Currency

Eric Balchunas thinks regulatory apprpoval in the U.S. will follow on the heels of successful launches in Canada.

A bitcoin (BTC, +1.65%) exchange-traded fund (ETF) in the U.S. could be in the cards this year.

That’s according to Eric Balchunas, an ETF analyst at Bloomberg Intelligence, Bloomberg reported on Tuesday.

“The institutional adoption of crypto is much greater,” Balchunas said when asked why he thought this year was different to bitcoin’s last bull run in 2017 and 2018. “You have the intense growth of ‘default’ crypto products like (Grayscale’s Bitcoin Trust) which are not ideal for retail investors and the SEC (U.S. Securities and Exchange Commission) knows this.”

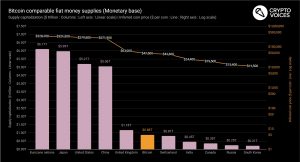

Bitcoiners are in a triumphant mood these days. The price is near all-time highs. Coinbase just went public. Institutional interest is growing. All the naysayers who mocked it over the last decade are humiliated and Having Fun Staying Poor. However in their drive towards victory, there is one recurring Bitcoin talking point that must be debunked. The claim that Bitcoin is now the 5th biggest currency in the world, even larger than the British pound. Here is a chart published by Crypto Voices from February, when it was still below $50K per coin and its total market cap was just under $900 billion, and it shows it knocking on the door of the British pound based on the total “monetary base” of the pound and other fiat currencies. Since the chart was published of course, Bitcoin has grown a lot more and would now be, theoretically, in 5th place.

Now right away you should immediately see the problem. This idea of ranking currencies based on the size of their so-called monetary base means the yen and the euro are both larger than the U.S. dollar. I’m really not sure what to tell you, but I’ll just say this. If you ever get to a point in life where you’re ranking the size of currencies, and somehow you stumble on a measure which purports to show that the yen and the euro are larger than the dollar, you need to just stop everything and re-evaluate the decisions that got you to this point. Because everybody knows that’s nonsense, and you should start looking for another measure. Seriously, that fact alone should tell you you’ve stumbled on a very wrong way to measure currencies. And yet within the Bitcoin community rankings like this one proliferate.

We could stop right there, but it’s worth powering forward for a second to just explain the levels of wrongness at play here. First, what are we even talking about when we are talking about the monetary base like this? As the creator of the above chart Matthew Mežinskis explained on the On The Brink Podcast with Nic Carter, it’s a combination of coin and cash out there, plus the reserves the banks hold at monetary authorities. The problem is that reserves is just not that useful as a measure of anything. All it simply reflects these days is how much QE the central bank has done. QE is a swap of one type of government liability (a government bond like a Treasury or a Gilt) for another type of government liability (reserves). It’s not a measure of currency size. It simply reflects how the government has chosen to structure its own liabilities.

Bitcoiners may admit that it’s not a perfect measure, but then they say it’s conceptually useful, because just as fiat currency has various Ms (M1, M2, M3 etc) reflecting broadening forms of the money, so too does Bitcoin, which has a base layer (the blockchain) but also has Layer 2 payments whereby transactions can be conducted off chain and then settled ultimately on the chain itself. You can actually think of the newly public Coinbase as offering centralized Layer 2 payments, because they enable instant Bitcoin transfers between Coinbase users. Those transactions aren’t actually registered on the blockchain itself. They’re just reflected in Coinbase’s own internal ledger. There are also other solutions such as the decentralized Lightning Network that allow multiple parties to enter into transactions, which only later get properly settled on the blockchain itself. But while it’s seductive to compare the levels of Bitcoin and fiat this way, the analogy doesn’t take you very far.

The conceptual flaw is that Bitcoin’s second layer solutions need the dollar value of the base layer to grow in order to scale. You can’t have billions of layer 2 Bitcoin transactions until the base layer is worth several billions. With fiat, no such constraint exists. Everyday dollar payments scale just as well today as they did before the Global Financial Crisis, when the amount of Fed reserves were much smaller, because QE wasn’t a thing yet. Dollar transactions don’t need a large base money at all, whereas Bitcoin transactions absolutely do.

So the chart fails on its face. (Obviously the euro and yen aren’t bigger than the dollar). It fails conceptually since base money isn’t a measure of a currency’s size. And it fails logically. Base money measures aren’t analogous structurally to Bitcoin’s base layer, because for Bitcoin, growth in the base is needed in order to scale payments, and this isn’t the case for fiat.

You know there are always long-running Twitter arguments about whether Bitcoin is technically a currency or not. And TBH I don’t find the discussion to be that important. But if Bitcoiners are going to insist on actually comparing the currency to the big fiats, then they should use proper measures. What is the Bitcoin share of international payments? What is the Bitcoin share of central bank reserves? How much Bitcoin-denominated debt is there? These are the logical type of ways to rank and compare money. By these rankings, Bitcoin is still incredibly tiny.

Now it’s true, more and more people use Bitcoin as an investment vehicle and that’s getting pretty big. At $1.2 trillion, it’s smaller than Alphabet, but larger than Facebook. It’s also around the value of all NYC real estate, which was pegged last year around $1.4 trillion. Pretty impressive as an investment or savings vehicle no doubt! But so far, as a currency it just doesn’t measure up yet to the big ones. If Bitcoin ever gathers real steam as a way that people pay for things, we can revisit the currency ranking side seriously.

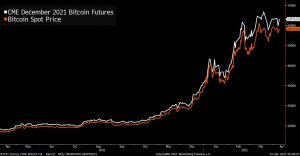

Everybody knows by now that Wall Street is getting increasingly interested in Bitcoin. It was on the cover of Barron’s this weekend. And of course this is the week that Coinbase is going public. However, alongside all this people are increasingly talking about a specific Bitcoin trade that offers the appearance of very easy money. At issue is the extreme contango in the Bitcoin futures curve. On the CME — one of the most straightforward avenues for institutional traders to go long Bitcoin exposure — prices trade at a significant premium to spot.

So for example, at the close of trading on Friday, Bitcoin spot was just over $58,300, whereas the December 2021 CME contract was over $63,000.

What this means is that in theory (I stress, *in theory*) you could go long spot Bitcoin, while shorting the December future, and if you just wait for the two to converge then that’s an easy 8% return in 12 months. That’s a lot in a world where risk-free trades pay you nothing these days. You can amplify it even more if you have leverage. And in fact the closer months offer even more juice.

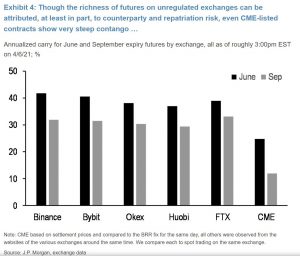

Anyway, this is clearly starting to get the attention of some on Wall Street. It was a topic of conversation I heard about last week and then on Friday JPMorgan’s rate derivatives strategist Josh Younger put out a report on the steepness of the Bitcoin futures curve. He calculated that as of last week the June CME contract was offering a 25% annualized yield relative to spot.

So then of course the question is, if this is just sitting there, why hasn’t the spread been arbed away. Of course, contango is a frequent feature in commodity futures curves but with, say, oil, you have storage costs if you buy the spot oil and carry it all the way to the out months. (We saw this to an extreme degree almost a year ago, when the price of short-term oil went negative because it was so costly to hold.) Of course Bitcoin doesn’t have carrying costs, but it has all kinds of other issues. The biggest, as Younger notes, is that there’s still not a great way for a regulated, big institution to just go long spot Bitcoin. How many shops can hold their own Bitcoin keys? How many are really in a position to trade on Coinbase? And even if you have a way of going long the spot in size to make the trade worth it, it’s not easy to get leverage to really exploit the arb in a big way.

There’s a great piece by my colleague Matt Leising last month about companies like BlockFi that have been offering juicy double-digit returns to depositors in order to get USD that they can then lend to leveraged Bitcoin traders. But overall the industry is still small.

The theoretical returns to the Bitcoin basis trade are even fatter when you go off the CME to less regulated exchanges, which also have futures contracts. So for example, you can get annualized returns of 40% on the June contract at places like FTX or Binance, per Younger.

But again, how many institutions with any scale are touching these exchanges? The yields are there, but execution risks abound. In a tweet last week, the CEO of FTX Sam Bankman-Fried (a recent Odd Lots guest) explained the situation like this:

So in the meantime three things. Smaller traders/funds will probably continue to attempt to exploit the arb, but not at a big enough scale to close it. However since this is clearly getting more and more attention among institutions (hence the JPM note), larger players will probably try to find ways to take advantage. And finally as Younger notes, if there’s ever an ETF approval, the spread would theoretically compress significantly, because then there would be a super simple way to go long spot and short the futures all in the same accounts — making the execution much easier. In the meantime, keep an eye on this space. And of course this is crypto, so if anyone’s feeling brave, please be careful and think about possible ways (like losing your coins) this could blow up in your face.

Any firm that approaches $1T in value has tapped into a basic human instinct. Consuming, signalling, loving, and praying have been the fuel of Amazon, Apple, Facebook, and Google’s ascents, respectively. That the crypto asset class universe has reached $2T reveals, I believe, that it taps into two attributes we instinctively pursue: trust and scarcity.

Trust

Our superpower as a species is cooperation, which requires trust. It’s the reason banks, traffic lights, and anesthesiologists exist. Even before crypto, creative minds have been drawn to finance, as trust creates opportunities for leverage and securitization. In 1997, seeking more control over his songwriting catalog, David Bowie raised $55 million with Bowie Bonds. The bonds paid 7.9 percent interest over a 10 year-long term — a scant premium to a U.S. 10 Year Treasury Note at 6.4 percent. What made Bowie Bonds unique was the collateral, or source of trust: future royalties on Bowie’s music, which the bondholder felt people would continue to value. Moody’s rated the bonds A3 and Bowie used the proceeds to buy out his former manager, shoring up the bonds and securing long-term control of his music.

Though innovative in its collateralization, the Bowie Bond was on its face a vanilla financial instrument, no different in form than a bond issued by GM or P&G. In order to connect his art and potential investors, Bowie had to rely on the (expensive) apparatus of traditional gatekeepers in finance and entertainment to imbue his bonds with the essential attributes of trust and scarcity. The royalty stream (trust) was mediated by lawyers and accountants in big publishing houses, and the legitimacy of each individual bond (scarcity) was dependent on the financial powers of Wall Street.

What if Sir David Bowie (note: he declined knighthood in 2003, but it’s my blog) fell to earth in 2021? What might Bowie have done … with crypto?

Bitcoin’s founder, Satoshi Nakamoto, may have just moved his coins as an 11-year-old address moved the entirety of its funds to an untraceable chain.

A Bitcoin (BTC) address that collected 50 BTC from a mining reward has just shown the first sign of activity since February 2009 — just one month after the creation of Bitcoin.

According to data from Blockchair.com, the address 17XiVVooLcdCUCMf9s4t4jTExacxwFS5uh has moved the entirety of its 50 BTC mining reward to two different wallets.

Of this, 40 BTC is laying inactive on what appears to be a change address. The remaining 10 BTC has been sent to a multisig address, as evidenced by its starting number.

The chain of transactions becomes more difficult to track from here, as the BTC was split into almost dozens of pieces across a complex chain of outputs…CLICK for complete article