After Mar. 20 Close:

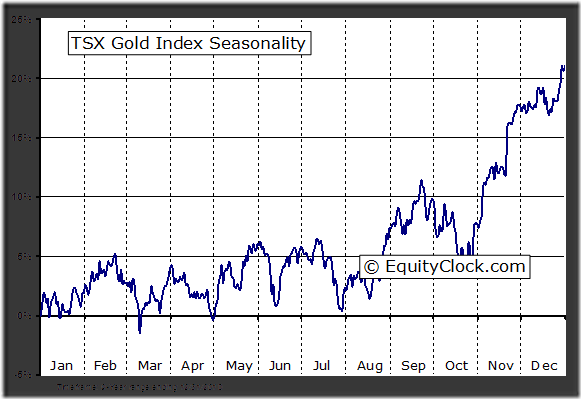

TSE Gold Index Seasonality:

Via Don & Jon Vialoux’s Equity Clock

Good As Gold!

Just as a matter of reference on January 1, 2010 the Dow was at 10,550 so to date it has risen 25.42% while gold has moved from 1,100.00 for a gain 50.54%! So in spite of the Fed’s best efforts to pump the stock market up with a barrage of fiat currency while at the same time suppressing the price of gold with relentless intervention, gold has out performed the Dow two to one!! That tells you all you need to know.

They say a picture is worth a thousand words so if that’s true

…..read the rest & view more charts HERE

(also don’t miss Mark Leibovits daily gold comment HERE

A Big Relative Decline

Since April of 2011, gold stocks have entered a notable downtrend relative to the prices of gold and silver. Various theories have been advanced as to why this is the case and all of them have some merit (e.g. the fact that ‘resource nationalism’ is increasing all over the world, that costs are ratcheting higher, that metal-backed ETFs give investors exposure to the metals while avoiding the hassles gold mining companies have to deal with, and so forth).