Investment/Finances

It didn’t matter which market we were watching – currencies, commodities, stocks – they had become oversold after a plunge throughout the month of September 2011. We expected a bounce and positioned our members accordingly. It is paying off so far. And as we currently see it, this is only a near-term correction that is going to be resolved in another major market collapse.

Perhaps the magnitude of the September move won’t be matched in depth and/or speed, but we believe most markets will ultimately fall through those September lows.

As those who follow us regularly know, we are big fans of using Elliott Wave principles to pinpoint trade setups. We recently came across this article from Elliott Wave International that does a good job of establishing the technical justification for another steep market decline. Give it a read – you’ll learn a lot in just 5 minutes.

Thanks,

Jack

P.S. They are also offering a FREE report at the end of the article. I think it’s worth checking out — you’ll be happy you did …

Did the Past 7 Weeks of Rally Lull You to Sleep?Here’s why you SHOULDN’T get too comfortable

Bear markets are cunning beasts.

Don’t get me wrong — we are not in the bear market territory yet. At least, not officially. An “official” bear market begins when the stocks indexes decline 20%. The DJIA’s decline from the May 2, 2011 high to the September 21 low is about 17%. Close, but no cigar.

Add to that the strong rallies we’ve seen over the past few weeks (Sept. 12-20: +685 points in the Dow, for example) — and lots of people conclude that despite the volatility, things aren’t so bad.

But let’s get some perspective. The stock market has been around a while. Only when you look at its history do you realize just how cunning — and fast, and strong — bear markets can be.

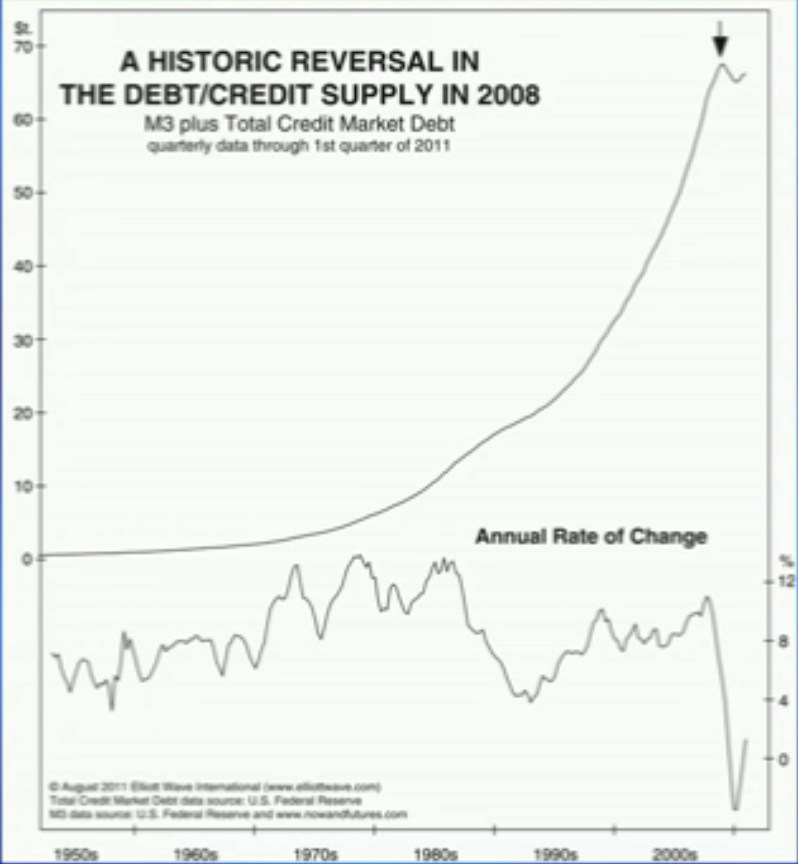

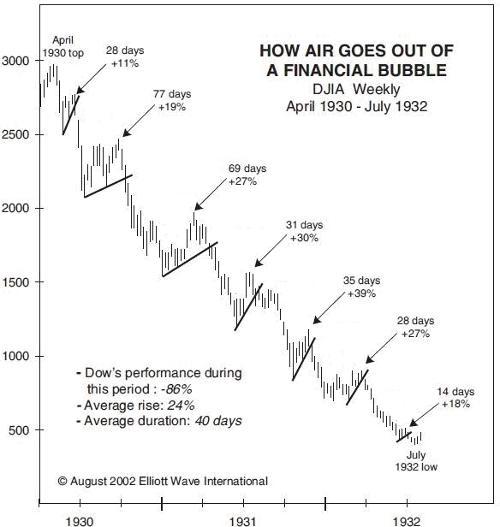

Here’s a chart we’ve shown readers before. It’s worth printing out and keeping on the wall above the desk where you open your brokerage statements.

This is the DJIA between 1930 and 1932, one of the worst bear markets in history. Robert Prechter, EWI’s president, took the time to measure the percentage gain of each bear market rally during the 2-year period — you can see them in this chart.

When you routinely see double-digit rallies (11 percent, 18 percent, even 39%) over the course of two or three years, it’s easy to be lulled into thinking that maybe things aren’t so bad.

The reality, of course, is that the bear market’s chokehold grows tighter around your neck with every drop-rally sequence. (Think back to the 2007-2009 collapse, and you’ll remember the same behavior.)

Which brings us to here and now. Rallies and declines of 300-400+ points have been so common since August that we’re kinda getting used to them.

The question is: Are we in a bear market, or is it that “maybe things aren’t so bad”?

You need some perspective to answer that question. The research we do here at EWI can help.

Ed Note: I have subscribed and downloaded and took a screen shot of the EWI report Buying Opportunity Ahead or Another “Free Fall” Ahead that Jack Crooks refers to. You can look at it by clicking HERE – The trouble is within the report is a video containing some fascinating charts, like the one at the top of this article, and that video will not play. If you want to view those charts you’ll need to subscribe to the EWI Free Report HERE – Robert Zurrer for Moneytalks.net

I am a big believer in the idea MAJOR global macro events are catalysts that produce long-‐term trend changes in markets (granted the gift of hindsight helps us see this; but for the record I believed the dollar had put in the a bottom during the credit crunch , and said so then, and though confidence in that call has waxed and waned, I still think the credit crunch marked the end of the US dollar bear market; now a multi-‐ year bull market is likely underway.

Victor Adair for Moneytalks.net: Welcome Daniel Park at the show, Daniel good morning how are you?

Danielle Park of Venable Park Investment Counsel Inc: Hey Victor my friend, how are you?

Victor: Good. In Ontario, this morning.

Daniel: Indeed.

Victor: Listen, we had an amazing week here but you know I kind of get the sense that we’ve had a lot of things go on this summer that have just been sort of set aside. Now, despite the fact that we had supporting up and down days back to back in September and we got the potential to really see some stresses in the markets. What’s your gut feeling?

Danielle: Yes, it’s been remarkable the pattern overlays, we’ve done…we do quite a lot of technical work at our firm and my partner Cory is a technician and we’ve done a lot of overlays lately of the patterns that have developed in the markets in terms of the valuations price, relative strengths, some of the main trends that have taken place. We’ve looked at that relative to both, for example the Japanese experience over the last 30 years in the deflationary cycle they’ve had and we’ve compared it as well to the inflexion points, or major turning points in the market in the North American markets and the global stock market as we look over the last say 11 years Victor, since the secular bear really started as we’ve discussed before in the late ‘90s. So, we look at that pattern versus where we are now, it’s amazing to me that it’s setting up very much like what we saw in 2008, where you had shots over the bow in the summer of ‘08 and then you had a couple of rebound or rally weeks in there. Then you got these huge down draft days that picked up into September, October, November when it made the first bottom in November there of 2008.

So, yes the jury is really out but it looks to me like it’s possible we could get that kind of a set up again. I hear so many people saying today, well, this isn’t 2008, this isn’t 2000…and I get that. They hope to hell it’s not but what if it is? Because really I think you could make the argument we’re worse off today than we were in 2008. Both in terms of the credit strains have gone global, China has civil unrest, riots taking place all over as much as they are trying to quash them. Back in 2008, China had inflation of 1%, they had tons of cash in reserves. We had a policy rate of five and a quarter at the Federal Reserve and they had room to go in terms of cutting all the way down to get things stimulated. You fast forward to today and there is a lot of things that are not available to us to combat this next down turn.

Victor: Danielle, I should remind our listeners here that you are the president and the portfolio manager at Venable Park Investment Council. You are also a CFA and as well as being a personal friend of mine and Michael Campbell’s.

Danielle: It’s like old school week here this show today.

Victor: Listen, the kind of the picture you are painting here I’m somewhat sympathetic to. On the show here over the past several months, I have repeatedly said we had a key turn date on the second of May and that was the day when the equity markets and the commodity markets reached a peak. Lots of exceptions but you know the broad indices did and it was the day that the US dollar hit a low relative to a lot of currencies. We’ve changed since then. I mean just to take a look at the credit markets, which I think are really key to everything here. Who wants to take a lot of risk with their money, they don’t want to take a shot on moose pasture and hope it works out. They want to try to hang on to what they’ve made and they are looking around and saying “Gosh, what can I do with my money?” T-bills are less than a half a percent, now here are 10 year treasuries at 2%. Its almost it’s like the authorities are forcing people who need to generate some income to take unwanted risk. What’s your take on that?

Danielle: I think there’s two distinct camps here. First of all, I would like to say that though there is a lot of economic malaise going on in the world right now, I’m actually fairly excited. We are basically setting up for the next buying opportunity in the secular bear. In our newsletter to clients this month, we were pointing out that every major secular bear that we’ve seen throughout history has a series of three significant down turns in the midst of three major recessions during that secular period. A secular period may be 15 to 20 years and during that, we got three severe recessions that came sort of every three or four years in there. Well, if we are entering recession right now Victor, this could be the third and possibly final recession of this secular bear. For somebody who’s been dealing with this with eyes wide open since the late 90s when we anticipated changing and from secular bull to secular bear, we are going to be having these really challenging conditions to work through for that long a period. I’m personally excited to think that we might actually be getting to the end of this period where there’s been so much monkey business, so much baloney, so many unwise people leading the way. If we can actually get a washout here, a third washout, it could potentially be the buying opportunity of our generation. So, that to me is extremely exciting.

Now, how do we get from here to there? Well, there’s two groups of people right? One is the accumulation group; those are the folks that are still working and hopefully now saving and able to amass some capital as they go here. Then there is the other group which have already accumulated and they are trying to live off the stuff they’ve stored in the cupboard. So, the people that are trying to live off right now have a really hard goal because they cannot in my view take blind reckless risks with their capital regardless of what the politicians are trying to incent them to do. I think if we’ve learnt anything in this time, we’ve learned that the individual cannot put blind face in government politicians or federal bankers’. Bankers in general have led us astray, caused much of this problem and still have not got it. So, you have to deal with the reality of that and say okay, I have to look out for myself. Most financial advisors today are utterly useless in this climate Victor, you and I have talked about this before. The learners will inherit the world here. The learners are the people that understand there is huge seismic shifts going on and that you have to calibrate your approach for that, not some textbook idea of that hasn’t applied for over a decade now. So, the buy and hold crowd, the passive allocators, that plow past the inequities and hope for the best, all that is rubbish. It’s hurt people, it will continue to hurt people. But for the people that get it, if you are in the accumulation stage here, what you need to do in my view is keep some powder dry.

First of all look at the bright side, interest rates have never been lower. So, if you have debt lock and load and get that paid off, use this opportunity to become debt free. That’s the first thing. The second thing is use this opportunity now where we’ve had this ridiculous rally really quick, really fast in the last couple of years, money was quickly given back that was lost in 2008. Great, if you are lucky enough to ride that sucker back up take some profit and develop some liquid assets because here is the thing. We’ve never really had a time in history when we’ve had an overdone real estate market in Canada, for example, and on overdone stock market at the same time to this degree. So, if we are right, and going right into the next recession of this secular bear, you could see a sell off in risk assets of another 20%, maybe 30% from here. You could see a sell off in real estate in Canada, maybe 20 to 30%. What you want to do is reduce your risk now, have some capital and make a list of what you are looking to buy, because if you do all that, this could be the greatest thing that ever happened to you.

If you can just maintain your liquidity, keep yourself out of harms way and know what you are looking for, the sale prices that are coming could be extremely rewarding for you. For the people that are already accumulated and trying to live on their interest income of course, it’s very challenging. But you also will probably get a buying opportunity in the next little while that will be really meaningful, not making 2 or 3% on dividends with horrendous risk to capital. I’m talking about great undervalued assets for the first time in years that will pay you 5, 6, 7% in dividends while this thing slowly recovers. That will be rewarding, to hold stuff that isn’t manically up and down 5% in a day which is the hallmark of bear markets. But if you get through this next contraction and you are able to buy things with good dividend yeilds, you’ll probably be able to hold them for a little while, like three or four years perhaps before they become overvalued again. So, that’s all good news.

Victor: Danielle I think our listeners just got a taste as to why I love having you on the show. Good for you. Listen, I’ve got Danielle’s blog site, it’s one of the things I look at regularly its www.jugglingdynamite.com. I’d recommend it to you.

We have the scenario here where you could get pretty gloomy about how things are. You could look at what’s going on in Europe, you could look at housing market in the United States, you could look at any number of things around the world where we’ve already got interest rates down near zero, so what more bullets do they have there. But Danielle you’ve just painted a very positive picture where if you can get through this period of time there will be great opportunities ahead.

Certainly my view has been that we had a credit boom that lasted for 30 years in commodities, real estate in particular stocks that really increased everybody’s willingness to take risk. By everybody I mean borrowers and lenders in particular as the leverage just got bigger and bigger. Now there is a book out there that Danielle and I are both fans by Gary Shilling called ‘The Age of Deleveraging’. His essential argument is that we are going to go through a number of years of like deleveraging, paying down the debt, gearing back and that will be met or countered to some degree by the authorities, government and the central banks with monetary policy.

Daniel: Absolutely a detox that we needed to have. We definitely needed it, and I think back to when I first got out of law school in 1990 mortages were 13% at that time and they have come down steadily ever since. Now if you look, I just checked the globe this morning and the best Canadian three year mortgage rate is 2.9%. So it’s really amazing and I think what is so significant about that is that rates are so low but the bias of consumers right now is not to borrow right. It’s like you’ve been out all night and drank for the last 24 hours you don’t want to drink any more. You’re sick of that, you want to regroup, recoup, have some water and some orange juice. That’s what consumers are doing today and thank God for that, because it’s been such a destructive period in so many ways.

CEO pay went to 300 times the average worker in the midst of all this because the wizards of leverage became looked on as a magicians and they were rewarded handsomely for that magic. But now we realize that in fact that adding leverage is not a magical potion, it is actually a very destructive force in the world eventually because it’s always taken to extremes. We’ll have this again in human history but the good news for those of us that are here right now is that we are coming to the end of this and that once the rubber hits the road, once the truth gets out and I mean they have been trying to quash the truth here for he last few years, pretend and extend. All those gimmicks that are being used in accounting, suspending fair disclosure,all that stuff but it’s a house cards and it’s come back around again. The Euro crisis is just part of that, the financial crisis never went a way, it’s been bubbling under the surface.

Credit derivatives extended the leverage, allowed leverage on planet earth to go into the universe and all of that is now in the decline phase, and that’s all very healthy.

Victor: Can you give me a time frame?

Danielle: The leveraging started into the stratosphere with the US housing market bubble that burst in roughly 2006 and we started into the end game of the entire credit bubble at that time because “what happened was instead of letting that run it’s course the governments tried to intervene, which is typical by the way. Governments are not any dumber or smarter today than they have been throughout history, they are just people trying to do something because they are in a position of power and leadership and they are expected to do something. So they have tried to do things but what they’ve really done is depreciate the strength of the balance sheet, the fiscal strength over the last few years. So I think this phase when the crisis is coming back into bloom we’ll probably see a decline something like we saw in ’08. Really fast and furious, it could be within six months from now where we’re significantly lower. I am saying the buying opportunity possibly could come within the next three to six months on things like stocks and commodities if it goes rapid fire.

Now if they step in with more intervention and they try and bail everything out a bit more you could see that elongated because then we’ll probably get another interim rally. If that’s the case we’re headed into something more like Japan. Japan has had 30 years of lower lows on the stock market, personally I am hoping that we come to our senses a little quicker than that. If you remember Victor they used to say Japan is full of great pride and no one wanted to admit the bad mistake, no wanted to admit that their banks were full of bad debt. Hopefully we wouldn’t do that here, but I am not so sure. We seem to be wanting to do that same game and if that’s the case we’ll just make this harder on our selves, it will extend longer and that will be challenging. Patience has to be used because you will get sick of doing the prudent thing. You’ll get sick of waiting if you have to wait longer, you ‘llwant to run in with the madness of crowds but those who can control themselves and remain prepared will be the ones who get the reward.

Victor: We’ve got sort of two camps, there is the Keynesian camp that says what we need to do is to borrow more and stimulate the economy because the private sector is back on it’s heals and then there is the austerity camp that says debt got us into this problem in the first place and taking on more debt is not going to fix anything but as a trader and as an investor you may have a view as to how you think the world aught to be, but if you’re going to put you’re money to work on the basis if that’s I don’t think a good plan. I think what you need to do as a trader or an investor is you need to look at how the world is rather than how you think it should be and deploy your capital that way.

Daniel: Have you’re rules sets.

Victor: Have you’re rules. Now Daniel we need to take a break here for the news but if you wouldn’t mind staying with is like when we come back after the news to have you tells us what you are doing now for the clients that you manage.

Daniel: Okay.

Victor: You’re listening to Money Talks all across the Corus Radio Network and we’ll be right back.

[20:29] [COMMERCIAL BREAK] [25:22]

You’re listening to Money Talks on the Corus Radio Network, here again is Victor Adair.

Victor: Well welcome back we’re talking with Daniel Park let me mention her website again this is something I look at every day or two www.jugglingdynamite.com if you can’t write that down just try t to remember Daniel Park and you can Google that and you’ll find her website you will also find a number of views she’s done she is all over place this girl.

Daniel we could go on for another hour, I know you and I have had these kind of conversations before over dinner and that sort of thing.

Daniel: Usually with a glass of wine yes.

Victor: Absolutely but listen we have only got six or so minutes so tell me or tell us what are you doing these days for your clients and what sort of the objective of the your clients and how are you positioning yourself?

Daniel: Well I think the objective of everybody [IB] snow ball slowly and dangerously forward at all time, you don’t want to have a hand blasted off of it because then it takes a long time to grow it back. So I think you adjust your strategy given the inherent risk presently and like I say the hope that we’re going to get some meaning full opportunity in the not to distant future so that means for example if you have a lot of you’re asset wealth presently in real estate for example and I meet lots of people who say well my plan in the next year or four years is to seal this and downsize and have that money for my retirement. I would say then think about doing sooner. If you think you don’t want to hold your real estate for the next ten years if that wouldn’t suite you very well then probably you should think about downsizing your real estate sooner than later that’s the first thing. The second thing is don’t get lulled into the stuff that goes on main stream TV financial news, the stuff that passes as financial coverage is so harmful most of the time and you will hear 95% of the people saying that their buying everyday but if they have no liquidity, if they never told you sell if you have no cash then it’s absolutely pointless to tell people that everything is a buying opportunity, so that’s the next thing. So we definitely are sitting with a good portion of cash today, we have had a very healthy allocation to fixed income bonds which have done great Victor over the last several months, some of our bond units are up to 8% since the start of year. So it’s been very rewarding but we were in camp of deflation near term deflation because of the asset decline etcetera, so Gary Shelling was calling for long bonds to go down to 2 and 3% and we were off that same mindset, so far we are on target for that.

Bonds are still as I said decent place, the US dollar made us 20% in 2008 as everything fell as Canadian investors you can park in US T-bills, US denominated. I think it’s interesting the whole safety idea. When you heard a hurricane hit New York City last weekend I saw some pictures taken [IB] no water, food because what do people really do in crisis they use things they need, like cash, like food, like water. They don’t have a lot of like woven silver bars, like that wasn’t the thing people were scurrying to their underground caves with or trying to hunker down with. So I know gold has been on a hell of tear, it’s been a great thing for people that got in early. I am worried about it at these levels because Victor as you remember in 2008, 2009 gold shares sold off with everything else, they are basically paper assets so the whole real money aspect doesn’t really apply to paper traded version so that’s basically it.

Liquidity for me these days means US dollar some bonds, some cash and less exposure to real estate where possible.

Victor: Listeners on this show have known that I have taken the view that I want to have some currency diversification I personally benefitted hugely by the Canadian dollar rallying along with the commodity markets here over the last ten years and it’s not that long ago we were at the 60 cent number on the Canadian and now we’re both par. My global purchasing power as I call it went up and I had nothing to do with it [IB] into US dollars. I don’t know and that doesn’t imply that I know where the Canadian dollar is going to hit, it may go to $1.5 for all I know. I just know that at around a $1.3 I am very happy to diversify some of my currency exposure. Diversification a sort of rule of risk management and asset allocation that you don’t as you’re grandma would say, you don’t put all your eggs in one basket and you keep a littler powdered rye for an opportunity that will come up.

Anybody that stretched right to the max is a disaster waiting to happen and [IB] just protect [IB] for every guy that was in that spot there was probably 99 other guys that were stretched right to the max and you’re never going to hear about their happy story.

Daniel: No exactly and the other thing I think I have been hearing lately which gives me shades of ’08 is this whole [IB] fantasy. So to talk about the Canadian economy is tied to the hip of the US economy. We contracted in the second quarter Victor we just got that confirmation last well so we’re actually leading this down turn this time usually we follow behind the US we’re actually ahead of them on this down turn it seems but people are talking about the US going down and then they maintain hope that the Canadian dollar will maintain above par and our stock market won’t have decline and I wish that was the case but on planet earth there is no decoupling I am afraid.

Victor: Daniel thanks very much for taking the time to visit with us on a long weekend I’ll recommend again your website www.jugglingdynamite.com a very interesting blog site more than anything else. You can also find ways to connect with Daniel from that website. I look forward to seeing you again at one of these conferences where we can be on the same panel and then get a way and have a dinner and glass wine and talk about things we can’t even say on the radio.

Daniel: Okay Victor it’s always fun.

Victor: Okay Daniel.

[0:31:47] [RECORDING STOPPED] [006]

Last week we brought to your attention a world-class emerging shale play happening in Argentina’s Neuquén Basin.

The potential here for unconventional oil & gas development is enormous by any measure. A number of companies are well positioned to grow and prosper, including a few junior companies with significant land holdings.

In part 2 of our story below, my colleague and guest writer Michel Maassad of BeatingTheIndex.com shares his unique insights on those juniors… in what he calls “an opportunity of a lifetime.”

– Keith

P.S. Neither Michel nor I own shares in any of the securities covered below.

Ed Note: Michael Berry has written some gripping copy in the last few days.

This Time it’s Different

1. “This time it’s different” is a phrase, more than any other, which is found amongst the smoking wreckage of past investment bubbles. The dot-com and housing bubbles are only the most recent examples. However, it’s worth examining this phrase again in light of the storm that global financial markets are currently weathering. Many of us in the commodity space got caught short by the severity of the downturn in 2008. We can remember more than a few junior mining company CEOs who told us horror stories of flirting with bankruptcy.

We’re of the opinion that the correction we’re witnessing in gold now is a temporary correction in an otherwise secular bull market. We base this on the thinking that the underlying forces perpetuating this gold bull market are still intact. Read more HERE …

World Markets Down in Lockstep

2. The 3rd Quarter of 2011 ended on Friday, September 30. The world’s markets were down – lockstep. Of the world’s 38 major equity markets 35 fell, some more, some less with an average decline of almost 1%. US equity market declines averaged a heady 2.53%. North and South American markets declined 1.65% on average. Russia was off almost 3%. Only markets in Israel, New Zealand, Bangkok and Taiwan, of the 38, achieved positive returns. 82% of the 3rd quarter’s decline occurred in August and September. Read more HERE …

The New Credit Cycle

2. 1. The bottom line is, has always been, that the end of a credit crisis and the beginning of a new credit cycle cannot occur until all the debts have been repaid or forgiven. 1.

The Edge Of Chaos, is an out of print book but worth a read. In it author Bernice Cohen holds the simple prescription for the solution. She says “all debts must be settled.” Such a process can be drawn out and painful or quick and painful.

But our leaders, on both sides of the aisle, have abrogated the duty to solve the world’s massive debt problem. I am not claiming this will be an easy task. Because politics is involved in the decision of debt resolution and as a society we our addicted to debt, any painless solution is unlikely. Read more HERE…