Currency

“So what?” he asked. “Things will only get worse. We have reached a point where we’re trying to figure out how to survive just the next day, let alone the next 10 days, the next month, the next year.”

-Anastasis Chrisopoulos, Athens taxi driver (from Reuters)

130-billion-euro here, 130-billion-euro there, and pretty soon you have to start finding some growth!

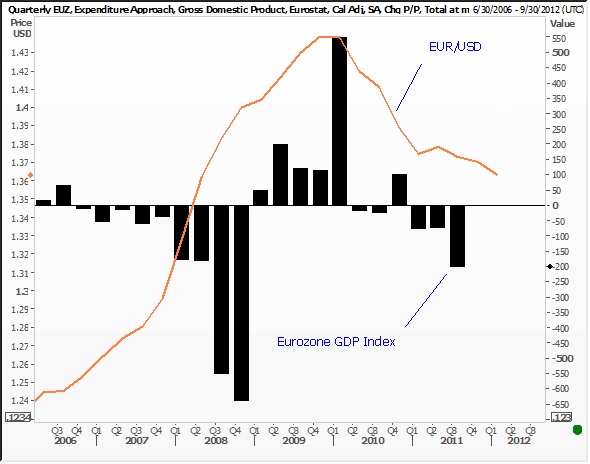

One adage that seems to work as much as anything else, and why it is an adage I guess, is “buy the rumor and sell the news.” I won’t bore you with the behavioral aspects of why this works, I think you know. We are seeing it a bit this morning on display on news a Greek default has been averted: the euro is lower, and ditto for most Eurozone bonds since the announcement of a deal that gives Greece another 130-billion-euro it can pour down the rabbit hole with the rest of the money funneled in by Eurozone taxpayers.

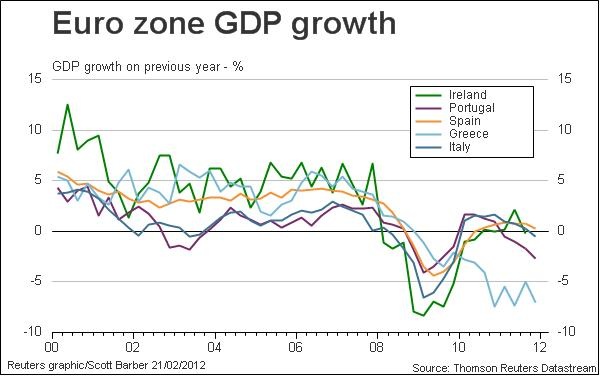

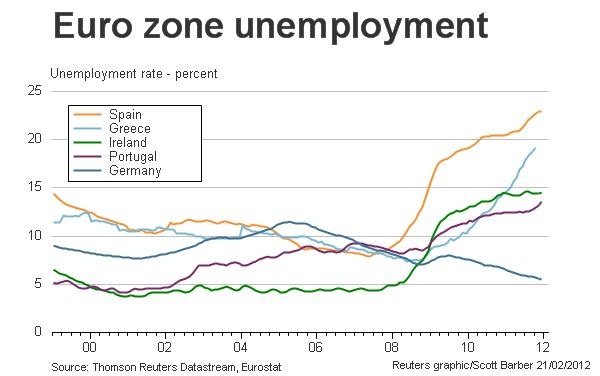

Of course, sooner or later financial engineering reaches the limits of its public relations effect and there must be some underlying payoff from said engineering besides getting funds to follow banks chasing into periphery debt for a trade. It’s not that rising periphery bond prices, i.e. lower yields, isn’t helpful; it is. But even at current rate levels, it will be mighty hard for many countries to maintain austerity pledges; all attempts to do so will likely accentuate the trend we see in the chart below:

And of course, this chart is the mirror image of the domestic adjustments periphery countries have to make because they do not have a free-floating currency available to help them make these adjustments:

Thus, periphery economies desperately need some growth. Rising unemployment and tighter budgets will not produce revenues needed to pay debt; instead it produces a self-feeing vicious spiral downward. This view seems completely at odds with the Troika program even though the Greek economy provides them with live test case of abject failure stemming directly from the implementation of their own flawed theories.

And here is why it will likely get worse for Greece and other periphery countries whose growth is heading lower—the real economy will be starved.

We have already witnessed this economic/money/manipulation phenomenon in the US, from the WSJ this morning:

“The eight giant European banks that have disclosed their annual results in recent weeks reported holding a total of about $816 billion in cash and deposits at central banks as of Dec. 31. That is up 50% from a year earlier, when the same banks were holding roughly $543 billion.”

Does any of this sound familiar? You can lead a horse to water, in fact you can force-feed said horse with massive amounts of reserves, but you can’t make him lend any of it to the real economy where real people build real businesses and hire other real people who need real jobs.

Just in case you forgot just how tightly US banks have held on to their Fed sponsored reserves via the massively steep yield curve that impoverishes savers to subsidize bank healing, here is a look. This chart shows reserves in the US banking system … hmmm … three years and counting so far since Bernanke and Company decided this is the only viable strategy for the economy. Viable for financial assets, but the other side of the economy is still starved …

The point is, despite the new Greek rescue (I am losing count how many we have had so far), it appears the Eurozone, now clearly a two-track world with Germany bathing in credit and low rates and low unemployment (which adds to more angst and animosity toward Germans amongst the PIIGS), appears collectively heading into deeper recession.

One wonders if now, finally, EU leaders have run out of rabbits of financial engineering to pull from their hats. Financial engineering is a lot easier than real growth. If you don’t believe me, go ask Goldman; after all it is their fun and games that caused much of this Greek problem in the first place.

Hmmm …

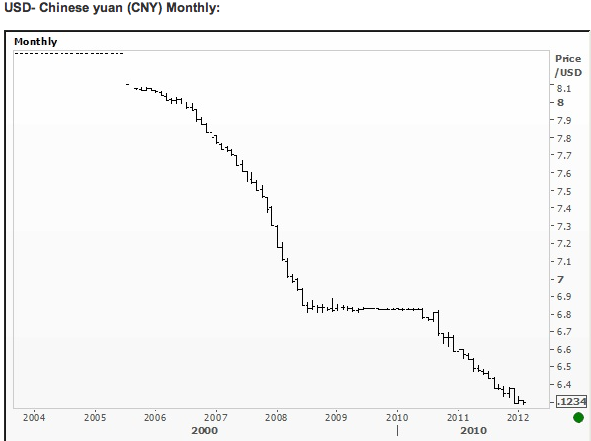

A theme being discussed more and more is the idea China is going to save us from the monetary mess in which we are now firmly ensconced. But based on my understanding, it will likely be several decades, if ever, before the Chinese currency seriously challenges the US dollar for global reserve currency status.

“Be extremely subtle, even to the point of formlessness. Be extremely mysterious, even to the point of soundlessness. Thereby you can be the director of the opponent’s fate.” – Sun Tzu

However, it is not to say there won’t be a different global monetary solution in the years ahead. It will depend on whether or not there is a repudiation of US debt. If so, I think some new order will take place, along the lines of what Keynes’ talked about — the Bancor. He knew early on the dangers attached to a dominant world reserve currency. [Mr. Triffin, aka ofTriffin’s dilemma fame, warned the US would be facing structural current account deficits as far as the eye could see in its role of world currency reserve supplier.] Thus, these two were very aware of the danger of global imbalances before it became popular in this cycle. The Great Depression was a valuable teacher for them.

Of course history tells us global monetary systems are more haphazardly morphing events than they are planned occurrences. All we have to do is watch the G-20 to see how difficult serious, multi-global planning can be; heck, those guys can hardly decide on what wine to serve and the order of photo ops.

The handoff from pound Sterling to the US dollar was an unplanned evolving event that accelerated after WWI. There was no great planning when President Richard Nixon took us off the gold standard and ushered in the error of floating rate currencies. The gold was draining out of Fort Knox, something had to be done. Game over. Dirty float for a couple of years, then no pretense whatsoever of anything backing the currencies of the world’s major powers. Just faith! No pretense was justifiable; from that point onward money was a store of value. Purely a unit of exchange it became. Case closed.

So, it leaves us where we are, as I shared with you yesterday, thanks to the excellent insight from Professor Barry Eichengreen. Now I think it is time to explode the myth China’s currency will replace the dollar. Many newsletter writers think that will happen tomorrow. Proving once again newsletter writers never have to answer for their inflated farcicality. But even some serious people believe within the next decade China’s currency will rule. I think even some serious people are wrong.

Rather than turn this into a LONG essay, I will try to breakdown the reasons why I think the Chinese yuan is a very long way from world reserve currency status:

-

It is never as simple as “the world reserve currency goes to the country with the largest global GDP.” The US surpassed the UK in terms of total GDP back in the 1870s. Yet pound Sterling remained the reserve currency for another 40 years or so.

-

Remember, the world reserve currency country is saddled with a consistent current account deficit. Thus, China must push out trillions of renminbi and renminbi-based asssets into the world economy. Fine if your model is open and based on consumption. Not so good if it is driven primarily by exports, as China’s is. So we will need to see a big shift in China’s growth model. That will be a wrenching long-term process.

-

The reserve currency country must open its market to allow foreign investors to hold local assets. This means China will have to make a complete change to its current political structure to allow much more freedoms for citizens (not only allow money to flow in, but allow its citizens money to flow out freely). The system in place is not something that is likely to change anytime soon despite the window dressing. The communist party still maintains absolute power, despite the comments from visitors that all they saw was free market capitalism during their trip to the Orwellian Hall of Mirrors. It shows just how well the central committee is doing its job. If you want a better insight into this issue, I strongly suggest you read, The Party: The Secret World of China’s Communist Rulers, by Richard McGregor. I think this does a great job of showing us how the West in general is duped by the Chinese leadership.

-

The US is becoming wealthier relative to China. Say what? All true. The fact is since 1991, “the average Chinese citizen is more than $17,000 poorer relative to the average American than he was in 1991.” Per capita income for relatively large states is the best single determinant of competitiveness long term. So, until this trend changes, it is highly unlikely the US will give up the mantle of currency reserve status. [See “China’s Century?” by Michael Beckley, International Security, Vol. 36, No. 3 (Winter 2011/12), pp. 41-78.

-

Even optimistic assumptions from those who should know, assuming China’s growth remains on track, suggest by 2035 up to 12% of global reserves may be held in yuan. [See Jong-Wah Lee, Asian Development Bank, “Will the Renminbi Emerge as an International Reserve Currency?”]

-

Officially, all is good. But unofficially, China may be facing its own debt bomb that could dampen growth for years, not just one or two quarters. It happened to Japan. Never say never! “The government’s official debt is only 15 percent of GDP, but it adds up quickly. Ratings agency Fitch estimates a bailout could cost 20 percent of GDP. Add the unpaid cost of the last bailout, debts at state-owned entities, local governments and pension liabilities, and a Breakingviewscalculation suggests Beijing’s debt rises to roughly 130 percent of GDP,” according to Reuters Breakingview.

-

The current attempts at internationalization of the yuan seem backwards. Normally a country opens its capital account and upgrades its domestic financial system before attempting to internationalize its currency. Instead China is offering bi-lateral exchange deals with some trade partners, and that gets a lot of press. But that seems to be mere window dressing as countries are really taking up the credit China is offering. And the developing offshore yuan deposits in Hong Kong may actually backfire, as the unofficial yuan rate in Hong Kong (CNH) is fluctuatiing around the official rate in China (CNY). This may force China’s central bank to actually hold more dollars.

So as much as it might be a good thing for the global economy to have a new reserve currency on the scene, it doesn’t seem as if it will happen soon enough to help in this cycle.

With investors globally wondering what central planners are up to next and how it will impact gold, today the Godfather of newsletter writers, Richard Russell, was discussing this very subject: “A few months ago I wrote a piece about avoiding pain in the economy. How do we do it? We do it by turning away from austerity and embracing inflation. And the question — will the inflationary method of avoiding economic pain kill our economy, just as the drug (taking drugs) way of avoiding pain has killed so many talented musicians? I think the results will be the same.”

Richard Russell continues:

“The world has drunk at the punch-bowl of good times and debt ever since World War II. The world has avoided the discipline of pay-as-you-go and austerity for decades. But sooner or later the piper must be paid. Up to now, the piper has been ‘paid’ with vast amounts of fiat paper.

The politicians want to make the people happy. The Fed is beholden to the politicians. The voters want it all, and they don’t like pain. The Fed and the politicians want to make the voting public fat and happy causing as little pain as possible.

Examples: courtesy of Bill Gary’s great publication, ‘Price Perceptions.’

Last week the Fed announced that they were extending the current near-zero interest rates out to the end of 2014.

The European central bank gave in and finally reduced interest rates to 1%.

The Bank of England is meeting next week to decide on another round of QE. (money printing).

This week the Bank of Australia will decide on whether to reduce rates again.

The Swiss National Bank placed a currency floor of 1.2 francs per euro in September to prevent further strengthening of the franc.

Japan has been printing for years in an effort to keep the yen cheap and competitive against other currencies.

Every nation wants a cheap and export-friendly currency. The result is a blizzard of (fiat) paper money blowing across the face of the earth.

Inflation is the central banks’ method of avoiding the pain of austerity. Inflation is the current economic narcotic that is used by modern nations. It’s the old ‘beggar thy neighbor’ system, and it will ultimately result either in all out hyperinflation and a collapse of the fiat currency system or a corrective deflationary crash. Either way, the last currency standing will be gold.”

To subscribe to Richard Russell’s Dow Theory Letters CLICK HERE.

Inflation can be deadly to your investments. It’s a silent killer, too — one that reduces your “real” asset value even when the “nominal” worth looks higher.You can now defend Yourself From The Fed With new Inflation ETFs offering direct exposure to U.S. inflation and deflation expectations.

….read Defend Yourself From The Fed With These New Inflation ETFs (INFL, DEFL, RINF, FINF)

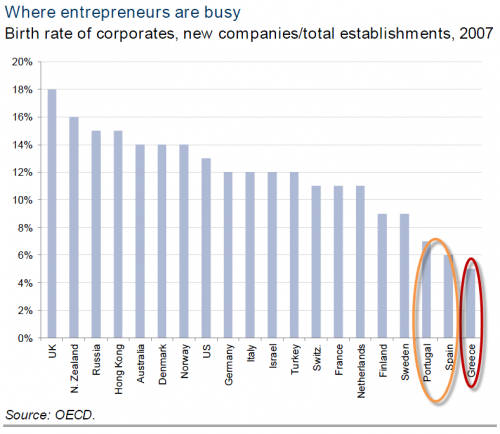

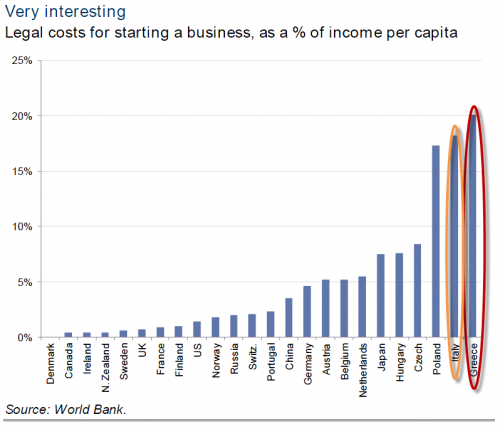

Perhaps after today’s budget miss in the Hellenic Republic it is time that the focus shift from the reality of a pending #fail for the voluntary PSI (for all the reasons we have at length discussed no matter how many headlines the markets tries to rally on) to a post-restructuring real economy reality in Greece. Whether self-imposed by devaluation or Teutonia-imposed by Troika, austerity is in the cards but there is a much more deep-seated problem at the heart of Greece – a total and utter lack of innovation and entrepreneurship. As Goldman’s Hugo Scott-Gall focuses on in his fortnightly report this week “the competitive advantage of innovation is one that developed markets need to keep” and in the case of European nations that desperately need to find a way to grow somehow, it is critical. Unfortunately, Greece, center of the universe for a post-restructuring phoenix-like recovery expectation, scores 0 for 3 on the innovation front. Lowest overall patent grant rate, lowest corporate birth rate, and highest cost of starting a new business hardly endear them to direct investment or an entrepreneurial dynamism that could ‘slow’ capital flight. Perhaps it is this reality, one of a Greek people perpetually circling the drain of dis-innovation and un-growth, that Merkel is starting to feel comfortable ‘letting go of’. Maybe some navel-gazing after seeing these three doom-ridden charts will force a political class to open the economy a little more, cut the red tape (after a drastic restructuring of course) and shift focus from Ouzo, Olive Oil, and The Olympics. We also suggest the rest of the PIIGS not be too quick to comment ‘we are not Greece’ when they see where they rank for innovation.

As if these were not bad enough, via Wikipedia, we also note the following three fun facts about the glorious Mediterranean nation:

Greece has the EU’s second worst Corruption Perceptions Indexafter Bulgaria, ranking 80th in the world, and lowest Index of Economic Freedom and Global Competitiveness Index, ranking 88th and 90th respectively.

Quite impressive…and no wonder 5Y CDS held their high cost of protection even when immediate credit event triggers were doubted…sooner rather than later they will default again unless something drastic changes and our admittedly premature discussion of more violence is becoming more and more likely every day as social unrest seems the only catalyst for change in a surreal world of central bankers, banks, and politicians.