Risk Happens Fast

The S+P 500 hit All-Time Highs on Monday’s opening – but closed 165 points (3.5%) lower by Friday’s close. The daily S+P futures volume on Friday was the highest since early October – and was probably the highest EVER for a Thanksgiving Friday.

The DJIA closed at a 7-week low, down ~1,800 points (5%) from the All-Time High reached three weeks ago.

The Acid Test

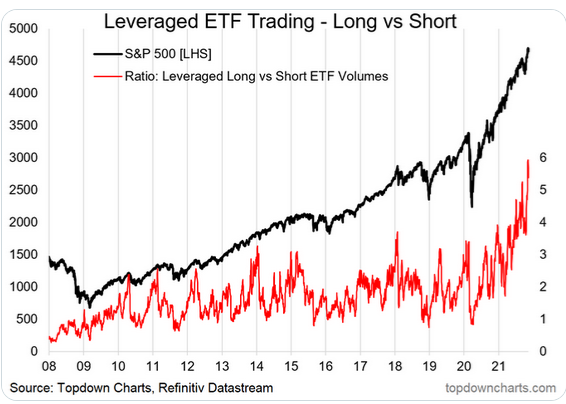

My recent thinking has been that market complacency would likely continue – unless the September/October lows are taken out. I think people who have put money into “passive” investment strategies have been told to expect minor corrections and short-term spikes in volatility – but to stay the course because, inevitably, stocks will keep rising.

I think those folks also “feel” as though the unrealized gains in their investment accounts are as “good as cash” when it comes to calculating their net worth, and that, while the market could have a dip now and then, it will NEVER AGAIN drop like it did in March 2020.

When Complacency Turns To Panic, Volatility Soars

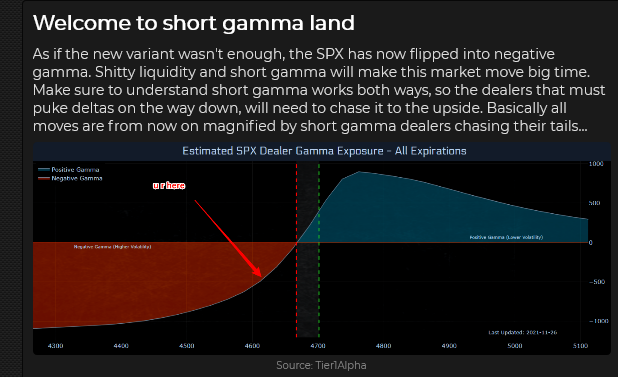

There was complacency with “risk-on” sentiment across asset classes early this week, but as sentiment turned “risk-off” Thursday afternoon and prices began to slide, “liquidity risk” accelerated the panic, and volatility soared.

Position Unwinding Added To Volatility

For the past few weeks, traders (especially in the interest rate and currency markets) have been building positions around the idea that the Fed would be “forced” to raise interest rates much more, and much faster, than previously expected – because of “inflation.” There was severe unwinding of some of those positions in illiquid market conditions during the last 24 hours of the trading week.

Interest rates: As stock indices tumbled on Thursday/Friday, bonds rallied hard, and short-term interest rate futures “un-priced” at least one Fed rate increase next year.

Currencies: The US Dollar Index surged to a new 16-month high early this week on expectations that the Fed would be much more hawkish next year than previously expected. The USD reversed those gains on Friday to close unchanged for the week.

The Japanese Yen plunged to a new 5-year low against the US Dollar early this week but reversed HUGE on Friday. Speculators have amassed a HUGE net short Yen position over the past few months.

The Swiss Franc caught a “haven” bid Friday after tumbling the past two weeks on expectations of Fed tightening next year.

The Canadian Dollar hit a 6-year high against the USD at 83 cents in June but fell back as the USD began to rally against all currencies.

The CAD rallied to a lower high (81 cents) in October as commodity indices (especially crude oil) surged to 7-year highs. When the commodity indices (especially crude oil) began to roll over and slide lower, the CAD also began to trend lower.

WTI rallied from ~$62 to ~$85 (37%) in two months, from mid-August to mid-October. The strong demand for near-term delivery over deferred delivery caused a severe steepening of the forward curve. Front-month WTI fell from ~$85 three weeks ago to a low of ~$68 Friday, with more than half that decline happening in illiquid conditions on Friday. Implied volatility in WTI options spiked sharply.

Gold rallied ~$110 the first two weeks of November and fell ~$100 the next two weeks. Gold’s initial rally phase happened in sync with a USD rally (an unusual occurrence) as both markets reacted to the “soaring inflation” narrative. Gold’s tumble happened as the USD continued to rally (the more typical gold/dollar relationship), and as real interest rates reversed from record negative levels.

Open interest in the gold futures market (circled above) increased sharply as gold rallied in early November as speculators “chased” it higher. As gold fell, some of those speculators “bailed out,” exacerbating the decline.

My Short Term Trading

The only position I held as this week began was short gold, and I covered that for a good profit on Monday. Gold had tumbled ~$75 in three days – I was only short because I was looking for some “give-back” after the early November rally – so I covered the position.

I shorted the NAZ about an hour after the Monday floor session opened. The market had surged to an All-Time High on the opening but then dropped below the opening range. I had been looking to sell “irrational exuberance,” so I saw a nice setup and got short with tight stops. The market fell during the day, and I lowered my stops – and was stopped for a small gain later in the day.

The falling bond market on Monday increased my confidence to short NAZ as that index is heavily weighted with “long duration” stocks.

I shorted NAZ again on Tuesday but I was also watching the Dow futures and noticed they were not falling. I covered the short NAZ for a small gain and bought Dow futures. I was stopped for a small loss.

I bought the S+P on Wednesday, was stopped for a small loss, but then I bought it again. The market closed right on its highs so I decided to stay with the trade into the Thanksgiving holiday. (This was a decision to give the trade an opportunity to run. The market had been trending strongly higher, had dipped Monday and Tuesday, and was now closing right on the highs. Staying with the trade was the right thing to do.)

The market continued to rally in the Wednesday overnight session. I raised my stops. The market drifted sideways during the Thursday holiday session, but then began to tumble as soon as the Thursday overnight session began and I was stopped for a small gain.

I made the right decision to stay with the trade when it closed on its highs. At its best levels, I was ahead nearly 40 points but was stopped for a gain of only four points. I have no regrets about that. Given what happened next, I’m thankful that I use stops.

I bought the CAD and gold on Wednesday. I was stopped for a small loss on the CAD in the Thursday overnight session and covered the gold for a small gain Friday morning.

I did not establish any new positions Friday and was flat going into this weekend. My P+L was up just short of 1% on the week.

On My Radar

I don’t know if Friday’s market action was the start of something BIG or a one-day flash-in-the-pan. I’m willing to go either way, although I’m leaning towards the start of something.

My bias has been that too much money has been flooding into risk assets without appreciating just how risky those assets can be. The risk in those assets has increased “because” of the money flooding in.

Thoughts On Trading

For years I had a small yellow sticky note on my screens saying, “Anything Can Happen.” I put it there to remind myself that I had no idea what was going to happen next.

A few weeks back, in the Quotes From The Notebook section, I featured the Godfather saying, “I spent my entire life trying not to be careless.”

If I wanted to briefly explain the essence of my trading style, I would say that I never want to take a big loss. I never “fall in love” with a trade.

Several years ago, I started working with another broker that I didn’t know very well. We were opening a new office for a Chicago commodity firm in Vancouver. One day I overheard him talking to his best client. He was telling his client why they had to stay with a trade that was relentlessly going against them. I couldn’t believe what I was hearing.

A few days later, I had an epiphany while taking a shower before I headed to work (I get a lot of good ideas in the shower or in the pool – there’s something about water that does that – and, of course, you can’t make a note to yourself when you’re in the water!) My epiphany was that the broker was, first and foremost, a stockbroker – who also happened to be a commodity broker – and that stockbrokers believe and tell stories – good commodity brokers don’t do that.

Here’s a 90-second video of Jack Schwager (author of the Market Wizards series) explaining that one of the things the 70 Wizards he interviewed for his books had in common was their ability to have no loyalty to a position. (This is a fantastic insight – and great trading advice!)

Quotes From The Notebook

“Don’t count your chickens before they hatch.” My Grandmother kept telling me that from the time I was a little boy until she died.

My comment: My friend Peter Brandt likes to say that he never counts unrealized gains as “his money” it’s not his until he closes the trade. I can’t tell you how many times I’ve assumed that a trade would be a big winner – only to have it go sour on me.

Peter also likes to ask this question, “Let’s say you hold a position with an unrealized gain of $10,000. The market moves against you and you liquidate the trade to realize a $5,000 gain. Do you feel like you made $5,000 or lost $5,000 ?”

My guess is that if you feel like you lost $5,000 (because you didn’t get out at the top) you’re going to have an unhappy life as a trader. Have I mentioned before that trading is not a game of perfect?

“WHEN you make a trade is WAY more important than WHY you make a trade.” Raoul Pal, Founder of Real Vision TV, 2021

My comment: I agree 100%. Focusing on “why” you are making a trade may cause you to be too “loyal” to the trade. (Refer to Jack Schwager’s interview above.) Focusing on “when” you make a trade means you realize that there is a time to make the trade, and a time to NOT make the trade.

A Small Request

If you like reading the Trading Desk Notes, please do me a favour and forward a copy or a link to a friend. Also, I genuinely welcome your comments. Please let me know if there is something you would like to see included in the TD Notes. Thanks, Victor

Barney (now 12 weeks old) “Papa, leave your computers alone and play with me!”

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.