Market Opinion

Join MoneyTalks own Victor Adair and a select group of industry insiders at a FREE evening dedicated to helping you trade the markets with better information, less risk and more success.

Kamloops – Tuesday, May 18th – 6:30pm – The Coast Canadian Inn

Kelowna – Wednesday, May 19th – 6:30pm – Delta Grand Okanagan

Surrey – Thursday, May 20th – 6:30pm – Sheraton Guildford Hotel

If the last year has revealed anything, it is that most of us are not sure when it’s the right time to get in or out of the market. Way too many of us make our decisions based on emotions compared to the professionals who trade with a strict discipline designed to manage their risks and enhance their profits.

Our goal is to protect your capital and make you money. And the truth is we’ve done pretty well at it even in these difficult times.

These evening workshops start at 6:30pm and promise to be must-see events. MoneyTalks listeners and website users can attend these workshops AT NO COST but you must register in advance. Please email me at grant@worldoutlookconference.com or call 1.877.926.6849 to reserve.

Seating is limited and we will be making the tickets available on a first come – first serve basis. You are welcome to reserve tickets for family, friends and colleagues. We look forward to seeing you in May.

Sincerely,

Grant Longhurst

High Performance Communications Inc.

200 – 1311 Howe Street

Vancouver BC, V6Z 2P3

www.highpci.com

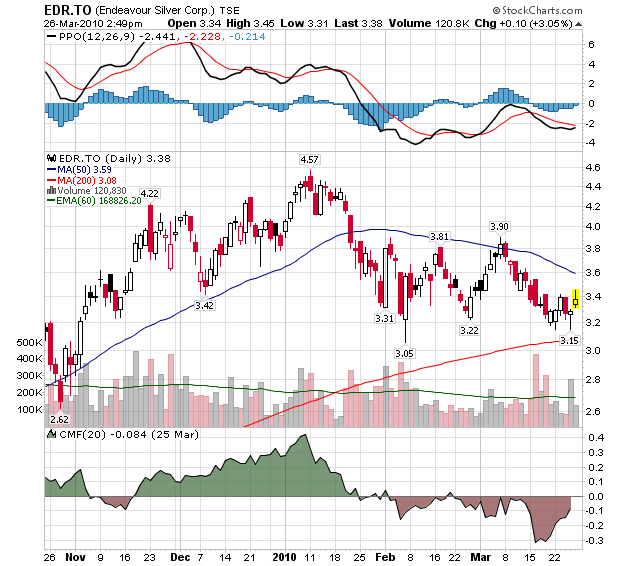

TORONTO (miningweekly.com) – Precious-metals miner Endeavour Silver expects production to increase 20% in 2010, to some 3,1-million ounces of silver and 15 000 oz of gold, produced as a by-product.

Last year, the company produced 2,6-million payable ounces of silver and 13 298 gold ounces from its two Mexican mining operations, Guanacevi and Guanajuato.

Production this year will be relatively flat in the first half of the year, but will ramp up in the third and fourth quarters, as new orebodies that will be developed in the initial part of the year come into production in the second half, CEO Bradford Cooke said on a conference call.

Cash costs are expected to decline to an average of around $5,50/oz for the year, compared with $6,04/oz in 2009, he said.

Endeavour has budgeted $29-million of capital investment for this year, as it continues to expand production capacity at both mines.

When the 2010 projects are completed, Guanacevi should reach 1 000 t/d and Guanajuato is expected to achieve rates of 600 t/d, the company said.

The final phase of organic growth currently planned should see the mine and plant capacities rise to 1 200 t/d at Guanacevi and 800 t/d at Guanajuato in 2011-2012.

Endeavour reported net income of $3,1-million for the fourth quarter, compared with a $5,2-million loss a year earlier.

Sales revenues more than tripled, to $24,2-million, and cash costs declined 33%, to $4,96/oz of silver produced, net of by-product credits.

“a new order in the making – one in which miners can prosper, and therefore better aid the broader prosperity in the areas where they work. Quite a turn around from a decade ago when miners, and most others who lift heavy objects, were still being distained as “old economy” while the last hurrahs of the Tech Bubble were being readied for a blow out. The exponential growth potential of the Tech era has been replaced by the shrinking supply concerns of the new resource era.”

Continuum

The Chilean earthquake that has done so much damage in the southern area of the country also cut short the consolidation that copper’s price had begun.

All reports indicate that there has been little damage at mine sites, most of which are in northern Chile. There is still a question of whether infrastructure disruptions resulting from the need to focus on the quake hit areas could reduce the country’s metal shipments.

Mines have begun to restart in Chile after having suffered power outages, and there appears to be little reason at this point to assume the world’s largest copper supplier will have to forgo much of this export that is so important to its economy. Despite this, the quick gains for the red metal have held fairly well until recently.

It’s also true that the past several weeks has seen the first significant declines in the LME warehouse stocks of copper, with over 20,000 tonnes moved off the list in a steady downshift. However, that was after stocks had built to a higher level than last year’s peak in London, and a much higher one still in Shanghai. The warehouse decline may have helped keep the quake induced price spike in place. Added to that has been some incrementally better economic stats coming out from various corners.

Strong numbers out of India, including a resumption of +7% growth on the back of a Q4 ’09 that saw a 14% gain in manufacturing that offset weak farm output due to bad weather. These numbers suggest India continues moving towards the next up shift in metal usage that China is already in.

The high base metal pricing has been sustained long enough that smaller producers, and some exploration stories, are beginning to make headway in the market. It is reasonable to expect decent Q1 numbers from producers who have been able to sell in to recent spot prices. There has also been room all along for beaten up explorers who have been ignored despite good prospects to see some lift.

That said, we are not comfortable that there has been enough shift towards a high inventories regime in the copper space to assume smooth sailing going forward. The red metal is again seeing tandem warehouse and price declines, and we continue to expect the market to remain choppy until there is some clarity on what a sustainable base price looks like. We may finally see some gain for base metal players delivering good drill-hole results, but do expect risk discounts to remain large for the time being.

The balance of the base metals space continues to follow copper’s lead, for the most part. The shifting sentiment is actually more obvious in the uranium space were several successful explorers we follow have announced bought-deal financings. Given the relative weakness the metal continues to show in the limited number of “spot” sales, this has to be viewed as further evidence that longer term optimism is returning. Even with the expectation that European and US recoveries will be sluggish, sufficient demand is now expected to keep the resource space moving forward.

That does not mean caution has been wrung out of the market. Gold continues hold steady even on days when the US dollar is moving up. The on-going game of musical stares the currency traders have with each other in Dollar/Euro pairs got a little more interesting on the weekend. Chinese Premiere Wen stated that he didn’t think the RMB (as the external Yuan is short formed) is undervalued and was tired of the West harping on the point. As Asian analysts point out, the issue is as much about the harping as the underlying question.

That is not likely to prevent further harping from politicians who are shy of brownie points for their next round at the polls. There are plenty of those in the US Congress in particular who have been writing up protectionist trade notes. We won’t bother rehashing the obvious observations about the US biting the hand that has been writing the cheques lately.

Post Crunch trade diplomacy has so far mostly just lengthened the tether on the protectionist monster. Any rumblings about taking its collar off will be good for the yellow metal, though unfortunately because it would be bad for the global economy. We would rather be focused on a return of the Indian retail buyer to gold’s market, and are looking for that.

Details aside, gold explorers putting out good results and generating volume continue to be well regarded by the market. Here too, bought deal financings are available to those with liquidity on offer. This will continue to be a favored space through the period of “stress-testing” of economies that will come as governments peel back their stimulus spending. Those tests will be measured in quarter by quarter terms.

The announced take over of Underworld by Kinross (see the update) also speaks to the potential boon coming. Kinross must have decided that waiting for the next few holes at Golden Saddle, which could add enough resource expansion to bring more bidders in, was not worth the risk. They are willing to pay full price for what is on the table now, and give UW a decent premium to market, even though not all of the detail they might want is laid out yet. In the process Kinross has made itself the most logical buyer for others who may be successful this summer in the White River region.

That is a theme that has played out a number of times recently, and that we expect to see continue. It has always been true that the most coveted discoveries are those that can open a producer to a new district scale potential. It’s getting tougher to find that kind of potential in comfortable jurisdictions.

Celebrations and Confabs

The celebration that took hold at Vancouver’s Winter Olympics was indeed a sight to behold. Though we had opined a party would get started, the scale and the celebratory nature of it, particularly in light of early tragedy and uncooperative weather, was eye opening. The city’s downtown was given over to the games with little grousing once they were underway, and from this sprang an unabashed show of Canadian pride.

As uncharacteristic and sometimes schmaltzy as this may have seemed to visitors, we heard little complaint that the overt nationalism was shading negative sentiments. Perhaps the visitors were just being polite on the subject, but that would require inverting yet another stereotype.

Events grow beyond expectations when seemingly disparate things come together. The much vaunted Own the Podium program may have built expectations, but that really wasn’t conversation fodder on the streets so much as at the TV interview level. There has been a sense in the aftermath of the Crunch that the country, and the city, is on the right side of history.

The psychology of well being and the shifting of herds it can sometimes generate, emotional states for which the “quants” of the finance world have no programming, are important to determining how well people do in the world. While the deep recession in the US has been hard on central Canada’s manufacturing sector the country was never caught in the bad bank issue; Vancouver slowed, but kept the perspective the drubbing it had when the Asian Tigers melted in 1997 would be balanced out to the good this time around. For the most part, it has been.

China, India and Brazil would not have continued on their growth paths after the Crunch had they believed they needed the banks that were failing in the US and Europe to do so. The market ups and downs as each new stat is laid out rarely account properly for that underlying sentiment that will actually determine how bright, or dull, the future will be. We are still looking for that sentiment shift to take hold in the debtor nations. In the mean time we are trying to find some tickets to the Paralympics sledge hockey tournament – all the Canadian games are long since sold out.

The annual Prospectors and Developers Conference was underway in Toronto less than a week after the Olympic flame had been doused in Vancouver. Whereas there had been a large drop in attendees at last year’s PDAC, this year some 20,000 people showed up in what is the largest gathering of its kind in the industry. Since we can remember when the event comfortably filled just the Royal York hotel (comfortable unless your room was booked in beside someone’s hospitality suite), the event now takes over much of downtown. The real change is not so much in size, but in composition.

The grab bag that comes with picking up a name tag used to be predominantly filled with pitches from different listed companies. This year the dominant pitch was from different countries. To the Russian Far East (“not far from Canada”) and half of South America was added a few African states, and Papua New Guinea talking about the soon to be first ever deep sea mining venture that is coming to its waters. The World Bank also had a pitch.

The international component isn’t new, but it is now composed of ministerial delegates who want to make sure the sector knows they are ready to move developments forward. A similar message is coming from Canada’s native groups who know they can sit down with companies and hammer out deals that governments have to listen to.

This again feels like a new order in the making – one in which miners can prosper, and therefore better aid the broader prosperity in the areas where they work. Quite a turn around from a decade ago when miners, and most others who lift heavy objects, were still being distained as “old economy” while the last hurrahs of the Tech Bubble were being readied for a blow out. The exponential growth potential of the Tech era has been replaced by the shrinking supply concerns of the new resource era.

Even with processes in place and generally accepted to deal with very real issues surrounding mine building, that won’t mean all is smooth sailing. We still expect to see calls for greater returns to the governments who are doing the courting. But now at least all parties are working from the realization that nothing will be developed unless everyone can benefit from the process. Cooperative capitalism, to coin a phrase.

There was a more cautious mood about stock picking this year. The turn around many feared was years away last March has come so quickly it is tough for many to accept.

That isn’t surprising. Mining is a cyclical business by nature. Those that picked the wrong metals at the wrong end of a warehousing cycle usually paid for their mistake with bankruptcy. There were many cycles that ended that way before this secular one began. Those hard lessons have not been forgotten by mining executives even now. Not surprising since several large mining houses were much closer to spectacular demise a year ago than many care to think about. That cautiousness has always been mirrored by mining analysts and even the “optimistic Coffins” get an occasional bout of it.

We agree with the caution in principal. The better things are in the market the harder it will be to find bargains. We like to think that we’ve done that pretty well through the past year. Several picks are doing very well indeed. We’ve learned the hard way to avoid that feeling of omnipotence that comes just before a spectacular tumble. We are always on the lookout for new stories but won’t add companies willy nilly just to fill pages. The market isn’t strong enough yet to lift all boats. We’re not afraid of it, but we’re still checking for oars and life vests before pushing off.

Ω

Gain access to potential gains of hundreds or even thousands of percent! HRA initiated coverage on 8 new companies in 2009. So far, the average gain on those companies is over 250%! For more information about HRA Advisories, please visit: www.hraadvisories.com

The HRA – Journal, HRA-Dispatch and HRA- Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-base expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

©2009 Stockwork Consulting Ltd. All Rights Reserved.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ , 85071 Toll Free 1-877-528-3958

hra@publishers-mgmt.com http://www.hraadvisory.com

The coming crunch will make last Sunday look pretty.

Not many people noticed amid the Democrats’ struggle to jam their health-care bill through the House, but in recent weeks U.S. Treasury bonds have lost their status as the world’s safest investment.

The numbers are pretty clear. In February, Bloomberg News reports, Berkshire Hathaway sold two-year bonds with an interest rate lower than that on two-year Treasuries. A company run by a 79-year-old investor is a better credit risk, the markets are telling us, than the U.S. government.

Warren Buffett’s firm isn’t the only one. Procter & Gamble, Johnson & Johnson, and Lowe’s have been borrowing money at cheaper rates than Uncle Sam.

Democrats wary of voting for the health-care bill may have been soothed by the Congressional Budget Office’s report that it would reduce federal deficits over the next ten years. But bond buyers know that the Democrats gamed the CBO system to get a good score.

The realities, as former CBO director Douglas Holtz-Eakin pointed out in the New York Times, are different. The real cost is disguised by the fact that the bill includes ten years of revenue but only six years of spending. It includes $70 billion in premiums for long-term care that will have to be paid out later. It excludes $114 billion in discretionary spending needed to run the program. It includes nearly half a trillion dollars in unrealistic Medicare savings.

Holtz-Eakin’s bottom line: The bill will not lower deficits, but will raise them by $562 billion over ten years. Treasury will have to borrow that money — and probably pay much higher interest than it’s paying now. Moreover, once the bill is fully in effect, the Cato Institute’s Alan Reynolds points out, its expenses are likely to grow at least 7 percent a year — significantly faster than revenues. At that rate, spending doubles every ten years.

No wonder Moody’s declared last week that the Treasury is “substantially” closer to losing its AAA bond rating. It’s not only the federal government that is heading toward insolvency. State governments will have to spend more under the health-care bill — $735 million in Tennessee alone, according to Democratic governor Phil Bredesen.

And state governments are already facing a huge problem called pensions. The Pew Charitable Trusts estimates that state-government pensions are underfunded by $450 billion. My American Enterprise Institute colleague Andrew Biggs argues in the Wall Street Journal that the real figure is over $3 trillion.

……read page 2 HERE

I think water will be one of the most important investment themes over the next decade, at least.”

Water is Too Cheap

“America’s water supply. It is – or is in the process of becoming – unreliable. I’ve written about this unfolding water crisis for years, and it always interests me. I think water will be one of the most important investment themes over the next decade, at least.”

….read the entire article HERE

Water is Too Cheap, Part II

Water is too cheap in the US…and it is also too cheap in the global stock markets. These are the main thoughts I took away from the Gabelli Water Investment Summit in New York earlier this year.

The most eye-opening presentation was by Nick DeBenedictis, the CEO of Aqua America, which is the second largest investor-owned water utility in the country. (It trades on the NYSE under the ticker WTR.) DeBenedictis told us about a city that “wondered why it couldn’t put fires out anymore.” The reason was the pipes were so old and clogged that there was only two inches for water flow. You’re never going to get enough water flow out of a pipe that size to put out a fire. “That’s not even enough to take a shower,” DeBenedictis said.

…..read more HERE