Inflation [ɪnˈfleɪʃ(ə)n]

Noun

- the action of inflating something or the condition of being inflated. “the inflation of a balloon”

- a general increase in prices and fall in the purchasing value of money. “policies aimed at controlling inflation”

Hobby [ˈhɒbi]

Noun

an activity done regularly in one’s leisure time for pleasure. “her hobbies are reading and gardening”

Hobby horse [ˈhɒbi hɔː(r)s]

Noun

- a child’s toy consisting of a stick with a model of a horse’s head at one end.

- a preoccupation or favourite topic. “Brennan admits that the greenhouse effect is a hobby horse of his”

Yesterday’s FOMC meeting, very much as expected, made clear that US rates are on hold until the end of 2023 at the very least, even as the economic projections were actually upgraded relative to the depths they plunged to in June. (Indeed, Q3 GDP is still apparently tracking above 30% q/q annualized.) For Philip Marey’s coverage of the meeting, please see here.

In short, the Fed, like all central banks, does not understand inflation and cannot control it to either the upside or the downside of any possible target over any credible timeframe. Indeed, it no longer seems to have a theory of inflation: inflation just is; or rather isn’t. We can therefore expect rates to be on hold longer than just flagged. And not just in the US, of course. Japan and Europe, the UK, Australia, and New Zealand – all face the same fate. Zero (or lower) rates and zero ideas about how things will get better.

Emerging markets like Brazil have also moved rates to incredibly low levels. Several are already monetizing debt too. The only major central bank that is not openly easing is China, where ‘rates are set’ in three days as per the new normal: but that is only because the level of rates doesn’t matter in traditional market terms (look at the USD500bn in new lending in August); which is now true in the West too, just at a lower nominal level, at least until deflation kicks in, and with none of the same kind of finesse. They have de facto state planning with a market on top: we have state planning with no plan and markets always coming out on top.

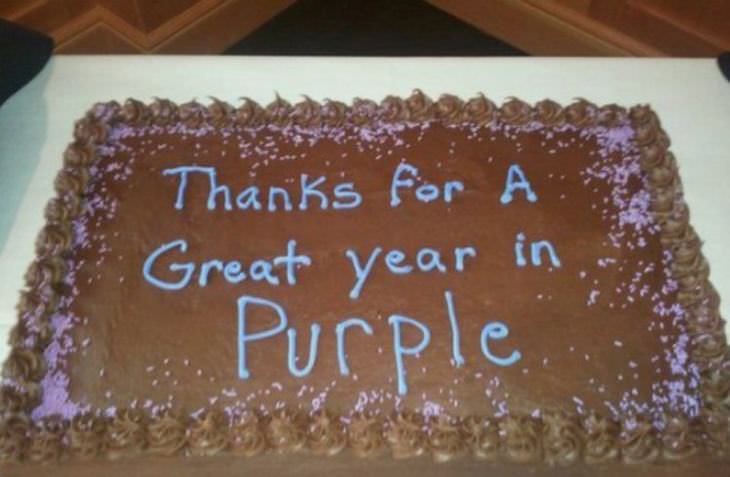

Of course, these views are a favorite hobby horse here. Yet after the Fed has made clear what we had long expected to eventually happen, let me offer some suggestions of worthwhile hobbies for central banks and those who watch them to more usefully spend their time on for the next five years:

- 3D printing (which they do already); Acrobatics ; Acting; Amateur radio (all three are already normal at their press conferences); Animation (they have little of that); Aquascaping (well, liquidity is their thing); Astrology (see their economic forecasts); Astronomy (they are space cadets); Baking (failure into the cake); Baton twirling (for sure!); Blogging (absolutely, and boringly).

- Building (not so much); Board/tabletop games (Dungeons & Draghis); Book discussion clubs (try Kalecki); Book restoration (their copies of Friedman and Hayek are tatty); Bowling (they can’t pick up that spare); Brazilian jiu-jitsu (they don’t lack muscle, just brain); Breadmaking (for the 1%); Bullet journaling (they are out of them); Cabaret (I can almost see Lagarde open the next ECB meeting with the appropriately fin-de-regime “Willkommen, bienvenue, welcome”: yet note that movie then descends to the always-terrifying “Tomorrow Belongs to Me” **Shudder**).

- Calligraphy (make their irrelevance look pretty); Candle making (to not light in the darkness); Candy making (for the 1%); Car fixing & building (outsource it!); Card games (3-card Monty); Cardistry (see press conferences); Cheesemaking (so, so much cheese); Cleaning (this is a hobby?!); Clothesmaking (offshore it!); Coffee roasting (more millennial barista jobs!); Collecting (financial assets); Coloring (green, not red); Computer programming (algos!); Confectionery (for the 1%); Cooking (the books); Cosplaying (which is what this whole sham is, just in the drabbest possible costumes); Couponing (which millions are relying on); Craft(y); Creative writing (not the RBA, obviously); Crocheting (see forecasting); Cross-stitch (see FX forecasting); Crossword puzzles (see central bank minutes); Cryptography (see previous); Cue sports (think ‘The Hustler’).

- Dance (anything that gets actual circulation going would be good); Digital arts (cryptos!); Distro Hopping (fiddling with computers: HFT); DJing (they only have one tune: “The sun will come out tomorrow”); Do it yourself (which is what we will eventually see governments return to as policy); Drama (of the drawn-out, tragi-comic variety); Drawing (see dot plots); Drink mixing (toxic cocktails); Drinking (and boy are they driving us all to that!)

That just covers A-D. But don’t worry, I have five years of the Daily to kill before a rate hike – we will get to the rest.

Of course, the Fed did make clear that the way to avoid me having to write about Zumba is for the government to spend more money, which they will then monetize (even if they won’t say so out loud). On that front, US President Trump is now all in favor of thinking big, reportedly backing at least USD1.5 trillion in further stimulus, and noting “…it all comes back to the USA anyway (one way or another)”.

Which it actually does, apart from the portion that flows to all the countries that produce things that you used to make yourself. So do we have an evolving pro-MMT position from the White House by any other name? That is another hobby horse here, but a discussion with far more relevance to markets than anything major central banks will, or rather won’t, be doing in the next few years. Indeed, imagine the US reflating but not letting those USD flow out to others: and isn’t that what China is trying in some ways and is being cheer-led?