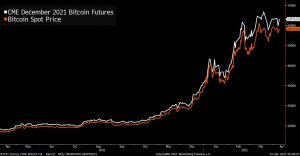

Everybody knows by now that Wall Street is getting increasingly interested in Bitcoin. It was on the cover of Barron’s this weekend. And of course this is the week that Coinbase is going public. However, alongside all this people are increasingly talking about a specific Bitcoin trade that offers the appearance of very easy money. At issue is the extreme contango in the Bitcoin futures curve. On the CME — one of the most straightforward avenues for institutional traders to go long Bitcoin exposure — prices trade at a significant premium to spot.

So for example, at the close of trading on Friday, Bitcoin spot was just over $58,300, whereas the December 2021 CME contract was over $63,000.

What this means is that in theory (I stress, *in theory*) you could go long spot Bitcoin, while shorting the December future, and if you just wait for the two to converge then that’s an easy 8% return in 12 months. That’s a lot in a world where risk-free trades pay you nothing these days. You can amplify it even more if you have leverage. And in fact the closer months offer even more juice.

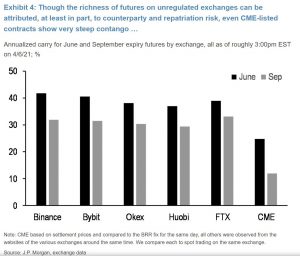

Anyway, this is clearly starting to get the attention of some on Wall Street. It was a topic of conversation I heard about last week and then on Friday JPMorgan’s rate derivatives strategist Josh Younger put out a report on the steepness of the Bitcoin futures curve. He calculated that as of last week the June CME contract was offering a 25% annualized yield relative to spot.

So then of course the question is, if this is just sitting there, why hasn’t the spread been arbed away. Of course, contango is a frequent feature in commodity futures curves but with, say, oil, you have storage costs if you buy the spot oil and carry it all the way to the out months. (We saw this to an extreme degree almost a year ago, when the price of short-term oil went negative because it was so costly to hold.) Of course Bitcoin doesn’t have carrying costs, but it has all kinds of other issues. The biggest, as Younger notes, is that there’s still not a great way for a regulated, big institution to just go long spot Bitcoin. How many shops can hold their own Bitcoin keys? How many are really in a position to trade on Coinbase? And even if you have a way of going long the spot in size to make the trade worth it, it’s not easy to get leverage to really exploit the arb in a big way.

There’s a great piece by my colleague Matt Leising last month about companies like BlockFi that have been offering juicy double-digit returns to depositors in order to get USD that they can then lend to leveraged Bitcoin traders. But overall the industry is still small.

The theoretical returns to the Bitcoin basis trade are even fatter when you go off the CME to less regulated exchanges, which also have futures contracts. So for example, you can get annualized returns of 40% on the June contract at places like FTX or Binance, per Younger.

But again, how many institutions with any scale are touching these exchanges? The yields are there, but execution risks abound. In a tweet last week, the CEO of FTX Sam Bankman-Fried (a recent Odd Lots guest) explained the situation like this:

So in the meantime three things. Smaller traders/funds will probably continue to attempt to exploit the arb, but not at a big enough scale to close it. However since this is clearly getting more and more attention among institutions (hence the JPM note), larger players will probably try to find ways to take advantage. And finally as Younger notes, if there’s ever an ETF approval, the spread would theoretically compress significantly, because then there would be a super simple way to go long spot and short the futures all in the same accounts — making the execution much easier. In the meantime, keep an eye on this space. And of course this is crypto, so if anyone’s feeling brave, please be careful and think about possible ways (like losing your coins) this could blow up in your face.