Waving the White Flag

Viva Los Rescates Financieros de los Bancos

Contagion is Real It Doesn’t End With Spain

New York, Atlanta, and Philadelphia

A common mistake that people make when trying to design something completely foolproof is to underestimate the ingenuity of complete fools.

– Douglas Adams, The Hitchhiker’s Guide to the Galaxy

For quite some time in this letter I have been making the case that for the eurozone to survive, the European Central Bank would have to print more money than any of us can now imagine. That the sentiment among European leaders was that they were prepared for such a move was clear – except for Germany, which is haunted by fears of a return to the days of the Weimar Republic and hyperinflation.

When Germany agreed to a fixed monetary union and a European Central Bank, it was with the clear understanding that it would be run along the lines of the German central bank, the Bundesbank. The members of the Bundesbank and the German members of the ECB were most outspoken about the need for a conservative monetary policy that would keep a clamp on inflation.

However, as I have previously noted, the Bundesbank was a toothless tiger. Germany has two votes out of 23 on the ECB, and the loud drumbeat from most of Europe, which is experiencing the difficulty of austerity accompanied by too much debt, is for a far more accommodating ECB.

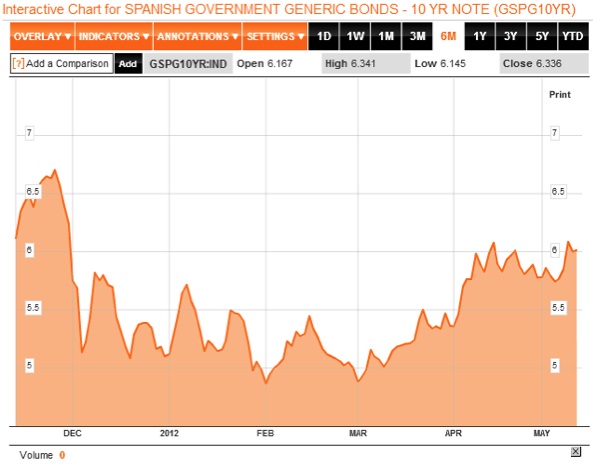

The simple fact is that Mario Draghi, the Italian president of the ECB, created €1 trillion euros to help fund European banks, which promptly turned around and bought their respective countrys’ sovereign debt. Germany’s Angela Merkel forced the Bundesbank to “play nice” and go along with what was seen as the only way to solve a growing banking crisis in Europe. Everyone breathed a sigh of relief, thinking that this at least bought a year during which things could be sorted out. But it turns out that a trillion euros just doesn’t go as far as it used to. The “relief” lasted about a month. The last few weeks have presented yet another budding crisis, as least as large as the last one. Where to get the next trillion?

This week the German Bundesbank waved the white flag. The die is cast. For good or ill, Europe has embarked on a program that will require multiple trillions of euros of freshly minted money in order to maintain the eurozone. But the alternative, European leaders agree, is even worse. Today we will look at the recent German shift in policy, why it was so predictable, and what it means. This is a Ponzi scheme that makes Madoff look like a small-time street hustler. There is a lot to cover.

At the end of the letter I will mention a few upcoming speaking engagements, in Atlanta, Philadelphia, and a webinar I will be doing next week. Now let’s jump over to Europe.

Waving the White Flag

It is the world’s worst-kept secret: Germany does not want inflation but wants to abandon the European Union even less. And as we will see, the eurozone simply does not have enough money to keep itself together without massive ECB intervention.

“Cry havoc,” wrote Shakespeare in Julius Caesar, “and let slip the dogs of war.” The military order “Havoc!” was a signal given to the English military forces in the Middle Ages to direct the soldiery (in Shakespeare’s parlance “the dogs of war”) to pillage and incite chaos.

The cry is much the same in Europe today, though it is not the dogs of war that will ravage the land but the hounds of inflation. The English edition of Spiegel Online today carries a story with the headline “High Inflation Causes Societies to Disintegrate.”

To Read More CLICK HERE