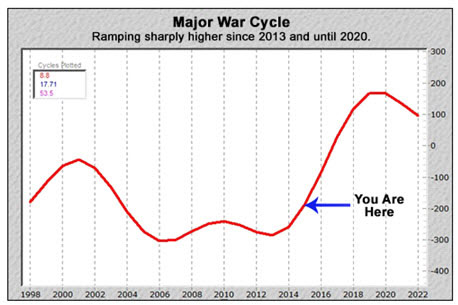

When I first forecast a rise in geopolitical turmoil in January 2013, few people believed me.

Many thought I was crazy or I was simply fearmongering.

Yet, here we are, only two and a half years into my warnings of a rising cycle of social and international unrest that will not peak until 2020 to 2022 …

And already, nearly everywhere you turn, geopolitical unrest is exploding off the charts.

Just consider the above map of the world from Uppsala University, the leading think tank on conflict, that highlights in red the countries at war, racked by revolutions or suffering other kinds of violent conflicts.

And consider …

– Israel and Gaza, still fighting a war that could easily spread throughout the entire Middle East.

– Vladimir Putin, bullying his way through Ukraine and likely to target other former Soviet Union satellite countries.

– Syria’s civil war, where more than 210,000 are now dead.

– Boko Haram, murdering and kidnapping hundreds of innocent people, crusading to create another Islamic state on the world’s second largest continent.-

– Nearly all of Africa, where there are now fully 24 countries engaged in wars, involving 146 different militias-guerrillas, separatist and anarchic groups.

– Asia, where 15 countries, involving 129 different radical and separatist groups, are waging wars and uprisings.

– Europe, where nine countries are under siege by 70 different militias, representing mostly separatist and anarchist groups.

– The Middle East, where eight countries and 169 different rebel groups are now engaged in conflict.

– The Americas, where five countries are either at war or experiencing massive domestic unrest, involving 25 different rebel and separatist groups and drug cartels.

– And the most violent of all, ISIS, the Islamic State, known for its harsh Wahhabist interpretation of Islam and brutal violence directed at Shia Muslims and Christians in particular. Terrorizing the Middle East, killing tens of thousands.

And these are just the “officially” recognized conflicts.

They do not include other hot spots around the world that are likely to lead to either civil or international war, including yes, the potential for armed conflict between China and the U.S.

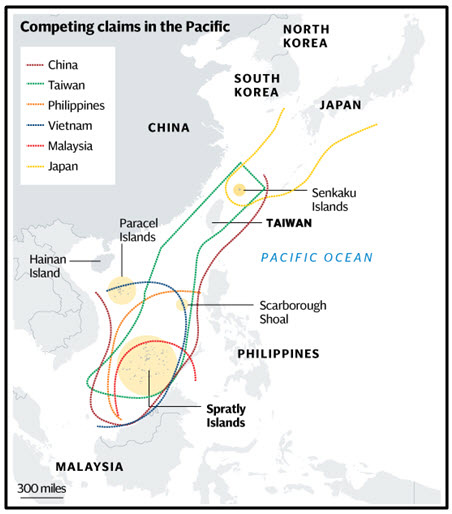

I was perhaps one of the first to warn of this potential conflict, way back in 2004. In an issue of my Real Wealth Report, I explicitly described how China would move into the South China Sea, specifically targeting the Spratly Islands, the region’s oil and gas reserves and shipping routes.

That’s where China can grab an undeveloped, but easily exploited, 100 billion barrels of oil and 882 billion cubic feet of natural gas.

And that’s where the volume of oil — shipped through the South China Sea — is three times greater than the volume shipped through the Suez Canal (pipeline included) and fifteen times greater than the oil that flows through the Panama Canal.

And yes, over the past year, Beijing has been very aggressive seeking to stake out its territorial claims and reach.

And yes, over the past year, Beijing has been very aggressive seeking to stake out its territorial claims and reach.

So much so that now, there’s the very real threat of a conflict between the U.S. and China.

Just consider the latest fighting words from U.S. Defense Secretary Ashton Carter, demanding a halt to land reclamation in disputed waters and vowing that the U.S. “will remain Asia’s leading power for decades to come.”

And that “There should be no mistake about this: The United States will fly, sail and operate wherever international law allows, as we do all around the world.”

China’s response, via the Global Times, a newspaper run by the Communist Party:

“If the United States’ bottom line is that China has to halt its activities, then a US-China war is inevitable in the South China Sea.”

Will there be a war between the U.S. and China?

It’s impossible to say at this time. But I do know this:

A. China will not back down on its efforts to claim what it believes is its sovereign claims to the South China Sea and the Spratly Islands. It needs the area’s vast natural resources and shipping lanes.

B. Washington will not back down either. Unfortunately, the powers-that-be in Washington still think they can be the lead influence in the rest of the world and have consistently failed to recognize that the geopolitical sands of time are changing.

C. Leaders in both countries would like nothing more than to distract their people’s attention from growing domestic problems. In the U.S. — a sluggish economy and a widening gap between the rich and the poor. In China — an extremely nationalistic population that views the South China Sea, like Hong Kong or Taiwan, as part of China … and a population that increasingly sees the U.S. as a threat to its economic rise.

Hopefully, it won’t come to war in the South China Sea. But given how the war cycles are slated to ramp higher for the next five to seven years, I wouldn’t be surprised if some sort of military conflict erupts between Washington and Beijing in the South China Sea or elsewhere.

However, nearly all of these conflicts — even a future Sino-American war — are

However, nearly all of these conflicts — even a future Sino-American war — are

merely a manifestation of the deeper, pervasive impact of the big war cycle that’s ramping up and should continue to do so for the rest of the decade.

This is the same war cycle I’ve told you about repeatedly. And it’s the same one I’m displaying here again. —->

We see it everywhere. Rising domestic violence. Spreading international conflict. An unmistakable shift toward more separatism, anarchism and terrorism. Currency wars. Trade wars. Cyberespionage. Capital controls. And more.

What’s behind it? Much of the cycle is in parallel to a coming sovereign debt crisis — a crisis the likes of which hasn’t been seen in developed economies since the 1930s. It’s a crisis that …

Takes Europe into bankruptcy …

Leaves Japan unable to fund its massive liabilities, and …

Exposes the $235 trillion of patently unpayable debts of the United States of America for what they really are — the handiwork of emperors with no clothes.

That’s why these are dangerous times, far more dangerous than most realize.

And that’s why the investment implications are equally fraught with dangers — and opportunities, provided you have a good sense of history, a knowledge of how markets truly work, and you position yourself accordingly.

Start taking some big steps right now:

First, don’t let anyone convince you that all these global conflicts are somehow going to “die down” or “peter out.”

Second, remember that it’s never too early to prepare for the worst.

Third, if you own any sovereign bonds of the U.S., Europe or Japan — get the heck out and don’t look back.

Above all, stay safe!

Larry

The post War Cycles Spread Globally: Now China vs. US? appeared first on Money and Markets – Financial Advice | Financial Investment Newsletter.