital debt based currency units for real money – silver and gold.

Asian stocks have commenced on a positive note this morning, as strong U.S. corporate earnings and optimism over China boosting fiscal support for its economy rekindled risk appetite. European markets could benefit from the risk-on sentiment; however, gains may be limited as investors adopt a guarded approach ahead of a meeting between the European Commission President Jean-Claude Juncker and U.S. Donald President Donald Trump.

Asian stocks have commenced on a positive note this morning, as strong U.S. corporate earnings and optimism over China boosting fiscal support for its economy rekindled risk appetite. European markets could benefit from the risk-on sentiment; however, gains may be limited as investors adopt a guarded approach ahead of a meeting between the European Commission President Jean-Claude Juncker and U.S. Donald President Donald Trump.

With escalating trade tensions between the European Union and the United States still, a key theme that continues to weigh on global sentiment, the outcome of today’s meeting could leave a lasting impact on the markets. If the talks prove unsuccessful and trade tensions end up escalating further, risk sentiment is likely to be negatively impacted. Market players should be prepared to expect the unexpected from the talks, especially when considering how highly unpredictable the Trump administration can be.

Turkish Lira crumbles after central bank holds rates

The Turkish Lira depreciated heavily against the Dollar yesterday after the nation’s central bank defied market expectations by leaving interest rates unchanged at 17.75%, despite inflation soaring.

This move immediately raised questions over the central bank’s independence, a month after President Recep Tayyip Erdogan’s re-election under an amended constitution that enabled him to follow through on his promise to take more direct control over monetary policy. Outside of Turkey, global trade tensions, a broadly stronger Dollar and expectations of higher US interest rates have exposed to the Lira to downside risks. With a combination of external and domestic factors eroding buying sentiment towards the Lira, the local currency remains at risk of depreciating towards 5.00 and beyond against the Dollar.

Currency spotlight: EUR/USD

The euro/U.S. dollar (EUR/USD) currency pair was on standby on Wednesday morning, as investors positioned ahead of the anticipated meeting between US President Trump and European Commission President Jean-Claude Juncker.

Heightened concerns over a trade war with the United States have shaved some attraction away from the euro and this can be reflected in the bearish price action. There could be some action on the EUR/USD today depending on the outcome of the meeting. Focusing on the technical picture, the EUR/USD remains in a wide range on the daily charts. Sustained weakness below 1.1700 could inspire a decline towards 1.1640 and 1.1600, respectively. In regards to the longer-term outlook, the divergence in monetary policy between the European Central Bank and the Federal Reserve could ensure the currency pair remains depressed for prolonged periods.

Commodity spotlight: Gold

It has been a quiet start for gold this morning as bulls and bears were both missing in action. Regardless, the yellow metal remains bearish on the daily charts and has scope to extend losses as the Dollar stabilizes. Although global trade tensions could accelerate the flight to safety and support appetite for safe-haven gold, any meaningful gains are likely to be threatened by U.S. rate hike expectations. Gold bears need to attack and conquer $1,213 for prices to sink towards the psychological $1,200 level.

Trump “is not happy” with the Fed raising interest rates…claiming that rising rates hurt the American economy and cause the US Dollar to rise…that a rising US Dollar makes America less competitive. My good friend Dr. Martin Murenbeeld, (www.Murenbeeld.com ) has long argued that the best way to correct the huge American trade deficit is to drive down the USD…especially against overvalued Asian currencies.

Trump “is not happy” with the Fed raising interest rates…claiming that rising rates hurt the American economy and cause the US Dollar to rise…that a rising US Dollar makes America less competitive. My good friend Dr. Martin Murenbeeld, (www.Murenbeeld.com ) has long argued that the best way to correct the huge American trade deficit is to drive down the USD…especially against overvalued Asian currencies.

Trade wars: In my July 7/18 notes I quoted Christopher Wood of CLSA as saying that “politics” have replaced Central Banks as the most important driver of world markets. I agree and I see Trump as the epicenter of “politics.” Trade wars (Trump Vs. the Rest of The World) are a sub-set of “politics” and Trump is now threatening to escalate again with 25% tariffs on auto imports and up to $500B of tariffs on Chinese imports. In my June 9/18 notes I wrote that trade tensions were growing as Trump steps up his game…and that he was just getting started.

“Currency wars” are another sub-set of politics and Trump has linked “currency wars” to “trade wars” by declaring that the EU and China are deliberately devaluing their currencies to gain a competitive advantage over America. There may be some truth to that…at least in China’s case…and Trump has a point when he says that high US interest rates push up the US Dollar. But the New Fed is doing the right thing by boosting rates from “emergency” levels…the economy is strengthening and is able to deal with rising rates. But capital flows to America for safety and opportunity…not just to pick up yield.

The US Dollar Index (USDX) hit a one year high this week following Powell’s Congressional testimony. Powell said that the US economy is doing fine and that the Fed will likely continue to gradually raise short term interest rates. The Dollar fell from those highs on Thursday’s CNBC Trump interview and fell further Friday morning on Trump’s tweets.

The Chinese Yuan has fallen ~8% since its April highs (when the USDX was near 3 year lows) with most of those gains coming since early June when the US hit China with $34B in tariffs. Trump has a point: this looks like the Chinese have manipulated their currency lower of mitigate the effect of tariffs…but…it also looks like the Chinese economy has been slowing with the Shanghai stock index down >20% from its January highs and with 2 year interest rates falling from ~4.75% in January to the current level around 3.5%. As the Chinese currency has fallen so have the currencies of nearly every Asian country as they need to stay competitive with China. The Indian Rupee has fallen to fresh All Time Lows. Capital is flowing out of Emerging Markets…the “stealth strength” of the USD that I have been writing about for the past few months.

The Euro Currency has chopped sideways between 1.16 and 1.18 since hitting 10 month lows in late May on the Italian “existential crisis.” US 2 year gov’t interest rates currently yield ~3.25% more than 2 year German gov’t paper…which is a substantial inducement to sell EURUSD…so once again Trump has a point…relatively high US rates boost the USD.

The Canadian Dollar (CAD) has been on a roller coaster ride on the daily and hourly charts since mid-April when the US Dollar turned higher…but on the weekly charts it has clearly been trending lower since hitting a 2 year high near 83 cents in September 2017. CAD has weakened as diverging policies between the Canadian and American central banks have widened the American interest rate premium, as Nafta and “trade war” concerns hit the market, as the USD rallied against other currencies and…to a lesser degree as commodity prices fell.

Gold has been negatively correlated with the USD falling ~$150 to one year lows since the USD began to rally in April.

Crude oil prices have also been hugely affected by “politics.” The rally in WTI from last summer’s lows around $42 to the recent $75 highs was largely on the back of the political collusion between the OPEC cartel and Russia to reduce supply. The jump from around $64 to $75 in late June was largely due to fears that Trump’s sanctions on Iran were going to be much harsher-than-expected while the break from the July highs was accelerated by Trump’s demands that Saudi Arabia should increase production…and Trump’s talk that maybe the US should sell oil from the SPR. (The cynics say he wants lower gasoline prices going into the November mid-term elections.) Another aspect of the political impact on oil prices is the thought that oil could tumble like it did in 2008 if the world falls into another financial crisis as a result of escalating trade and currency wars. BTW: US domestic production hit another all-time high above 11 MBD and Russia appears to now be pumping as much (or more) than they were prior to their production cutback agreement with OPEC.

Commodity prices have been hurt by trade war fears / slowing demand / unwinding of speculative positioning / and a rising USD. US soybeans have dropped over 20% in the last 6 weeks, copper fell nearly 20% in a month while Nickel was down 16% and zinc fell 23%.

My trading this week: I sold CAD short early in the week thinking that the USD correction was over and took profits before Trump’s CNBC interview caused the USD to tumble. I took profits because I thought CAD should have been weaker that it was…given the weakness in other currencies…so I was just lucky to be out when the Trump/USD news hit. I’m flat at the end of the week.