Daily Updates

Overview of Presentation

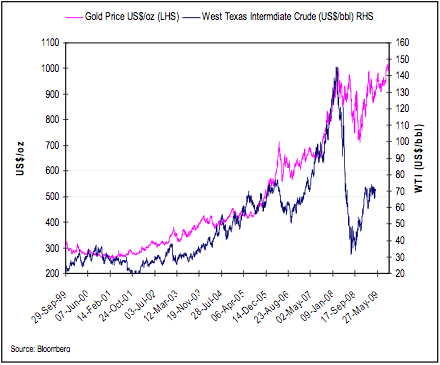

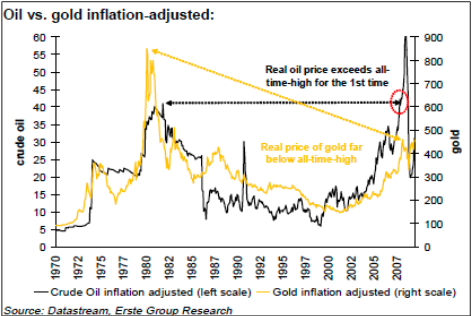

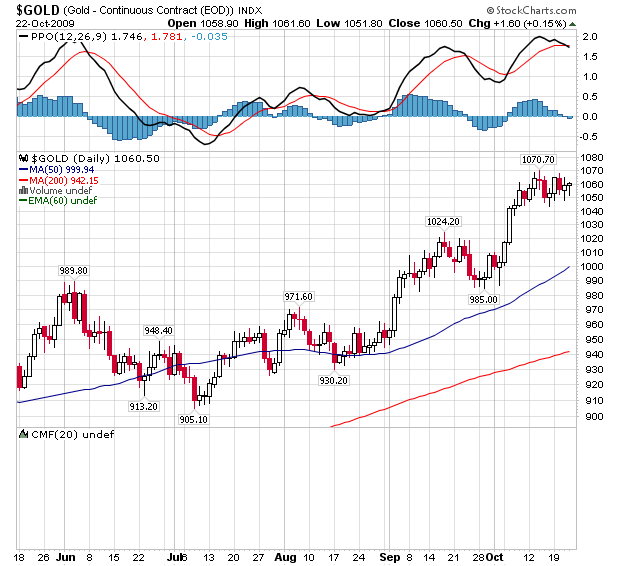

• Brief overview of the gold price.

• A closer look at how gold has performed over the last four dramatic quarters.

• Review supply-demand fundamentals over the last four quarters.

• Form a view on the outlook for gold.

• Brief review of the issues for A$ gold.

Ed note: this 46 page is extremely thorough and frankly, remarkable. Just two of a plethora of interesting images below:

….read full

Grandich will illuminate his favorite trading techniques at The Money Talks All Star Trading Super Summit – Saturday, October 24, 2009 -Vancouver Wall Centre REGISTER HERE

Update From Vancouver

No rain today (tonight is expected to be another story) so hoping to head up to Whistler for the day.

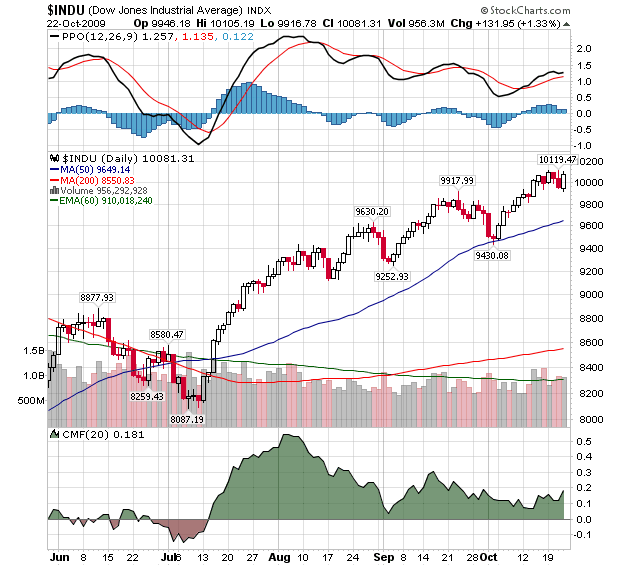

U.S. Stock Market – Yesterday’s late day sell-off was the first of its kind in quite awhile. The market has not had a 10%+ correction since the March lows. We’ll need to watch the next couple of days to see if one has finally arrived. Whether it does or not the market continues to “melt-up” and my target of DJIA 10,500-11,000 remains intact.

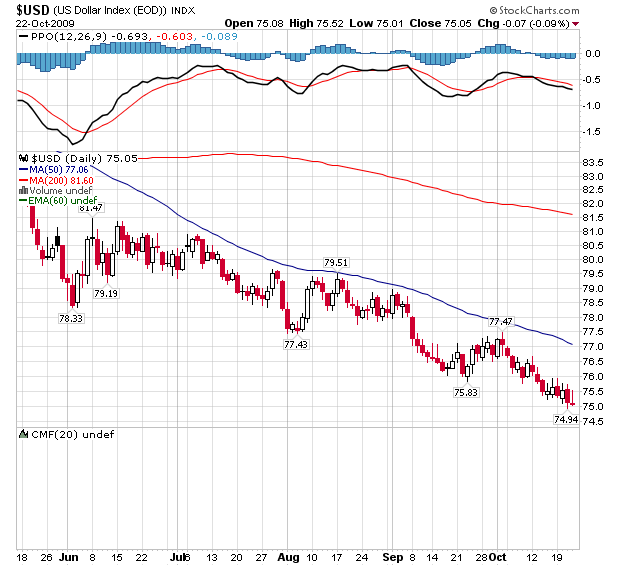

U.S. Dollar – In 25 years+ in this business, I can’t recall any single market having such an overwhelming number of bears (95% bears in U.S. Dollar Futures) and not see a reversal of some magnitude. There are just so many legitimate bearish factors continuing to pile up against the U.S. Dollar. The only hope for some counter-trend rally to begin would come IMHO if the U.S. Dollar Index could close above 78. Until such time, the path of least resistance remains down.

Gold – Sorry for the bad language but if you’re a bear you have to be poo-pooing in your pants right about now. Despite widespread bearishness not only from the usual wrong suspects, many former bulls became weak kneed or outright bearish and continue to see the market move away from them. Gold has shown tremendous internal strength by actually self-correcting intra-day by selling off only to come roaring back. Today so far has been no exception. We’re in a secular bull market that has been “stealth-like” and despite being a few dollars from it’s all-time nominal high, gold remains hated and/or ignored by most. I LOVE IT!!!!

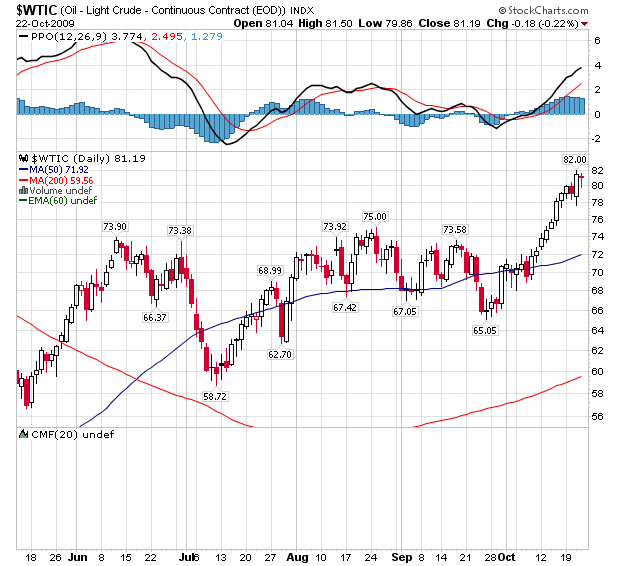

Oil – Oil indeed broke out above $76 and has $85+ written all over it. If it can get there with the DJIA also hitting my target, both could become shorts so stay tuned.

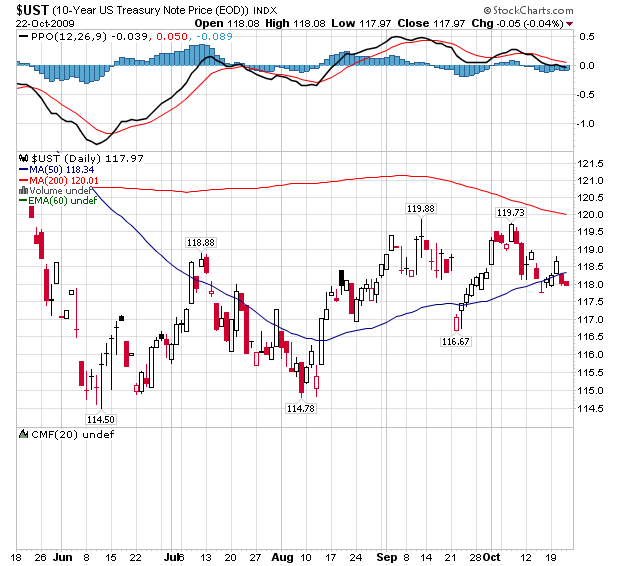

U.S. Interest Rates – Going much higher over time!

I’ve met with a few companies so far on my trip and here’s a summary of those meetings as of now:

Effective immediately, I’ve resigned my position with ATW Gold. I’ve said over and over again that management is the key for a junior’s ability to be the one in ten that makes it. While I have considerable personal respect for Graham Harris of ATW Gold, I believe his management team has not done the job. While I believe Graham will try hard to right the ship, the bottom line is they lost the confidence of shareholders, myself and the market in general. I think there are too many others who offer better opportunity at this time and one should recognize this and move on.

I had a terrific meeting with the management of Evolving Gold. Yesterday’s drill results IMHO strongly suggest that they have true home-run potential. I no longer think the question is DO they have something but HOW BIG will it end up? Management agreed with me that they have room for improvement on the corporate communication side of things but don’t let that be a knock against them. Remember, they’re the very same management team which has discovered and is developing what 99% of all other management teams can only dream about. I CONTINUE TO BELIEVE ANYTHING UNDER A BUCK IS AN AGGRESSIVE SPECULATIVE BUY.

Met with Hunter-Dickinson management and had great updates on Farallon, Taseko, Northern Dynasty and Continental Minerals. With great bias I must tell you in all my years associated with HD, I never found them as confident in one of their deals as they are with KMK. I was there when they received an update from KMK’s CEO from China and I truly believe if they could do cartwheels they would have. I know that sounds like hype but it’s truly the mood I felt at the time. The fact that their former lone major shareholder is crying the blues only makes my belief more likely that a takeover is coming IMHO. Stay tuned!

I had an in-depth update on Sunridge Gold. They have all the makings of becoming the next Nevsun. Company is on European road show. I’m told to look forward to lots of news flow.

Must Watch! For all those who make fun of people like me and others that speak openly about the U.S. government’s “Working Group”, I strongly suggest you watch this video.

God Bless!

(Paul Farrel provides a bigger-picture analysis, quoting Jared Diamond and Marc Faber below.)

How Empires Fall

Diamond’s book ’s, Collapse: How Societies Choose to Fail or Succeed, studies the collapse of civilizations throughout history, and finds:

Civilizations share a sharp curve of decline. Indeed, a society’s demise may begin only a decade or two after it reaches its peak population, wealth and power…

One of the choices has depended on the courage to practice long-term thinking, and to make bold, courageous, anticipatory decisions at a time when problems have become perceptible but before they reach crisis proportions

And PhD economist Faber states:

How [am I] so sure about this final collapse?

Of all the questions I have about the future, this is the easiest one to answer. Once a society becomes successful it becomes arrogant, righteous, overconfident, corrupt, and decadent … overspends … costly wars … wealth inequity and social tensions increase; and society enters a secular decline.

[Quoting 18th century Scottish historian Alexander Fraser Tytler:] The average life span of the world’s greatest civilizations has been 200 years progressing from “bondage to spiritual faith … to great courage … to liberty … to abundance … to selfishness … to complacency … to apathy … to dependence and … back into bondage”

[Where is America in the cycle?] It is most unlikely that Western societies, and especially the U.S., will be an exception to this typical “society cycle.” … The U.S. is somewhere between the phase where it moves “from complacency to apathy” and “from apathy to dependence.”

In other words, America’s rapid fall is not really that novel after all.

How Consumers, Politicians and Wall Street All Contributed to the Fall

On the individual level, people became “fat and happy”, the abundance led to selfishness (”greed is good”), and then complacency, and then apathy.

Indeed, if you think back about tv and radio ads over the last couple of decades, you can trace the tone of voice of the characters from Gordon Gecko-like, to complacent, to apathetic and know-nothing.

On the political level, there was no courage in the White House or Congress “to practice long-term thinking, and to make bold, courageous, anticipatory decisions”. Of course, the bucket loads of donations from Wall Street didn’t hurt, but there was also a religion of deregulation promoted by Greenspan, Rubin, Gensler and others which preached that the economy was self-stabilizing and self-sustaining. This type of false ideology only can spread during times of abundance and complacency, when an empire is at its peak and people can fool themselves into thinking “the empire has always been prosperous, we’ve solved all of the problems, and we will always prosper” (incidentally, this type of false thinking was also common in the 1920’s, when government and financial leaders said that the “modern banking system” – overseen by the Federal Reserve – had destroyed instability once and for all).

And as for Wall Street, the best possible time to pillage is when your victim is at the peak of wealth. With America in a huge bubble phase of wealth and power, the Wall Street looters sucked out vast sums through fraudulent subprime loans, derivatives and securitization schemes, Ponzi schemes and high frequency trading and dark pools and all of the rest.

Like the mugger who waits until his victim has made a withdrawal from the ATM, the white collar criminals pounced when America’s economy was booming (at least on paper).

Given that the people were in a contented stupor of consumption, and the politicians were flush with cash and feel-good platitudes, the job of the criminals became easier.

A study of the crash of the Roman – or almost any other – empire would show something very similar.

By George Washington of Washington’s Blog.

Death of ‘Soul of Capitalism’: Bogle, Faber, Moore

Jack Bogle published “The Battle for the Soul of Capitalism” four years ago. The battle’s over. The sequel should be titled: “Capitalism Died a Lost Soul.” Worse, we’ve lost “America’s Soul.” And, worldwide, the consequences will be catastrophic.

That’s why a man like Hong Kong contrarian economist Marc Faber warns in his Doom, Boom & Gloom Report: “The future will be a total disaster, with a collapse of our capitalistic system as we know it today.”

No, not just another meltdown, another bear-market recession like the one recently triggered by Wall Street’s too-greedy-to-fail banks. Faber is warning that the entire system of capitalism will collapse. Get it? The engine driving the great “American Economic Empire” for 233 years will collapse, a total disaster, a destiny we created.

OK, deny it. But I’ll bet you have a nagging feeling that maybe he’s right, that the end may be near. I have for a long time: I wrote a column back in 1997: “Battling for the Soul of Wall Street.” My interest in “The Soul” — what Jung called the “collective unconscious” — dates back to my Ph.D. dissertation, “Modern Man in Search of His Soul,” a title borrowed from Jung’s 1933 book, “Modern Man in Search of a Soul.” This battle has been on my mind since my days at Morgan Stanley 30 years ago, witnessing the decline.

Has capitalism lost its soul? Guys like Bogle and Faber sense it. Read more about the soul in physicist Gary Zukav’s “The Seat of the Soul,” Thomas Moore’s “Care of the Soul” and sacred texts.

But for Wall Street and American capitalism, use your gut. You know something’s very wrong: A year ago, too-greedy-to-fail banks were insolvent, in a near-death experience. Now, magically, they’re back to business as usual, arrogant, pocketing outrageous bonuses while Main Street sacrifices, and unemployment and foreclosures continue rising as tight credit, inflation and skyrocketing federal debt are killing taxpayers.

Yes, Wall Street has lost its moral compass. It created the mess, but now, like vultures, Wall Streeters are capitalizing on the carcass. They have lost all sense of fiduciary duty, ethical responsibility and public obligation.

Here are the Top 20 reasons American capitalism has lost its soul:

1. Collapse is now inevitable

Capitalism has been the engine driving America and the global economies for over two centuries. Faber predicts its collapse will trigger global “wars, massive government-debt defaults, and the impoverishment of large segments of Western society.” Faber knows that capitalism is not working, capitalism has peaked, and the collapse of capitalism is “inevitable.”

When? He hesitates: “But what I don’t know is whether this final collapse, which is inevitable, will occur tomorrow, or in five or 10 years, and whether it will occur with the Dow at 100,000 and gold at $50,000 per ounce or even confiscated, or with the Dow at 3,000 and gold at $1,000.” But the end is inevitable, a historical imperative.

2. Nobody’s planning for a ‘Black Swan’

While the timing may be uncertain, the trigger is certain. Societies collapse because they fail to plan ahead, cannot act fast enough when a catastrophic crisis hits. Think “Black Swan” and read evolutionary biologist Jared Diamond’s “Collapse: How Societies Choose to Fail or Succeed.”

A crisis hits. We act surprised. Shouldn’t. But it’s too late: “Civilizations share a sharp curve of decline. Indeed, a society’s demise may begin only a decade or two after it reaches its peak population, wealth and power.”

Warnings are everywhere. Why not prepare? Why sabotage our power, our future? Why set up an entire nation to fail? Diamond says: Unfortunately “one of the choices has depended on the courage to practice long-term thinking, and to make bold, courageous, anticipatory decisions at a time when problems have become perceptible but before they reach crisis proportions.”

Sound familiar? “This type of decision-making is the opposite of the short-term reactive decision-making that too often characterizes our elected politicians,” thus setting up the “inevitable” collapse. Remember, Greenspan, Bernanke, Bush, Paulson all missed the 2007-8 meltdown: It will happen again, in a bigger crisis.

3. Wall Street sacked Washington

Bogle warned of a growing three-part threat — a “happy conspiracy” — in “The Battle for the Soul of Capitalism:” “The business and ethical standards of corporate America, of investment America, and of mutual fund America have been gravely compromised.”

But since his book, “Wall Street America” went over to the dark side, got mega-greedy and took control of “Washington America.” Their spoils of war included bailouts, bankruptcies, stimulus, nationalizations and $23.7 trillion new debt off-loaded to the Treasury, Fed and American people.

Who’s in power? Irrelevant. The “happy conspiracy” controls both parties, writes the laws to suit its needs, with absolute control of America’s fiscal and monetary policies. Sorry Jack, but the “Battle for the Soul of Capitalism” really was lost.

4. When greed was legalized

Go see Michael Moore’s documentary, “Capitalism: A Love Story.” “Disaster Capitalism” author Naomi Klein recently interviewed Moore in The Nation magazine: “Capitalism is the legalization of this greed. Greed has been with human beings forever. We have a number of things in our species that you would call the dark side, and greed is one of them. If you don’t put certain structures in place or restrictions on those parts of our being that come from that dark place, then it gets out of control.

….read page 5 – 20 HERE.

Click HERE to watch BNN speaking to Peter Grandich, chief market commentator, Agoracom.com, who’s keeping a close eye on the USD, the TSE, $CDN and Gold.

Ed Note: from Kitco

![]()

![]()

When the US Dollar gets stronger, it takes fewer dollars to buy any commodity that is priced in $USD. When the US Dollar gets weaker it takes more dollars to purchase the same commodity.

The price of all US Dollar denominated commodities, like gold, will change to reflect the fact that it will take fewer or more dollars to buy that commodity. So it’s quite possible, in fact it’s almost always the case that a portion of the change in the price of gold is really just a reflection of a change in the value of the US Dollar. Sometimes that portion is insignificant. But often the opposite is true where the entire change in the gold price is simply a mathematical recalculation of an ever-changing US Dollar value.

When the dollar gets strong, gold appears to go down, and vice versa. That accounts for part of the fluctuations that we see in the value of gold.

The other part is an actual increase in the supply or demand for gold. If the price is higher when being measured not only in US Dollars, but also in Euros, Pounds Sterling, Japanese Yen, and every other major currency, then we know the gold demand is higher and it has actually increased in value.

Consequently, if gold is higher in US Dollars while at the same time cheaper in every other currency, then we can conclude that the US Dollar has weakened, and that gold has actually lost value in all other currencies. But the price, because it is being quoted in $USD will be higher and give the illusion of gold becoming more valuable. In such a case the devaluation of gold, due to increased supply on the market, is camouflaged by a weakened US Dollar.

Our feature on kitco.com breaks the change of the price of gold into 2 components. One part shows you how much of that change can be attributed to US Dollar strength, or lack of it. The other portion is indicative of how much the price changed as a result of normal trading. Interestingly whatever changes happen to the price of gold as a result of US Dollar strength/weakness also occurs to every other US Dollar denominated commodity by the exact same proportion.

![]()

The Kitco Gold Index has one purpose, that is to determine whether the value of gold is actual, a reflection of changes in the US Dollar value, or a combination of both.

The U.S. Dollar Index® represents the value of the US Dollar in terms of a basket of six major foreign currencies: Euro (57.6%), Japanese Yen (13.6%), UK Pound (11.9%), Canadian Dollar (9.1%), Swedish Krona (4.2%) and Swiss Franc (3.6%). It is an exchange traded (FINEX) index and has become a standard used worldwide.

The Kitco Gold Index is the price of gold measured not in terms of US Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®.

Since the Kitco Gold Index has no US Dollar component it needs to be compared to the actual US Dollar price to give it some perspective. In all of the historical and live charts that we are displaying here we’re showing both trend lines for the purposes of making this comparison. Here are a few possible situations that you may see and what the meaning could be:

The Kitco Gold Index is up and the USD price of gold is up even more:

This would definitely mean that gold has increased in value. It also means that the USD has weakened and so the degree of the gold value increase will be exaggerated when examined strictly in terms of the US Dollar. This is the exact scenario that we’ve witnessed over the span of the early years of the 21st century.

The Kitco Gold Index is down and the USD price of gold is down even more:

This would definitely mean that gold value has declined in value. But not by as much as it may appear in USD terms.

The Kitco Gold Index is up and the USD price of gold is down:

This would indicate that the USD has strengthened relative to the other major currencies, but that gold has gained in value.

The Kitco Gold Index is down and the USD price of gold is up:

This would indicate that the USD has weakened relative to the other major currencies, and that gold is really not up as it may appear.

Only a tiny handful of huge gold discoveries have been made worldwide in the last decade, which experts say is because virtually all the juiciest low-hanging fruit has been picked some time ago. And this new reality promises to help edge bullion prices increasingly higher.

The scarcity of world-class gold discoveries is already taking a toll on the mining industry’s bottom line. Global gold output has been dwindling by nearly 5% per annum since it peaked in 2001, even though bullion’s spot price has more than tripled since then.

An even more pronounced downward trend can be seen in North America. This is where output has dropped over the last decade from 17.06 million ounces in 1998 to 10.59 million ounces in 2008.

Part of the problem is that historically gold-rich territories like eastern Canada’s Abitibi Greenstone Belt and Nevada’s fabled Carlin Trend have failed to yield any monster gold finds in recent years, according to Mickey Fulp, a geologist and exploration/mining analyst who has over 30 years of mineral exploration experience all over the world.

….read more HERE.