Mike’s Big Fat Idea

Victor’s big idea this week is to capture the huge gains in Vancouver real estate and buy on Vancouver Island for a fraction and banking or investing the balance. The beautiful lifestyle change is a bonus.

Don’t miss Featured Guest: Dennis Gartman: Major Markets Are Heading Down

The BFI this week involves a play on an expansion in market volatility. You can see that the Volatility Index on the chart enclosed is at a very low level from a year ago. In order to contain risk, an options strategy known as a “strangle” against the SPY is recommended.

….another BFI: Legalized Pot Can Be A Big Investment Winner

It’s a fledgling industry with a $6 billion dollar price tag. The question – is it time for a little weed in your portfolio?

Perhaps related? another Big Fat Idea – Making Money From The Oldies

….or what to do with $15K Inheritance from Grandma

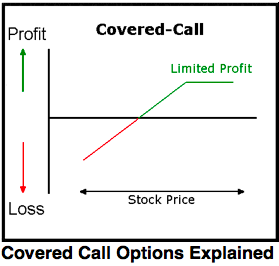

1. A a creative conservative investment for those frustrated with low interest rates of 1-2%. An investment in the the BMO Covered Call Utilities ETF.

Why?

1. As of as of July 29th/2016 it has generated an annualized yield of 6.65%

2. It delivers a tax-efficient monthly income from dividend paying telecommunications and pipeline dividend stocks.

3. The covered call strategy provides a partial hedge against market declines as well as while increasing income.

4. Its simple. Covered call ETFs make the relatively sophisticated strategy available to individual investors. (the average person usually doesn’t have the experience or know-how to execute option strategies on their own, and most advisers aren’t licensed to sell options).

How do they play it?

Contact your broker or bank and invest in BMO Covered Call Utilities ETF symbol ZWU (Zebra Whiskey Uniform)

Who is this appropriate for?

This is a conservative investment that ideally should be held for an entire market cycle, which generally lasts 4 years.

“covered call ETFs should, over a period of five years or longer, deliver returns that are 1.5 percentage points higher on average than comparable stock market ETFs. Call products will underperform in fast-rising market and outperform in sideways and down markets. Sometimes, the outperformance will come in the form of losing less money.” – Eden Rahim of Horizon Exchange Traded Funds

….related: Also using option strategies the following BMO ETF below is a more aggressive and unconventional alternative that sells puts against money in T-Bills aiming to gain an annualized return of 8%. By selling out of the money puts the fund is intended to protect investors from a 10-`5% decline. That said a 20% decline in the stock market would affect the strategy negatively.

….read more: BMO ETF aims to profit from writing puts in a strategy designed to yield 8% annually.

Also, Horizons Enhanced Income Gold Producers ETF uses the covered call strategy gain exposure to North American base gold mining and exploration companies while generating monthly distributions of dividend and call option income. An investment to consider in a developing bull market.

Who would have thought that you can make money from the fact that there are more people in Canada over 65 than under 15. Venturewerx President Collin Bowkett mines for gold in the aging popuation.

Also: Mike’s Quote of the Week will help you avoid significant losses