2018 World Outlook Financial Conference

FRIDAY & SATURDAY, Feb 2 & 3, 2018

THE WESTIN BAYSHORE, VANCOUVER, BC

Since its founding in 1990 the World Outlook Financial Conference has been dedicated to one goal - to help individual investors make more money from their investments.

Keep checking back for lots of exciting speaker additions

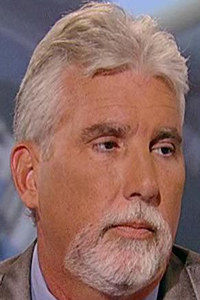

Michael Campbell

Business Analyst | Broadcaster | Author

Michael Campbell helps audiences find ways to survive and thrive in today’s tumultuous economic environment. The top-rated business analyst in British Columbia, Campbell is the senior business analyst for BCTV News on Global TV and a frequent contributor to their Canada Tonight broadcast. He is also the host of radio’s Money Talks, and the author of the bestseller, Cooking the Books with Mike: Michael Campbell’s Favourite 50 Recipes for Instant Financial Success.

Martin Armstrong

Martin Armstrong is the Founder of Armstrong Economics which provides analysis for the average person to comprehend the global economy and for professionals to access the most sophisticated international analysis possible. Mr Armstrong developed the Economic Confidence Model, which focuses on the impact of the 8.6 year business cycle on the world economy. Armstrong Economics uses this model to provide an integrated understandable global model approach that is free of personal bias, bravado, or other nonsense to enable you to see the inherent inner-workings of the world economy to grasp how everything is truly integrated into a single enterprise driven by international capital flows.

Martin Armstrong is the subject of the movie The Forecaster

Jeff Olin

President and CEO, Vision Capital Corporation

Jeffrey Olin is the President, CEO and Portfolio Manager of Vision Capital Corporation, an investment counseling and portfolio Management Company which manages the Vision Opportunity Funds. The Vision Opportunity Funds are primarily real estate focused and invest in North America with a principal emphasis on unique market inefficiencies that allow Vision to buy real estate more cheaply through the stock market than one can in the property market. The Funds target superior risk-adjusted returns through long and short investments in publically traded securities.

The Vision Funds have received considerable industry recognition for their leading risk-adjusted total return performance from leading, independent Canadian and Global firms including S&P Capital IQ, Morningstar and the Canadian Hedge Fund of the Year Awards

Between 2003 and 2007, Mr. Olin served as the Managing Partner, Ontario and Head of Investment Banking with Desjardins Securities, a $200 billion financial institution. Mr. Olin was previously a Managing Director with HSBC Securities and a Vice President with Canaccord Capital. As an investment banker, Mr. Olin was the Lead Manager and M&A advisor with direct responsibility for over 70 transactions representing over $5 billion in value. He has served as a key advisor to many of Canada’s leading corporate, institutional, and family-owned real estate enterprises.

Prior to his investment banking career, Mr. Olin has ten years of direct real estate industry experience. Between 1985 and 1991, Mr. Olin was Vice President with Bramalea Limited in Dallas, Texas and Toronto, Canada. In addition he worked with Olympia & York Developments Ltd., and the Parking Authority of Toronto. His experience in real estate includes acquisitions and dispositions, development, financing, leasing, operations, and planning and design.

Mr. Olin has extensive corporate governance experience and expertise. He has served on the Board of Directors for numerous public companies as well as charitable and community boards and is currently a member of AIMA’s Education and Research Committee and Committee of Managers. Presently, Mr. Olin is the Chairman and Director of BrightPath Early Learning Inc. and a Director of Exchange Income Corporation. He has also acted as an expert witness on behalf of the Ontario Securities Commission and the Government of Canada Parliamentary Finance Committee.

Mr. Olin is a graduate from the Kellogg Graduate School at Northwestern University in Chicago with an

MBA. He received his Bachelor of Commerce degree from the University of Toronto.

Dr. James E. Thorne

Caldwell Investment Management

Dr. James E. Thorne is the Chief Capital Market Strategist and a Senior Portfolio Manager of Caldwell Investment Management Ltd. From February 2001 to September 2014, he held various senior investment management positions at M&T Bank and its wholly owned subsidiary, Wilmington Trust Investment Advisors, Inc in the U.S., including Chief Investment Officer of Equities, Managing Director and Chief Capital Market Strategist. During his tenure, he was responsible for the management of approximately $23B in assets under management and developed small, mid and large-capitalization investment strategies which employed a combination of quantitative and qualitative analysis and achieved top-quartile performance. Dr. Thorne is a member of Caldwell’s Investment Risk Committee. Dr. Thorne received a Ph.D. in Economics in the fields of Finance and Industrial Organization from York University in June 1993 and was subsequently employed as a Professor of Economics and Finance at the Schulich School of Business and at Bishop’s University.

Paul Beattie

Paul Beattie has over 30 years as a professional in finance with extensive international experience. He earned an MBA from INSEAD, France and a Bachelor of Commerce (Honours), Queen’s University, Canada. Paul co-founded with Jacques Lacroix the investment firm BT Global Growth in 2006. From 2000 to 2006, he co-founded and worked as a managing Partner, of a boutique investment bank, Stable Capital Advisors. Paul also possesses extensive experience in private equity, including raising investment capital for alternative asset funds from within Canada and abroad. He was also a founding executive of Telesystem International Wireless in 1994 and its predecessor company in 1992. He was Vice-President, Mergers and Acquisitions and was involved in all aspects of financing activities.

As the head of Business Development and Investment Strategy in emerging countries he had the chance to work in Brazil, the Czech Republic, India, Mexico, Romania, and across South East Asia. Paul Beattie was involved in all aspects of international investments and public/private capital raising activities totaling several US $ billions. Mr. Beattie began his career as Investment Banker from 1986 to 1991 at Merrill Lynch Canada Inc., in the position of Vice-President, Corporate Finance and was involved in a diverse range of advisory assignments and capital markets activities including M&A mandates and new equity issues for Canadian clients with private and public financing on these transactions exceeding CAD $850 million.

Bob Hoye

Bob serves as the Chief Investment Strategist and Editor at Institutional Advisors, and writes the weekly overview as well as historical essays and presentations. Bob has experience on the trading desk and in the research department of a large investment dealer. His review of financial history provided the forecasting models designed to anticipate significant trend reversals in the sometimes alarming volatility typical of the transition from rampant speculation in tangible assets to fabulous speculation in financial assets. With a degree in Geophysics, Bob has had research pieces published in important financial venues and has addressed academic and financial seminars in many countries.

Brent Holliday

Brent has been in the technology finance industry for 24 years and is the co-founder and CEO of Canada’s first technology-focused boutique M&A advisory firm, Garibaldi Capital Advisors. Founded in 2013, Garibaldi helps private technology companies across Canada grow by planning and executing on their capital strategy needs and assisting them through M&A transactions. With offices in Vancouver, Toronto and Saint John, Garibaldi has completed 18 transactions in 4 years in technology centers across Canada.

Brent spent five years prior to founding Garibaldi doing technology transactions for Capital West Partners in Vancouver. Before that, Brent was a technology focused venture capitalist, raising over $40 million with two other partners in 1999 to invest in 15 early stage companies. In the Internet 1.0 days of the mid-90’s Brent helped found an Internet Software company, later known as Maximizer Technologies and worked for BDC’s venture capital group before founding his own fund.

He has an MBA from the University of British Columbia and an Honours Bachelor of Science from Western University in his original hometown of London, Ontario.

Ryan Irvine

Keystone Financial Independent Equity Advisors

Keystone specializes in uncovering, before the broader market, under followed small to mid-sized companies that are financially sound and producing solid growth in both revenues and earnings. Mr Irvine has annually presented conference attendees with the World Outlook Conference Small-Cap Portfolio which was up over 32% in 2013, 86% in 2012 and 60% in 2011.

Mark Leibovit

Mark Leibovit, CIMA, is Chief Market Strategist for VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL ™ methodology and Annual Forecast Model. His trading strategy provides clearly defined risk-management guidelines based on his technical volume indicators. His Annual Forecast Model has gained increasing notoriety on Wall Street as a predictor of future market movement. Mark has often held the post of Top U.S. Market Timer and #1 Intermediate Market Timer as ranked by Timers Digest. His book, ‘The Traders Book of Volume’ was recently released by McGraw-Hill.

Victor Adair

Senior Vice President and Derivatives Portfolio Manager, Pi Financial

Victor Adair began trading over 40 years ago and has held a number of senior executive positions during his career as a commodity and stockbroker. Victor is a regular analyst and frequent host on Mike Campbell’s nationally syndicated Moneytalks Radio Show, he is frequently interviewed on business TV and occasionally speaks at financial conferences. His primary business focus is corporate risk management using exchange traded derivative markets. He actively trades futures and options in currencies, interest rates, precious metals, stock indices and commodities for his own accounts and for a limited number of managed accounts.

Greg Weldon

Greg Weldon is in his 30th year observing and analyzing the global financial markets. His pedigree includes a trial-by-fire introduction to the industry as the point-man in the COMEX Gold and Silver pits. He left the floor to move into institutional brokerage, and on to hone his skills as a trader, purveyor of macro-markets and portfolio-risk manager. In 1997, Greg started Weldon Financial, and launched “Weldon’s Money Monitor”, and “The Metal Monitor”, products that have more recently evolved into the all-encompassing “WeldonLIVE (with TradeLAB).” Greg has sucessfully navigated some of the most treacherous markets in history, most often guiding clients into macro-market trends and profitable trading strategies, repeatedly, year-after-year, over the 18-year history of producing top-shelf, thought provoking, global-macro market research. Greg authored he book “Gold Trading Boot Camp”, published in November of 2006, in which he very accurately predicted that the US credit markets would implode, that the Fed would purchase trillions of dollars of US government debt, and that Gold prices would more than double from their then-level of $550 per ounce. Greg will be joining us via Skype from his office in Florida.

Jack Crooks

Jack has over 25 years of experience in the currency, equity, and futures arena. He has held key positions in brokerage, investment research, money management, and trading. Jack is founder and president of Black Swan Capital LLC (a newsletter firm specializing in currency trading and global macro-economic analysis). He has worked as both a Registered Investment Advisor specializing in global stock, bond, and currency asset management and as a Commodities Trading Advisory specializing in foreign exchange trading. Prior to entering the investment arena, Jack worked in various corporate finance positions. He has written extensively on the subject of global currencies and international economics. He holds a B.S. in finance/accounting and MBA in finance and Master’s degree in economics.