Daily Updates

First Greece, then Ireland, and now Spain and probably Portugal. What, you don’t believe it? Then check out the two charts below. And Spain is no little Ireland. Spain is big time, and it will take one heck of a lot of euros to bail Spain out. And the question, of course, is this — could the euro and the euro-zone be falling apart? The Euro-zone has put up one trillion dollars to cover emergency bailouts. If Spain and Portugal unravel, there won’t be enough money.

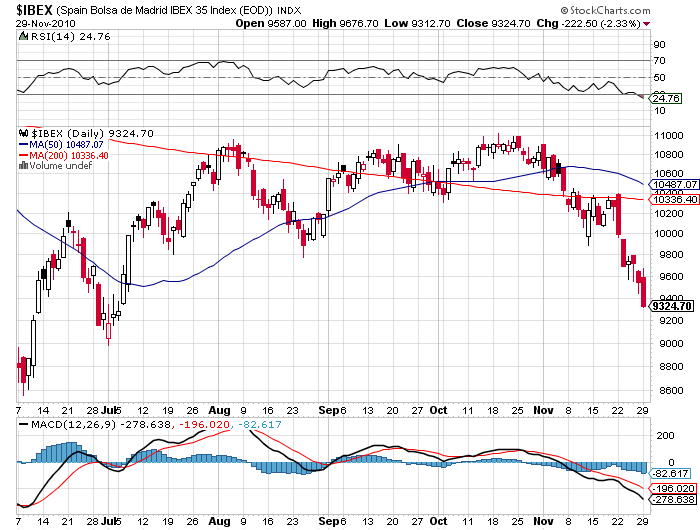

Spain below, and it’s crashing

Portugal below and starting to fall apart.

Richard Russell has made his subscribers fortunes. One of the best values anywhere in the financial world at only a $300 subscription to get his DAILY report for a year. HERE to subscribe.

Euro Falls Through 200-Day Moving Average

By Chuck Butler

Well… November hasn’t been kind to the currencies and precious metals, that’s for sure… But then, it was about time for the markets and media to shift their focus in November, wasn’t it? Yes, it was… The thing I kept worrying about, happened, and here we are today with the euro (EUR) barely hanging by a thread to the 1.30 handle once again… Shoot Rudy, haven’t we seen this before, like last winter? Then it was the knee-jerk reaction to the GIIPS (Greece, Italy, Ireland, Portugal, Spain) that caused a huge sell-off of the euro from 1.45 to 1.18… But then the markets and media grew tired of this story, and their attention span ended for the GIIPS, and was shifted back to the problems of the US.

In June, the focus shifted back to the US and we saw a huge rally in the currencies and precious metals, with gold reaching $1,409.55 and the Swiss franc (CHF), Aussie dollar (AUD), and Canadian dollar/loonie (CAD), all reaching parity to the US dollar…

But now the focus has shifted back to the GIIPS, even in the face of an aid package for Ireland, now the keyword in the markets is “contagion”… As in what is going to be the contagion risk for the European periphery countries like Spain and Portugal… So… Once again, it’s time to batten down the hatches and ride this storm out… Riding the storm out, waiting for the fall out… And those of us who in our heart of hearts know that the end game for the dollar is to be much weaker to allow the government to pay the interest on the debt they’ve issued, will use this current weakness to buy more insurance against a dollar devaluation, at much cheaper levels… As I told a group of people yesterday… When the currency is weaker, you get to buy more of it! So, it can be a good thing!

As the day went on yesterday, the weakness of the currencies was confined to the euro and the euro alternatives, like Norway and Switzerland (Sweden, as I told you yesterday is cooking with gas these days!). The commodity currencies (minus Norway) were gaining ground versus the dollar along with gold and silver, which had turned their negative performance on the day to positive by the afternoon.

The overnight markets brought more pain to the euro, and the other euro alternative currencies, this time including Sweden, are getting taken to the woodshed, while the commodity currencies of Aussie, Canada, New Zealand, Brazil, and South Africa, are weaker, but by just a small amount.

I told you yesterday that the euro was nearing its 200-day moving average, and if it falls through that average it could be an indicator that more weakness is coming… And that’s what’s happened overnight. So… I checked with my tech charts friend, and he tells me that a move through the 200-day moving average that is now confirmed, could mean the euro would fall through 1.30, all the way to 1.25… But these are charts friends… Do not bet your house on them coming to fruition… But, the historic data on moving through 200-day moving averages is pretty good…

The “better than the average bear” – economic data for Germany – continues to print… This morning, it was German unemployment data that showed a slight fall in jobs of 9,000, but the overall unemployment fell for a 17th month… The total unemployed moved to 3.14 million, the lowest level of unemployment in Germany since 1992!

So… It’s chaos all around Germany, but in the core country, the largest economy of the Eurozone, things are moving in the right direction… The export driven economy will get a further boost by the weaker euro, folks… So, a weaker euro is not all bad for Germany! I’m sure the Germans would prefer to see their currency remain around this 1.30 level, with 1.25 being the low water mark. To have the euro at 1.50 isn’t their preference either…

Speaking of data today… Canada will print its third quarter GDP today, and Australia will print their third quarter GDP late today (tomorrow morning for them)… I would look for Canada to outperform Australia and, as I told you yesterday, I’m looking for a softer GDP in Australia after one year of rate hikes.

And In Brazil, inflation is really setting into the Brazilian economy. Brazil’s IGP-M Price Index – which measures consumer, construction and wholesale prices – jumped 1.45% in November… Since January of 2010, this inflation measure has been positive each month, but November’s increase of 1.45% is the largest move. This is what happens when a Central Bank and government get their hands in the cookie jar.

By that, I mean, inflation in Brazil has been rising all year, and the year started off with the Brazilian Central Bank (BCB) raising interest rates aggressively… But by doing so, it caught the markets’ attention, and the money flowed into Brazil, pushing the Brazilian real (BRL) stronger, and stronger. That’s when the BCB and government decided that they didn’t want to see the real that strong, and cut off the interest rate hikes, and implemented all sorts of hoops for investors to jump through if they wanted to invest in Brazil.

But the kicker was the cutting off of interest rate hikes… And now… Inflation is the strongest it’s been all year! I would think that the BCB will be back to the rate hike table soon, especially if next month’s inflation number is as strong…

This news of stronger inflation in Brazil allowed the real to rally yesterday, and overnight, with the markets thinking like me that the BCB would be back to the rate hike table soon.

Well… I see where the President has announced a pay freeze for federal civilian employees… I don’t think he got the message loud and clear, though… A pay freeze is OK… But didn’t the recent elections tell the government that the public supports measures to narrow the budget deficit? Freezing pay doesn’t narrow the deficit… Only cutting the fat narrows the deficit…

And in my never-ending attempt to show you what China is doing to gain wider distribution of the renminbi (CNY)… It was reported overnight that renminbi deposits, which can now be made in Hong Kong, jumped by a record $10 billion-worth in October… And in other news… China offered 5 billion renminbi-worth of bonds in Hong Kong, and they were oversubscribed by 10 times! Folks, this means that investors all around the world see Chinese bonds as a very good opportunity to hold renminbi assets… And, to me, I do believe these investors are looking at the faster appreciation that we’ve seen recently in the renminbi, and licking their chops that they get paid interest on the bonds, while the renminbi appreciates…

These are baby steps, folks… Baby steps to the ultimate goal for the renminbi, and that is to have it be the world’s reserve currency.

Oil, which was priced at $81.04 on November 17th, is priced today at $85.45! This rise in the oil price is interesting to me, given the claim that there’s deflation in our economy… Deflated prices in houses, yes… But overall economic deflation is a bunch of bunk… I’ve shown you the price increases in food this year, and just think about your personal economics. I’m sure you have your own example of rising inflation… But then the “Bernank” is going to implement more quantitative easing? I just can’t get this out of mind… The “Bernank” is doing nothing more than throwing gas on the inflation fire we already have! Can you say hyperinflation?

OK… Maybe I went a little overboard there, and hyperinflation is a little harsh… But… When it happens, you’ll be able to say that Chuck told you about it long before the media got the memo.

Then there was this from US News & World Report…

US can take lessons from Europe’s debt crisis

It might be a matter of time before the debt crisis that first struck Greece and then spread to Ireland reaches the US, according to US News & World Report. One lesson the US can learn from Europe’s crisis is that when debt starts getting out of hand, don’t stall. No country, not even China, has enough money to bail out the US.

Amen, brother!

To recap… The euro has fallen through its 200-day moving average, which could be an indicator that more weakness is on the way. German unemployment is at the best level since 1992, but the periphery countries are weighing down the euro, and German data is being ignored. Brazilian inflation is soaring, and we get to see the third quarter GDP reports from Canada and Australia today.

The ‘Don’t Worry, Be Happy” crowd continue to evoke a “Rescue Me” theme at the 11,000 mark on the DJIA. Because of this, we now have some significant stops just below that level. A close below 10,975 can bring on a test of the 200-Day M.A. around 10,625. Keep in mind, we’re now in the “happy” people most “happy” seasons and the famous “Santa Claus Rally” can be evoked for the good of performance payouts so stay tuned.

s it Germany’s fault that their labor efficiency has improved

What’s the secret to building a strong high-yield portfolio? While there is no magic bullet, I do have some rules I follow to create portfolios that pay nearly double-digit yields and see strong capital appreciation.

Four Ways to Boost Yields and Returns

On average, they’re yielding 7.5%. That’s over three times the yield of the S&P 500. Try getting that amount from a money market or savings account.

But that’s not the half of it. In tandem with those high yields, the capital gains have been great too. Twenty-nine of the thirty securities are showing positive returns. The best performer has gained +104.6%, yet still yields 5.3%.

This isn’t the performance of some secret index or an exclusive hedge-fund’s holdings. It’s what is currently happening within the portfolios of my High-Yield Investing advisory.

What’s the secret to that sort of performance? How can you build a similar portfolio for yourself? Don’t get me wrong — I do an enormous amount of research and watch my holdings and the market like a hawk. But much of the good fortune comes from sticking to a few simple rules that you can use as well.

Over the years, these rules have proven their value in bull and bear markets. The techniques are not complicated. Anyone can follow them and potentially get the same results. So as a little holiday gift to my fellow income investors, I wanted to share with you the four basic rules I follow to build my winning High-Yield Investing portfolios. I’m confident these tips can work for you as well:

Rule #1: Look for High Yields Off the Beaten Path

To find exceptional returns and yields, I frequently venture off the beaten path. Some of the best yields I’ve found have come from assets classes few investors know about. A case in point is Canadian REITs. These REITs delivered exceptional yields this year (some as high as 12%), but many stateside investors have never heard of them.

Other lesser-known securities I look at are exchange-traded bonds, master limited partnerships and income deposit securities. All of these usually yield more than typical common stocks. In addition, they can also be less volatile and hold up better during market downturns.

If you’re not familiar with these securities don’t fret. I have — and will continue to — cover them within Dividend Opportunities. (To read more about Canadian REITs, see my recent article on the topic by clicking here.)

Rule #2: Consider Alternatives to Common Stocks

It is a well-known fact that the vast majority of common stocks simply don’t yield much. The S&P 500’s average yield is only 2.0%.

So when I can’t find the income I want from common stocks I like, I look elsewhere. My first stop is often preferred shares of the same company, which almost always yield more. Say you wanted to invest in General Electric (NYSE: GE). The common shares of General Electric (NYSE: GE) currently yield 3.0%, but you can find preferred shares of GE yielding upwards of 7.0%. You still benefit from the underlying company’s backing, but with a much higher yield.

Similarly, many companies offer exchange-traded bonds. While you don’t get actual ownership of the business as you would with common stock, you will earn a much higher yield and have your principal backed by the underlying company.

Rule #3: Look for Securities Trading Below Par Value

Some of my highest returns have come from buying bonds when they trade below par value. Par value is simply the face value assigned to a stock or bond on the date it was issued. Most exchange-traded bonds (which you can buy just like a share of stock) have a par value of $25 per note.

But sometimes — most recently during the recent market panic — investors indiscriminately dump these bonds, pushing their prices down. By purchasing the bonds at a discount to par, you lock in great opportunities for capital gains in addition to higher-than-normal yields.

A case in point was Delphi Financial Group 8% Senior Notes (which have since been called). I purchased the notes in July 2009 for $19.27 — a -23% discount to par value. During the 16 months I held, I collected $3.00 per note in interest payments while the shares rose to their $25 par value. In total, the notes returned over +45%.

Rule #4: Sell When It’s Time

This rule may seem the most obvious, but it is also the most difficult to follow.

Like everyone else, I hate to admit I was wrong about an investment. But I find it even harder to watch losses mount as a pick falls further. That’s why I’m not afraid to take a loss. I swallowed my pride and closed out several positions for losses during the bear market, and I’m glad I did. Continuing to hold these would have greatly reduced returns on my portfolio.

It may sound like a cliche, but knowing when to sell is just as important as knowing when to buy. A wise investor knows when to cut losses and move on to the next opportunity. If the security in question is falling with the market, I may not be worried. However, if changes in the company’s operations mean it could see rocky times ahead, I don’t want a part of it.

[Note: The rules I’ve shared above should help guide you to higher yields and better returns — they’ve certainly done well for my High-Yield Investing subscribers. I hope you can put them to good use in the coming year. And if you’d like to learn more about High-Yield Investing, including how to access my full portfolios, click here.]

Good Investing!

![]()

Carla Pasternak’s Dividend Opportunities

About Carla Pasternak’s Dividend Opportunities

Does the endless string of Wall Street investment fads ever make you feel like you’re missing something?

Well, please take a deep breath and relax. It’s time to forget about

the rocket scientists with their black boxes . . . the PhDs with their Greek formulas . . . and the high priests of Efficient Market Theory.

The most important investment decision you’ll ever make pivots on something far more basic: how you treat the overlooked stepchild of Wall Street, the lowly dividend.

Although little respected and often ignored, more than 100 years of data point to the inescapable conclusion that owning hum-drum dividend-paying stocks . . . and then reinvesting those dividends . . . beats all other investment approaches hands down.

….read more HERE

The Bottom Line

Excluding the possibility of another “out of the blue” negative shock, equity markets are poised to move significantly higher between now and May next year. Recent weakness in equity markets has provided an opportunity to accumulate favoured equities and ETFs. Stocks market equity indices with favourable seasonality at this time of year include Canada, U.S.A., China, Germany and Japan. Sectors with favourable seasonality at this time of year include technology, consumer discretionary, materials, industrials, lumber, metals & mining and Canadian Financial Services.