SPECIAL NOTE. We are moving back to a buy for gold as of today’s close. – Stephen Todd #1 Gold Timer 2011. Previous Message from The Gold Report:

“The next few years will be dangerous times for investors. During the last inflationary near-collapse of the monetary system in the late 1970s, there was less debt and interest rates could rise to their natural market levels, which turned out to be close to 18%. Today, a 15% interest rate would mean all of the U.S. government’s revenue would be needed just to pay the interest on its debt, guaranteeing a monetary system collapse. So, I own gold and silver to protect my wealth.”

Jeff Berwick, chief editor and founder of The Dollar Vigilante and avowed anarchist, holds precious metals for safety and holds their equities for profits. In this exclusiveGold Report interview, he counsels geopolitical diversity and paying close attention to precious metal stocks.

COMPANIES MENTIONED: AMARILLO GOLD CORP.– GOLDEN PREDATOR CORP. – IAMGOLD CORP. –MERREX GOLD INC. – NAUTILUS MINERALS INC. – TIREX RESOURCES LTD.

The Gold Report: Your newsletter, The Dollar Vigilante, is the closest thing the newsletter industry has to a comic book superhero. Why the name?

Jeff Berwick: In 2007 a headline, “Where are the bond vigilantes?” started me thinking that you really cannot have bond vigilantes when the central banks can buy as many bonds as they want. There is no point in being a bond vigilante if you cannot influence governments and central banks by selling bonds. I realized that the only way you could do that was by selling dollars.

A dollar vigilante is a free market individual who protests the government monopoly and financial policies, such as fractional reserve banking and unbacked fiat currencies, by selling those same fiat currencies in favor of other assets, including gold and precious metals. We are dollar vigilantes to protect ourselves from what we see is the coming demise of the fiat currency system and the collapse of the socialist, Western nation base as we know it.

TGR: Are you really an anarchist?

JB: Yes, I am 100% anarchist. Anarchy to me is a belief that all transactions, all activity, should be voluntary. It is a peaceful philosophy of not forcing anyone to do anything and not allowing anyone else to force you to do anything. By its nature, governments and taxes are not voluntary. Government actions are violent and coercive, and theft as well. We are against those things.

TGR: In the February issue of The Dollar Vigilante your partner Ed Bugos wrote that 2012 will be the “last hurrah for equity bulls.” Can you explain the rationale behind that?

JB: Ed was reflecting on when he might turn bearish on the stock market in general, after having remained bullish since 2009. He sees 2012 as a “buy everything” kind of year, when bears will be throwing in the towel and trying to call the next “black swan” event.

The bears’ capitulation here, the expanding bullish froth and the withdrawal of the monetary stimulus and other phenomena will set us up for the next wave of the financial crisis, which we believe will likely be in 2013.

TGR: Here’s a statement from Mr. Bugos that sounds positive for the companies our readers are looking for: “The downgrade of our short-term outlook for the U.S. dollar and Treasury bonds. . .falls into line with the rest of our view, the return of the reflation trade disguised as a recovery trade or ‘return to risk.'” How will that happen?

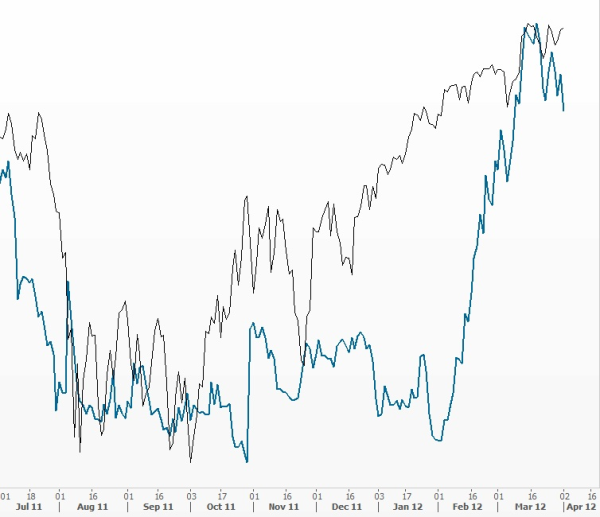

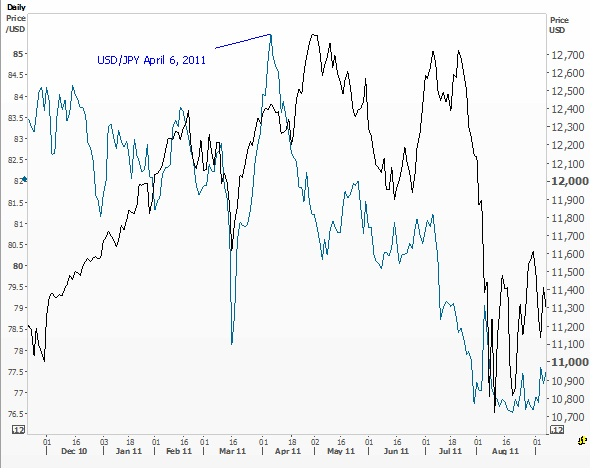

JB: We have been proposing that narrative since we upgraded our stock market outlook in September 2011 to bullish. Our forecast for a sideways gold price looking out 12 months rested on a return of bullish sentiment and stocks in the economy, especially in the U.S., which will result in people liquidating the safe haven assets they ran to last year: U.S. dollars, Japanese yen, Swiss francs, Treasury bonds and gold.

Last year people bought gold and gold stocks expecting a financial calamity, even while the Fed was increasing the money supply by double digits. February 2012 marked the 38th consecutive month in which the annualized money supply in the U.S. grew by more than 10%—an all-time record.

Now, people are beginning to sell gold, again for the wrong reasons; they think the crisis has passed and we are moving on to growth again. But that is a mirage. Instead of growth, this increase in money supply diverts resources to wealth-destructive activities. The central banks have created another boom and investors are falling for it. A good 80% of the recovery in earnings since 2008 is the result of monetary debasement. That is why price/earnings ratios remain so low.

TGR: Should people hold both precious metals and precious metals equities, or lean more toward one or the other?

JB: Personally, I hold both: precious metals for safety and stocks for profit.

The next few years will be dangerous times for investors. During the last inflationary near-collapse of the monetary system in the late 1970s, there was less debt and interest rates could rise to their natural market levels, which turned out to be close to 18%. Today, a 15% interest rate would mean all of the U.S. government’s revenue would be needed just to pay the interest on its debt, guaranteeing a monetary system collapse. So, I own gold and silver to protect my wealth.

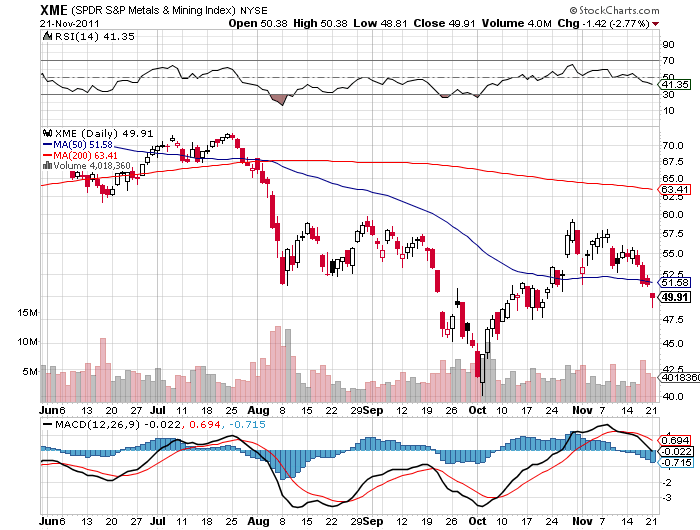

TGR: Let’s talk about some of those stocks. Last month The Dollar Vigilante downgraded its outlook on precious metals equities to “neutral.” What is your outlook on precious metals equities for the rest of 2012?

JB: Ed believes the December 2012 lows will be the low on average, especially for the juniors. He sees gold producers and juniors as quite separate. He is quite bullish on the juniors, but not as much on the producers. Our 2012 gold price outlook predicts a 2-in-3 chance of being range bound between $1,500/ounce (oz) and $1,800/oz and maybe 1-in-5 chance of gold declining to $1,350/oz. In any case, he expects a year-end rally to new highs.

We expect the equities that are most sensitive to the gold price in the short term to be at their worst in the next few months. However, we see explorers and emerging juniors recovering and trading higher, after being beaten down last year on what turned out to be a bum call for the deflation trade.

The worst is over for nonproducing juniors, but gold price-sensitive plays, which would include explorers with proved-up ounces at the lower-grade end of the spectrum, might be treading water until June, as gold prices retreat to the lower end of our expected range for 2012.

TGR: In your newsletter, you suggest that Golden Predator Corp. (GPD:TSX) could become a producer sooner than expected. How would that happen?

JB: Its flagship project, Brewery Creek, is a fully permitted mine with two leach pads in place holding 120,000 oz (120 Koz) of gold, 30% of which the company thinks may be recoverable. In the ground, it has an NI 43-101 resource estimate of about 288 Koz gold, half Indicated, half Inferred, some of it in the Proven and Probable category at a grade of about 1.6 grams per ton in near-surface oxides. That estimate will probably grow to 1 million ounces (Moz) once it publishes its updated NI 43-101 in the next few months.

If the leach pads on the property still work, the capital expense (capex) required to fund the project to production should be less than $20 million (M), more if it has to build new leach pads. Golden Predator has a strong balance sheet; it will not have to issue a trillion shares just to get up and running. That is one reason it makes sense to start up with a resource as small as 1 Moz.

Management tells us they are targeting commercial production and positive cash flow within 14 months, starting with small-scale production of 30 Koz/year. Management will use the cash flow to expand over two years to a processing rate of 140 Koz/year.

Its royalty portfolio is strong, with more than a $30M net present value (NPV) in our opinion and a lot of non-core assets it can monetize. It is also looking at debt financing rather than equity.

TGR: Why debt financing?

JB: I do not know, but we are supportive. We would rather see debt financing than dilutive equity financing at this point. Too many of the juniors are stuck having to do heavily dilutive equity financing at the bottom of the market.

TGR: You call Nautilus Minerals Inc. (NUS:TSX) a “must-own piece of a new industry,” the new industry being mining precious metals on the ocean floor. That seems more risky than land-based operations. Why should investors take on that risk?

JB: There are big profits in being first. We disagree in general about the relative risks of land-based mining vis-à-vis underwater based. Naturally, the risks of any new industry will be higher, but we expect there could be massive profits involved here.

As far as the risks go, a lot of the technology being used for undersea mining is borrowed from the technology developed by oil and gas drillers over the last 50 years or so. Remember, this is not drilling deep into the ocean floor. It is dredging and bringing up the sludge, as you see in one of my favorite TV shows, “Bering Sea Gold.”

Critics may also be worried about assaults by environmentalists. We looked into the environmental issue and concluded that the footprint will be smaller than on land.

TGR: This is not all sea floor mud. There also will be hard-rock mining, I believe.

JB: Yes and no. As I said, there are risks, but the rewards are great. Looking at the resource estimates, there is an average value of $1,000/ton (t) at current metals prices, including copper, gold, silver and zinc. But, according to the company’s 2010 study, it will cost only about $100/t to extract them from the sea floor and transport to shore. In our view, the market overestimates the risks of mining the sea floor and underestimates the potential profits.

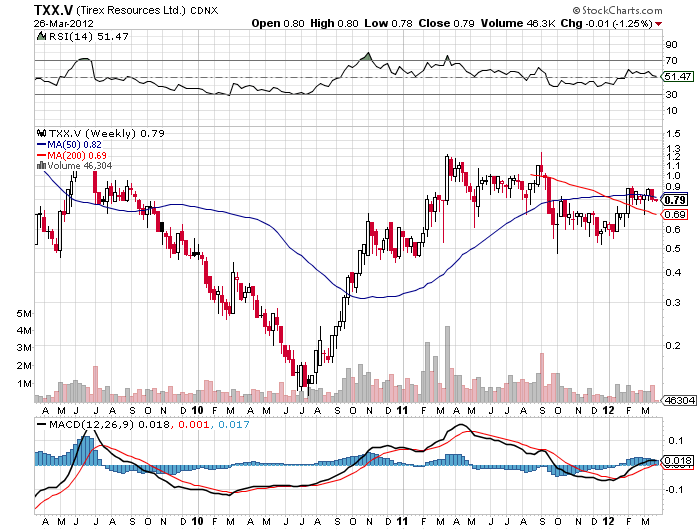

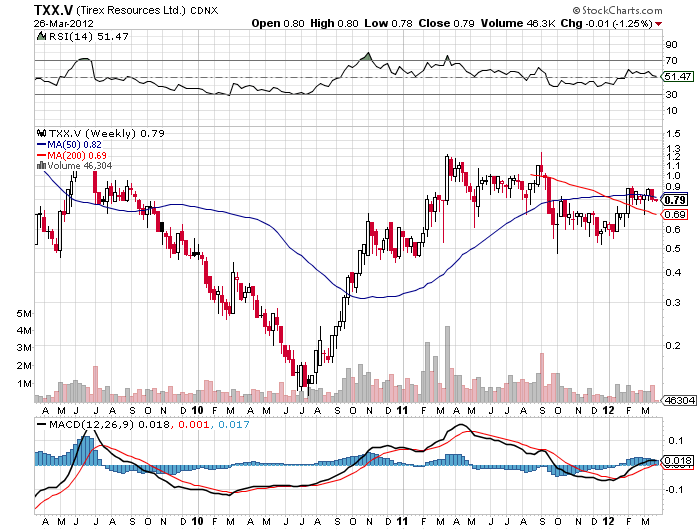

TGR: You follow Tirex Resources Ltd. (TXX:TSX.V), which owns 90% of the Mirdita copper-gold volcanogenic massive sulphide project in Albania, another jurisdiction unknown to most of our readers. Tell us about that.

JB: Let me start by talking about Albania. One of our strategies is to diversify our gold stocks geopolitically. This is because we believe the world’s financial monetary system is going to collapse and that governments will be the biggest risk to our capital over the next few years.

We want to own gold stocks in many different places because we never know which government will tax or nationalize gold equities. We like Tirex, in part, because we do not see a lot of political risk in Albania.

One of the uncertainties keeping Tirex from breaking away is the issue of permits. Another junior company in Albania ran into some low-level corruption with the local bureaucracy. This scandal cast a shadow over Tirex’s prospects for getting a permit.

Recently, Tirex brought on to its board a high-level fund manager with connections to top-level bureaucrats; this is a good sign that Tirex will not have too much difficulty getting its mining permits.

The company is in a joint venture with a local miner that will trade its facilities in exchange for an interest. Basically, Tirex will be toll milling its way to production once it gets its permits.

TGR: What other companies do follow?

JB: We really like Amarillo Gold Corp. (AGC:TSX.V) and Merrex Gold Inc. (MXI:TSX.V; MXGIF:OTCQX).

Merrex will have 35% of 5–10 Moz at Siribaya in Mali, and that is not even its best target. We believe the market is going the wrong way on this deal. IAMGOLD Corp. (IMG:TSX; IAG:NYSE) has earned its 50% interest in Siribaya one year early, and in 2012 is spending an amount equal to what it spent the previous three years. Based on what we have seen, drilling done in 2011 will increase the resource from 378 Koz to more than 1 Moz. This year’s drilling could triple that in 12 months.

The joint venture has shown continuity on that trend for up to 8 kilometers (km) with more than 50,000 meters of reverse circulation drilling. It will be easy to prove up more than 5 Moz, the amount usually needed to turn the market’s head. The next year or two will be rife with good drills and the potential for a big find. Most of its drilling now is at surface; there is a lot of potential when it goes deeper.

As we speak there is news of a “coup” in Mali. As an anarchist, I am always in favor of governments being overthrown—I just wish they’d stop replacing them with other governments! But in this particular case we have already been in communication with our sources on the ground in Mali. From what we hear it seems, so far, very much a case of “business as usual.” Merrex has no expats in country at present, so no issues there, and IAMGOLD’s in country guy is telling us that this is very much the military being unhappy about its inability to counter the insurgency’s firepower in the far north of Mali, at the Libyan border, and we are getting the same feedback from our Malian associates.

Obviously, we are monitoring the situation but for now we are not doing anything precipitous in the market on the sell side. In fact, we are looking at this at the moment as a buy opportunity. We don’t expect any kind of uprising that would in any way affect foreign business interests adversely.

But, this again points out the importance of geopolitical diversification and not placing all your eggs in one statist basket. Governments are the biggest threat to our liberties and wealth at this time.

TGR: On to Amarillo Gold and its Mara Rosa gold project in Brazil.

JB: The company plans to put Mara Rosa, a 1.3 Moz hosted-load deposit, into production by 2014 or 2015. Its prefeasibility study announced last year that it calculated an after-tax NPV of $178M using a $1,200/oz gold price and proposing an operation yielding 124 Koz/year gold over an initial seven-year mine life. It is moving toward a feasibility study now.

The company has average total cash operating costs of $524/oz and a forecasted preproduction capex of approximately $184M. These economics are robust, but not as robust as originally thought. The capex is twice the estimate in an earlier preliminary economic assessment. Mine life was also shortened. On the other hand, it increased production rates to maximize near-term cash flows and optimize NPV.

The bad news is that the capital requirement equals more than twice its total market cap, which will mean it will have to do a dilutive financing or an equally burdensome debt security. Either way, our $1.75/share valuation assumes full equity dilution as the worst-case scenario. That attributes an NPV of $212M to Mara Rosa, meaning it is $50M toward its exploration portfolio in Brazil.

TGR: What is the next catalyst there?

JB: It will probably have to do a financing fairly soon. But we like what we’ve seen so far.

TGR: Do you have any parting thoughts for our readers?

JB: We believe these are dangerous times for investors. In no more than five years, the U.S. dollar will be in a state of collapse and it will take down all fiat currencies with it. It is more important than ever to be prepared. That means diversifying your gold equities geopolitically.

Diversify your physical gold as well. In 1933, the U.S. government confiscated gold; it could do it again or it could tax it at a high rate. Try to put your physical gold holdings in different jurisdictions. I hold precious metals in more than a dozen countries to limit the political risk.

My overall message is that this is a highly dangerous time. People who are investing in gold and gold stocks are in the right area, but you have to go beyond that. It is more important than ever to do your own research.

If we can get rid of this system controlled by the central banks and move on to a more free market system—which I hope would include gold as money—the world would be a much safer, more prosperous, better place.

TGR: Jeff, thank you for your time.

Jeff Berwick is the chief editor of The Dollar Viligante newsletter. His background in the financial markets dates back to his founding of Canada’s largest financial website, Stockhouse.com, in 1994. He served as CEO from 1994 until 2002, when he sold the company, and continued on as a director until 2007. To this day more than a million investors use Stockhouse.com for investment information every month. Berwick is also the host of Anarchast, an anarcho-capitalist video podcast; a frequent contributor to numerous financial and precious metal websites; and a speaker at hard-money investment and freedom conferences.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) Brian Sylvester of The Gold Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Golden Predator Corp., Amarillo Gold Corp., Merrex Gold Inc. Streetwise Reports does not accept stock in exchange for services.

3) Jeff Berwick: I personally and/or my family own shares of the following companies mentioned in this interview: None. I personally and/or my family am paid by the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for partic