Featured Article

Even as the rest of the market continues to submerge with the now traditional rug-pull at the open which sent Nasdaq tumbling after a modestly green open as Kathy Wood is apparently hell bent on liquidating all of her most liquid “growth” names to triple and quadruple down in her biggest losers, oil is surging on the back of yesterday’s latest OPEC+ surprise which has set the stage for a $100 barrel of oil as well as a Goldman oil price target upgrade.

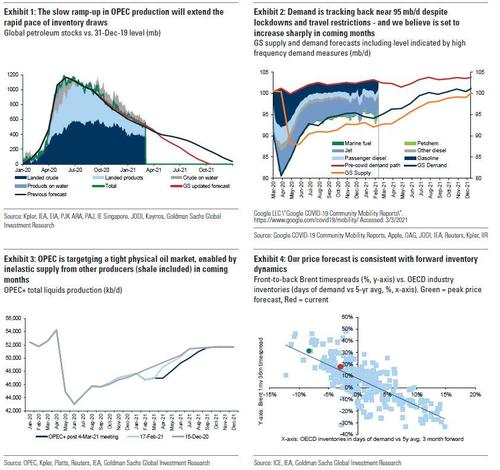

For those who missed the discussion (available to pro subs), late on Thursday Goldman’s Damien Courvalin wrote that “OPEC+ surprised once again by deciding to keep its production quotas unchanged for April, against our and consensus expectations for a 1.5mb/d hike (with only another small increase for Russia and Kazakhstan). In particular, Saudi Arabia will extend its unilateral 1 mb/d cut for one more month,guiding for an only gradual ramp-up afterwards.”

He adds that his key takeaway from the press conference is that “the discipline of shale producers is likely behind this slower increase in production” and this is consistent with Goldman’s own view that shale, Iran and non-OPEC supplies are likely to remain highly inelastic to prices until 2H21, allowing OPEC+ to quickly rebalance the oil market.

As a result, Goldman is lowering its OPEC+ production forecast by 0.9 mb/d over the next six months… which as demand rises of course means that prices will go up sharply. More on that in a minute.

Couralin then explains that OPEC’s supply strategy is working “because of its unexpectedness and suddenness.”

Today’s surprise follows Saudi’s January unexpected cut, with both working in Saudi’s favor – since January 5, oil prices are up 25% and excess inventories down 56% with Saudi’s production down only 9% and with the US oil rig count up only 20% and still 33% below the level needed to stabilize output (without DUCs).

This stands in sharp contrast to the Saudi strategy prior to 2020, when OPEC viewed itself as the central bank of the oil market, reassuring too much with predictable but never large enough cuts. According to Goldman, key will be the potential shale supply response, although the latest earnings season suggests investors are still a long ways away from rewarding growth, with the few producers who hinted at higher capex underperforming the rally in oil equity share prices.

So what does all this mean for price?

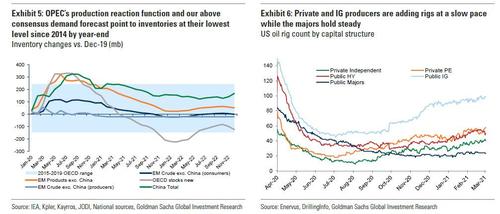

According to Goldman – which was already quite bullish on oil prices ahead of the OPEC+ summit (see “This Is The Best Inflation Hedge”: Goldman Doubles Down On Commodity Supercycle”) the bank says that it is now clear that OPEC+ is in fact pursuing a tight oil market strategy, with Goldman’s updated supply-demand balance pointing to OECD falling to their lowest level since 2014 by the end of this year.

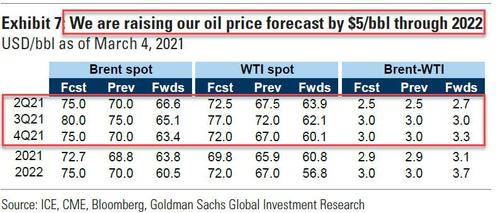

Given the bank’s revised demand forecasts remain unchanged and above consensus, OPEC’s decision led Goldman to raise its Brent forecast by $5/bbl, to $75/bbl in 2Q and $80/bbl in 3Q21: “This increase in our price forecast reflects stronger timespreads, with our updated inventory path consistent with $5/bbl additional backwardation over the next six months relative to our prior forecast.”

End result: Brent is approaching $70 this morning…

… which while great news for the like of XOM whose price rose above $60 for the first time in over a year, is also very bad news for those who still use cars instead of Uber to get from point A to point B.

That cushioned the blow of the pandemic, but raises some hard questions about what Canada got for all that spending.

The economy shrank 5.4% last year, Statistics Canada said Tuesday, the sharpest annual decline in the post-World War II era and the third straight year in which it underperformed the U.S. economy. That’s despite Canadians receiving C$20 ($16.55) in government transfers for every dollar of income lost, according to government data.

Treated to larger handouts, Canadians mostly hoarded them, potentially opening Trudeau’s government to criticism it has wasted money on programs that spread cash quickly but inefficiently. As one opposition lawmaker likes to put it: “The government spent the most to achieve the least.”

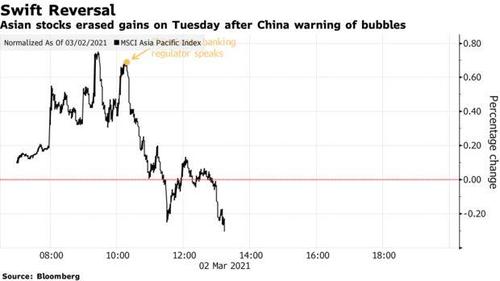

Lately not a session seems to pass without some “exciting”, unexpected event forcing momentum to reverse course, and sure enough following the best day for US stocks since June, overnight futures dropped after China’s top banking regulator said he’s “very worried” about risks emerging from bubbles in global financial markets and the nation’s property sector, sparking fresh concerns about further tightening in the world’s second-biggest economy and slamming risk assets.

Asian and European markets dropped, and US equity futures slid after Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission and central bank party secretary, said that bubbles in U.S. and European markets could burst because their rallies are heading in the opposite direction of their underlying economies and will have to face corrections “sooner or later.” Meanwhile, punting fears China’s own massive financial bubble – as a reminder China’s financial system is more than twice the size of the US making it the biggest bubble in the world – he said that China’s financial regulators are “walking a fine line of trying to curb risks at home while limiting disruptions from abroad as the economy opens wider to foreign capital.” The CBIRC vowed in January to stay “ahead of systemic risks,” after capping bank lending to the property market, slashing shadow banking activities and claiming victory in unwinding a wild expansion in peer-to-peer lending.

“China’s monetary policy has not been as easy as the U.S. and Europe,” said Steven Leung, executive director at Uob Kay Hian (Hong Kong) Ltd. “This latest comment will create worry of further tightening.” One almost wonder if the next round of cold war between the US and Asia won’t take form of slamming each other’s capital markets and asset bubbles – after all, both are the biggest they have ever been, so if either country wanted to inflict the maximum financial pain in a short time, well it’s pretty clear what they need to do.

Asia stocks immediately tumbled on Guo’s comments, with the MSCI Asia Pacific Index erasing earlier gains of as much as 0.8%. The CSI 300 Index in China fell as much as 1.4% and Hong Kong’s main gauge dropped almost 1%….

… while Chinese government bonds gained from a shift toward haven assets, sending yields on benchmark 10-year notes to a nearly three-week low.

US futures also dropped, reversing some of Monday’s gains…

… before recovering much of the loss. In notable premarket moves, Bank of America, Citigroup, JPMorgan, Wells Fargo and Morgan Stanley all dipped between 0.3% and 1.1%. Zoom Video jumped about 10% after the company forecast current-quarter revenue above estimates, as it expects millions of people to continue using its video-conferencing platform. GameStop and other “meme” stocks AMC Entertainment and Koss shed about 1% and 4.4% after a sharp surge on Monday with no apparent news on the shares.

“There’s lot of uncertainty, a lot of risks being built in, that’s why you’re seeing a bit of skittishness,” said Lorraine Tan, Morningstar director of Asia equity research. “The positive tailwind for the market is still going to be the global economic recovery.”

Most European equities recovered early losses to trade in positive territory, with the Stoxx 600 rising as much as 0.6% with media and personal care stocks leading gains, while energy and miners pace declines. In the U.K., the FTSE 100 Index rose ahead of the government’s annual budget report on Wednesday. Energy stocks fell the most among sectors in the region ahead of an OPEC+ meeting this week.

Asian stocks bore the brunt of China’s comments with China’s CSI 300 Index the worst-performing regional gauge in Asia, down 1.3%. Hong Kong’s Hang Seng Index also fell 1.2% after the city’s Chief Financial Secretary Paul Chan said he doesn’t rule out further changes to the city’s stamp duty on stock trades. Chinese technology firms such as Xiaomi were higher Tuesday, seen as beneficiaries of one of the biggest-ever revamps for Hong Kong’s benchmark Hang Seng Index. Energy was among the worst-performing sector in Asia as oil price fell before OPEC+ meeting.

Japanese shares fell, erasing early gains as technology firms reversed climbs and telecommunications providers declined. The intraday reversal mirrored broader moves in Asia as a China official said the nation is “very worried” about bubbles in overseas financial markets. Service providers and retailers also weighed on the benchmark Topix. The Nikkei 225 Stock Average gave up an early rise of as much as 1.1% and tumbled, dragged by a slide in Fast Retailing. The blue-chip gauge remains below 30,000 after its 4% slide on Friday but is still up 7.2% on the year, outperforming major U.S. and global indexes. “It’s been one-way up until this point for equities, so some would want to take profits,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management Co. “But in the end, equities will likely bounce back up on dip buying and such a trend is likely to persist over the medium-to-long term. That hasn’t changed.” Tokyo Governor Yuriko Koike said Tuesday the capital may not be able to meet the conditions needed in time for lifting the emergency status this Sunday given the growth pace of new infection cases, according to Kyodo News

In rates, after dipping early in Asian trading, Treasury yields rose two basis points to 1.44%, cheaper by ~3bp vs Monday’s close; gilts outperformed by ~2bp while bunds keep pace. Treasuries were lower with the curve steeper after Asia-session advance was unwound during London trading, leaving yields cheaper by as much as 4bp across long-end of the curve.

Long-end-led losses steepen 5s30s by nearly 4bp, 2s10s by 2.5bp; 5s30s extends rebound to ~153bp from 141.8bp at Friday’s close. Yields rose despite pressure on U.S. stock futures and declines for Asia bourses after China warned about asset bubbles. Fed’s Brainard, Daly are slated to speak later.

In FX, the dollar advanced against most G-10 peers except Norway’s krone and Australian dollar, with the BBDXY rising as much as 0.4% to the highest since Feb. 5. The euro ground below $1.20 before paring losses; the flattening bias that took over its volatility term structure from mid-February seems to have run its course. The pound fell versus all G-10 peers amid dollar strength; U.K. Chancellor Rishi Sunak will announce the U.K.’s budget Wednesday. The Australian dollar erased losses and the nation’s 10-year bond yields climbed after the central bank showed no discomfort with their recent rise, keeping rates unchanged in its Tuesday announcement. The Thai baht and the Indonesian rupiah led emerging Asian currencies lower on the back of a stronger dollar. The yuan weakened, tracking declines among Asia’s emerging-market currencies, with trading muted ahead of the nation’s annual congress meeting.

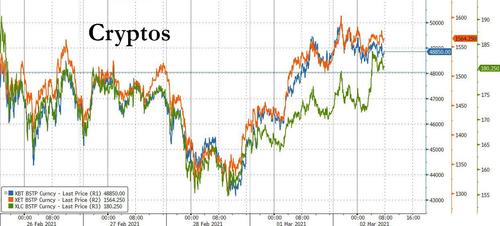

In commodities, oil futures in New York traded near $60 a barrel, with investors looking ahead to the OPEC+ meeting later this week. Meanwhile, Bitcoin steadied around $49,000 after rallying 8% on Monday.

Looking at the day ahead, data releases include the flash Euro Area CPI reading for February, German retail sales for January and the unemployment change for February, along with Canada’s Q4 GDP. Central bank speakers include the Fed’s Brainard and Daly, along with the ECB’s Panetta.

Market Snapshot

- S&P 500 futures down 0.5% to 3,878.50

- MXAP down 0.3% to 209.67

- MXAPJ down 0.2% to 704.86

- Nikkei down 0.9% to 29,408.17

- Topix down 0.4% to 1,894.85

- Hang Seng Index down 1.2% to 29,095.86

- Shanghai Composite down 1.2% to 3,508.59

- Sensex up 0.5% to 50,113.92

- Australia S&P/ASX 200 down 0.4% to 6,762.27

- Kospi up 1.0% to 3,043.87

- Brent futures down 0.8% to $63.21/bbl

- Gold spot down 0.2% to $1,721.18

- U.S. Dollar Index up 0.28% to 91.30

- Stoxx Europe 600 little changed at 412.64

- Euro down 0.3% to $1.2008

- Brent futures 0.8% to $63.21/bbl

Top Overnight News from Bloomberg

- China’s top banking regulator said he’s “very worried” about risks emerging from bubbles in global financial markets and the nation’s property sector, sparking fresh concerns about further tightening in the world’s second-biggest economy

- For U.S. politicians, China’s potential to dominate sensitive cutting- edge technologies poses one of the biggest geopolitical threats of the next few decades. President Xi Jinping is similarly worried the U.S. will block China’s rise, and this week will unveil plans for greater self-sufficiency

- ECB Vice President Luis de Guindos says it’ll be key to understand whether bond yields have risen due to inflation trends or due to other factors, though in any case officials “have the flexibility that is needed in order to react,” according to Publico interview

- The European Central Bank “can and must react against” any unwarranted rise in bond yields that threaten to undermine the euro-area economy, policy maker Francois Villeroy de Galhau said

- New Zealand’s central bank said it’s watching financial markets closely for signs of dysfunction and warned it has the ability to increase its weekly bond purchases to put more downward pressure on yields

- Oil fell toward $60 a barrel in early Asian trading amid growing concern over this week’s OPEC+ output-setting meeting

- Turmoil in Treasuries that has sent longer-dated yields soaring is stoking talk that the Federal Reserve might look to reviveOperation Twist in order to reassert stronger control over interest rates at both ends of the yield curve

- Vice President Kamala Harris said Monday that the U.S. has the “imperative to strengthen infrastructure in our cities and create good union jobs” as the Biden administration readies a sweeping stimulus package to follow its $1.9 trillion coronavirus relief proposal

- A single shot of either Pfizer Inc. or AstraZeneca Plc’s coronavirus vaccines can cut hospitalizations among older people by around 80%, according to a study, in a further boost for the U.K.’s immunization program

- Dublin is the favorite destination for finance firms moving jobs into the European Union after Brexit, according to a study by consultancy EY

A quick look at global markets courtesy of Newsquawk

Asian equity markets whipsawed as risk momentum gradually waned despite the region initially taking impetus from the rally on Wall St, where all major indices notched substantial gains and the S&P 500 posted its best performance in almost nine months amid vaccine developments, impending stimulus, bond market rebound and strong US data. ASX 200 (-0.4%) reversed the early upside with the index dragged by weakness in the commodity-related sectors and after mixed data releases, while Nikkei 225 (-0.9%) also wiped out its opening spoils as participants digested soft data including a continued contraction in quarterly company profits, sales and capex in which the government cited uncertainty regarding the economic outlook for the decline in manufacturers’ business spending. KOSPI (+1.0%) outperformed as it played catch up to yesterday’s rally on return from an extended weekend and with South Korea to draft a KRW 15tln extra budget to support small businesses, protect jobs and purchase vaccines. Hang Seng (-1.2%) and Shanghai Comp. (-1.2%) were pressured after China’s banking regulator stated that China will reduce the level of leveraging, as well as curb reckless capital expansion and warned of large bubbles in the property sector, while Hong Kong Financial Secretary also refused to rule out additional duties on stock trades. Furthermore, it was reported that the US administration will engage with allies to combat forced labour including in China and will examine how the Treasury, Commerce Department and USTR can work together to deter currency intervention for trade advantage and is to pursue all available tools to address China’s unfair trade practices from excess capacity to coercive technology transfers. Finally, 10yr JGBs were higher and reclaimed the 151.00 level as yields marginally eased and following recent source reports that the BoJ is prepared to defend its yield range prior to the upcoming review and could take action prior to yields attaining 0.2%, while weaker results at the 10yr JGB auction failed to derail the ongoing bond market rebound.

Top Asian News

- China ‘Very Worried’ About Bubbles in Property, Global Markets

- Carlos Ghosn’s Smugglers Brought to Japan to Face Charges

- Citi’s Head of Hong Kong Investment Banking Said to Leave Firm

- Ant Tells Staff It Will Find Solution for Unsellable Shares

European equities (Euro Stoxx 50 +0.3%) opened the session softer across the board following a mixed APAC handover, but European indices now trade modestly firmer. Stateside, US equity futures are softer with RTY (-0.9%) the underperformer, whilst the other contracts take a breather after yesterday’s rally. Back to Europe, sectors kicked off trade predominantly negative but have since flipped to see the majority in the green. To the upside, Banks, Construction and Autos are the biggest gainers with upside of around +0.7%. Conversely, cyclically exposed sectors are faring worse off – indicating potential risk aversion, with Oil & Gas (-0.6%) the laggard as the sectors tracks losses in crude complex – with both BP (-1.3%) and RDSA (-1.4%) in firm negative territory. In terms of individual movers, Taylor Wimpey (+2.2%) saw better than expected earnings with FY revenue a beat on expected, GBP 2.79bln vs exp. GBP 2.76 and posted a record UK forward order book. Elsewhere, travel names are unwinding some of their recent gains, with reports also noting the EU is said to plan digital vaccine passports in a bid to boost travel. Ryanair (-3.4%) underperforms in the travel sector as the group stated February traffic was -95% Y/Y. Infineon (+0.2%) failed to sustain much strength despite reports it is to replace Nokia (+0.1%) in the Euro Stoxx 50. Meanwhile, from a portfolio standpoint, Goldman Sachs notes that balanced portfolios have suffered with the combined sell-off of equities and bonds. The bank suggests long-duration equities might continue to suffer from a real rate increase. This is shown as a 60/40 portfolio with Nasdaq & US 10y bonds recorded one of its largest biweekly losses since 2010. “For this reason, we continue to like value sectors and commodity assets which are levered to stronger-than-expected growth and have a less negative sensitivity to higher real rates,” GS notes.

Top European News

- Boohoo Faces Request for U.S. Import Ban Over Labor Concerns

- Lindt Plans Share Buyback Amid Upbeat Outlook for Chocolate

- Danone Starts Search for New CEO as Faber to Give Up Role

- Renishaw Starts Sale Process as Founders Seek to Bow Out

In FX, no fresh fundamental news or driver, but the Dollar extended its recovery gains from recent sub-90.000 lows in index terms against all major and EM counterparts, plus oil and precious metals on a mixture of short covering and increasingly bullish technical momentum. Indeed, the DXY has established a firmer platform having taken out a recent peak at 91.228 (from February 8) and the 100 DMA (91.282) on the way up to 91.396, thus far, to clear a path to 91.500 and a prior high from early last month at 91.600 (February 8). Ahead, light US data docket, but 2 more Fed speakers on tap in the guise of Brainard and Daly who are both 2021 FOMC voters and considered to be neutral.

- NZD/EUR/AUD – The Kiwi is lagging in the 0.7250 zone vs its US peer and under 1.0725 against the Aussie after relatively dovish/downbeat remarks from RBNZ Assistant Governor Hawkesby overnight (repeated more room for easing and upping QE if needed as the economic recovery is fragile and uneven), while the RBA rolled out almost identical policy guidance with the addition of acknowledging the fact that it bought bonds recently to reinforce YCT and will continue to as required in response to market conditions. Hence, Aud/Usd is holding near 0.7775 ahead of Q4 GDP and a component breakdown having digested mixed building approvals, current account and net export data. Elsewhere, the Euro is scrambling to retain grip of the 1.2000 handle after a dip below in wake of sub-forecast German data and more pledges from the ECB that more policy recalibration is possible if financing conditions are adversely impacted by the recent spike in nominal yields. For the record, preliminary Eurozone inflation prints were broadly in line with consensus, and from a chart perspective Eur/Usd could retreat further on a close beneath the 100 DMA (1.2033), while decent option expiry interest between 1.2045-65 (1.5 bn) may keep rebounds in check.

- GBP/CHF/CAD – Also losing out amidst the Greenback revival, with Cable losing 1.3900+ status, the Franc extending declines towards 0.9200 and Loonie closer to 1.2700 than best levels above 1.2650 against the backdrop of a deeper retracement in crude prices. However, Usd/Cad should derive some additional impetus/direction from Canadian GDP in the absence of competing US releases at the same time even though the updates are somewhat old (Q4 and December).

- JPY – The Yen continues to tread water near 107.00, but Japanese data was somewhat disappointing aside from a steady jobless rate vs expectations for a marginal uptick, and JGBs spiked despite a weak auction to unwind some convergence to USTs. So, 1.5 bn option expiries from 106.50-30 are exerting less gravitational pull before February’s services PMI.

In commodities, WTI and Brent front-month futures have been somewhat choppy throughout the morning briefly moving into positive territory but have since retraced the marginal upside. The complex saw overnight pressure amid the risk sentiment and with some potential jitters due rising expectations that OPEC+ will raise oil supply from April (full preview available in the newsquawk Research Suite). Moreover, an additional component potentially pressuring prices could be due to ongoing concerns regarding a slowdown in demand in China. On that note, it’s also worth mentioning reports suggesting Germany is set to extend its already modified COVID lockdown restrictions to March 28th from March 7th. Nonetheless, the fundamentals remain the same heading into the JMMC and OPEC+ meeting on Wednesday and Thursday respectively, while mass vaccinations continues move ahead and eyes turn to the Brazilian variant of the virus and any potential resilience to vaccines. WTI now resides around USD 60.60/bbl (vs low USD 59.50/bbl) and Brent circa USD 63.50/bbl (vs low USD 62.50/bbl). Notable risk events on the table today surrounds the OPEC JTC meeting, albeit the technical committee is to gather data to present to the JMMC, who tomorrow will review the data and make recommendations ahead of the policy-setting OPEC+ confab. Elsewhere, precious metals trade largely in tandem to the firmer Buck and have both been softer. In terms of forecasts bank, Citi cut their XAU average price to USD 1,800/oz from USD 1,900/oz. Spot gold is currently only modestly firmer at USD 1,730/oz but spot silver is lower by just under 1.0% intraday at USD 26/oz. Turning to base metals LME copper is seeing gains despite Shanghai copper falling for a third straight session in top consumer China as there appears to be signs of weakening demand. Shanghai stainless steel futures fell down as much as 2.6% after traders witnessed higher inventories with stockpiles jumping according to the latest data.

US event calendar

- 1pm: Fed’s Brainard Discusses Economic Outlook

- 2pm: Fed’s Daly Speaks to Economic Club of New York

DB’s Jim Reid concludes the overnight wrap

There have been two weeks this year that have reminded me of the Dallas TV series in 1986 where Pam Ewing wakes up from a dream at the end of a ratings flop of a series to find Bobby Ewing in the shower and that his death (and the entire series) was just a bad dream. The first such week was the one immediately after the GameStop saga. After being the most talked about financial story in the world for a few days it was hardly mentioned the week after. Fast forward to this week and after a huge furore last week over rising yields and weak equity markets, risk exploded higher yesterday and forgot about all possible troubles. I can’t help but think these big events will be a regular feature of this year as the forces in both direction continue to be huge and prone to sparking volatility.

As for yesterday, by the close of trade, global equities had surged on both sides of the Atlantic, in spite of the fact that investors continued to price in two full rate hikes from the Fed by the end of 2023, as well as an initial hike within the next two years. It was an incredibly broad-based advance, with the S&P 500 gaining +2.38% as every sector closed in the green and 465 companies in the index moved higher on the day, which is the largest number of positive movers since last April. It was the largest one day gain since June and the reversal in investor sentiment was further reflected by the VIX index of volatility falling -4.6pts, as it also erased most of the moves higher from last week. In particular, small-cap stocks outperformed yesterday, with the Russell 2000 up +3.37%, whereas the NYSE FANG+ index of mega-cap tech companies rose by a smaller +2.81%.

It was much the same story for European equities, as bourses including the STOXX 600 (+1.84%) rose across the continent. 550 members of the index rose yesterday with the reopening trade winning once again, even as some restrictions were extended across the continent yesterday. Travel & Leisure (+3.20%), Basic Resources (+2.60%) and Industrial Goods (+2.32%) all outperformed and reflected the better than expected PMI data.

Sovereign bonds witnessed a more divergent performance on either side of the Atlantic. In Europe they rallied strongly, with yields on 10yr bunds (-7.4bps), OATs (-8.6bps) and BTPs (-10.3bps) all seeing sharp declines as they caught up with the late US move on Friday. In fact, for all 3 it was the biggest daily move lower in yields since at least June. But for Treasuries it was a different story as 10yr yields rose a further +1.2bps to 1.417%, albeit unlike last week the move was driven by higher inflation expectations (+1.1bps) rather than real rates (+0.1bps). Nevertheless, there was a recovery for 5yr Treasuries, which suffered the steepest losses last week, with yields falling -3.5bps to 0.70%, having moved up +15.5bps last week. The long end of the curve continued to rise with 30yr USTs up +3.9bps to 2.19%, meaning the US 5y30yr curve steepened +8.3bps to almost halve the move from the latter part of last week.

One of the factors behind this divergence other than the catch up to Friday’s late US moves may have been the lack of remarks from Fed officials on last week’s events, with a speech from Brainard not really touching on the current developments as some might have expected. She is speaking again today but perhaps Chair Powell will have more to say on the matter when he speaks on Thursday. By contrast, the French central bank governor François Villeroy de Galhau said that “In so much as this tightening (in financial conditions) is unwarranted, we can and must react against it, starting with an active flexibility of our PEPP purchases”. Furthermore, he said that forward guidance could be strengthened to make it more explicit that the ECB would tolerate above-target inflation to make up for previous undershooting”. His remarks came as the ECB’s asset purchase data showed they bought €12.0bn in net purchases last week, beneath the €17.2bn of the week before, though it’s difficult to judge the exact impact here without having a full view on redemptions, which we’ll find out today.

Amidst the strong performance for risk assets yesterday, strong economic data supported the buoyant mood, with the manufacturing PMIs coming in above expectations for the most part. We’d already had the flash readings from a number of countries, but the Euro Area number was revised up to 57.9 (vs. flash 57.7), France up to 56.1 (vs. flash 55.0) and Germany up to 60.7 (vs. flash 60.6). On top of this, the ISM manufacturing index in the US rose to 60.8 (vs. 58.9 expected), the strongest reading since February 2018 with only the May 2004 reading higher going all the way back to 1988. ISM prices paid for inputs rose almost 4 points to 86 (vs. 80.0 expected), which was the highest reading since July 2008 as supply shortages and difficulty in finding workers were described as putting upward pressure on prices. It has only been higher for 40 months in the 878 months the series has been in existence since 1947. These instances were mostly clustered in 2008, 2004, 1979/78,1974/73 and 1950/51.

Overnight in Asia, markets are being weighed down by comments from Guo Shuqing, the chairman of China‘s Banking and Insurance Regulatory Commission and Party secretary of the PBOC. He said that he is “very worried” about risks emerging from bubbles in global financial markets and the domestic property sector. He added that bubbles in US and European financial markets could burst because their rallies are heading in the opposite direction of their underlying economies and will have to face corrections “sooner or later.” These comments have helped the Nikkei (-0.86%), Hang Seng (-1.33%) and Shanghai Comp (-1.31%) to reverse early gains. The Kospi (+0.39%) is trading higher though as it reopened post a holiday and with Korea posting a stronger Feb manufacturing PMI at 55.3 (vs. 53.2 last month) being partly helped by the global semiconductor chip shortage. In details of the PMI, there was a strong pick up in new export orders and indications that manufacturers are now passing the price increases to their customers which was not the case a few months ago. There was a similar message from Taiwan’s PMI (at 60.4 vs. 60.2 in January). Back to markets and futures on the S&P 500 have also turned negative (-0.50%). Elsewhere, WTI and Brent crude oil prices are down -1.53% and -1.44% respectively ahead of the OPEC+ meeting.

We also had the RBA monetary policy decision this morning where the central bank kept its key interest rate and three-year bond yield target unchanged. The RBA added that it stands ready to make further adjustments to its purchases in response to market conditions as it has done over the last few days. However the outcome is not as dovish as expected and 10y yields are back up +5.2bps as we type. Remember that this comes after last week’s +48.5bps rise and yesterday’s -24.7bps rally.

Global yields are a bit all over the place at the moment due to the upcoming US stimulus package and yesterday President Biden called on the US Senate to quickly approve the $1.9 trillion bill. Treasury Secretary Yellen also lobbied for a quick vote saying the bill “ensures that people make it to the other side of this pandemic and are met there by a strong, growing economy.” She indicated that the large recovery plan could mean the US returns to full employment next year rather than struggling to do so before 2025. Senate Majority leader Schumer said that the upper chamber will take up the bill this week though no final vote has been scheduled yet. Given the amount of edits and changes expected, the House is likely to need to vote again on the bill before President Biden can sign it into law. One item that will not make it into the bill is an increase of the federal minimum wage. Senate Democrats are putting that effort to the side for now, forgoing a plan which included tax penalties on big companies that pay low wages along with incentives for smaller companies. The idea came down after the Senate parliamentarian ruled last week that raising the federal minimum wage to $15 an hour failed to qualify under the budget reconciliation guidelines.

In terms of the latest on the pandemic, many European countries saw fresh restrictions, with a state of emergency being declared in Finland, as yesterday also saw new measures come into force in certain areas of Italy, with people in some places not permitted to leave their city or town except for work and other emergency reasons. Meanwhile in France, AFP cited President Macron as saying that the country needed another 4-6 weeks before restrictions could begin to be lifted. There was a brighter picture here in the UK however, as the 7-day average number of cases fell beneath 8,000 for the first time since early October. The European Commission is set to unveil a new proposal this month for a covid-19 vaccination pass or “digital green pass”, which will provide documentation that a person had been inoculated, recovered from Covid-19 or received a negative test recently. Some countries, including France, have already raised objections on the grounds of potential discrimination and personal data issues.

Meanwhile, France has now decided to allow the AstraZeneca vaccine for the elderly, thereby taking a U-turn from an earlier directive where France had originally advised only for people under 65 years age. In the US, Johnson&Johnson is trying to boost production of its newly approved vaccine, with the goal being 20 million shots delivered by the end of March and 100 million total by the end of June. A new Covid variant has been identified in New York City and is being “watched closely” by the CDC and US health officials according to Dr Fauci. The variant has already travelled through various neighborhoods of the city and has shown some resistance to existing antibodies. Across the other side of the world, China has now set a goal of vaccinating 40% of its population by the end of June.

Looking at yesterday’s other data, the German CPI reading for February remained at +1.6% as expected on the EU-harmonised measure, while Italian CPI rose to +1.0% (vs. +0.7% expected). Elsewhere, the UK reported that January’s mortgage approvals fell back to 99.0k (vs. 98.0k expected).

To the day ahead now, and data releases include the flash Euro Area CPI reading for February, German retail sales for January and the unemployment change for February, along with Canada’s Q4 GDP. Central bank speakers include the Fed’s Brainard and Daly, along with the ECB’s Panetta.

Neil McIver joined Michael to share why re-balancing your portfolio needs to happen right now – to avoid unnecessary risk in a COVID skewed market and in light of government interventions.

This was one of the themes in Neil’s 2021 World Outlook Financial Conference workshop – Beating the Market in 2021 & What Institutions Know That You Don’t. This workshop is the #1 most watched presentation from the Conference. As a special bonus for our MoneyTalks audience we’re able to offer you free access to Neil’s full video presentation. CLICK to Access

Mike’s Editorial

Posted by Michael Campbell

on Saturday, 27 February 2021 11:23

It’s the most anti-intellectual attitude in history. Straight out of the dark ages, McCarthyism or totalitarian China. The cost is huge but still we sat back and let it happen.