Daily Updates

Brief comment below from the Ledendary Trader Dennis Gartman. For subscription information for the 5 page plus Daily Gartman Letter L.C. contact – Tel: 757 238 9346 Fax: 757 238 9546 or E-mail:dennis@thegartmanletter.com HERE to subscribe at his website.

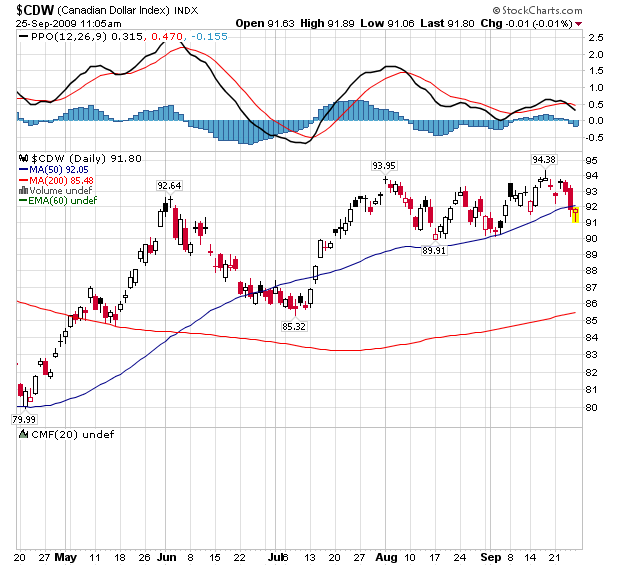

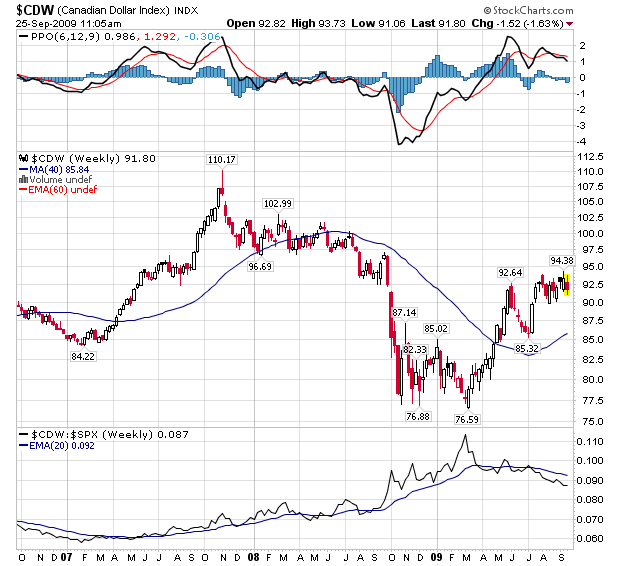

“We have been and we remain this morning concerted bulls of the Canadian dollar relative to the US dollar for the same reasons we have been bullish for the past several years on balance. The world needs energy: Canada has energy to go; The world needs food; Canada’s got food; The world needs base metals; they can be found in Canada…and Canada has the ports to ship those needs; it has the laws to protect contracts signed, and it has favourable and friendly relations with everyone… something the US cannot say it has or enjoys.” – From Dennis Gartman’s comment 9/15 HERE.

Turning then to trading, we are rather aggressively net short of Sterling vs. the US dollar, and in reality given that we are long of the Canadian dollar against the US dollar, we’ve actually “legged” our way into a long C$/Short Sterling trade.

Concerning the Canadian dollar, one thing we can be relative certain of is that the “Left” will not be calling for a vote of no confidence anytime soon, as they have tried to do in recent months several times. They won’t do so because the political winds are now beginning to blow rather severely against them and are blowing rather pleasantly for the centre-right Conservatives.

According to the latest poll taken of the political winds that are blowing by the CBC, the Tories have the support of 37% of those polled, up from 35.1% a few weeks ago, while the Liberal Party has the support of only 29.9%, unchanged over that same period of time.

The three lesser partiers, the New Democrats and the Bloc Quebecois, are divvying up the remaining support, with the former holding the support of 13.8%, down from 16.5%, while the latter has the support of 9.1%, down from 9.6. The “Greens” have the support

of 10.2%, up from 9.0% previously. Thus, on balance, support for the farther-left-of-centre parties is waning… and that once again is what Marta Stewart would call “A good thing.” From our perspective, when the far Left’s support has fallen from 35.1% to 33.1%, while the Centre-Right’s support has risen by a couple of percent that is a very, very good thing.

Canada’s elections at the federal level are “first past the post” and that means that a party can win a majority in the Parliament without a majority of the voters. Thus, it tends to require roughly 40% of the votes to be cast for one party to assure that party a majority. Given how closed the Tories are to that magic 40% level, the Liberals cannot and likely will not put their own support to a test by risking an election. The Liberals have tested the waters several times this year by floating the notion of a no-confidence vote and a swift election to follow, and each time the Liberals have stood down. Now, in light of the polls, they’ll not even raise the question of a non-confidence vote.

Ed Note: The Legendary Trader Dennis Gartman will be speaking at the:

The Money Talks All Star Trading Super Summit

Saturday, October 24, 2009 -The Sheraton Vancouver Wall Centre

Click HERE for the Speaker Lineup and to REGISTER if you want to take advantage of this Event.

Mr. Gartman has been in the markets since August of 1974, upon finishing his graduate work from the North Carolina State University. He was an economist for Cotton, Inc. in the early 1970’s analyzing cotton supply/demand in the US textile industry. From there he went to NCNB in Charlotte, N. Carolina where he traded foreign exchange and money market instruments. In 1977, Mr. Gartman became the Chief Financial Futures Analyst for A.G. Becker & Company in Chicago, Illinois. Mr. Gartman was an independent member of the Chicago Board of Trade until 1985, trading in treasury bond, treasury note and GNMA futures contracts. In 1985, Mr. Gartman moved to Virginia to run the futures brokerage operation for the Virginia National Bank, and in 1987 Mr. Gartman began producing The Gartman Letter on a full time basis and continues to do so to this day.

Mr. Gartman has lectured on capital market creation to central banks and finance ministries around the world, and has taught classes for the Federal Reserve Bank’s School for Bank Examiners on derivatives since the early 1990’s. Mr. Gartman makes speeches on global economic and political concerns around the world.

Regular Guest on Money Talks, and one of Michael Campbell’s favorites Jack Crooks of Black Swan Capital is offering Exclusively for readers and listeners of MoneyTalks a very SPECIAL OFFER. When looking at investments or the Economy – “Its all about the price of currencies” – Michael Campbell

Today’s Currency Currents below:

Quotable

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous. The final outcome of the credit expansion is general impoverishment.” – Ludwig von Mises

FX Trading – Newspeak ramble…and this time last year the dollar rallied

Editor’s Note: If you like government and government control, I suggest you skip today’s issue. We get complaints often about being “too political,” as if politics just seem to operate in a vacuum and have no impact on the economy. We agree this publication should not be about politics. It should be about global macro economics and how that might impact currency movement. But, sometimes we just can’t help it. And watching the G-20 is just too much for any somewhat sane person to take.

Mr. Orwell, the Ministry of Truth would like to see you…

“Demonstrating the repeated abuse of language by the government and by the media in his novel, Orwell shows how language can be used politically to deceive and manipulate people, leading to a society in which the people unquestioningly obey their government and mindlessly accept all propaganda as reality” – Jem Bakes

Ah, G-20! Always trying to save us from ourselves…

The White House, masters of hyperbole on almost any issue one can think of, may have even outdone themselves with this one. According to the Financial Times, the White House said:

“The G20 leaders reached a historic agreement to put the G20 at the centre of their efforts to work together to build a durable recovery while avoiding the financial fragilities that led to the crisis.”

It just kinda makes you all tingly inside doesn’t it?

That is assuming you’re a bureaucrat hitched to this gravy train of government, or a lawyer who just loves more laws to exploit to fit a client’s needs. But if you are just trying to build or run a small business, or find risk capital to start a business, which if done successfully provides such trivial things as wealth and jobs creation, so government leaders can skim off much of that wealth in or to save us from ourselves, than you probably aren’t jumping for joy to hear the G-20 is going to give us more…

More regulation…More wine drinking and croissant eating weekend meetings to discuss more regulation and how to organize the next meeting so they can provide us with more regulation…

All makes sense, because those bankers are the bad guys…those bankers are the bad guys…those bankers are the bad guys…those bankers are the bad guys….those bankers are the bad guys…those bankers are the bad guys….

Find a demon. Justify your power grab based on that demonization. It’s a beautiful thing…and so it goes.

Just wondering, is it Oceana or Eurasia we are at war with this week? Hmmm….getting so confusing…

Speaking of Eurasia, we noticed our “good friends” the Chinese making catcalls from the cheap seats once again. Damn the dollar. It is the cause of all ills. Maybe they found a daemon to exploit? Ya think? Oh…not the Chinese!

It is interesting, as the US dollar was spiraling down to its dirt nap from 2002 to 2007, the Chinese didn’t seem all that concerned about the dollar. I guess, that’s because all those US consumers where giving them so darn many of them. Now that the symbiotic game is over, and China is now stuck with a massive export-based economy, built on the back of all those nasty little dollars, and Mr. and Mrs. US Consumer ain’t buying much anymore, it’s much easier to blame the dollar than their own internal policies of currency manipulation and massive capacity build now that the local serfs are finding it hard to find jobs.

Game over?

Maybe, but rebalancing hasn’t yet entered the lexicon of the central committee it seems. If we just hold on a bit, hammer the Americans for their spending habits, and hope their spending habit return to drunken sailor proportion, which we are now criticizing them about, we will get that V-shaped recovery we were hoping for, and get more dollars and grab more market share thanks to our massive infrastructure stimulus package. Ah yes…Capitalism with a Chinese face. It is the way.

So, instead of doing the heavy lifting of making a transition to more balance internal growth, which means we just might have to lift capital controls, which would give our citizens a modicum of freedom to choose, let’s instead just bash the dollar. Heck, we know all about Newspeak. And of course The Ministry of Truth is there to help those who don’t quite understand capitalism with a Chinese face. Proving once again those White House guys are hyperbole pikers compared to us.

If we could just find a new currency…hmmm…let’s see, because we don’t want to lift our draconian capital controls, or let our currency find its economic value, or give our citizens more power to spend their wealth in other countries, and create a viable currency and all the responsibility and freedoms that come with it, let’s just see if those guys at the IMF have some leftover Special Drawing Rights (SDR’s) in a desk drawer or storage closet somewhere down in the basement. Yeah. Maybe if we could pump those things into the system magically global demand will rebound and we could all get rid of these nasty little dollars. We know the Russians hate those greenbacks too.

New world currencies, regulation that will create growth, demonization passed off as action…it’s just so depressing.

Do we need a new world currency? Yeah. But not another one of the fiat variety that will be used to create endless spending and paper over the massive inefficiencies and incredible arrogance of governments everywhere…we would want men to trade real value for value, then maybe they’d get unhappy with all the blood sucking parasites in between that hang their very existence on political favors and the dole.

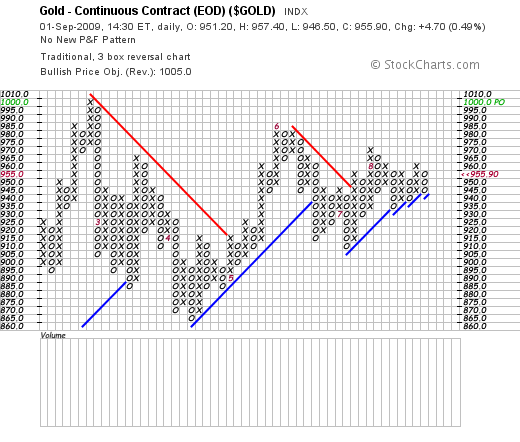

Gold of course would be a nice choice.

But that genie is out of the bottle. The rigors of a monetary system based on something of real value might cut back on wine sipping weekends for government officials. And, gasp!!!…It means they sadly wouldn’t be able to create the funds to “help” their constituents who can’t seem to help themselves.

Trading real value for value would crush the altruism of our leaders; altruism with our money, proving Ayn right once again, that altruism is nothing more than the ugly lead dog of power.

Nope. Instead we play this game of wealth creation hampered by those who don’t seem to get it. They just don’t seem to get the fact that if they got the heck out of the way we would all be better off.

So, back to decision making in this warped environment that I guess seems perfectly natural to most…

Yesterday the dollar got a nice bounce on news that central banks may start reining in all those dollar-based credits they relied upon when the global credit markets were close to imploding and the world was staring into the proverbial abyss. Today, the G-20 communiqué tells us stimulus will stay. So, a mixed bag we have.

Either way, the dollar is due for a bounce. But then again, it’s been due for a while unfortunately in our book. And from a cyclical standpoint, it would make sense. That is assuming cycles make sense.

Of course the yen isn’t playing nice today with the dollar. It was reported Japan may start pulling in on the reins on their stimulus, the Bank of Japan may upgrade its economic outlook, and there is a growing view the new Japanese government would not be upset by a strong currency.

On a purchasing power parity bases, the last numbers we saw suggested the yen was about 27% overvalued against the US dollar. But overshoot is part and parcel to this currency game.

Interesting, the yen was a currency that appreciated strongly from September 2008 last year, even as the US dollar index did the same….

Happy Friday! ☺

Jack Crooks

Black Swan Capital LLC

www.blackswantrading.com

Exclusively for readers/listeners/members of MoneyTalks a very SPECIAL OFFER.

Three Full Months of EVERYTHING We Do For Just $99!

Dear MoneyTalks Reader/Listener,

Exclusively for fans of MoneyTalks with Michael Campbell, we’d like to make you an EXCLUSIVE OFFER.

Sign up now to receive 3-months of ALL our advisory trading services and we’ll discount the price by more than 80% – three full months for less than one month’s cost! Plus if you like what you see you’ll continue getting all our trading services at the discounted rate of just $99 per month for as long as you want.

You see, we recently segmented our all-in-one newsletter, Currency Strategist, into four brand new, separate, focused newsletters. As we launch we thought we’d extend an opportunity for you to get in early …

At a very special price.

Everything listed below for 3 months … for just a onetime payment of $99.00.

The value of all these services together is $2,434.00 per year … or about $200 per month. We’re offering you the opportunity to get three full months for just $99.

That’s a difference of over $500.00 for the first three months, and …

With this offer you lock in forever additional savings of more than $100 each and every month off the total value of these services for as long as you remain a member.

As a member you’ll receive…

Currency Currents

Description: Macro view of the global economy and how it may impact currency prices.

Frequency: Daily

Price: Free

Currency Investor

Description: Designed to help investors ride intermediate- and long-term trends in major and select emerging market currencies.

Frequency: Monthly

Recommendations: Exchange Traded Funds (ETFs) [*Analysis and time frames also support multi-currency deposit investors.]

Everyday Price: $149 per year

Currency Options

Description: Designed to provide speculators with trading recommendations covering both the FX options listed on the International Securities Exchange (ISE)and currency futures options listed on the Chicago Mercantile Exchange (CME).

Frequency: Bi-weekly

Average Holding Period: Days or Weeks to months

Recommendations: International Securities Exchange (ISE)-listed FX Options or Chicago Mercantile Exchange (CME)-listed currency futures options

Everyday Price: $595 per year

Emerging Market Currencies

Description: Designed to help traders and speculators exploit short- and intermediate-term trading opportunities in the highly volatile and potentially profitable world of emerging market currencies.

Frequency: Bi-weekly

Average Holding Period: Weeks to months

Recommendations: Spot Forex

Everyday Price: $695 per year

Forex & Currency Futures Description: Designed to help short-term traders, using high leverage, spot trading opportunities among major currency pairs and cross rates.

Frequency: Daily

Average Holding Period: Intraday to several days

Recommendations: Spot Forex and Currency Futures

Everyday Price: $89 per month or $995 per year

[Note: All services include Flash Alerts delivered outside of regular publication dates to enter or exit positions as the market dictates.]

THIS IS WHERE YOU WIN …

As a fan of MoneyTalks, we’re offering you an outstanding deal.

Get three months of all our services for just a onetime payment of $99. That’s a savings of more than 83% on your first three months, and …

You lock in forever an additional savings of over 50% each and every month after that for as long as you remain a member.

Here’s some explanation on the different newsletters you’ll receive …

Our Emerging Market newsletter is geared towards specific emerging market commentary and takes time to evaluate individual countries and themes in depth. We will also recommend a balanced portfolio of currencies to hold as an emerging currency speculator.

In our Currency Options newsletter we are technical-minded, active, and a bit medium-term oriented … occasionally diverging from our longer-term fundamental market views. In addition to that, we incorporate a strict stop-loss guideline in our recommendations, usually around a 50-60% loss threshold, as well as a level at which to take partial profits. We believe this helps reduce the downside and allows for you to be more proactive in grabbing gains when you have them.

In the Forex & Currency Futures newsletter we are active and base most of our trade analysis on short-term technical setups — shooting to grab small open gains when we have them and keeping a skin in the game if we are fortunate to have latched on to a trend. That means you will consistently see recommendations to trade with at least two lots at a time. But remember: the size you trade and amount of leverage must make sense for your own account size and circumstances.

Within the monthly newsletter — Currency Investor — will reside the longer-term trend analysis work and thematic fundamental views incorporating a detailed look at weekly and monthly inter-market relationships between currencies, stocks, bonds and commodities.

Everything you read about above plus access to archives, webinar notifications, audio updates, special reports and more.

We work hard to consistently deliver, what we consider, the best currency trading newsletters available on the market today. We hope you’ll agree.

I urge you, if you were thinking about trading currencies, whether through options, ETFs, futures or Spot FX then don’t wait.

If you want an honest approach and a realistic look at currencies, you’ll have come to the right place.

If for any reason whatsoever you try us out and are unsatisfied with Black Swan’s currency newsletters within the first 30-days of your Membership, we’ll issue a full refund and our thanks for giving us a try.

Take advantage of this 30-day Risk Free offer!

So, if you’re ready to give us a try, Click Here to Sign Up

we’re looking forward to having you onboard with us!

P.S. As a BONUS, subscribe today and receive this 20-page Special Report:

Preparing for a Breakup in the European Monetary System

Most people are worried about the US dollar … and for good reason. These same people tend to see the euro as a real competitor vying for world reserve currency status. Many have been conditioned that way by the financial press. But we believe the risk of breakup in the European Monetary System is building rapidly. We examine the structure of this “artificial fiat currency” and why another downturn in the global economy could mean lights out for the euro. Be prepared.

Even if you decide to cancel, keep the report – it’s yours as a ‘thank you’ for giving us a try!

Even in tough times, which we recognize is on everyone’s mind these days, that’s a very reasonable price for the versatility and money-making potential packed into these newsletters. Of course, at a little over $3 per day you could instead put that money towards you’re morning cup of coffee on the way to work, I guess.

If you want to learn how to implement a solid approach to currency investing … or even if you’re just looking for well-researched trading and investing ideas …

Sincerely,

David Newman

Director of Sales and Marketing

Black Swan Capital

dnewman@blackswantrading.com

Toll-Free 866.846.2672

Futures, Forex and Option trading involves substantial risk, and may not be suitable for everyone. Trading should only be done with true risk capital. Past performance either actual or hypothetical is not indicative of future performance.

Black Swan Capital newsletter services are strictly informational publications and do not provide individual, customized investment advice. The money you allocate to futures or forex should be strictly the money you can afford to risk. Detailed disclaimer can be found at http://www.blackswantrading.com/disclaimer

“The biggest and most secretive gathering of ships in maritime history lies at anchor east of Singapore. Never before photographed, it is bigger than the U.S. and British navies combined but has no crew, no cargo and no destination…”

….full story HERE.

An offshore oil rig, shown here off Brest, France, and now under contract to BP off the coast of Angola. More than 200 oil discoveries have been reported so far in 2009 in dozens of countries.

….full story HERE.

‘FEEL GOOD’ FOMC PRESS STATEMENT

The bulls would call yesterday’s Federal Open Market Committee (FOMC) press statement to be the sweet spot:

• The Fed effectively declared the recession to be over (“economic activity has picked up following its severe downturn” — this was new).

• The Fed upgraded its economic forecast (“policy actions … will support a strengthening of economic growth” — in the August statement, it was “contribute to a gradual resumption of sustainable economic growth;” “support” means it is here, “contribute” means it is coming).

• The Fed sees NO inflation on the horizon: “subdued for some time” due to “substantial resource slack” and with “longer-term inflation expectations stable” — the part on inflation expectations is new; and the Fed took out its August 12 reference to rising commodity prices.

• The Fed is going to maintain its highly accommodative policy stance even with the economic forecast being taken higher (“economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period”). This commitment is not new, but in the context of the Fed’s more upbeat economic assessment it means that any further talk from anywhere pertaining to the Fed’s exit strategy should be readily dismissed.

This is indeed the proverbial ‘sweet spot’ — the economy turning up, no inflation, Fed on hold. My basic point is that the markets are already priced for it, and then some. From the time the S&P 500 bottomed on October 9, 2002, which at the time was also a massively oversold low, to the time that the Fed’s monetary easing program was over on June 30, 2004, the equity market rallied 47%. That is 47% over a 20-month span. We’ve already done 60% in little over six months.

No surprise that the Fed extended its mortgage buying program to the first quarter of next year, though the pace will slow.

A BIG REVERSAL

For the first time in this 60% bull run (I still call it a bear market rally), we saw the market sell off on what could only have been described as unabashed good news from the overall tone of the FOMC press statement. The high for the day on the Dow Jones Industrial was 9,916 at around 2:30 pm — about fifteen minutes after the FOMC release. At the end of the day, the Dow closed at 9,748. That’s a swing of 168 points.

At the March lows, we had a huge reversal too, but in the other direction. I’m obviously not a technical analyst, but we should think about what this could possibly mean (if it means anything at all). It could imply that the market has run out of buying power. Or it could mean that the market has already overpaid for the ‘sweet spot’. It could also mean that the psychology of “buying the dips” is over, and a “locking in the gains” mentality may be setting in. All I know is that this is the first time in this six-month rally that we have seen a reversal to the downside on a positive news day.